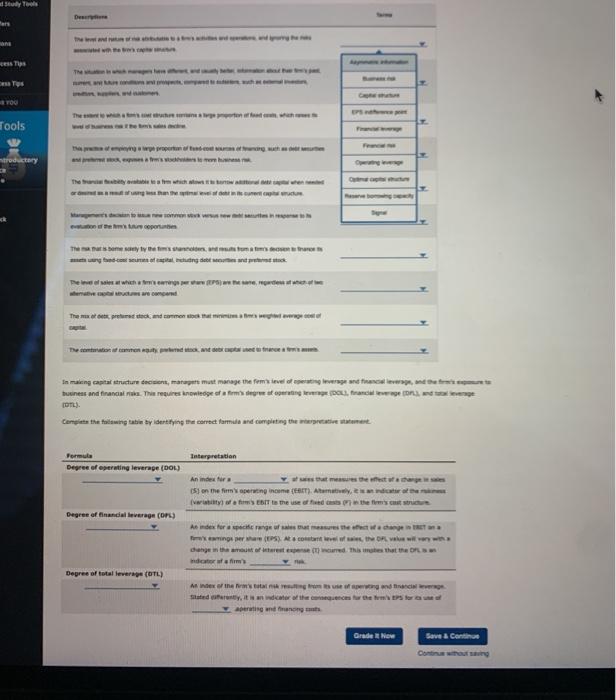

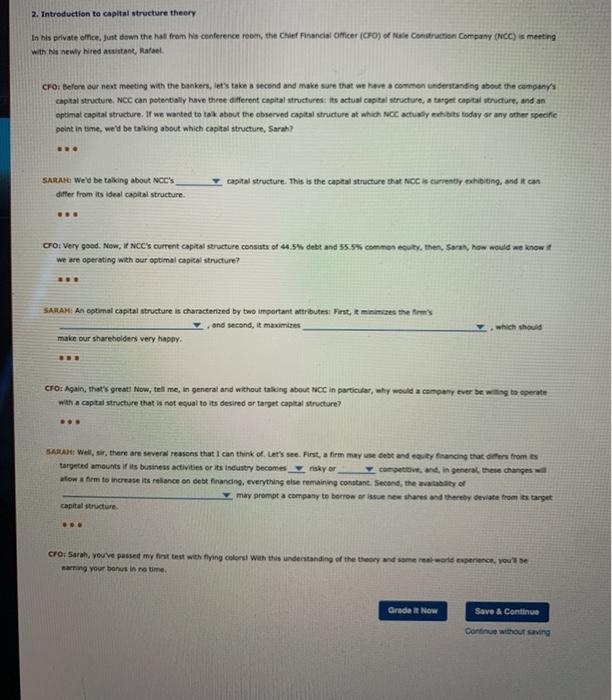

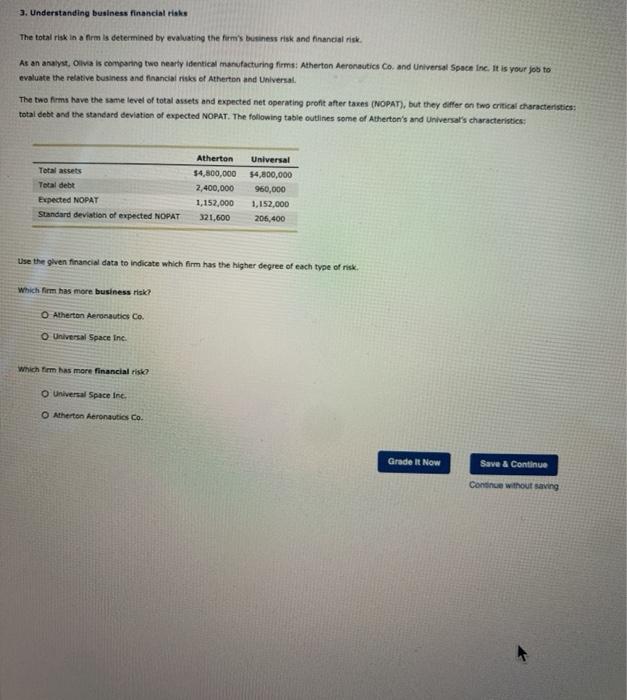

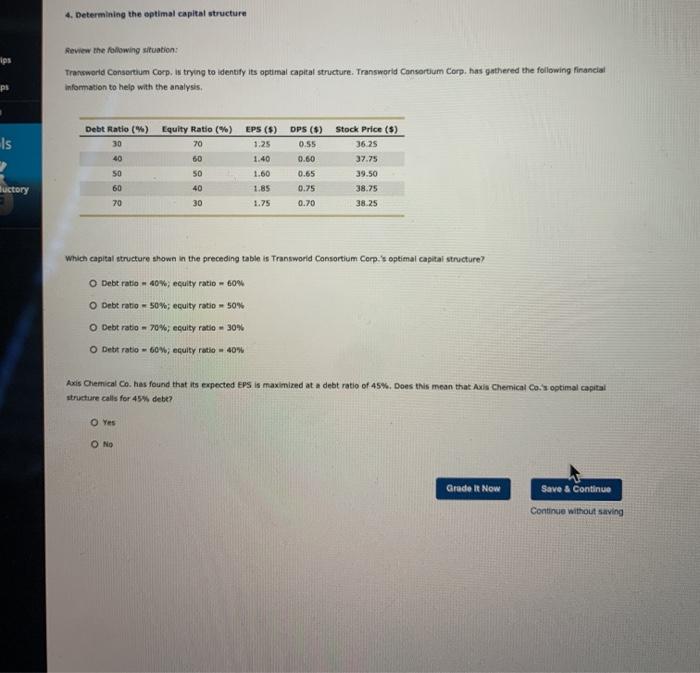

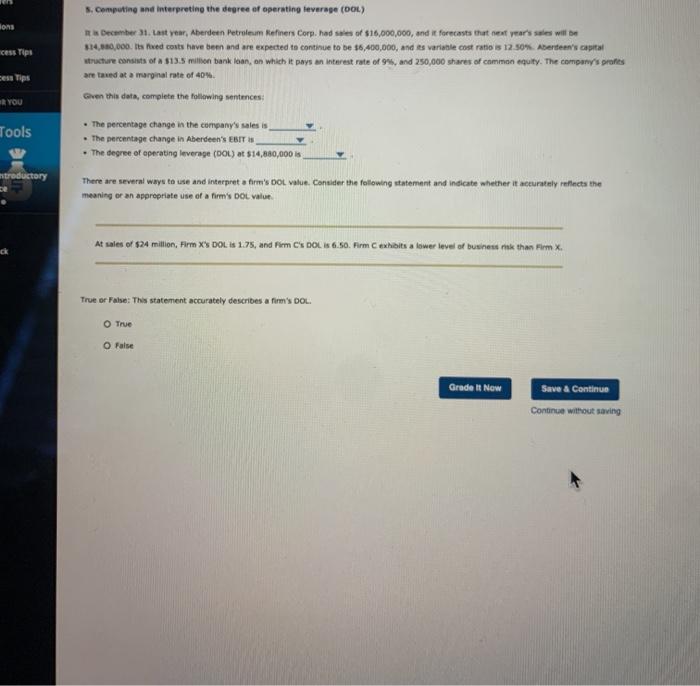

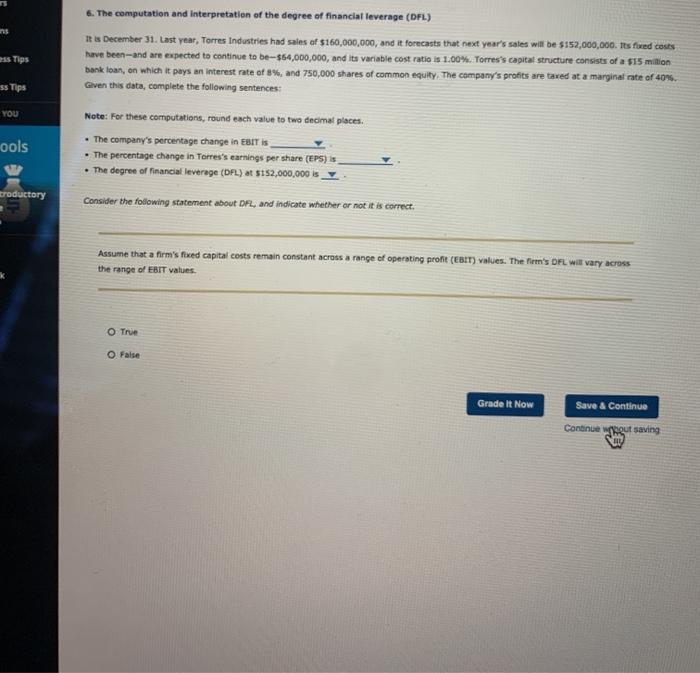

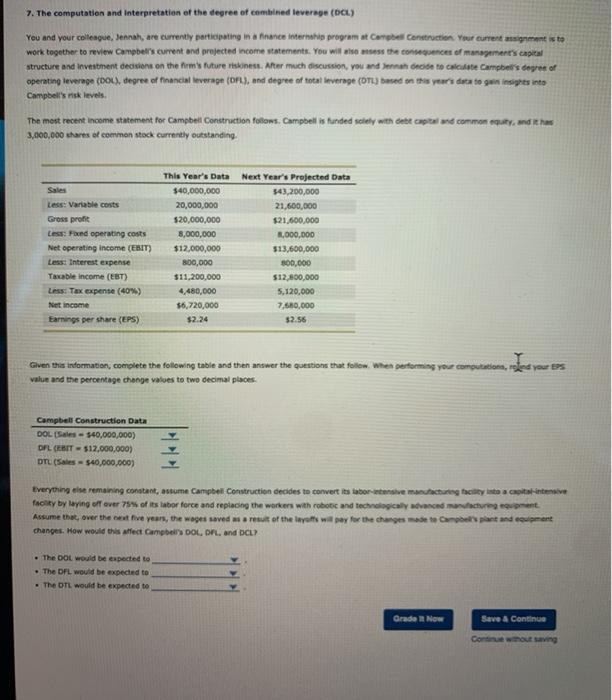

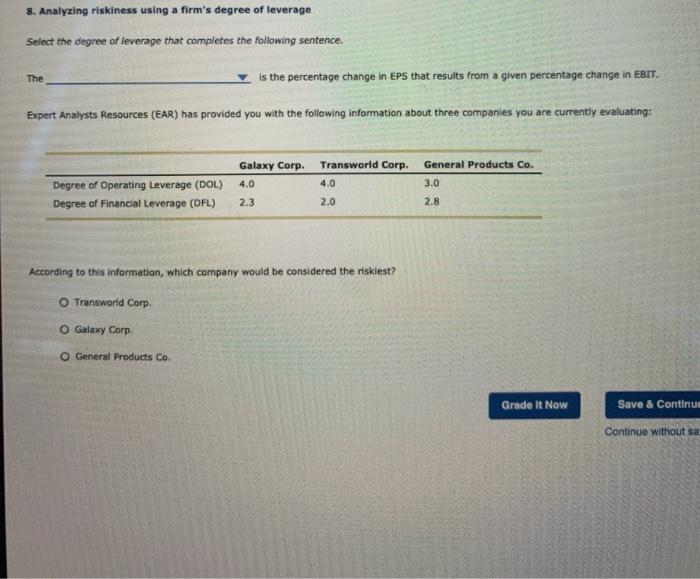

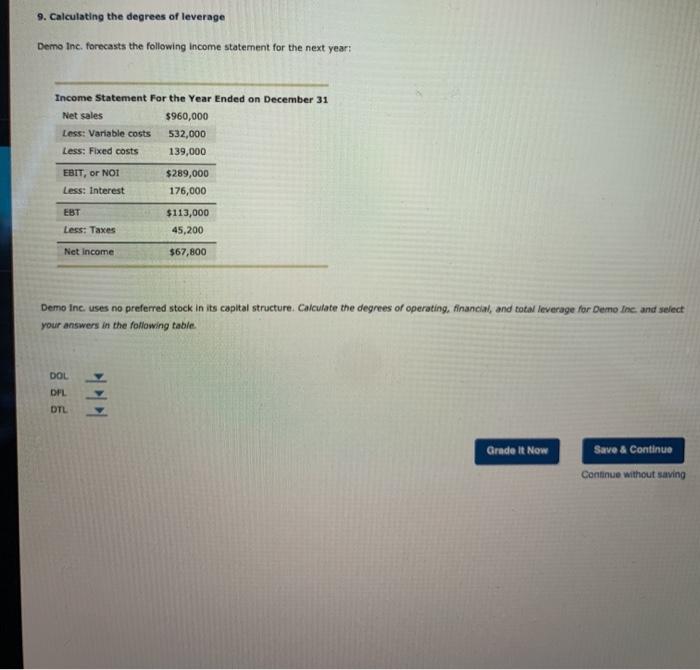

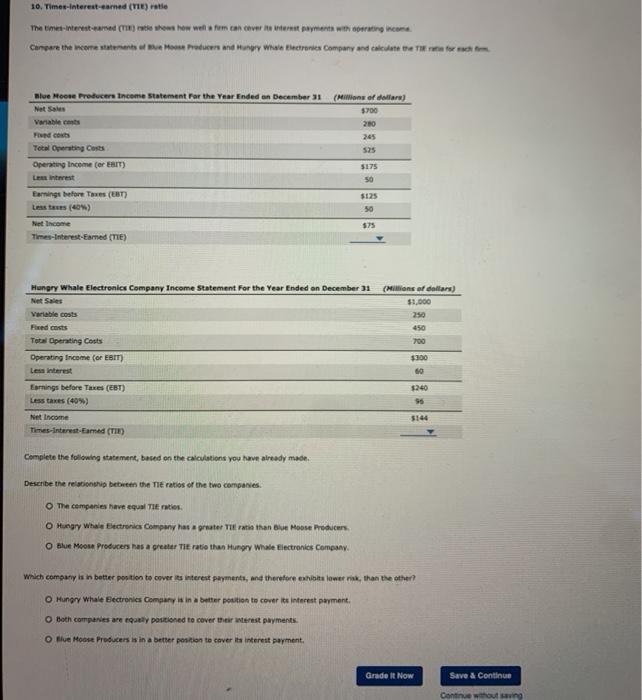

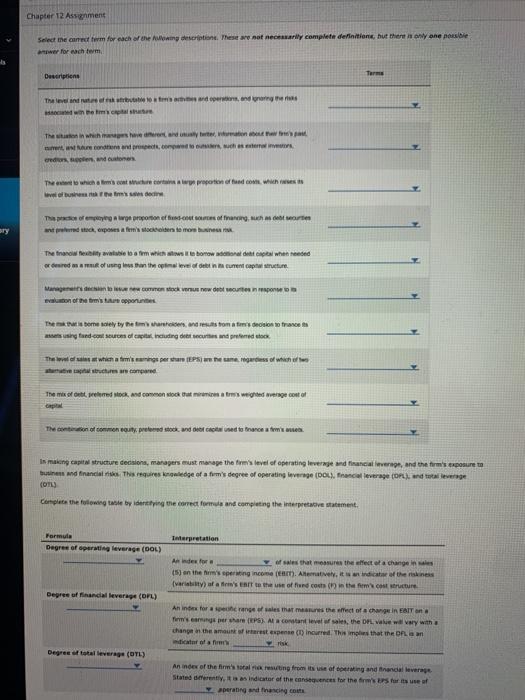

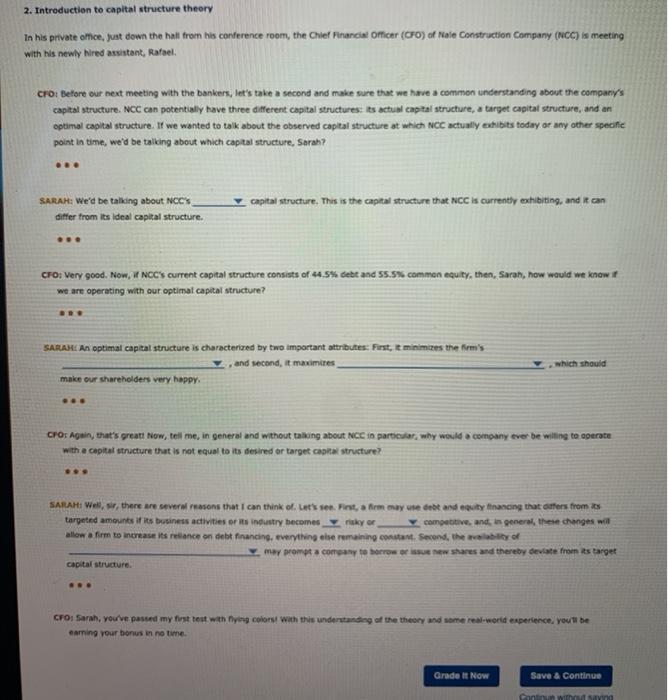

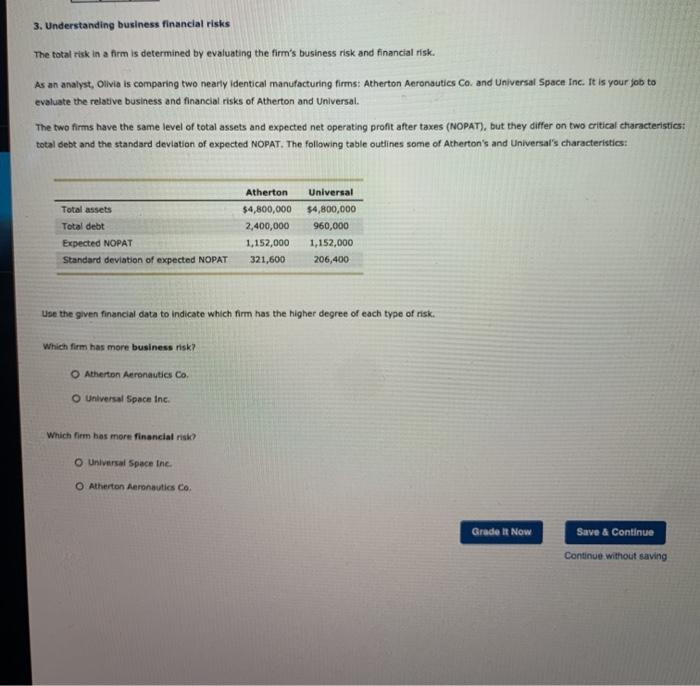

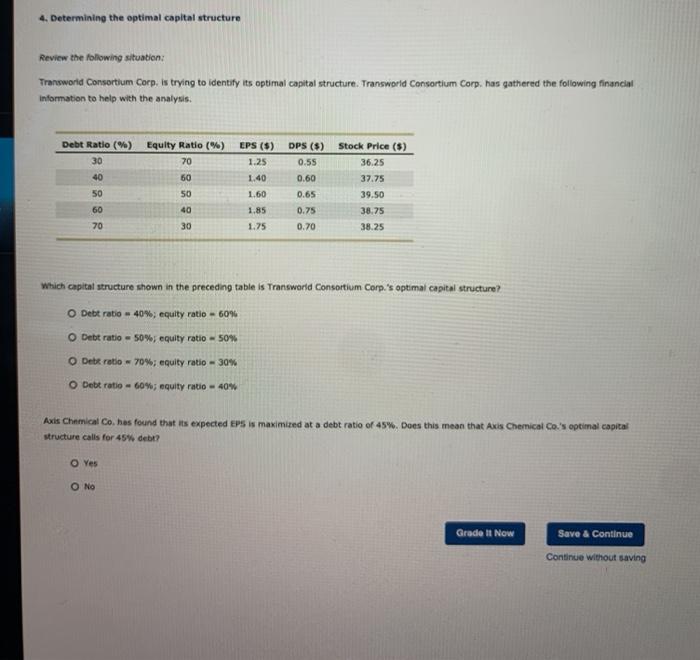

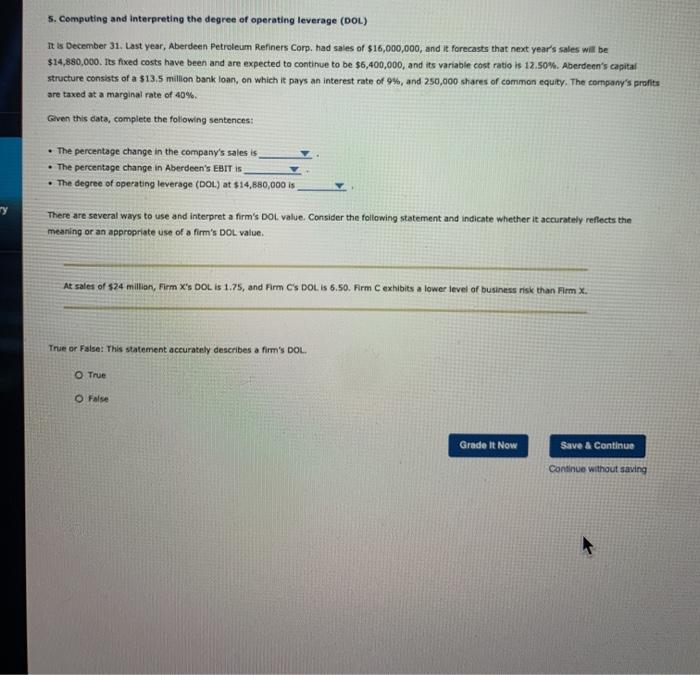

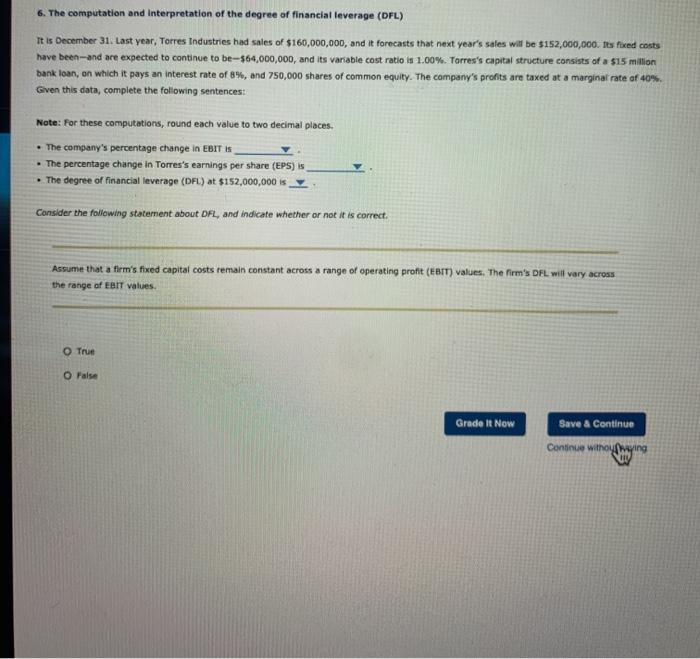

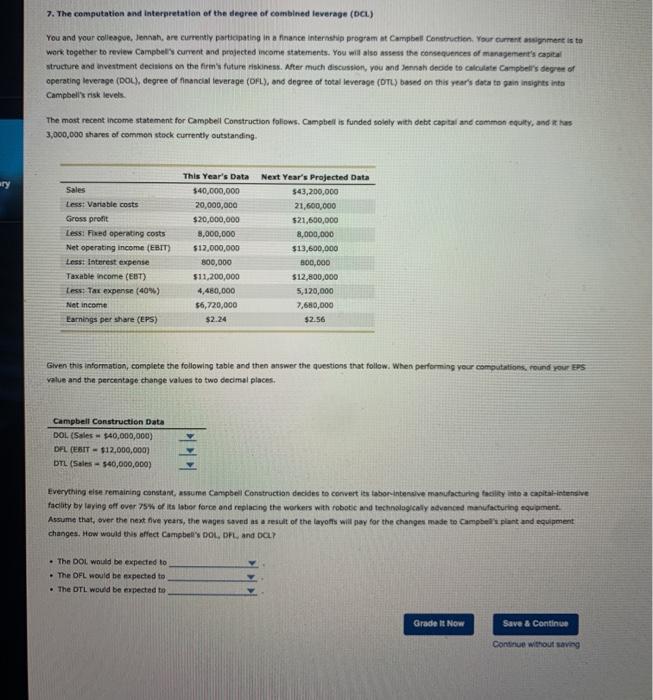

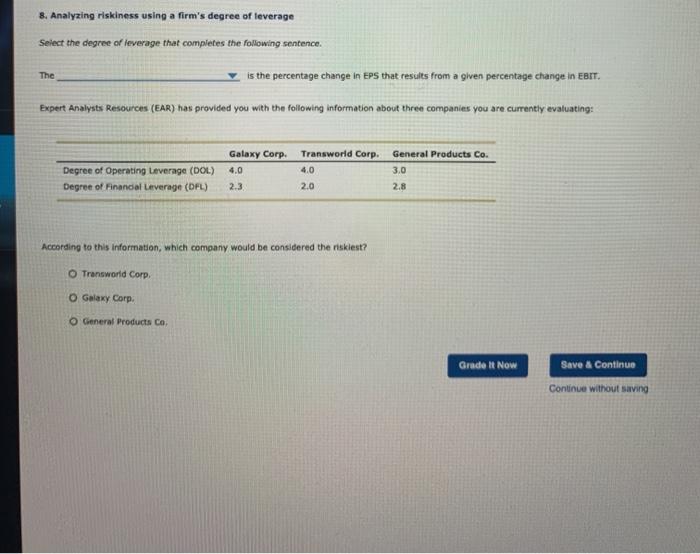

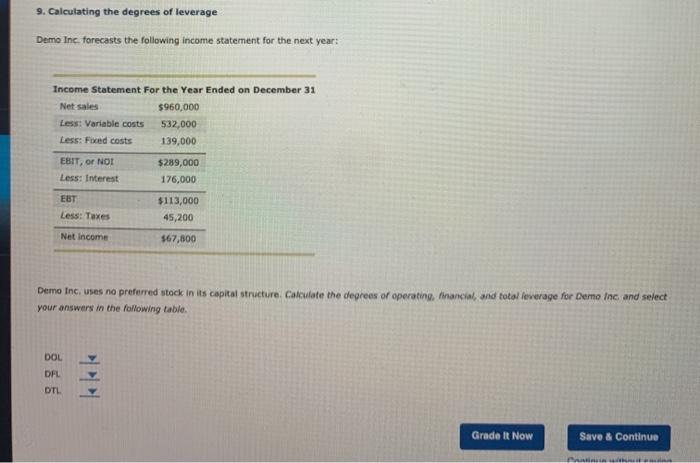

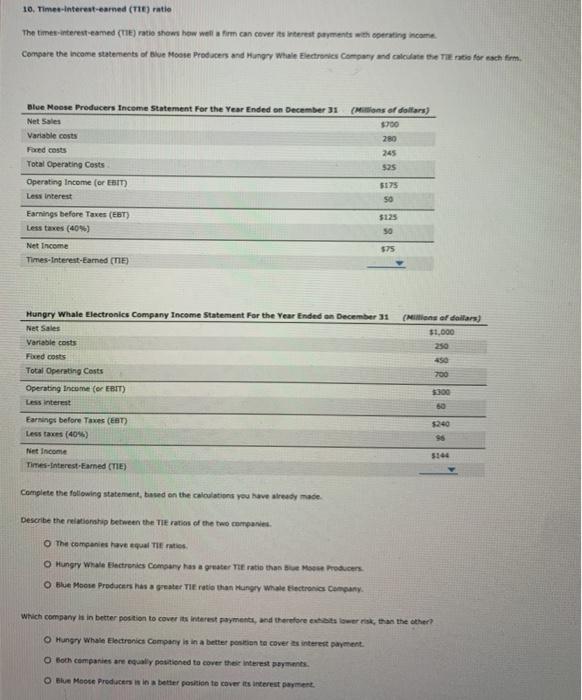

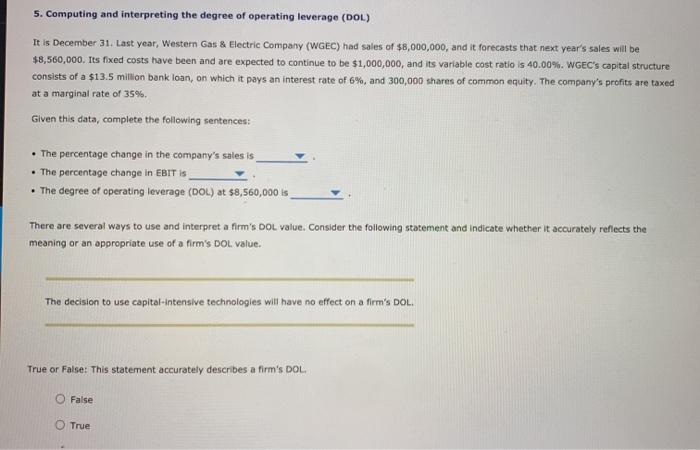

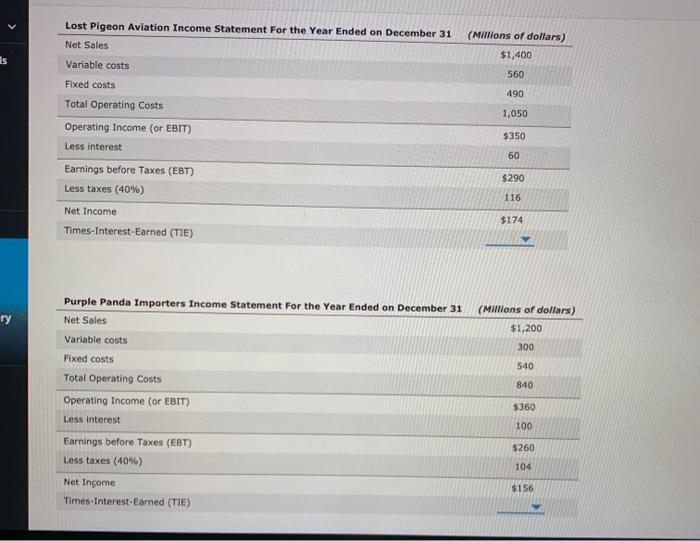

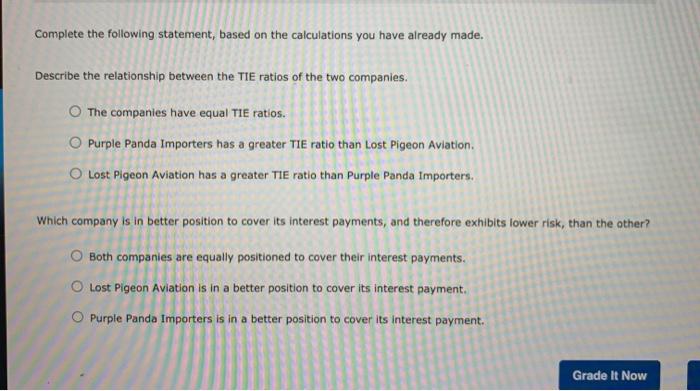

ars ess The Brod Tools the properto entreprise en troductory The better with pore The masse smyyn, omstret In maleng capital structure decision, matargers must manage the following leverage for business and financial This requires noget af den ganger, OTE). Cengite the following te ben the correct formula and computing the rivetement Formule Degree of operating leverage (DOL) Interpretation An idea Yes the estate 15 on the imperating income (EST), Amy WEBIT is the use of the first true Degree of financial leverage (OP) Aside for a change of states the chama per (PS). A the Own dange the freeware This makes that the India Degree of total leverage (TL) A externa atedry, dator of the consequences to the mattor pri nanong Save & Continue 2. Introduction to capital structure theory In his private office, just down the halfrom a conference room, the Chief Financial Officer (CFO) of the Construction Company (NCC) meeting with newly hired stant, Rafael Cro: Before our next meeting with the bankers, let's take a second and make sure that we have a common understanding about the company's capital structure, NCC can potentially have three different capital structures its actual capital structure, a target capital structure, and an optimal capital structure. If we wanted to talk about the observed capital structure at which NGC actually hits today or any other specific point in time, we'd be talking about which capital structure, Sarah? BO SARAH We'd be talking about NCC's differ from its ideal capital structure. y capital structure. This is the capital structure that NCC is currently exhibiting, and can CFO: Very good. Now, NCC's current capital structure consists of 44.5% debt and 35.5% common couty. Then, Sarah, how would we know it we are operating with our optimal capital structure? SAHAH: An optimal capital structure is characterized by two important attributes: First, a minimizes the firm's and second, it maximize make our shareholders very happy y, which should CFOAgain, that's great Now, tell me, in general and without taking about NCC in particular, why would company ever be willing to operate with a capital structure that is not equal to its desired or target capital structure? ... SARAH: Well, there are several reasons that I can think of. Let's see First, a firm may use cent and financing that others from targeted amounts if its business activities or its industry becomes_sky or y competition, in general these changes low a firm to increase its reliance on det financing, everything else remaining constant. Second, the way of may prompt a company to borrow orience shared thereby deviate from its target capital structure CFO Sarah, youve passed my first test with flying color with this understanding of the theory and caring your bows in a time world experience you'll be Grad Now Save & Continue Continue without saving 3. Understanding business financial raks The total risk in a firm is determined by evaluating the firm's business risk and financial risk. As an analyst, Olva is comparing two hearty identical manufacturing firms: Atherton Aeronautics Co. and Universal Space Inc. It is your job to evaluate the relative business and financial risks of Atherton and Universal The two firma have the same level of total assets and expected net operating profit after taxes (NOPAT), but they offer on two critical characteristics: total debt and the standard deviation of expected NOPAT. The following table outlines some of Atherton's and Universal's characteristics: Total assets Total deb Expected NOPAT Standard deviation of expected NOPAT Atherton 54,800,000 2,400,000 1,152,000 321,600 Universal 54,800,000 960,000 1,152,000 206,400 Use the given financial data to indicate which firm has the higher degree of each type of risk Which firm has more business risk? O Atherton Aeronautics Co. Universal Space Inc. Which firm has more financial risk? Universal Space Inc. O Atherton Aeronautics Co. Grade It Now Save & Continue Continue without saving Determining the optimal capital structure Review the following situation: Transwarles Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered the following financilat information to help with the analysis, pl EPS (S) Debt Ratio () 30 Equity Ratio (%) 70 Is Stock Price ($) 3625 40 37.75 60 50 40 30 50 DPS ($) 0.55 0.60 0.65 0.75 0.70 1.25 1.40 1.60 1.85 1.75 auctory 60 39.50 38.75 38.25 70 which capital structure shown in the preceding table is Transworld Consortium Corp. 's optimal capital structure? O Debt ratio 40%, equity ratio 60 Debt ratio -50%; culty ratio -50% Debt ratio - 70%, equity ratio - 30% Debt ratio -60%, equity ratio -40% Axis Chemical Co. has found that its expected EPS is maximized at a debt ratio of 45%. Does this mean that Axis Chemical Co.'s optimal capital structure calls for 45% debt? Yes O No Grade it Now Save & Continue Continue without saving 5. Computing and interpreting the degree of operating leverage (DOL) 103 cess Tips December 31. Last year, Aberdeen Petroleum Reiners Corp. had of 516,000,000, and it forecasts that next year's sales will be 314,000,000. Itsed costs have been and are expected to continue to be $6,400,000, and as variable cost ratio is 12.50% Aberdeen's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 94 and 250,000 shares of common equity. The company's profes are taxed at a marginal rate of 40 cess Tips YOU Given this data, complete the following sentences Tools The percentage change in the company's sales is . The perontage change in Aberdeen's EBIT The degree of operating leverage (DOL) at $14,880,000 is traductory There are several ways to use and interpretatiom's not value. Consider the following statement and indicate whether it acturately reflects the meaning or an appropriate use of a firm's DOL value At sales of $24 million, Firm X'S DOL is 1.75, and Firm C's DOLI 6.50. Firm Cexhibits a lower level of business than Firm X True or False: This statement accurately describes a firm's DOL. O True O False Grade It Now Save A Continue Continue without saving 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Tes fue costs have been-and are expected to continue to be-$64,000,000, and its variable cost ratio is 100%. Torres's capital structure consists of a $15 milion bank loan, on which it pays an interest rate of 8%, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences: ss Tips YOU ools Note: For these computations, round each value to two decimal places. . The company's percentage change in EBIT is The percentage change in Torres's earnings per share (EPS) is The degree of financial leverage (DFL) at $152,000,000 is Consider the following statement about Dr., and indicate whether or not it is correct. productory Assume that a firm's fixed capital costs remain constant across a range of operating profit (EBIT) values. The firm's DFL will vary across the range of EBIT values. O True O False Grade it Now Save & Continue Continue whout saving 7. The computation and interpretation of the degree of combined leverage (BCL) You and your colleague, Jennah, are currently participating in a finance Internship program at Care Construction your current assignment to work together to review Campbell's current and projected income statements. You will also the contences of managements capital structure and investment decisions on the firm's future rises. After much discussion, you and en die toe Campber's degree of operating leverage (DOL), degree of financial leverage (of), and degree of totalleverage (OTL) based on this year's data to gain initsints Campbell's risk levels The most recent income statement for Campbell Construction follows. Campbell is funded solely with one could common equity, and it has 3,000,000 shares of common stock currently outstanding. Sales Less: Variable costs Gross profit Less: Fond operating costs Net operating income (EBIT) Less: Interest expense Taxable income (EBT) Less: Tax expense (40%) Net Income Earnings per share (EPS) This Year's Data $40,000,000 20,000,000 $20,000,000 8,000,000 $12,000,000 800,000 $11,200,000 4,480,000 $6,720,000 $2.24 Next Year's Projected Data 343,200,000 21,600,000 $21.600.000 3,000,000 513,600,000 300.000 512,800,000 5,120,000 7,680,000 $2.56 Given this indormation, complete the following table and then answer the questions that follow when performing your computations, raked your 9 value and the percentage change values to two decimal places Campbell Construction Data DOL Sales - $40,000,000) OFLEBIT - $12,000,000) DTL (Sales - $40,000,000) Everything else remaining constant, astume Campbell Construction decides to convertits bor-tensive manufacturing facility to a capitale facity by laying off over 75% of its labor force and replacing the workers with robotic and technologically and machine want Assume that over the best five years, the wages saved as a result of the layouts will pay for the changes made to Campant and comment changes. How would this affect Campbell's DOL, FL, and DCL The DOL would be expected to The DFL would be expected to The OTL would be expected to Grad Now Save & Continue 8. Analyzing riskiness using a firm's degree of leverage Select the degree of leverage that completes the following sentence. The is the percentage change in EPS that results from a given percentage change in EBIT. Expert Analysts Resources (EAR) has provided you with the following information about three companies you are currently evaluating: Galaxy Corp. Transworld Corp. 4.0 General Products Co. 3.0 4.0 Degree of Operating Leverage (DOL) Degree of Financial Leverage (DFL) 2.3 2.0 2.8 According to this information, which company would be considered the riskiest? Transworld Corp O Galaxy Corp o General Products Co. Grade It Now Save & Continue Continue without sa 9. Calculating the degrees of leverage Demo Inc. forecasts the following income statement for the next year: Income Statement for the Year Ended on December 31 Net sales $960,000 Less: Variable costs 532,000 Less: Fixed costs 139,000 EBIT, or NOI Less: Interest $289,000 176,000 EBT $113,000 45,200 Less: Taxes Net Income $67,800 Demo Inc. uses no preferred stock in its capital structure. Calculate the degrees of operating, financial, and total leverage for Demo Inc and select your answers in the following table. DOL DFL DTL Grade It Now Save & Continue Continue without saving 10. Timer-interest-earned (T1) rate The times interested (THe shows how well from can cover a internet payments with ping income Core the correttamente se producers and How we recentes Company and calculate the Tom (Millions of dollars) Blue Moore Producers Income Statement for the Year Ended on December 31 Net Sales Variablets 200 525 $175 Total Operating costs Operating Income (or EBIT) Les interest Earnings before Thues (ET Less tas (409) 50 $125 50 75 Net Income Times Interest-Eamed (TE) Hungry Whale Electronics Company Income Statement For the Year Ended on December 31 (Millions of dollars) Net Sales $1,000 Variable costs 2:50 Fred costs 450 Total Operating costs 700 Operating Income (or EBIT) $300 Less interest 60 Earnings before Taxes (EBT) 12:40 Les taxes (40%) 95 Net Income Times-interest-Eamed (TE) Complete the following statement, based on the calculations you have already made Describe the relationship between the the ratio of the two companies The companies have equal TIE ration Hungry Whale Electronics Company has greater Tre than Blue Moose Producers O Blue Moon Producers has a greater Tieratie than Hungry Whale Electronics Company Which company is in better position to cover its interest Payments, and therefore its lower than the other? O Mungry Whale Bectronics Company is in a better position to cover its interest payment. O Both companies are equal positioned to cover their interest payments. O Blue Moose Producers is in a better position to cover its interest payment Grade it Now Save & Continue Continue without saving Chapter 12 Assignment Select the carreterm for each of the description. These are not necessarily complete definition, but there wone pole e for each tem Descriptions The land trots and personnage Then wiederter Mon preconchas on, and customers The which control of which is vel of the time The propery we propone of frare, such courte entered tuck, exposes a fe's toe te mos bem The tow they are sa tem which was e bomow donorat dette when need ordered a fungus than the optimalevel of Gebih tument constructure Mange er wel eens The store sciety headers and results from a trase seg fand consumo ding debt cute and pred stock The which meanings per EPS emerdess of what - verurs.com The misel on teed lock, and common stock trimm weighted rage cost of The content of common souty, pretend stook and few used to trance a to' em. in making capital structure decisions, managers must manage the firm's level of operating leverage and financiera, and the firm's posure to business and financial This requires gledge of a firm's degree of operating leverage (Donancial leverage (OPL), and to leverage COTL) Complete the flowing the boys in the correct formule and completing the interpretative statement Formula Degree of operating leverage (DOL) Interpretation An inden for of sales that measures the effect of a change in (15) on the spring incom. Alternatively, adicate the lines Lam's ERIT to the offer costs in the most sture Degree of financial leverage (OPL) An in a range of sales that means the effect of a change in EBIT an m'any pare (PS). A constant levelses, the Dale wiary with change in the amount est expense) incurred. The imples that the on into a Degree of totalleverage (DTL) An index of the firm's talenting from its of operating and Mandal leverage States frently as indicator of the consequences for the first for its use of perating and hancing 2. Introduction to capital structure theory In his private orice, just down the hall from his conference room, the Chief Financial Officer (CFO) of Nate Construction Company (NCC) is meeting with his newly hired assistant, Rafael CFO: Before our next meeting with the bankers, let's take a second and make sure that we have a common understanding about the company's capital structure. NCC can potentially have three different capital structures: its actual capital structure, target capital structure, and an optimal capital structure. If we wanted to talk about the observed capital structure at which NCC actually exhibits today or any other specific point in time, we'd be talking about which capital structure, Sarah? capital structure. This is the capital structure that NCC is currently exhibiting, and it can SARAH: We'd be talking about NCC'S differ from its ideal capital structure. CFO: Very good. Now, NCC's current capital structure consists of 44,5% debt and 55.5% common equity, then, Sarah, how would we know if we are operating with our optimal capital structure? SARAHAn optimal capital structure is characterized by two important attributes: First, it minimizes the firm's Vand second, it maximies make our shareholders very happy which should CFOs Again, that's great Now, tell me, in general and without taking about NCC in particular, why would a company ever be willing to operate with a capital structure that is not equal to its desired or target capital structure? SARAH: Well, there are several reasons that I can think of. Let's see. First, a firm may use debt and equity financing that offers from as targeted amounts of its business activities or its industry becomes y or competitive and is general these changes will allow firm to increase its reliance on debt financing, everything else remaining constant. Second, the way of may promet a company to borrow se new shares and thereby deviate from its target capital structure. ... CFO, Sarah, youve passed my first test with lying colors with this understanding of the theory and some real world experience, you be caming your bonus in no time. Grade It Now Save & Continue Can withing 3. Understanding business financial risks The total risk in a firm is determined by evaluating the firm's business risk and financial risk. As an analyst, Olivia is comparing two nearly identical manufacturing firms: Atherton Aeronautics Co. and Universal Space Inc. It is your job to evaluate the relative business and financial risks of Atherton and Universal. The two firms have the same level of total assets and expected net operating profit after taxes (NOPAT), but they differ on two critical characteristics: total debt and the standard deviation of expected NOPAT. The following table outlines some of Atherton's and Universal's characteristics: Total assets Total debt Expected NOPAT Standard deviation of expected NOPAT Atherton $4,800,000 2,400,000 1,152,000 321,600 Universal $4,800,000 960,000 1,152,000 206,400 Use the given financial data to indicate which firm has the higher degree of each type of risk. Which firm has more business risk? Atherton Aeronautics Co. O Universal Space Inc. Which firm has more financial risk Universal Space Ine. O Atherton Aeronautics Co. Grade It Now Save & Continue Continue without saving 4. Determining the optimal capital structure Review the flowing situation Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered the following financial Information to help with the analysis. Debt Ratio (%) 30 Equity Ratio (%) 70 60 40 EPS (5) 1.25 1.40 1.60 1.85 1.75 DPS (s) 0.55 0.60 0.65 0.75 0.70 Stock Price (5) 36.25 37.75 39.50 38.75 38.25 50 50 60 70 40 30 Which capital structure shown in the preceding table is Transworld Consortium Corp.'s optimal capital structure? Debt ratio - 40%, equity ratio -60% Debt ratio -50%, equity ratio -50% Debe ratio - 70%, equity ratio - 30% o Debt ratio -60%; equity ratio 40% Axis Chemical Co. has found that is expected EPS is maximized at a debt ratio of 45%. Does this mean that Axis Chemical Co.'s optimal capital structure calls for 45% debt? o Yes O No Grade It Now Save & Continue Continue without saving 5. Computing and interpreting the degree of operating leverage (DOL) It is December 31, Last year, Aberdeen Petroleum Refiners Corp. had sales of $16,000,000, and it forecasts that next year's sales will be $14,880,000. Its fixed costs have been and are expected to continue to be $6,400,000, and its variable cost ratio is 13.50%. Aberdeen's capital structure consists of a $13,5 million bank loan, on which it pays an interest rate of 9%, and 250,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences: The percentage change in the company's sales is The percentage change in Aberdeen's EBIT is The degree of operating leverage (DO1.) at $14,880,000 is There are several ways to use and interpret a firm's Dol value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. At sales of $24 million, Firm X's DOL is 1.75, and Firm Cs BOL is 6.50. Firm Cexhibits a lower level of business risk than Firm X. True or False: This statement accurately describes a fimm's DOL O True O False Grade it Now Save & Continue Continue without saving 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Its fixed costs have been-and are expected to continue to be-$64,000,000, and its variable cost ratio is 1.00%. Torres's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 8 %, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Gven this data, complete the following sentences: Note: For these computations, round each value to two decimal places. The company's percentage change in EBIT IS The percentage change in Torres's earnings per share (EPS) is The degree of financial leverage (DFU) at $152,000,000 is Consider the following statement about DFL, and indicate whether or not it is correct. Assume that a firm's fixed capital costs remain constant across a range of operating profit (EBIT) values. The firm's DFL will vary across the range of EBIT values. True O False Grade It Now Save & Continue Continue withouwing 7. The computation and interpretation of the degree of combined leverage (DCL) You and your colleague, Jennah, are currently participating in a finance Internship program at Campbell Construction. Your current assignment is to work together to review Campbell's current and projected income statements. You will also assess the consequences of management's capital structure and investment decisions on the firm's future makiness. After much discussion, you and Jenna dode to calculate Campbell's degree of operating leverage (DOL), degree of financial leverage (OFL), and degree of total leverage (OTL) based on this year's data to gain insights into Campbell's risk levels The most recent income statement for Campbell Construction follows, Campbell is funded tolely with debt capital and common equity, and it has 3,000,000 shares of common stock currently outstanding. Sales Less: Variable costs Gross profit Less: Fixed operating costs Net operating income (EBIT) Less: Interest expense Taxable income (EST) Less: Tax expense (40%) Net income Earnings per share (EPS) This Year's Data $40,000,000 20,000,000 $20,000,000 8,000,000 $12,000,000 800,000 $11,200,000 4,450,000 $6,720,000 $2.24 Next Year's Projected Data 543,200,000 21,600,000 $21,600,000 8,000,000 $13,600,000 300,000 $12,800,000 5,120,000 7,680,000 $2.56 Given this information, complete the following table and then answer the questions that follow. When performing your computations. Found your EPS value and the percentage change values to two decimal places Campbell Construction Data DOL(Sales - $40,000,000) DPL (EST - $12,000,000) DTL (Sales - $40,000,000) Everything else remaining constant, assume Campbell Construction decides to convertits taborIntensive manufacturing facility into a capital-intensive facity by laying off over 75% of its labor force and replacing the workers with robotic and technologically advanced manufacturing equipment Assume that, over the next five years, the wages saved as a result of the layots will pay for the changes made to Campbell's plant and equipment changes. How would this affect Campbell's DOL, DFL and DOLY The DOL would be expected to The OFL would be expected to The OTL would be expected to Grade Now Save & Continue Continue without saving 8. Analyzing riskiness using a firm's degree of leverage Select the degree of leverage that completes the following sentence. The is the percentage change in EPS that results from a given percentage change in EBIT. Expert Analysts Resources (EAR) has provided you with the following information about three companies you are currently evaluating: Galaxy Corp. 4.0 2.3 Degree of Operating Leverage (DOL) Degree of Finandal Leverage (DFL) Transworld Corp. 4.0 2.0 General Products Co. 3.0 2.8 According to this information, which company would be considered the riskiest? Transworld Corp O Galaxy Corp. O General Products Co. Grade It Now Save & Continue Continue without saving 9. Calculating the degrees of leverage Demo Inc. forecasts the following income statement for the next year: Income Statement For the Year Ended on December 31 Net sales $960,000 Less: Variable costs 532,000 Less: Fixed costs 139,000 EBIT, or NOT $289,000 Less: Interest 176,000 EBT $113,000 Less: Taxes 45,200 Net Income $67,800 Demo Inc, ses no preferred stock in its capital structure. Calculate the degrees of operating, financial, and total leverage for Demo Inc and select your answers in the following table DOL DFL DTL Grade It Now Save & Continue 10. Time-interest-earned (16) ratio The times interesteamed (IE) ratio shows how well form can cover its tres payments withing income Compare the income statements of Blue Moore Producers and Hungry Whale Electronics Company and at the Tere for each firm. (Milions of dollars) $900 280 245 Blue Mouse Producers Income Statement for the Year Ended on December 31 Net Sales Variable costs Fored costs Total Operating costs Operating Income (or EBIT) Less interest Earnings before Taxes (ET) Less taxes (40) $25 5175 90 $125 SO 575 Net Income Times Interest-Earned (TE) Hungry Whale Electronics Company Income Statement For the Year Ended on December 31 Net Sales Variable costs Fixed costs Total Operating costs (Milions of dollars) $1,000 250 $300 Operating Income (or EBIT) Less interest 50 5240 Earnings before Taxes (ET) Less taxes (40%) Net Income Times Interest-Earned (TIE) Complete the following statement based on the calculations you have already made Describe the relationship between the TIE ratio of the two companie The companies have equal TIEM Hungry Whale Electronics Company has a greater the ratio that Moose Producers Ob Moore Producers has a greater. The ratio than Hungry whalelectronics Company Which company is in better position to cover its interest payment, and therefore its lower than the other? Hungry Whale Electronics Company is in a better position to cover interest payment. O Both companies are equally positioned to cover the interest payments Blue Moose Producers in better position to cover its interest payment 5. Computing and interpreting the degree of operating leverage (DOL) It is December 31. Last year, Western Gas & Electric Company (WGEC) had sales of $8,000,000, and it forecasts that next year's sales will be $8,560,000. Its fixed costs have been and are expected to continue to be $1,000,000, and its variable cost ratio is 40.00%. WGEC's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 6%, and 300,000 shares of common equity. The company's profits are taxed at a marginal rate of 35% Given this data, complete the following sentences: . The percentage change in the company's sales is . The percentage change in EBIT is The degree of operating leverage (DOL) at $8,560,000 is There are several ways to use and interpret a firm's DOL value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. The decision to use capital-Intensive technologies will have no effect on a firm's DOL. True or False: This statement accurately describes a firm's DOL False True (Millions of dollars) $1,400 560 490 1,050 Lost Pigeon Aviation Income Statement For the Year Ended on December 31 Net Sales Variable costs Fixed costs Total Operating costs Operating Income (or EBIT) Less interest Earnings before Taxes (EBT) Less taxes (40%) Net Income Times-Interest-Earned (TIE) $350 60 $290 116 $174 ry (Millions of dollars) $1,200 300 Purple Panda Importers Income Statement for the Year Ended on December 31 Net Sales Variable costs Fixed costs Total Operating costs Operating Income (or EBIT) Less interest 540 840 $360 100 $260 104 Earnings before Taxes (EBT) Less taxes (40%) Net Income Times Interest-Earned (TIE) $156 Complete the following statement, based on the calculations you have already made. Describe the relationship between the TIE ratios of the two companies. The companies have equal TIE ratios. Purple Panda Importers has a greater TIE ratio than Lost Pigeon Aviation Lost Pigeon Aviation has a greater TIE ratio than Purple Panda Importers. Which company is in better position to cover its interest payments, and therefore exhibits lower risk, than the other? Both companies are equally positioned to cover their interest payments. O Lost Pigeon Aviation is in a better position to cover its interest payment. O Purple Panda Importers is in a better position to cover its interest payment. Grade It Now Average Rate of Ret Determine the average rate of return for a project that is estimated to yield total income of $394,000 over four years, has a cost of $685,000, and has a $102,400 residual value Round to the nearest whole number Cash Payback Period A project has estimated annual net cash flows of $50,500. It is estimated to cost $282,800. Determine the cash payback period. Round your answer to one decimal place. years ars ess The Brod Tools the properto entreprise en troductory The better with pore The masse smyyn, omstret In maleng capital structure decision, matargers must manage the following leverage for business and financial This requires noget af den ganger, OTE). Cengite the following te ben the correct formula and computing the rivetement Formule Degree of operating leverage (DOL) Interpretation An idea Yes the estate 15 on the imperating income (EST), Amy WEBIT is the use of the first true Degree of financial leverage (OP) Aside for a change of states the chama per (PS). A the Own dange the freeware This makes that the India Degree of total leverage (TL) A externa atedry, dator of the consequences to the mattor pri nanong Save & Continue 2. Introduction to capital structure theory In his private office, just down the halfrom a conference room, the Chief Financial Officer (CFO) of the Construction Company (NCC) meeting with newly hired stant, Rafael Cro: Before our next meeting with the bankers, let's take a second and make sure that we have a common understanding about the company's capital structure, NCC can potentially have three different capital structures its actual capital structure, a target capital structure, and an optimal capital structure. If we wanted to talk about the observed capital structure at which NGC actually hits today or any other specific point in time, we'd be talking about which capital structure, Sarah? BO SARAH We'd be talking about NCC's differ from its ideal capital structure. y capital structure. This is the capital structure that NCC is currently exhibiting, and can CFO: Very good. Now, NCC's current capital structure consists of 44.5% debt and 35.5% common couty. Then, Sarah, how would we know it we are operating with our optimal capital structure? SAHAH: An optimal capital structure is characterized by two important attributes: First, a minimizes the firm's and second, it maximize make our shareholders very happy y, which should CFOAgain, that's great Now, tell me, in general and without taking about NCC in particular, why would company ever be willing to operate with a capital structure that is not equal to its desired or target capital structure? ... SARAH: Well, there are several reasons that I can think of. Let's see First, a firm may use cent and financing that others from targeted amounts if its business activities or its industry becomes_sky or y competition, in general these changes low a firm to increase its reliance on det financing, everything else remaining constant. Second, the way of may prompt a company to borrow orience shared thereby deviate from its target capital structure CFO Sarah, youve passed my first test with flying color with this understanding of the theory and caring your bows in a time world experience you'll be Grad Now Save & Continue Continue without saving 3. Understanding business financial raks The total risk in a firm is determined by evaluating the firm's business risk and financial risk. As an analyst, Olva is comparing two hearty identical manufacturing firms: Atherton Aeronautics Co. and Universal Space Inc. It is your job to evaluate the relative business and financial risks of Atherton and Universal The two firma have the same level of total assets and expected net operating profit after taxes (NOPAT), but they offer on two critical characteristics: total debt and the standard deviation of expected NOPAT. The following table outlines some of Atherton's and Universal's characteristics: Total assets Total deb Expected NOPAT Standard deviation of expected NOPAT Atherton 54,800,000 2,400,000 1,152,000 321,600 Universal 54,800,000 960,000 1,152,000 206,400 Use the given financial data to indicate which firm has the higher degree of each type of risk Which firm has more business risk? O Atherton Aeronautics Co. Universal Space Inc. Which firm has more financial risk? Universal Space Inc. O Atherton Aeronautics Co. Grade It Now Save & Continue Continue without saving Determining the optimal capital structure Review the following situation: Transwarles Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered the following financilat information to help with the analysis, pl EPS (S) Debt Ratio () 30 Equity Ratio (%) 70 Is Stock Price ($) 3625 40 37.75 60 50 40 30 50 DPS ($) 0.55 0.60 0.65 0.75 0.70 1.25 1.40 1.60 1.85 1.75 auctory 60 39.50 38.75 38.25 70 which capital structure shown in the preceding table is Transworld Consortium Corp. 's optimal capital structure? O Debt ratio 40%, equity ratio 60 Debt ratio -50%; culty ratio -50% Debt ratio - 70%, equity ratio - 30% Debt ratio -60%, equity ratio -40% Axis Chemical Co. has found that its expected EPS is maximized at a debt ratio of 45%. Does this mean that Axis Chemical Co.'s optimal capital structure calls for 45% debt? Yes O No Grade it Now Save & Continue Continue without saving 5. Computing and interpreting the degree of operating leverage (DOL) 103 cess Tips December 31. Last year, Aberdeen Petroleum Reiners Corp. had of 516,000,000, and it forecasts that next year's sales will be 314,000,000. Itsed costs have been and are expected to continue to be $6,400,000, and as variable cost ratio is 12.50% Aberdeen's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 94 and 250,000 shares of common equity. The company's profes are taxed at a marginal rate of 40 cess Tips YOU Given this data, complete the following sentences Tools The percentage change in the company's sales is . The perontage change in Aberdeen's EBIT The degree of operating leverage (DOL) at $14,880,000 is traductory There are several ways to use and interpretatiom's not value. Consider the following statement and indicate whether it acturately reflects the meaning or an appropriate use of a firm's DOL value At sales of $24 million, Firm X'S DOL is 1.75, and Firm C's DOLI 6.50. Firm Cexhibits a lower level of business than Firm X True or False: This statement accurately describes a firm's DOL. O True O False Grade It Now Save A Continue Continue without saving 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Tes fue costs have been-and are expected to continue to be-$64,000,000, and its variable cost ratio is 100%. Torres's capital structure consists of a $15 milion bank loan, on which it pays an interest rate of 8%, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences: ss Tips YOU ools Note: For these computations, round each value to two decimal places. . The company's percentage change in EBIT is The percentage change in Torres's earnings per share (EPS) is The degree of financial leverage (DFL) at $152,000,000 is Consider the following statement about Dr., and indicate whether or not it is correct. productory Assume that a firm's fixed capital costs remain constant across a range of operating profit (EBIT) values. The firm's DFL will vary across the range of EBIT values. O True O False Grade it Now Save & Continue Continue whout saving 7. The computation and interpretation of the degree of combined leverage (BCL) You and your colleague, Jennah, are currently participating in a finance Internship program at Care Construction your current assignment to work together to review Campbell's current and projected income statements. You will also the contences of managements capital structure and investment decisions on the firm's future rises. After much discussion, you and en die toe Campber's degree of operating leverage (DOL), degree of financial leverage (of), and degree of totalleverage (OTL) based on this year's data to gain initsints Campbell's risk levels The most recent income statement for Campbell Construction follows. Campbell is funded solely with one could common equity, and it has 3,000,000 shares of common stock currently outstanding. Sales Less: Variable costs Gross profit Less: Fond operating costs Net operating income (EBIT) Less: Interest expense Taxable income (EBT) Less: Tax expense (40%) Net Income Earnings per share (EPS) This Year's Data $40,000,000 20,000,000 $20,000,000 8,000,000 $12,000,000 800,000 $11,200,000 4,480,000 $6,720,000 $2.24 Next Year's Projected Data 343,200,000 21,600,000 $21.600.000 3,000,000 513,600,000 300.000 512,800,000 5,120,000 7,680,000 $2.56 Given this indormation, complete the following table and then answer the questions that follow when performing your computations, raked your 9 value and the percentage change values to two decimal places Campbell Construction Data DOL Sales - $40,000,000) OFLEBIT - $12,000,000) DTL (Sales - $40,000,000) Everything else remaining constant, astume Campbell Construction decides to convertits bor-tensive manufacturing facility to a capitale facity by laying off over 75% of its labor force and replacing the workers with robotic and technologically and machine want Assume that over the best five years, the wages saved as a result of the layouts will pay for the changes made to Campant and comment changes. How would this affect Campbell's DOL, FL, and DCL The DOL would be expected to The DFL would be expected to The OTL would be expected to Grad Now Save & Continue 8. Analyzing riskiness using a firm's degree of leverage Select the degree of leverage that completes the following sentence. The is the percentage change in EPS that results from a given percentage change in EBIT. Expert Analysts Resources (EAR) has provided you with the following information about three companies you are currently evaluating: Galaxy Corp. Transworld Corp. 4.0 General Products Co. 3.0 4.0 Degree of Operating Leverage (DOL) Degree of Financial Leverage (DFL) 2.3 2.0 2.8 According to this information, which company would be considered the riskiest? Transworld Corp O Galaxy Corp o General Products Co. Grade It Now Save & Continue Continue without sa 9. Calculating the degrees of leverage Demo Inc. forecasts the following income statement for the next year: Income Statement for the Year Ended on December 31 Net sales $960,000 Less: Variable costs 532,000 Less: Fixed costs 139,000 EBIT, or NOI Less: Interest $289,000 176,000 EBT $113,000 45,200 Less: Taxes Net Income $67,800 Demo Inc. uses no preferred stock in its capital structure. Calculate the degrees of operating, financial, and total leverage for Demo Inc and select your answers in the following table. DOL DFL DTL Grade It Now Save & Continue Continue without saving 10. Timer-interest-earned (T1) rate The times interested (THe shows how well from can cover a internet payments with ping income Core the correttamente se producers and How we recentes Company and calculate the Tom (Millions of dollars) Blue Moore Producers Income Statement for the Year Ended on December 31 Net Sales Variablets 200 525 $175 Total Operating costs Operating Income (or EBIT) Les interest Earnings before Thues (ET Less tas (409) 50 $125 50 75 Net Income Times Interest-Eamed (TE) Hungry Whale Electronics Company Income Statement For the Year Ended on December 31 (Millions of dollars) Net Sales $1,000 Variable costs 2:50 Fred costs 450 Total Operating costs 700 Operating Income (or EBIT) $300 Less interest 60 Earnings before Taxes (EBT) 12:40 Les taxes (40%) 95 Net Income Times-interest-Eamed (TE) Complete the following statement, based on the calculations you have already made Describe the relationship between the the ratio of the two companies The companies have equal TIE ration Hungry Whale Electronics Company has greater Tre than Blue Moose Producers O Blue Moon Producers has a greater Tieratie than Hungry Whale Electronics Company Which company is in better position to cover its interest Payments, and therefore its lower than the other? O Mungry Whale Bectronics Company is in a better position to cover its interest payment. O Both companies are equal positioned to cover their interest payments. O Blue Moose Producers is in a better position to cover its interest payment Grade it Now Save & Continue Continue without saving Chapter 12 Assignment Select the carreterm for each of the description. These are not necessarily complete definition, but there wone pole e for each tem Descriptions The land trots and personnage Then wiederter Mon preconchas on, and customers The which control of which is vel of the time The propery we propone of frare, such courte entered tuck, exposes a fe's toe te mos bem The tow they are sa tem which was e bomow donorat dette when need ordered a fungus than the optimalevel of Gebih tument constructure Mange er wel eens The store sciety headers and results from a trase seg fand consumo ding debt cute and pred stock The which meanings per EPS emerdess of what - verurs.com The misel on teed lock, and common stock trimm weighted rage cost of The content of common souty, pretend stook and few used to trance a to' em. in making capital structure decisions, managers must manage the firm's level of operating leverage and financiera, and the firm's posure to business and financial This requires gledge of a firm's degree of operating leverage (Donancial leverage (OPL), and to leverage COTL) Complete the flowing the boys in the correct formule and completing the interpretative statement Formula Degree of operating leverage (DOL) Interpretation An inden for of sales that measures the effect of a change in (15) on the spring incom. Alternatively, adicate the lines Lam's ERIT to the offer costs in the most sture Degree of financial leverage (OPL) An in a range of sales that means the effect of a change in EBIT an m'any pare (PS). A constant levelses, the Dale wiary with change in the amount est expense) incurred. The imples that the on into a Degree of totalleverage (DTL) An index of the firm's talenting from its of operating and Mandal leverage States frently as indicator of the consequences for the first for its use of perating and hancing 2. Introduction to capital structure theory In his private orice, just down the hall from his conference room, the Chief Financial Officer (CFO) of Nate Construction Company (NCC) is meeting with his newly hired assistant, Rafael CFO: Before our next meeting with the bankers, let's take a second and make sure that we have a common understanding about the company's capital structure. NCC can potentially have three different capital structures: its actual capital structure, target capital structure, and an optimal capital structure. If we wanted to talk about the observed capital structure at which NCC actually exhibits today or any other specific point in time, we'd be talking about which capital structure, Sarah? capital structure. This is the capital structure that NCC is currently exhibiting, and it can SARAH: We'd be talking about NCC'S differ from its ideal capital structure. CFO: Very good. Now, NCC's current capital structure consists of 44,5% debt and 55.5% common equity, then, Sarah, how would we know if we are operating with our optimal capital structure? SARAHAn optimal capital structure is characterized by two important attributes: First, it minimizes the firm's Vand second, it maximies make our shareholders very happy which should CFOs Again, that's great Now, tell me, in general and without taking about NCC in particular, why would a company ever be willing to operate with a capital structure that is not equal to its desired or target capital structure? SARAH: Well, there are several reasons that I can think of. Let's see. First, a firm may use debt and equity financing that offers from as targeted amounts of its business activities or its industry becomes y or competitive and is general these changes will allow firm to increase its reliance on debt financing, everything else remaining constant. Second, the way of may promet a company to borrow se new shares and thereby deviate from its target capital structure. ... CFO, Sarah, youve passed my first test with lying colors with this understanding of the theory and some real world experience, you be caming your bonus in no time. Grade It Now Save & Continue Can withing 3. Understanding business financial risks The total risk in a firm is determined by evaluating the firm's business risk and financial risk. As an analyst, Olivia is comparing two nearly identical manufacturing firms: Atherton Aeronautics Co. and Universal Space Inc. It is your job to evaluate the relative business and financial risks of Atherton and Universal. The two firms have the same level of total assets and expected net operating profit after taxes (NOPAT), but they differ on two critical characteristics: total debt and the standard deviation of expected NOPAT. The following table outlines some of Atherton's and Universal's characteristics: Total assets Total debt Expected NOPAT Standard deviation of expected NOPAT Atherton $4,800,000 2,400,000 1,152,000 321,600 Universal $4,800,000 960,000 1,152,000 206,400 Use the given financial data to indicate which firm has the higher degree of each type of risk. Which firm has more business risk? Atherton Aeronautics Co. O Universal Space Inc. Which firm has more financial risk Universal Space Ine. O Atherton Aeronautics Co. Grade It Now Save & Continue Continue without saving 4. Determining the optimal capital structure Review the flowing situation Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered the following financial Information to help with the analysis. Debt Ratio (%) 30 Equity Ratio (%) 70 60 40 EPS (5) 1.25 1.40 1.60 1.85 1.75 DPS (s) 0.55 0.60 0.65 0.75 0.70 Stock Price (5) 36.25 37.75 39.50 38.75 38.25 50 50 60 70 40 30 Which capital structure shown in the preceding table is Transworld Consortium Corp.'s optimal capital structure? Debt ratio - 40%, equity ratio -60% Debt ratio -50%, equity ratio -50% Debe ratio - 70%, equity ratio - 30% o Debt ratio -60%; equity ratio 40% Axis Chemical Co. has found that is expected EPS is maximized at a debt ratio of 45%. Does this mean that Axis Chemical Co.'s optimal capital structure calls for 45% debt? o Yes O No Grade It Now Save & Continue Continue without saving 5. Computing and interpreting the degree of operating leverage (DOL) It is December 31, Last year, Aberdeen Petroleum Refiners Corp. had sales of $16,000,000, and it forecasts that next year's sales will be $14,880,000. Its fixed costs have been and are expected to continue to be $6,400,000, and its variable cost ratio is 13.50%. Aberdeen's capital structure consists of a $13,5 million bank loan, on which it pays an interest rate of 9%, and 250,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences: The percentage change in the company's sales is The percentage change in Aberdeen's EBIT is The degree of operating leverage (DO1.) at $14,880,000 is There are several ways to use and interpret a firm's Dol value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. At sales of $24 million, Firm X's DOL is 1.75, and Firm Cs BOL is 6.50. Firm Cexhibits a lower level of business risk than Firm X. True or False: This statement accurately describes a fimm's DOL O True O False Grade it Now Save & Continue Continue without saving 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Its fixed costs have been-and are expected to continue to be-$64,000,000, and its variable cost ratio is 1.00%. Torres's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 8 %, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Gven this data, complete the following sentences: Note: For these computations, round each value to two decimal places. The company's percentage change in EBIT IS The percentage change in Torres's earnings per share (EPS) is The degree of financial leverage (DFU) at $152,000,000 is Consider the following statement about DFL, and indicate whether or not it is correct. Assume that a firm's fixed capital costs remain constant across a range of operating profit (EBIT) values. The firm's DFL will vary across the range of EBIT values. True O False Grade It Now Save & Continue Continue withouwing 7. The computation and interpretation of the degree of combined leverage (DCL) You and your colleague, Jennah, are currently participating in a finance Internship program at Campbell Construction. Your current assignment is to work together to review Campbell's current and projected income statements. You will also assess the consequences of management's capital structure and investment decisions on the firm's future makiness. After much discussion, you and Jenna dode to calculate Campbell's degree of operating leverage (DOL), degree of financial leverage (OFL), and degree of total leverage (OTL) based on this year's data to gain insights into Campbell's risk levels The most recent income statement for Campbell Construction follows, Campbell is funded tolely with debt capital and common equity, and it has 3,000,000 shares of common stock currently outstanding. Sales Less: Variable costs Gross profit Less: Fixed operating costs Net operating income (EBIT) Less: Interest expense Taxable income (EST) Less: Tax expense (40%) Net income Earnings per share (EPS) This Year's Data $40,000,000 20,000,000 $20,000,000 8,000,000 $12,000,000 800,000 $11,200,000 4,450,000 $6,720,000 $2.24 Next Year's Projected Data 543,200,000 21,600,000 $21,600,000 8,000,000 $13,600,000 300,000 $12,800,000 5,120,000 7,680,000 $2.56 Given this information, complete the following table and then answer the questions that follow. When performing your computations. Found your EPS value and the percentage change values to two decimal places Campbell Construction Data DOL(Sales - $40,000,000) DPL (EST - $12,000,000) DTL (Sales - $40,000,000) Everything else remaining constant, assume Campbell Construction decides to convertits taborIntensive manufacturing facility into a capital-intensive facity by laying off over 75% of its labor force and replacing the workers with robotic and technologically advanced manufacturing equipment Assume that, over the next five years, the wages saved as a result of the layots will pay for the changes made to Campbell's plant and equipment changes. How would this affect Campbell's DOL, DFL and DOLY The DOL would be expected to The OFL would be expected to The OTL would be expected to Grade Now Save & Continue Continue without saving 8. Analyzing riskiness using a firm's degree of leverage Select the degree of leverage that completes the following sentence. The is the percentage change in EPS that results from a given percentage change in EBIT. Expert Analysts Resources (EAR) has provided you with the following information about three companies you are currently evaluating: Galaxy Corp. 4.0 2.3 Degree of Operating Leverage (DOL) Degree of Finandal Leverage (DFL) Transworld Corp. 4.0 2.0 General Products Co. 3.0 2.8 According to this information, which company would be considered the riskiest? Transworld Corp O Galaxy Corp. O General Products Co. Grade It Now Save & Continue Continue without saving 9. Calculating the degrees of leverage Demo Inc. forecasts the following income statement for the next year: Income Statement For the Year Ended on December 31 Net sales $960,000 Less: Variable costs 532,000 Less: Fixed costs 139,000 EBIT, or NOT $289,000 Less: Interest 176,000 EBT $113,000 Less: Taxes 45,200 Net Income $67,800 Demo Inc, ses no preferred stock in its capital structure. Calculate the degrees of operating, financial, and total leverage for Demo Inc and select your answers in the following table DOL DFL DTL Grade It Now Save & Continue 10. Time-interest-earned (16) ratio The times interesteamed (IE) ratio shows how well form can cover its tres payments withing income Compare the income statements of Blue Moore Producers and Hungry Whale Electronics Company and at the Tere for each firm. (Milions of dollars) $900 280 245 Blue Mouse Producers Income Statement for the Year Ended on December 31 Net Sales Variable costs Fored costs Total Operating costs Operating Income (or EBIT) Less interest Earnings before Taxes (ET) Less taxes (40) $25 5175 90 $125 SO 575 Net Income Times Interest-Earned (TE) Hungry Whale Electronics Company Income Statement For the Year Ended on December 31 Net Sales Variable costs Fixed costs Total Operating costs (Milions of dollars) $1,000 250 $300 Operating Income (or EBIT) Less interest 50 5240 Earnings before Taxes (ET) Less taxes (40%) Net Income Times Interest-Earned (TIE) Complete the following statement based on the calculations you have already made Describe the relationship between the TIE ratio of the two companie The companies have equal TIEM Hungry Whale Electronics Company has a greater the ratio that Moose Producers Ob Moore Producers has a greater. The ratio than Hungry whalelectronics Company Which company is in better position to cover its interest payment, and therefore its lower than the other? Hungry Whale Electronics Company is in a better position to cover interest payment. O Both companies are equally positioned to cover the interest payments Blue Moose Producers in better position to cover its interest payment 5. Computing and interpreting the degree of operating leverage (DOL) It is December 31. Last year, Western Gas & Electric Company (WGEC) had sales of $8,000,000, and it forecasts that next year's sales will be $8,560,000. Its fixed costs have been and are expected to continue to be $1,000,000, and its variable cost ratio is 40.00%. WGEC's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 6%, and 300,000 shares of common equity. The company's profits are taxed at a marginal rate of 35% Given this data, complete the following sentences: . The percentage change in the company's sales is . The percentage change in EBIT is The degree of operating leverage (DOL) at $8,560,000 is There are several ways to use and interpret a firm's DOL value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. The decision to use capital-Intensive technologies will have no effect on a firm's DOL. True or False: This statement accurately describes a firm's DOL False True (Millions of dollars) $1,400 560 490 1,050 Lost Pigeon Aviation Income Statement For the Year Ended on December 31 Net Sales Variable costs Fixed costs Total Operating costs Operating Income (or EBIT) Less interest Earnings before Taxes (EBT) Less taxes (40%) Net Income Times-Interest-Earned (TIE) $350 60 $290 116 $174 ry (Millions of dollars) $1,200 300 Purple Panda Importers Income Statement for the Year Ended on December 31 Net Sales Variable costs Fixed costs Total Operating costs Operating Income (or EBIT) Less interest 540 840 $360 100 $260 104 Earnings before Taxes (EBT) Less taxes (40%) Net Income Times Interest-Earned (TIE) $156 Complete the following statement, based on the calculations you have already made. Describe the relationship between the TIE ratios of the two companies. The companies have equal TIE ratios. Purple Panda Importers has a greater TIE ratio than Lost Pigeon Aviation Lost Pigeon Aviation has a greater TIE ratio than Purple Panda Importers. Which company is in better position to cover its interest payments, and therefore exhibits lower risk, than the other? Both companies are equally positioned to cover their interest payments. O Lost Pigeon Aviation is in a better position to cover its interest payment. O Purple Panda Importers is in a better position to cover its interest payment. Grade It Now Average Rate of Ret Determine the average rate of return for a project that is estimated to yield total income of $394,000 over four years, has a cost of $685,000, and has a $102,400 residual value Round to the nearest whole number Cash Payback Period A project has estimated annual net cash flows of $50,500. It is estimated to cost $282,800. Determine the cash payback period. Round your answer to one decimal place. years