Answered step by step

Verified Expert Solution

Question

1 Approved Answer

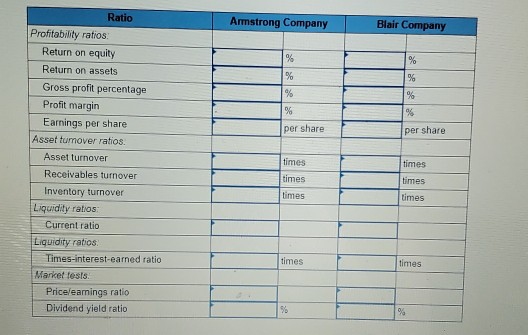

Armstrong Company Blair Company % % % % % % % % per share per share Ratio Profitability ratios Return on equity Return on assets

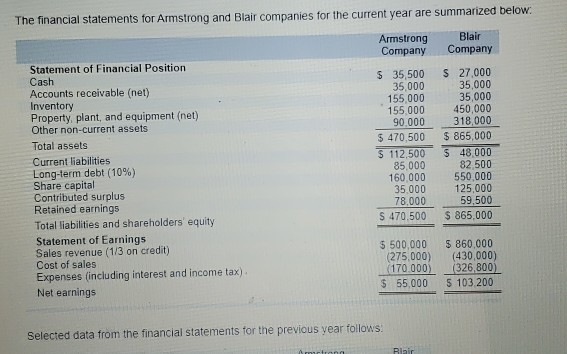

Armstrong Company Blair Company % % % % % % % % per share per share Ratio Profitability ratios Return on equity Return on assets Gross profit percentage Profit margin Earnings per share Asset turnover ratios. Asset turnover Receivables turnover Inventory turnover Liquidity ratios Current ratio Liquidity ratios Times-interest-earned ratio Market tesis Pricelearnings ratio Dividend yield ratio times times times times times times times times % % The financial statements for Armstrong and Blair companies for the current year are summarized below: Armstrong Blair Company Company Statement of Financial Position Cash $ 35,500 $ 27,000 Accounts receivable (net) 35,000 35,000 Inventory 155,000 35,000 Property, plant, and equipment (net) 155.000 450,000 Other non-current assets 90.000 318,000 Total assets $ 470.500 $ 865,000 Current liabilities $ 112,500 5 48 000 Long-term debt (10%) 85,000 82 500 Share capital 160.000 550.000 Contributed surplus 35.000 125,000 Retained earnings 78,000 59,500 Total liabilities and shareholders' equity $ 470.500 $ 865,000 Statement of Earnings Sales revenue (1/3 on credit) $ 500.000 $ 860,000 Cost of sales (275,000) (430,000) (170.000) Expenses (including interest and income tax). (326,800) Net earnings $ 55,000 5 103 200 Selected data from the financial statements for the previous year follows: mirtran Blair

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started