Answered step by step

Verified Expert Solution

Question

1 Approved Answer

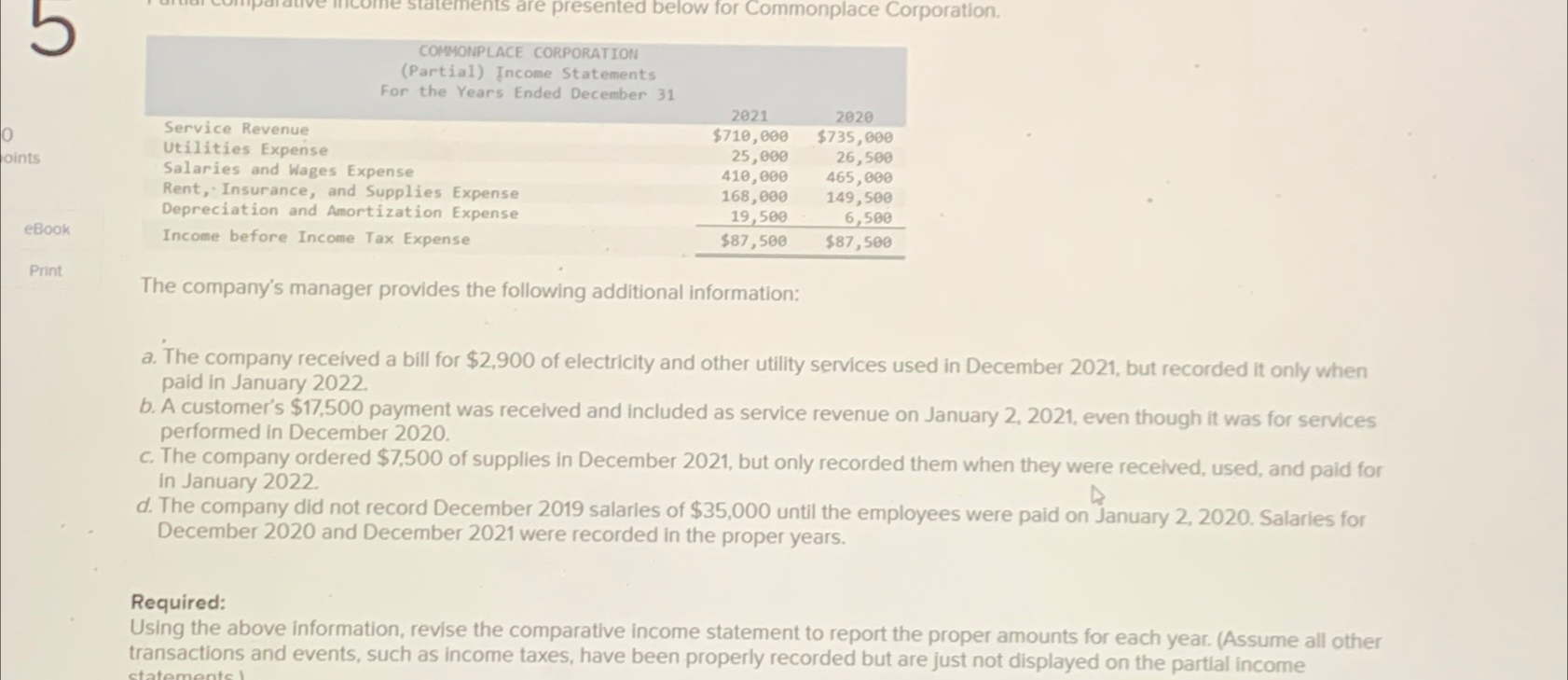

are presented below for Commonplace Corporation. table [ [ COMMONPLACE CORPORATION ] , [ For the Years Ended December 3 1 , , ,

are presented below for Commonplace Corporation.

tableCOMMONPLACE CORPORATIONFor the Years Ended December Service Revenue,$$Utilities Expense,Salaries and Wages Expense,Rent Insurance, and Supplies Expense,Depreciation and Amortization Expense,Income before Income Tax Expense,$$

The company's manager provides the following additional information:

a The company received a bill for $ of electricity and other utility services used in December but recorded it only when paid in January

b A customer's $ payment was received and included as service revenue on January even though it was for services performed in December

c The company ordered $ of supplies in December but only recorded them when they were recelved, used, and paid for in January

d The company did not record December salarles of $ until the employees were paid on January Salarles for December and December were recorded in the proper years.

Required:

Using the above information, revise the comparative income statement to report the proper amounts for each year. Assume all other transactions and events, such as income taxes, have been properly recorded but are just not displayed on the partial income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started