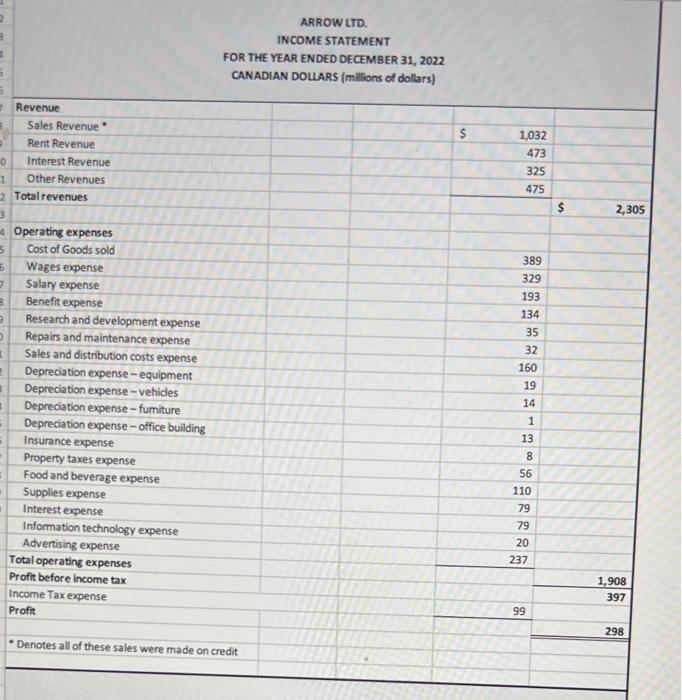

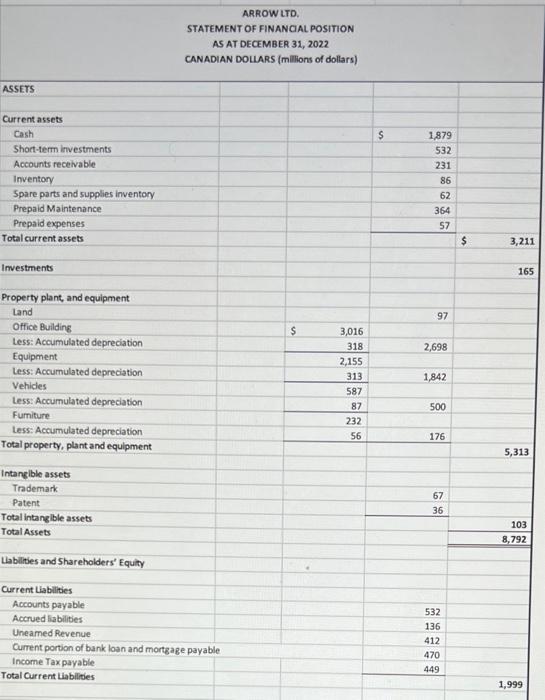

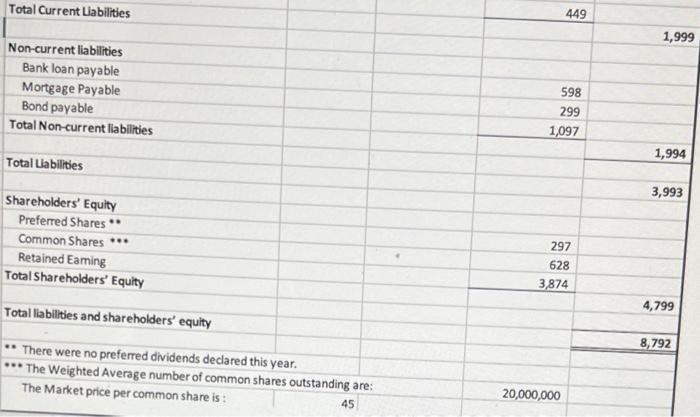

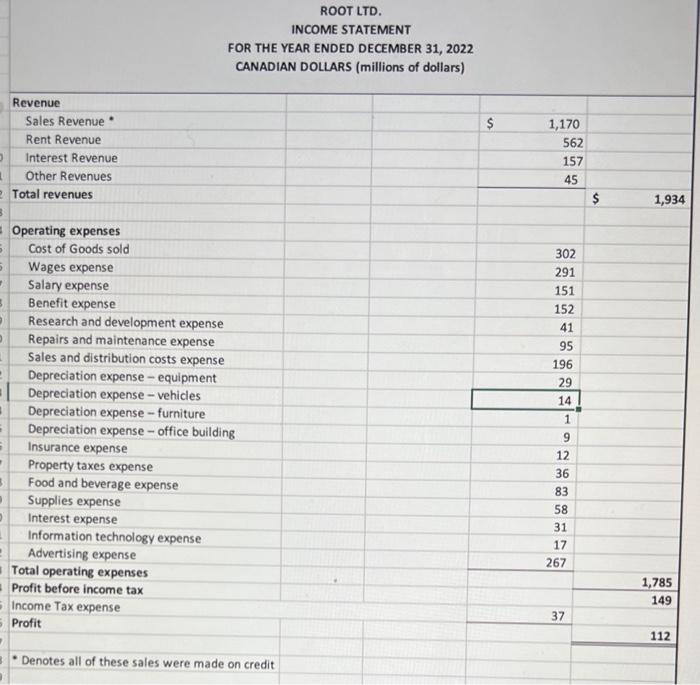

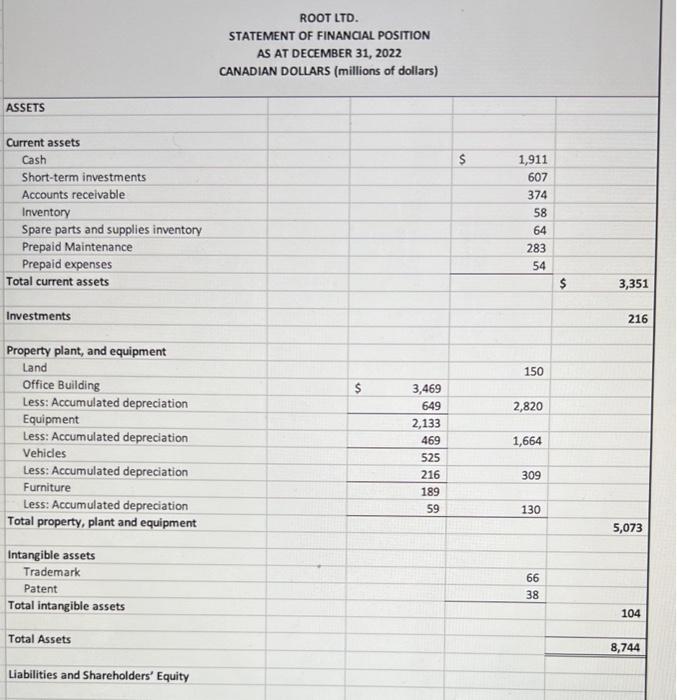

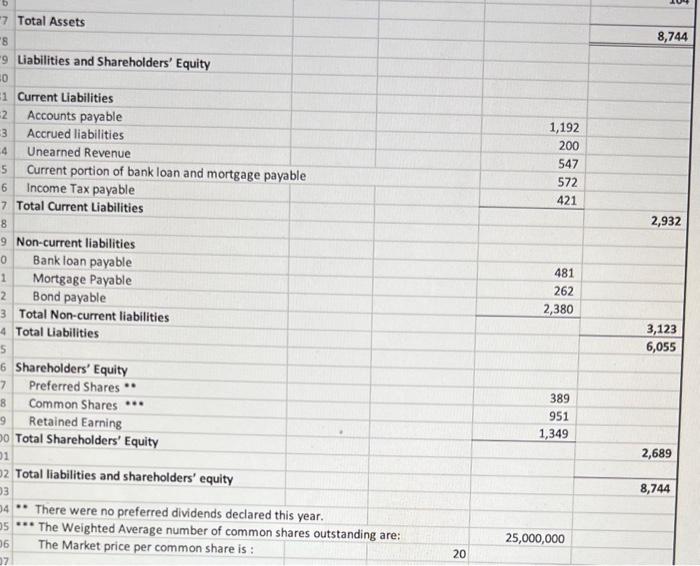

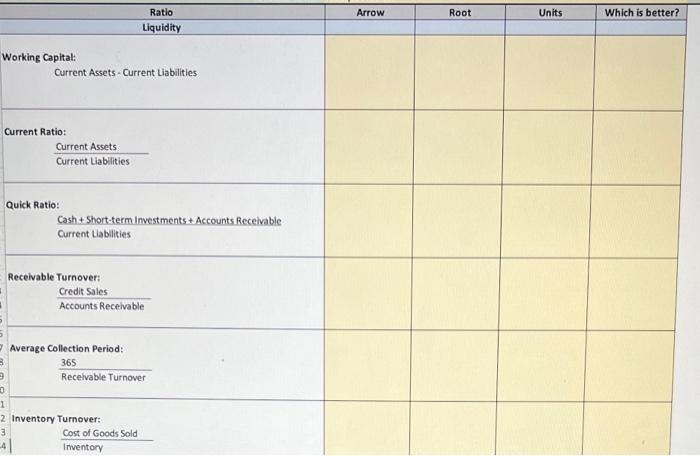

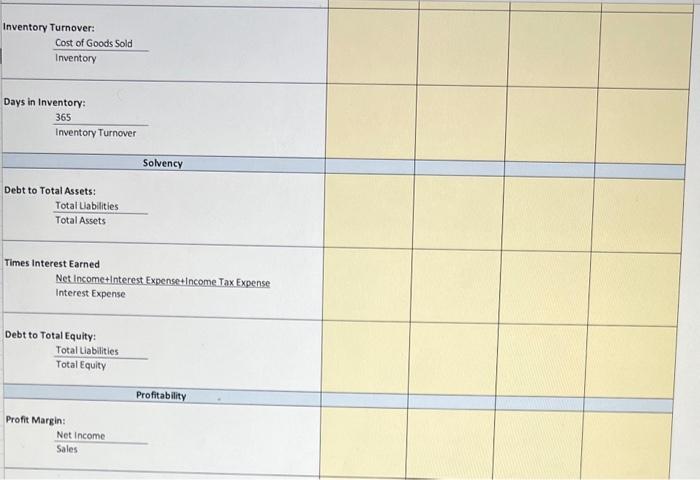

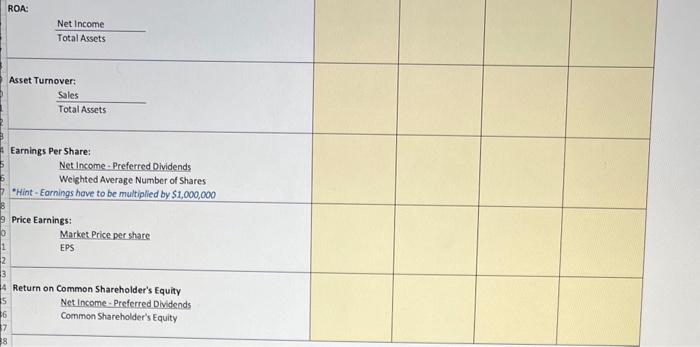

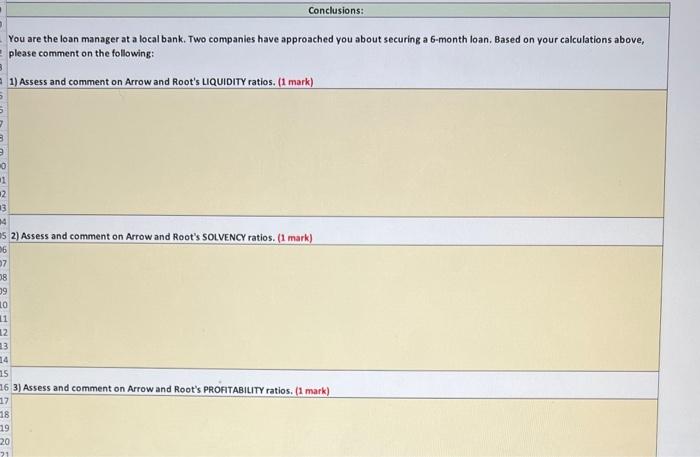

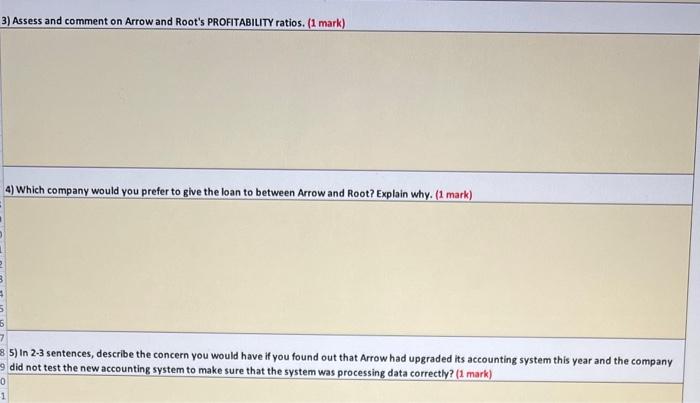

ARROW LTD. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2022 CANADIAN DOUARS (millions of dollars) Revenue ARROW LTD. STATEMENT OF FINANCAL POSITION AS AT DECEMBER 31, 2022 CANADIAN DOULRS (millions of dollars) ASSETS Current assets Cash Short-term Accounts n Inventory Spare part Prepaid M: Prepaid ex: Total current Imvestments Property plant, and equipment Total Current Labilities Non-current liabilities ROOT LTD. ROOT LTD. STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2022 CANADIAN DOLLARS (millions of dollars) ASSETS Current assets Total Assets Liabilities and Shareholders' Equity Current Liabilities Accounts payable 13 Accrued liabilities 4 Unearned Revenue 5 Current portion of bank loan and mortgage payable 6 Income Tax payable Total Current Liabilities 2,932 Non-current liabilities - Bank loan payable 1 Mortgage Payable 2 Bond payable 3 Total Non-current liabilities Total Liabilities Shareholders' Equity Preferred Shares ** 8 Common Shares 9 Retained Earning Total Shareholders' Equity Total liabilities and shareholders' equity There were no preferred dividends declared this year. The Weighted Average number of common shares outstanding are: The Market price per common share is : Inventory Turnover: InventoryCostofGoodsSold Days in Inventory: InventoryTurnover365 Debt to Total Assets: TotalAssetsTotalLiabilities Times Interest Earned Net Incometinterest Expensetincome Tax Expense Interest Expense Debt to Total Equity: TotalEquityTotalLiabilities Profit Margin: Net Income Sales ROA: TotalAssetsNetIncome Asset Turnover: TotalAssetsSales Earnings Per Share; Net income - Preferred Dividends Weighted Average Number of Shares "Hint - Earnings have to be multiplied by $1,000,000 Price Earnings: Market Price per share EPS Return on Common Shareholder's Equity Net income - Preferred Dividends Common Shareholder's Equity You are the loan manager at a local bank. Two companies have approached you about securing a 6-month loan. Based on your calculations above, please comment on the following: 1) Assess and comment on Arrow and Root's LIQUiDITY ratios. (1 mark) 3) Assess and comment on Arrow and Root's PROFITABIUITY ratios. (1 mark) 85) In 2-3 sentences, describe the concern you would have if you found out that Arrow had upgraded its accounting system this year and the company did not test the new accounting system to make sure that the system was processing data correctly? ( 1 mark)