Answered step by step

Verified Expert Solution

Question

1 Approved Answer

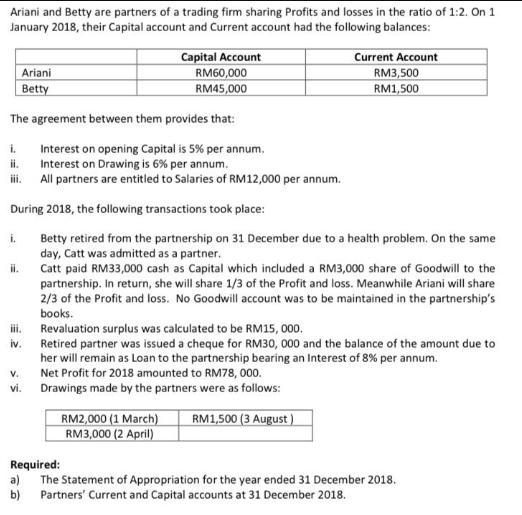

Ariani and Betty are partners of a trading firm sharing Profits and losses in the ratio of 1:2. On 1 January 2018, their Capital

Ariani and Betty are partners of a trading firm sharing Profits and losses in the ratio of 1:2. On 1 January 2018, their Capital account and Current account had the following balances: Capital Account RM60,000 RM45,000 The agreement between them provides that: Ariani Betty i. ii. Interest on Drawing is 6% per annum. iii. i. ii. All partners are entitled to Salaries of RM12,000 per annum. During 2018, the following transactions took place: Betty retired from the partnership on 31 December due to a health problem. On the same day, Catt was admitted as a partner. Catt paid RM33,000 cash as Capital which included a RM3,000 share of Goodwill to the partnership. In return, she will share 1/3 of the Profit and loss. Meanwhile Ariani will share 2/3 of the Profit and loss. No Goodwill account was to be maintained in the partnership's books. iii. iv. Interest on opening Capital is 5% per annum, V. vi. a) b) Current Account RM3,500 RM1,500 Revaluation surplus was calculated to be RM15,000. Retired partner was issued a cheque for RM30, 000 and the balance of the amount due to her will remain as Loan to the partnership bearing an Interest of 8% per annum. Net Profit for 2018 amounted to RM78, 000. Drawings made by the partners were as follows: RM1,500 (3 August) RM2,000 (1 March) RM3,000 (2 April) Required: The Statement of Appropriation for the year ended 31 December 2018. Partners' Current and Capital accounts at 31 December 2018.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started