Question

a.Read the following excerpt and roughly estimate the average price of the options when they were bought on March 11, 2008. Based on his strategy

a.Read the following excerpt and roughly estimate the average price of the options when they were bought on March 11, 2008. Based on his strategy and your result from

b), what is the investors potential maximum loss and maximum profit?

On Tuesday, March 11th, 2008, somebody nobody knows who made one of the craziest bets Wall Street has ever seen. The mystery figure spent $1.7 million on a series of options, gambling that shares in the venerable investment bank Bear Stearns would lose more than half their value in nine days or less. .But what's even crazier is that the bet paid. At the close of business that afternoon, Bear Stearns was trading at $62.97. At that point, whoever made the gamble owned the right to sell huge bundles of Bear stock, at $30 and $25, on or before March 20th. In order for the bet to pay, Bear would have to fall harder and faster than any Wall Street brokerage in history. .By the weekend, it (Bear Stern) wasforcedto sell itself to JPMorgan Chaseat the humiliating price of$2 a share. Whoever bought those options on March 11th woke up on the morning of March 17th having made 159 times his money, or roughly $270 million please provide formula and calculating step

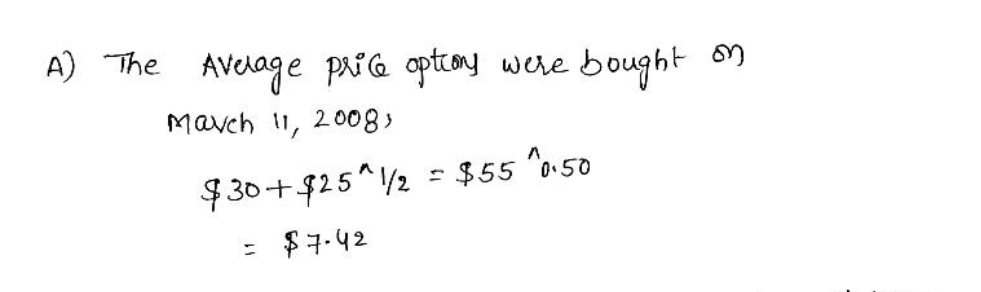

Can somebody explain why we use ($30+$25)^1/2 to get average price of option

A) The Average price options were bought on March 11, 2008) $30+$25"\/2 = $55 40-50 = $7.42 A) The Average price options were bought on March 11, 2008) $30+$25"\/2 = $55 40-50 = $7.42Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started