Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a financial analyst at deutsche bank investment banking, you are evaluating European call options and put options using Black Scholes model. Suppose stock

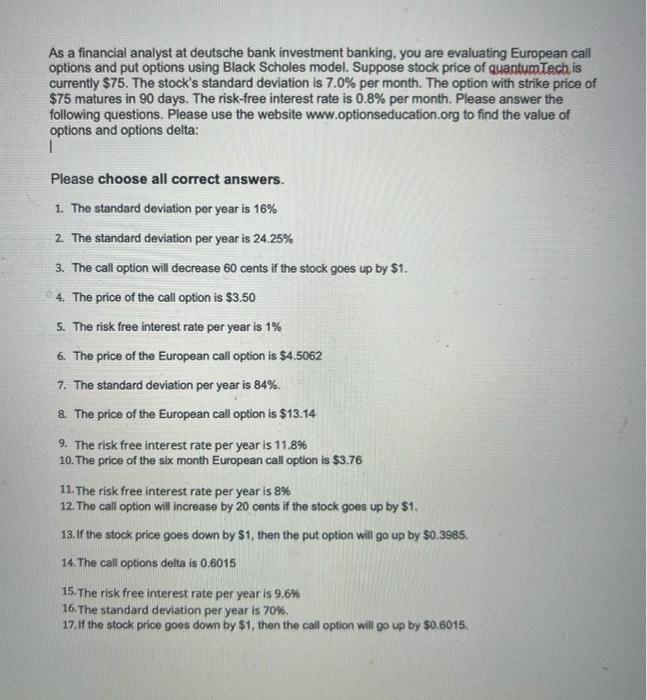

As a financial analyst at deutsche bank investment banking, you are evaluating European call options and put options using Black Scholes model. Suppose stock price of quantum Tech is currently $75. The stock's standard deviation is 7.0% per month. The option with strike price of $75 matures in 90 days. The risk-free interest rate is 0.8% per month. Please answer the following questions. Please use the website www.optionseducation.org to find the value of options and options delta: 1 Please choose all correct answers. 1. The standard deviation per year is 16% 2. The standard deviation per year is 24.25% 3. The call option will decrease 60 cents if the stock goes up by $1. 4. The price of the call option is $3.50 5. The risk free interest rate per year is 1% 6. The price of the European call option is $4.5062 7. The standard deviation per year is 84%. 8. The price of the European call option is $13.14 9. The risk free interest rate per year is 11.8% 10. The price of the six month European call option is $3.76 11. The risk free interest rate per year is 8% 12. The call option will increase by 20 cents if the stock goes up by $1. 13. If the stock price goes down by $1, then the put option will go up by $0.3985. 14. The call options delta is 0.6015 15. The risk free interest rate per year is 9.6% 16. The standard deviation per year is 70%. 17. If the stock price goes down by $1, then the call option will go up by $0.6015.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Correct Answers 2 The standard deviation per year is 2425 4 The price of the call option is 350 5 The risk free interest rate per year is 1 6 The price of the European call option is 45062 10 The pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started