As a financial analyst, after conducting a careful accounting, financial statement, and prospective analysis of a company, you are now developing an independent assessment of the value of the firm to develop an investment recommendation for your clients. Using the financial statements and additional notes provided for the firm in the attached excel file (Final Exam, tab Alpha Tech BS & IS), develop a valuation for the firm using the DCF model. Additional information and assumptions for the firm that you have made include:

a. The book value of the firms debt equals its market value.

b. The estimated market beta for the firm is 0.46, the expected risk-free rate is 2.5%, and the expected market premium is 5%.

c. The firms stock closed at $55.85 on March 31, 2017 (fiscal year end), and the stock is currently trading at $59.50 d. The firms statutory tax rate is 37%.

e. Based on a historical analysis, adjusted by a strategic and industry assessment, you have developed the following forecasts for the firm for the next four years, (2018-2021):

Sales Growth 8% Net operating profit margin (NOPM) 6.8% Net operating asset turnover (NOAT) 1.41 Terminal Period 1% 1. Develop an Estimate for weighted average cost of capital for the firm (4 points) a. Estimate the companys average pretax borrowing cost. b. Assuming the book value of the firms debt equals its market value, estimate the firms cost of debt capital. c. Estimate the cost of equity capital for the firm. d. Based on (b) and (c) estimate the firms weighted average cost of capital (WACC) 2. Estimating Valuation (3 points) a. Using the discounted cash flow model (DCF), estimate the value of a share for the firms common stock. b. Based on your valuation, provide an investment recommendation for your clients.

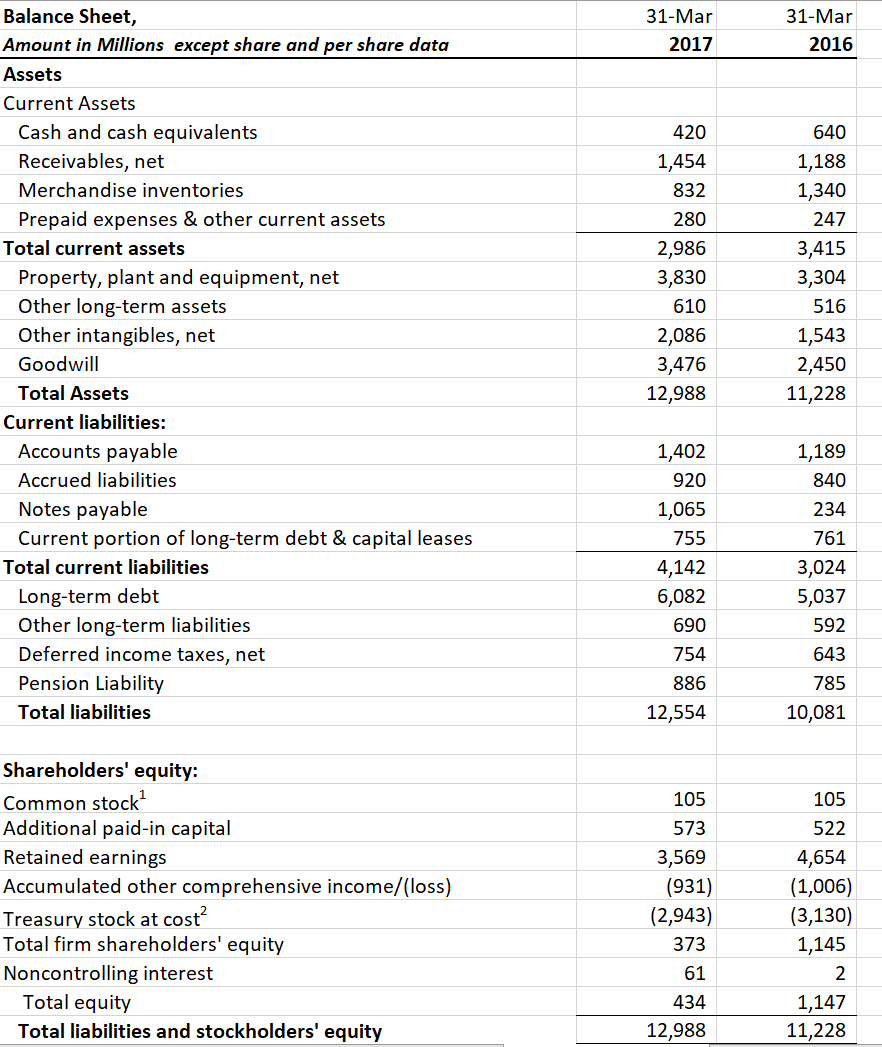

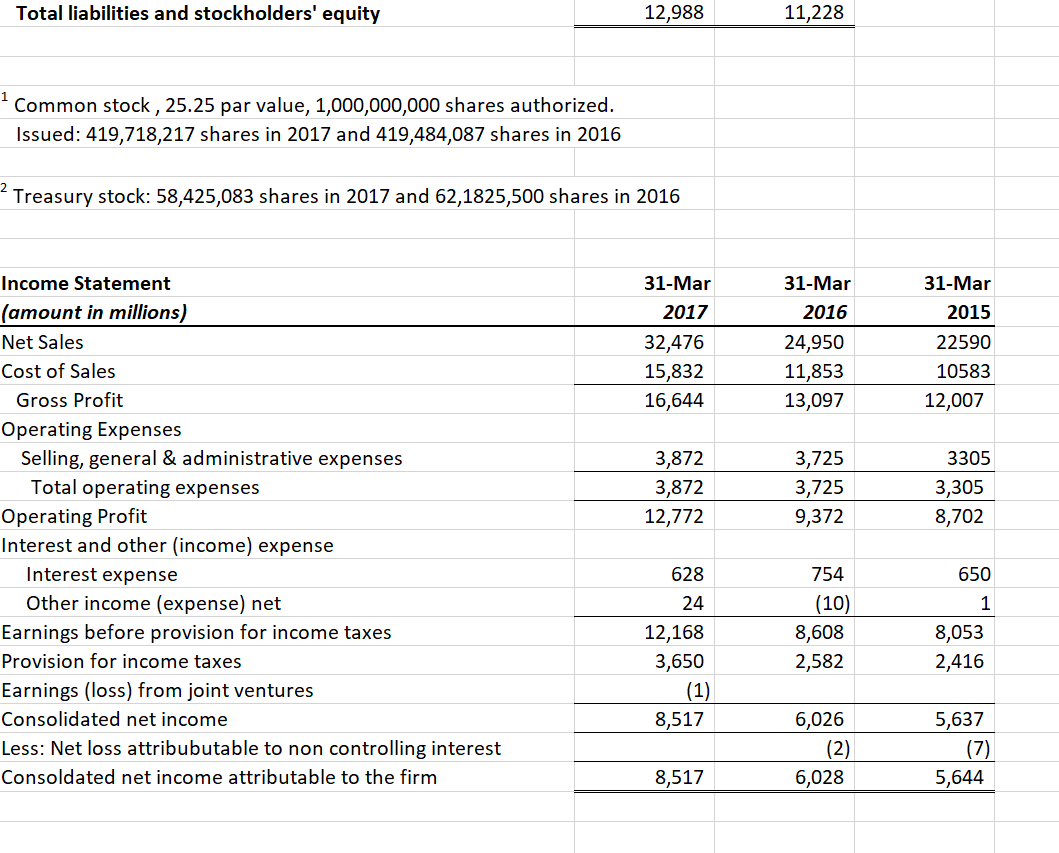

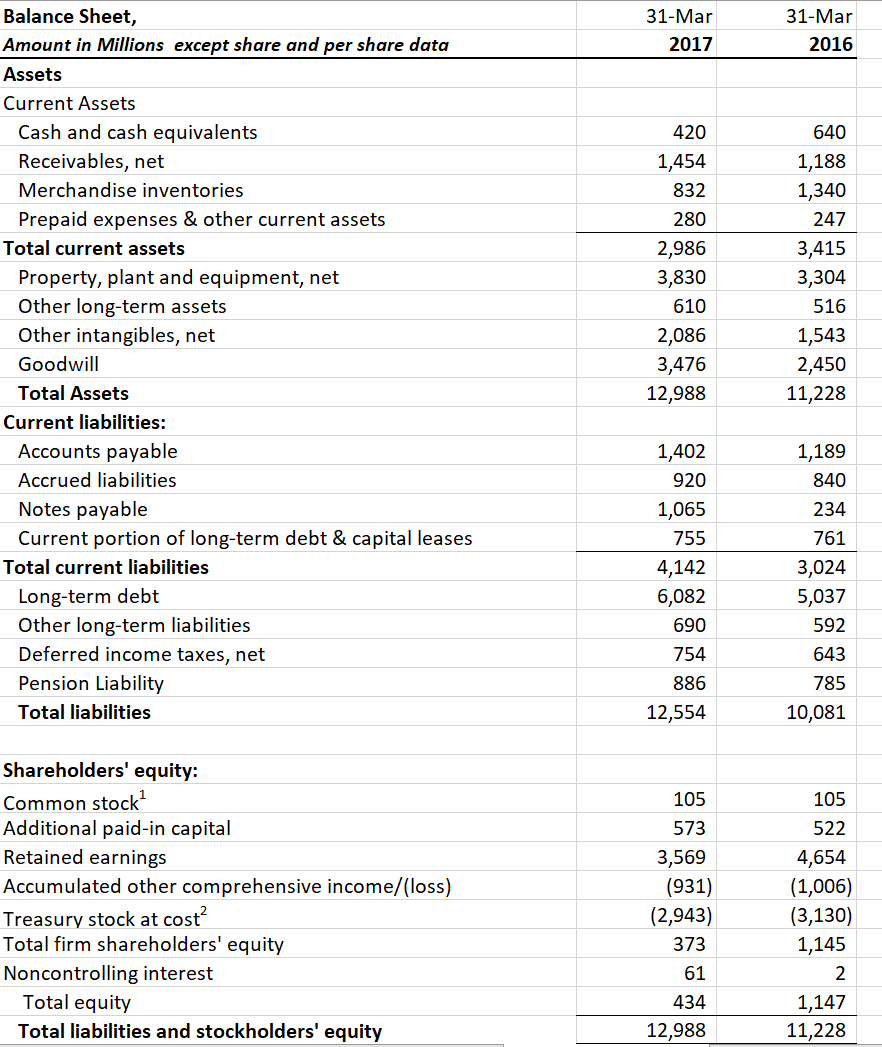

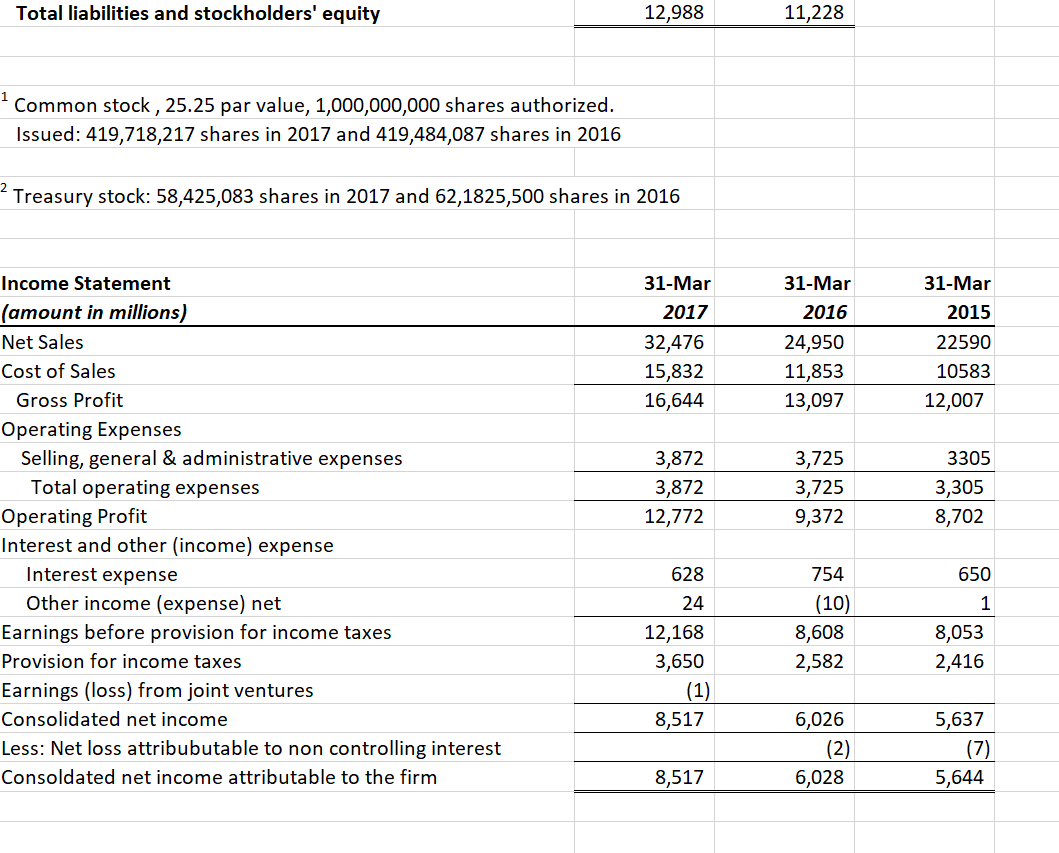

31-Mar 2017 31-Mar 2016 640 Balance Sheet, Amount in Millions except share and per share data Assets Current Assets Cash and cash equivalents Receivables, net Merchandise inventories Prepaid expenses & other current assets Total current assets Property, plant and equipment, net Other long-term assets Other intangibles, net Goodwill Total Assets Current liabilities: Accounts payable Accrued liabilities Notes payable Current portion of long-term debt & capital leases Total current liabilities Long-term debt Other long-term liabilities Deferred income taxes, net Pension Liability Total liabilities 420 1,454 832 280 2,986 3,830 610 2,086 3,476 12,988 1,188 1,340 247 3,415 3,304 516 1,543 2,450 11,228 1,402 920 1,065 755 4,142 6,082 690 1,189 840 234 761 3,024 5,037 592 754 643 886 785 12,554 10,081 105 Shareholders' equity: Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income/(loss) Treasury stock at cost? Total firm shareholders' equity Noncontrolling interest Total equity Total liabilities and stockholders' equity 573 3,569 (931) (2,943) 373 61 434 12,988 105 522 4,654 (1,006) (3,130) 1,145 2 1,147 11,228 Total liabilities and stockholders' equity 12,988 11,228 1 Common stock, 25.25 par value, 1,000,000,000 shares authorized. Issued: 419,718,217 shares in 2017 and 419,484,087 shares in 2016 2 Treasury stock: 58,425,083 shares in 2017 and 62,1825,500 shares in 2016 31-Mar 2015 31-Mar 2017 32,476 15,832 16,644 31-Mar 2016 24,950 11,853 13,097 22590 10583 12,007 3305 3,872 3,872 12,772 3,725 3,725 9,372 3,305 8,702 Income Statement (amount in millions) Net Sales Cost of Sales Gross Profit Operating Expenses Selling, general & administrative expenses Total operating expenses Operating Profit Interest and other (income) expense Interest expense Other income (expense) net Earnings before provision for income taxes Provision for income taxes Earnings (loss) from joint ventures Consolidated net income Less: Net loss attribubutable to non controlling interest Consoldated net income attributable to the firm 628 754 650 1 24 12,168 3,650 (1) 8,517 (10) 8,608 2,582 8,053 2,416 6,026 (2) 6,028 5,637 (7) 5,644 8,517 31-Mar 2017 31-Mar 2016 640 Balance Sheet, Amount in Millions except share and per share data Assets Current Assets Cash and cash equivalents Receivables, net Merchandise inventories Prepaid expenses & other current assets Total current assets Property, plant and equipment, net Other long-term assets Other intangibles, net Goodwill Total Assets Current liabilities: Accounts payable Accrued liabilities Notes payable Current portion of long-term debt & capital leases Total current liabilities Long-term debt Other long-term liabilities Deferred income taxes, net Pension Liability Total liabilities 420 1,454 832 280 2,986 3,830 610 2,086 3,476 12,988 1,188 1,340 247 3,415 3,304 516 1,543 2,450 11,228 1,402 920 1,065 755 4,142 6,082 690 1,189 840 234 761 3,024 5,037 592 754 643 886 785 12,554 10,081 105 Shareholders' equity: Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income/(loss) Treasury stock at cost? Total firm shareholders' equity Noncontrolling interest Total equity Total liabilities and stockholders' equity 573 3,569 (931) (2,943) 373 61 434 12,988 105 522 4,654 (1,006) (3,130) 1,145 2 1,147 11,228 Total liabilities and stockholders' equity 12,988 11,228 1 Common stock, 25.25 par value, 1,000,000,000 shares authorized. Issued: 419,718,217 shares in 2017 and 419,484,087 shares in 2016 2 Treasury stock: 58,425,083 shares in 2017 and 62,1825,500 shares in 2016 31-Mar 2015 31-Mar 2017 32,476 15,832 16,644 31-Mar 2016 24,950 11,853 13,097 22590 10583 12,007 3305 3,872 3,872 12,772 3,725 3,725 9,372 3,305 8,702 Income Statement (amount in millions) Net Sales Cost of Sales Gross Profit Operating Expenses Selling, general & administrative expenses Total operating expenses Operating Profit Interest and other (income) expense Interest expense Other income (expense) net Earnings before provision for income taxes Provision for income taxes Earnings (loss) from joint ventures Consolidated net income Less: Net loss attribubutable to non controlling interest Consoldated net income attributable to the firm 628 754 650 1 24 12,168 3,650 (1) 8,517 (10) 8,608 2,582 8,053 2,416 6,026 (2) 6,028 5,637 (7) 5,644 8,517