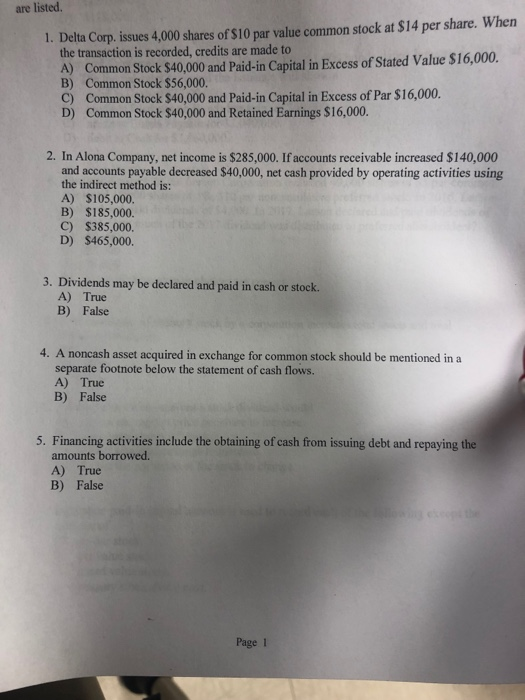

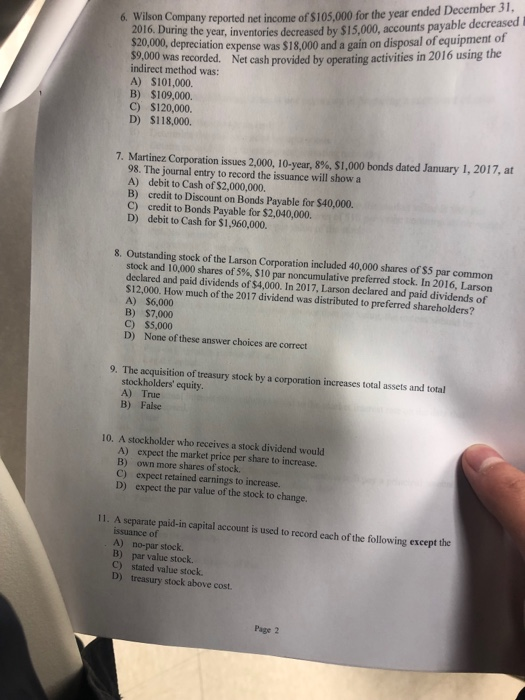

are listed. 1. Delta Corp, issues 4,000 shares of $10 par value common stock at $14 per share. When the transaction is recorded, credits are made to A2 Common Stocek $40,000and Paid-in Capital in Excess of Stated Value $16,000. C) Common Stock $40,000 and Paid-in Capital in Excess of Par $16,000 D) Common Stock $40,000 and Retained Earnings $16,000. 2. In Alona Company, net income is $285,000. If accounts receivable increased $140,000 and accounts payable decreased $40,000, net cash provided by operating activities using the indirect method is: A) $105,000. B) $185,000. C) $385,000. D) $465,000. 3. Dividends may be declared and paid in cash or stock. A) True B) False 4. A noncash asset acquired in exchange for common stock should be mentioned in a separate footnote below the statement of cash flows. A) True B) False 5. Financing activities include the obtaining of cash from issuing debt and repaying the amounts borrowed. A) True B) False Page 1 n Company reported net income of $105,000 for the year ended December 31, 2016. During the year, inventories decreased by $15,000, accounts payable $20,000, depreciation expense was $18,000 and a gain on disposal of equipment of indirect method was: A) $101,000. B) $109,000. C) $120,000. D) $118,000 6. Wilso eorded Net cash provided by operating activities in 2016 using the 7. Martinez Corporation issues 2,000, 10-year, 8%, $1,000 bonds dated January 1, 2017, at 98. The journal entry to record the issuance will show a A) debit to Cash of $2,000,000. B) credit to Discount on Bonds Payable for $40,000. C) credit to Bonds Payable for $2,040,000. D) debit to Cash for $1,960,000. 8. Outstanding stock of the Larson Corporation included 40,000 shares of $5 par common id dividends of stock and 10,000 shares of 5%, S 10 par noncumulative preferred stock. In 2016, Larson S12,000. How much of the 2017 dividend was distributed to preferred shareholders? A) $6,000 B) $7,000 C) $5,000 D) None of these answer choices are correct 9. The acquisition of treasury stock by a corporation increases total assets and total stockholders' equity A) True B) False 10. A stockholder who receives a stock dividend would A) expect the market price per share to increase B) own more shares of stock C) expect retained earnings to increase. D) expect the par value of the stock to change. 11. A separate paid-in capital account is used to record each of the following except the issuance of A) no-par stock. B) par value stock. C) stated value stock D) treasury stock above cost. Page 2