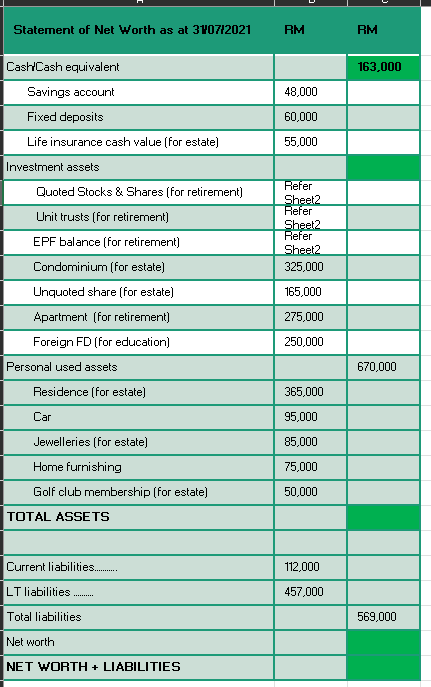

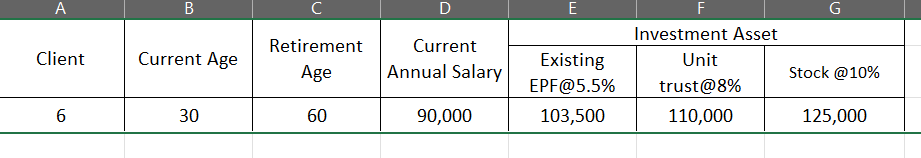

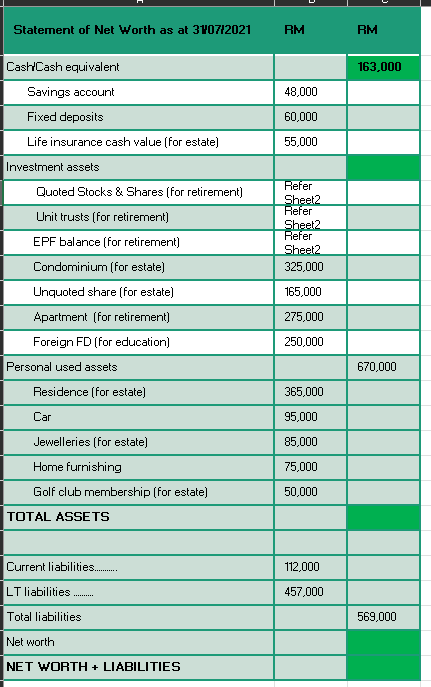

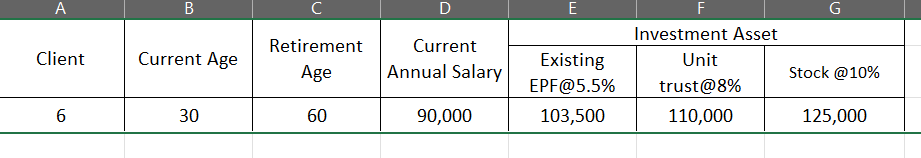

As a financial planner you are required to design and recommend a retirement plan to your client. The appropriateness of the plan will usually depend on how well it serves the need and objective of the client. Based on the given data, extracted from the client's fact finding sheet, you are required to analyze their financial data. Among the issue that should be included in your analysis are: A. The first year retirement income. B. The total lump sum needed for retirement under capital liquidation method. C. The value of the financial resources available for retirement. D. The retirement gap or surplus retirement fund. Note: 1. Rate of return during retirement is 5%. 2. Inflation rate is 3.5% 3. Salary growth rate is 4% 4. EPF contribution is 23% of annual salary. 5. The first year retirement income (calculated in today's dollar) is 65% of the salary. 6. All clients are assumed to remain in retirement period until age 75. Each group will choose only 1 client. No duplication please. Your submission must show all the calculations including the table and excel file) for finding the future value of the current and future resources, EPF projection, capital liquidation, determining whether retirement gap exist and your chosen method to fill up the gap (if necessary). You are also required to complete the Statement of Net worth of the Client. Statement of Net Worth as at 3707/2021 RM RM 163,000 48,000 CashCash equivalent Savings account Fixed deposits Life insurance cash value (for estate) 60,000 55,000 Investment assets Quoted Stocks & Shares (for retirement) Unit trusts (for retirement) EPF balance (for retirement) Condominium (for estate) Unquoted share (for estate) Apartment (for retirement) Foreign FD (for education) Refer Sheet2 Refer Sheet2 Refer Sheet2 325,000 165,000 275,000 250,000 Personal used assets 670,000 Residence (for estate) 365,000 Car 95,000 Jewelleries (for estate) 85,000 75,000 Home furnishing Golf club membership (for estate) TOTAL ASSETS 50,000 Current liabilities...... 112,000 LT liabilities .......... 457,000 Total liabilities 569,000 Net worth NET WORTH + LIABILITIES B C D E G Client Current Age Retirement Age Current Annual Salary F Investment Asset Unit trust@8% 110,000 Existing EPF@5.5% 103,500 Stock @10% 6 30 60 90,000 125,000 As a financial planner you are required to design and recommend a retirement plan to your client. The appropriateness of the plan will usually depend on how well it serves the need and objective of the client. Based on the given data, extracted from the client's fact finding sheet, you are required to analyze their financial data. Among the issue that should be included in your analysis are: A. The first year retirement income. B. The total lump sum needed for retirement under capital liquidation method. C. The value of the financial resources available for retirement. D. The retirement gap or surplus retirement fund. Note: 1. Rate of return during retirement is 5%. 2. Inflation rate is 3.5% 3. Salary growth rate is 4% 4. EPF contribution is 23% of annual salary. 5. The first year retirement income (calculated in today's dollar) is 65% of the salary. 6. All clients are assumed to remain in retirement period until age 75. Each group will choose only 1 client. No duplication please. Your submission must show all the calculations including the table and excel file) for finding the future value of the current and future resources, EPF projection, capital liquidation, determining whether retirement gap exist and your chosen method to fill up the gap (if necessary). You are also required to complete the Statement of Net worth of the Client. Statement of Net Worth as at 3707/2021 RM RM 163,000 48,000 CashCash equivalent Savings account Fixed deposits Life insurance cash value (for estate) 60,000 55,000 Investment assets Quoted Stocks & Shares (for retirement) Unit trusts (for retirement) EPF balance (for retirement) Condominium (for estate) Unquoted share (for estate) Apartment (for retirement) Foreign FD (for education) Refer Sheet2 Refer Sheet2 Refer Sheet2 325,000 165,000 275,000 250,000 Personal used assets 670,000 Residence (for estate) 365,000 Car 95,000 Jewelleries (for estate) 85,000 75,000 Home furnishing Golf club membership (for estate) TOTAL ASSETS 50,000 Current liabilities...... 112,000 LT liabilities .......... 457,000 Total liabilities 569,000 Net worth NET WORTH + LIABILITIES B C D E G Client Current Age Retirement Age Current Annual Salary F Investment Asset Unit trust@8% 110,000 Existing EPF@5.5% 103,500 Stock @10% 6 30 60 90,000 125,000