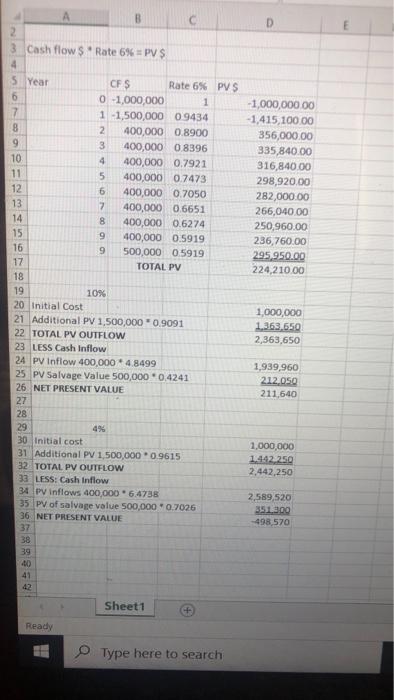

Are my calxulations correct?

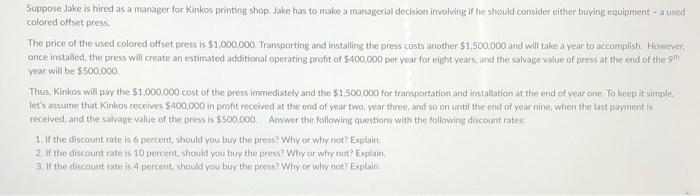

Suppose Jake is hired as a manager for Kinkos printing shop Jake has to make a managerial decision involving if he should consider either buying equipment - a used colored offset press The price of the used colored offset press is $1,000,000. Transporting and installing the press costs another $1,500,000 and will take a year to accomplish. However, once installed, the press will create an estimated adclitional operating profit of $400,000 per year for eight years, and the salvage value of press at the end of the 9th year will be $500.000 Thus, Kinkos will pay the 51,000,000 cost of the press immediately and the $1,500,000 for transportation and instaltation at the end of year one to keep it simple. let's assume that Kinkos receives $400,000 in profit rectived at the end of year two year three, and so on until the end of year nine, when the last payment is received and the salvage value of the press is $500,000. Answer the following questions with the following discount rates 1. If the discount rate is 6 percent, should you buy the press? Why or why not? Explain 2. If the discount rate is 10 percent, should you buy the press? Why or why not? Explain 3. If the discount rate is 4 percent should you buy the prem? Why or why not? Explain B Cash flow $ Rate 6% PV $ -1,000,000.00 -1,415,100.00 356,000.00 335,840.00 316,840.00 298,920.00 282,000.00 266,040.00 250,960.00 236,760.00 295.950.00 224,210.00 5 Year CFS Rate 6% PVS 6 0-1,000,000 1 1 -1,500,000 09434 8 2 400,000 0.8900 9 3 400,000 0.8396 10 4 400,000 0.7921 11 5 400,000 0.7473 12 6 400,000 0.7050 13 7 400,000 0.6651 14 8 400,000 0.6274 15 9 400,000 0.5919 16 9 500,000 0.5919 17 TOTAL PV 18 19 10% 20 Initial Cost 21 Additional PV 1,500,000 0.9091 22 TOTAL PV OUTFLOW 23 LESS Cash Inflow 24 PV Inflow 400,000 * 4.8499 25 PV Salvage Value 500,000 "0.4241 26 NET PRESENT VALUE 27 28 29 30 Initial cost 31 Additional PV 1,500,000 0.9615 32 TOTAL PV OUTFLOW 33 LESS: Cash Inflow 34 PV inflows 400,000 " 6.4738 35 PV of salvage value 500,000 0.7026 36 NET PRESENT VALUE 37 38 39 400 41 1,000,000 1.363.650 2,363,650 1,939,960 212.05 211,640 1,000,000 1442.250 2,442,250 2 589,520 351300 498 570 Sheet1 CF Ready Type here to search Suppose Jake is hired as a manager for Kinkos printing shop Jake has to make a managerial decision involving if he should consider either buying equipment - a used colored offset press The price of the used colored offset press is $1,000,000. Transporting and installing the press costs another $1,500,000 and will take a year to accomplish. However, once installed, the press will create an estimated adclitional operating profit of $400,000 per year for eight years, and the salvage value of press at the end of the 9th year will be $500.000 Thus, Kinkos will pay the 51,000,000 cost of the press immediately and the $1,500,000 for transportation and instaltation at the end of year one to keep it simple. let's assume that Kinkos receives $400,000 in profit rectived at the end of year two year three, and so on until the end of year nine, when the last payment is received and the salvage value of the press is $500,000. Answer the following questions with the following discount rates 1. If the discount rate is 6 percent, should you buy the press? Why or why not? Explain 2. If the discount rate is 10 percent, should you buy the press? Why or why not? Explain 3. If the discount rate is 4 percent should you buy the prem? Why or why not? Explain