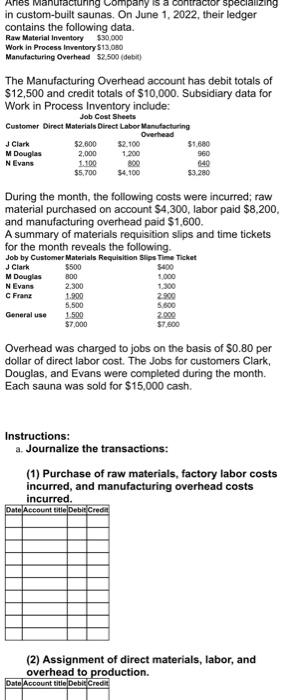

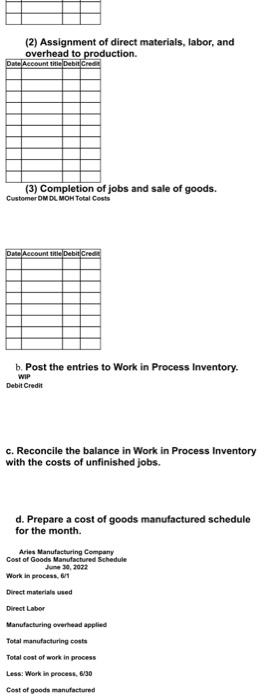

Ares Manufacturing company specializing in custom-built saunas. On June 1, 2022, their ledger contains the following data. Raw Material Inventory $30,000 Work in Process Inventory$13,080 Manufacturing Overhead 52.500 (debit) The Manufacturing Overhead account has debit totals of $12,500 and credit totals of $10,000. Subsidiary data for Work in Process Inventory include: Job Cost Sheets Customer Direct Materials Direct Labor Manufacturing Overhead J Clark 52.600 52.100 51.680 M Douglas 2,000 1.200 560 N Evans 1.100 800 34.100 53.280 $5.700 During the month, the following costs were incurred; raw material purchased on account $4,300, labor paid $8,200, and manufacturing overhead paid $1.600. A summary of materials requisition slips and time tickets for the month reveals the following Job by Customer Materials Requisition Slips Time Ticket J Clark $500 M Douglas 800 1,000 N Evans 2.300 1.300 C Franz 1.900 2.900 5.500 5.600 General use 1.500 2.000 $7,000 $7.600 Overhead was charged to jobs on the basis of $0.80 per dollar of direct labor cost. The Jobs for customers Clark, Douglas, and Evans were completed during the month. Each sauna was sold for $15,000 cash. Instructions: a. Journalize the transactions: (1) Purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs incurred. Date Account title Debit Credit (2) Assignment of direct materials, labor, and overhead to production. Date Account titlo Debit Credit (2) Assignment of direct materials, labor, and overhead to production. Date Account titi Debit Credit (3) Completion of jobs and sale of goods. Customer OM DL MOH Total Costs Date Account title Debit Credit b. Post the entries to Work in Process Inventory. Debit Credit WIP c. Reconcile the balance in Work in Process Inventory with the costs of unfinished jobs. d. Prepare a cost of goods manufactured schedule for the month. Arles Manufacturing Company Cost of Goods Manufactured Schedule June 30, 2022 Work in process, 61 Direct materials used Direct Labor Manufacturing overhead applied Total manufacturing costs Total cost of work in process Less: Work in process, 6/30 Cost of goods manufactured Ares Manufacturing company specializing in custom-built saunas. On June 1, 2022, their ledger contains the following data. Raw Material Inventory $30,000 Work in Process Inventory$13,080 Manufacturing Overhead 52.500 (debit) The Manufacturing Overhead account has debit totals of $12,500 and credit totals of $10,000. Subsidiary data for Work in Process Inventory include: Job Cost Sheets Customer Direct Materials Direct Labor Manufacturing Overhead J Clark 52.600 52.100 51.680 M Douglas 2,000 1.200 560 N Evans 1.100 800 34.100 53.280 $5.700 During the month, the following costs were incurred; raw material purchased on account $4,300, labor paid $8,200, and manufacturing overhead paid $1.600. A summary of materials requisition slips and time tickets for the month reveals the following Job by Customer Materials Requisition Slips Time Ticket J Clark $500 M Douglas 800 1,000 N Evans 2.300 1.300 C Franz 1.900 2.900 5.500 5.600 General use 1.500 2.000 $7,000 $7.600 Overhead was charged to jobs on the basis of $0.80 per dollar of direct labor cost. The Jobs for customers Clark, Douglas, and Evans were completed during the month. Each sauna was sold for $15,000 cash. Instructions: a. Journalize the transactions: (1) Purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs incurred. Date Account title Debit Credit (2) Assignment of direct materials, labor, and overhead to production. Date Account titlo Debit Credit (2) Assignment of direct materials, labor, and overhead to production. Date Account titi Debit Credit (3) Completion of jobs and sale of goods. Customer OM DL MOH Total Costs Date Account title Debit Credit b. Post the entries to Work in Process Inventory. Debit Credit WIP c. Reconcile the balance in Work in Process Inventory with the costs of unfinished jobs. d. Prepare a cost of goods manufactured schedule for the month. Arles Manufacturing Company Cost of Goods Manufactured Schedule June 30, 2022 Work in process, 61 Direct materials used Direct Labor Manufacturing overhead applied Total manufacturing costs Total cost of work in process Less: Work in process, 6/30 Cost of goods manufactured