Answered step by step

Verified Expert Solution

Question

1 Approved Answer

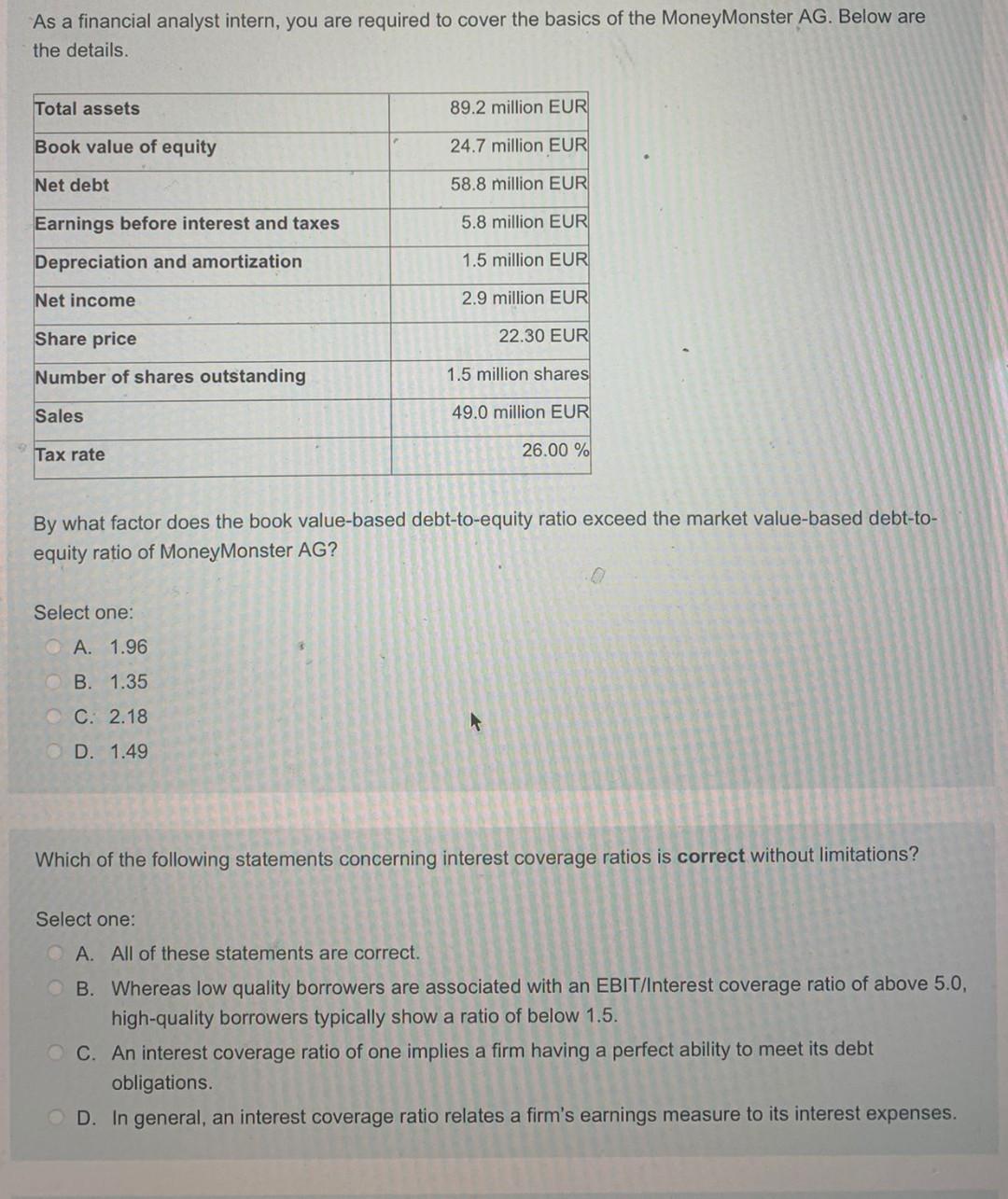

As a financial analyst intern, you are required to cover the basics of the Money Monster AG. Below are the details. Total assets 89.2 million

As a financial analyst intern, you are required to cover the basics of the Money Monster AG. Below are the details. Total assets 89.2 million EUR Book value of equity 24.7 million EUR Net debt 58.8 million EUR Earnings before interest and taxes 5.8 million EUR Depreciation and amortization 1.5 million EUR Net income 2.9 million EUR Share price 22.30 EUR Number of shares outstanding 1.5 million shares Sales 49.0 million EUR Tax rate 26.00 % By what factor does the book value-based debt-to-equity ratio exceed the market value-based debt-to- equity ratio of Money Monster AG? Select one: A. 1.96 B. 1.35 C. 2.18 D. 1.49 Which of the following statements concerning interest coverage ratios is correct without limitations? Select one: A. All of these statements are correct. B. Whereas low quality borrowers are associated with an EBIT/Interest coverage ratio of above 5.0, high-quality borrowers typically show a ratio of below 1.5. C. An interest coverage ratio of one implies a firm having a perfect ability to meet its debt obligations. D. In general, an interest coverage ratio relates a firm's earnings measure to its interest expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started