Question

As a Controller for a bottle making company, you are looking to replace your current unreliable bottling system. As you read the proposals, you are

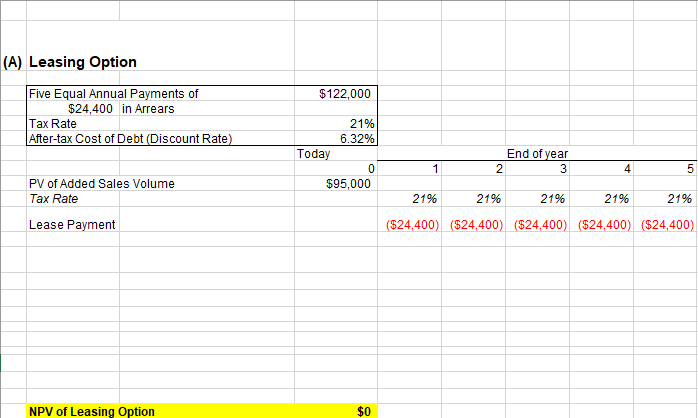

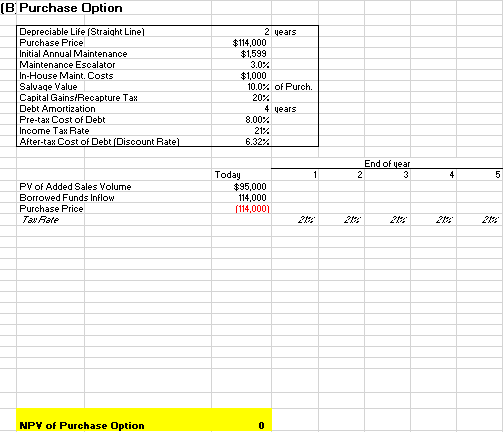

As a Controller for a bottle making company, you are looking to replace your current unreliable bottling system. As you read the proposals, you are not sure what to do. One company, Kirby Inc, is offering a 5-year lease on the Wonderbottler. The lease is for $24,400 annually payable in arrears, totaling $122,000 over the five years. The lease includes coverage for all major maintenance; but you estimate that you will pay an additional $1,900 annually for incidental maintenance items not covered by the lease. Northern Shores proposal is different: They are offering to sell you a Wonderbottler to you outright for $114,000. But, knowing that you cant pay for it all at once, Northern Shore offers to finance the entire purchase price at 8.0% interest over four years, with equal annual principal installment payments of $28,500 in arrears plus interest. They also quote a separate major maintenance contract of $1,599 per year for the first year, with an annual renewal clause that includes a 3% annual fee increase. No one at your company has the time or skill to do heavy maintenance of the dust collector, so you know you will have to purchase the add-on maintenance contract. You further estimate that non-covered incidental maintenance will cost $1000 every year you own the machine. You decide to gather a few facts and then analyze both proposals to find the one that has the lower cost/higher NPV. First, you estimate that the Present Value today of avoided fines, sick leave, and medical expenses attributable to the new dust collector is $95,000. This represents a benefit (i.e., cash inflow) at time t=0. Also, you know that many of the expenses you will pay are tax deductible, meaning that you can reduce the income tax you would have paid otherwise because of expenses associated with equipment use. You decide to discount the cash flows of both proposals by the opportunity cost of funds, which you conclude is the after-tax cost of the proposed 8.0% loan. Since your tax rate is 21%, this means your discount rate is 6.32%. (Your overall anticipated annual profits for the next five years, of which the dust collection costs are a small part, are large enough so that you are certain that you will be able to take full advantage of any tax deductions you may claim.) Your experience tells you that constant usage will lead to wear and tear sufficient that you will not want the dust collector after five years. If you choose the lease, the lessor will simply take the dust collector back at the end of the 5-year lease. If you own the dust collector, you figure that you can sell it for parts to a smaller workshop at the end of 5 years for 10% of its original purchase price. Your accounting manager lets you know that, if you buy the dust collector, a special tax incentive program will allow you to depreciate it for tax purposes in a straight line over 3 years (meaning depreciation expense equal to one-third of the purchase price for years 1, 2, and 3). But if you then sell the dust collector for more than its depreciated book value (which is your intention), you will have to pay a capital gains tax at that time of 20% of the difference between the actual sale proceeds and the depreciated value of zero. Just before you start your analysis, you make a few lists to help with this decision. One list is of non-cash charges that are nevertheless tax deductible. The next list is of balance sheet cash flows that have no tax impacts, like the t=0 purchase price (outflow) of $114,000 the original loan (inflow) of $114,000 and the four annual principal repayment outflows. And you continue with a list of cash expenses that will reduce your taxable income, like the major maintenance contract, the incidental upkeep, the 8.0% interest on the loan, and the lease payments. After you build a lease case and a buy case, you come to a decision. Questions: A. Build a 5-year pro forma cash flow statement for the lease case and determine its NPV. B. Build a 5-year pro forma cash flow statement for the buy case and determine its NPV.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started