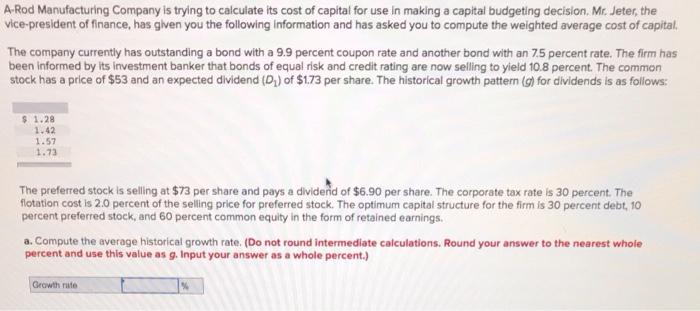

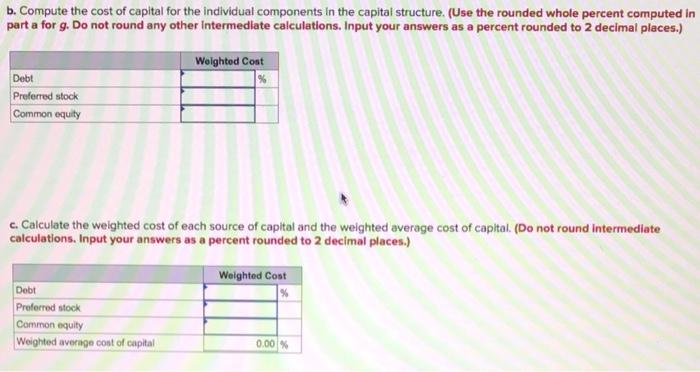

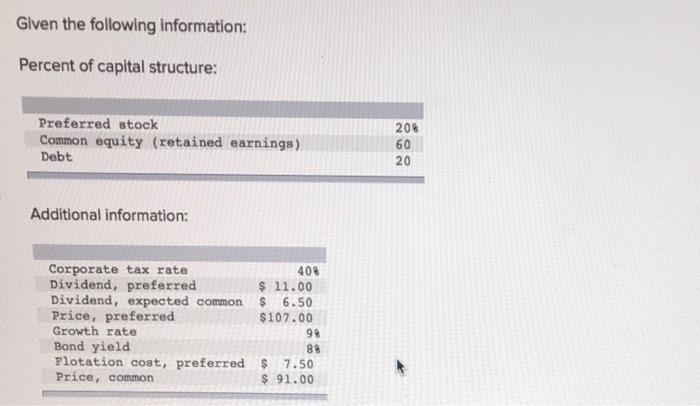

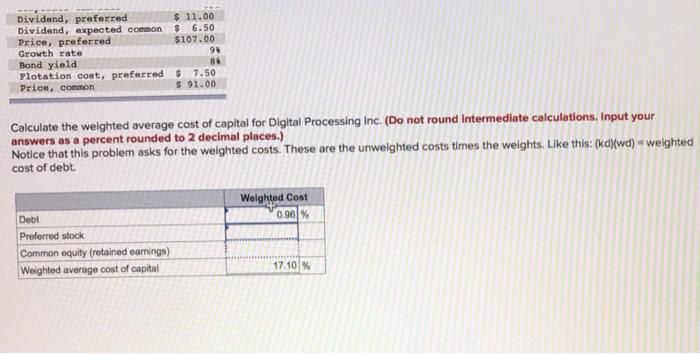

A-Rod Manufacturing Company is trying to calculate its cost of capital for use in making a capital budgeting decision, Mr. Jeter, the vice-president of finance, has glven you the following Information and has asked you to compute the weighted average cost of capital, The company currently has outstanding a bond with a 9.9 percent coupon rate and another bond with an 75 percent rate. The firm has been informed by its investment banker that bonds of equal risk and credit rating are now selling to yield 10.8 percent. The common stock has a price of $53 and an expected dividend (D) of $1.73 per share. The historical growth pattern (g) for dividends is as follows: $ 1.28 1.42 1.57 1.73 The preferred stock is selling at $73 per share and pays a dividend of $6.90 per share. The corporate tax rate is 30 percent. The flotation cost is 2.0 percent of the selling price for preferred stock. The optimum capital structure for the firm is 30 percent debt, 10 percent preferred stock, and 60 percent common equity in the form of retained earnings. a. Compute the average historical growth rate (Do not round intermediate calculations. Round your answer to the nearest whole percent and use this value as g. Input your answer as a whole percent.) Growth rate b. Compute the cost of capital for the individual components in the capital structure. (Use the rounded whole percent computed in part a for g. Do not round any other intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost Debt Preferred stock Common equity c. Calculate the welghted cost of each source of capital and the weighted average cost of capital (Do not round Intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost Debt Preferred stock Common equity Weighted average cost of capital 0,00 % Given the following information: Percent of capital structure: Preferred stock Common equity (retained earnings) Debt 208 60 20 Additional information: Corporate tax rate 409 Dividend, preferred $ 11.00 Dividend, expected common $ 6.50 Price, preferred $107.00 Growth rate 98 Bond yield 88 Flotation cost, preferred $ 7.50 Price, common $ 91.00 Dividend, preferred $ 11.00 Dividend, expected common $ 6.50 Price, preferred $107.00 Growth rate 90 Bond yield BA Plotation cost, preferred $ 7.50 Price, common $ 91.00 Calculate the weighted average cost of capital for Digital Processing Inc. (Do not round Intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Notice that this problem asks for the weighted costs. These are the unweighted costs times the weights. Like this: (kd)(wd) = weighted cost of debt. Weighted Cost 0.96% Debt Preferred stock Common equity (retained earnings) Weighted average cost of capital 17.10%