Answered step by step

Verified Expert Solution

Question

1 Approved Answer

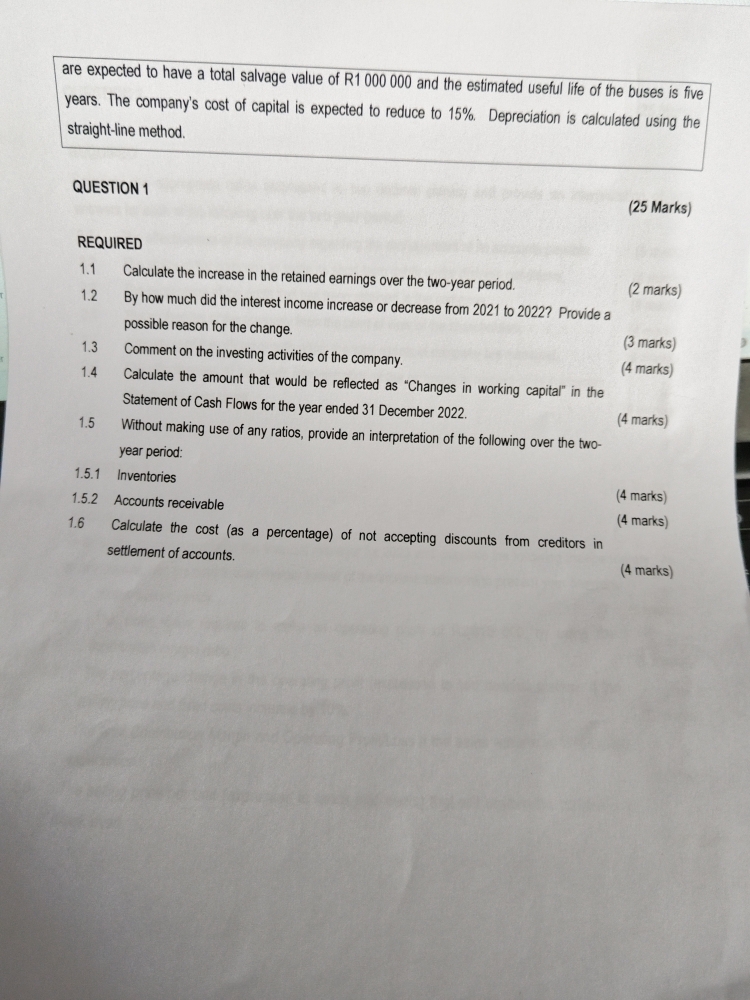

are expected to have a total salvage value of R1 000000 and the estimated useful life of the buses is five years. The company's cost

are expected to have a total salvage value of R1 000000 and the estimated useful life of the buses is five years. The company's cost of capital is expected to reduce to 15%. Depreciation is calculated using the straight-line method. QUESTION 1 (25 Marks) REQUIRED 1.1 Calculate the increase in the retained earnings over the two-year period. 1.2 By how much did the interest income increase or decrease from 2021 to 2022? Provide a (2 marks) possible reason for the change. 1.3 Comment on the investing activities of the company. (3 marks) 1.4 Calculate the amount that would be reflected as "Changes in working capital" in the (4 marks) Statement of Cash Flows for the year ended 31 December 2022. 1.5 Without making use of any ratios, provide an interpretation of the following over the two(4 marks) year period: 1.5.1 Inventories 1.5.2 Accounts receivable (4 marks) 1.6 Calculate the cost (as a percentage) of not accepting discounts from creditors in (4 marks) settlement of accounts. (4 marks)

are expected to have a total salvage value of R1 000000 and the estimated useful life of the buses is five years. The company's cost of capital is expected to reduce to 15%. Depreciation is calculated using the straight-line method. QUESTION 1 (25 Marks) REQUIRED 1.1 Calculate the increase in the retained earnings over the two-year period. 1.2 By how much did the interest income increase or decrease from 2021 to 2022? Provide a (2 marks) possible reason for the change. 1.3 Comment on the investing activities of the company. (3 marks) 1.4 Calculate the amount that would be reflected as "Changes in working capital" in the (4 marks) Statement of Cash Flows for the year ended 31 December 2022. 1.5 Without making use of any ratios, provide an interpretation of the following over the two(4 marks) year period: 1.5.1 Inventories 1.5.2 Accounts receivable (4 marks) 1.6 Calculate the cost (as a percentage) of not accepting discounts from creditors in (4 marks) settlement of accounts. (4 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started