Armando is buying a house worth 500,000, and must decide whether to take on a fixed or adjustable rate mortgage (ARM). The term of

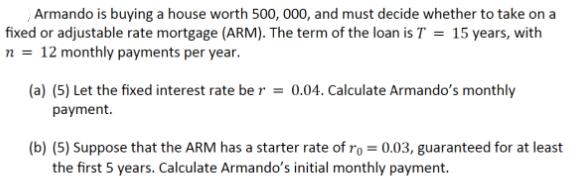

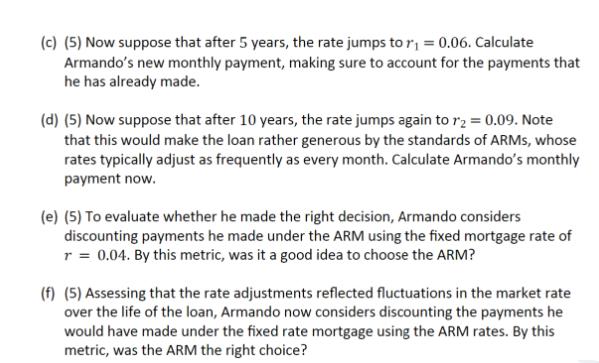

Armando is buying a house worth 500,000, and must decide whether to take on a fixed or adjustable rate mortgage (ARM). The term of the loan is T = 15 years, with n = 12 monthly payments per year. (a) (5) Let the fixed interest rate be r = 0.04. Calculate Armando's monthly payment. (b) (5) Suppose that the ARM has a starter rate of ro= 0.03, guaranteed for at least the first 5 years. Calculate Armando's initial monthly payment. (c) (5) Now suppose that after 5 years, the rate jumps to r = 0.06. Calculate Armando's new monthly payment, making sure to account for the payments that he has already made. (d) (5) Now suppose that after 10 years, the rate jumps again to r = 0.09. Note that this would make the loan rather generous by the standards of ARMs, whose rates typically adjust as frequently as every month. Calculate Armando's monthly payment now. (e) (5) To evaluate whether he made the right decision, Armando considers discounting payments he made under the ARM using the fixed mortgage rate of r = 0.04. By this metric, was it a good idea to choose the ARM? (f) (5) Assessing that the rate adjustments reflected fluctuations in the market rate over the life of the loan, Armando now considers discounting the payments he would have made under the fixed rate mortgage using the ARM rates. By this metric, was the ARM the right choice?

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Armandos monthly payment for a fixed interest rate of 004 we can use the formula for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started