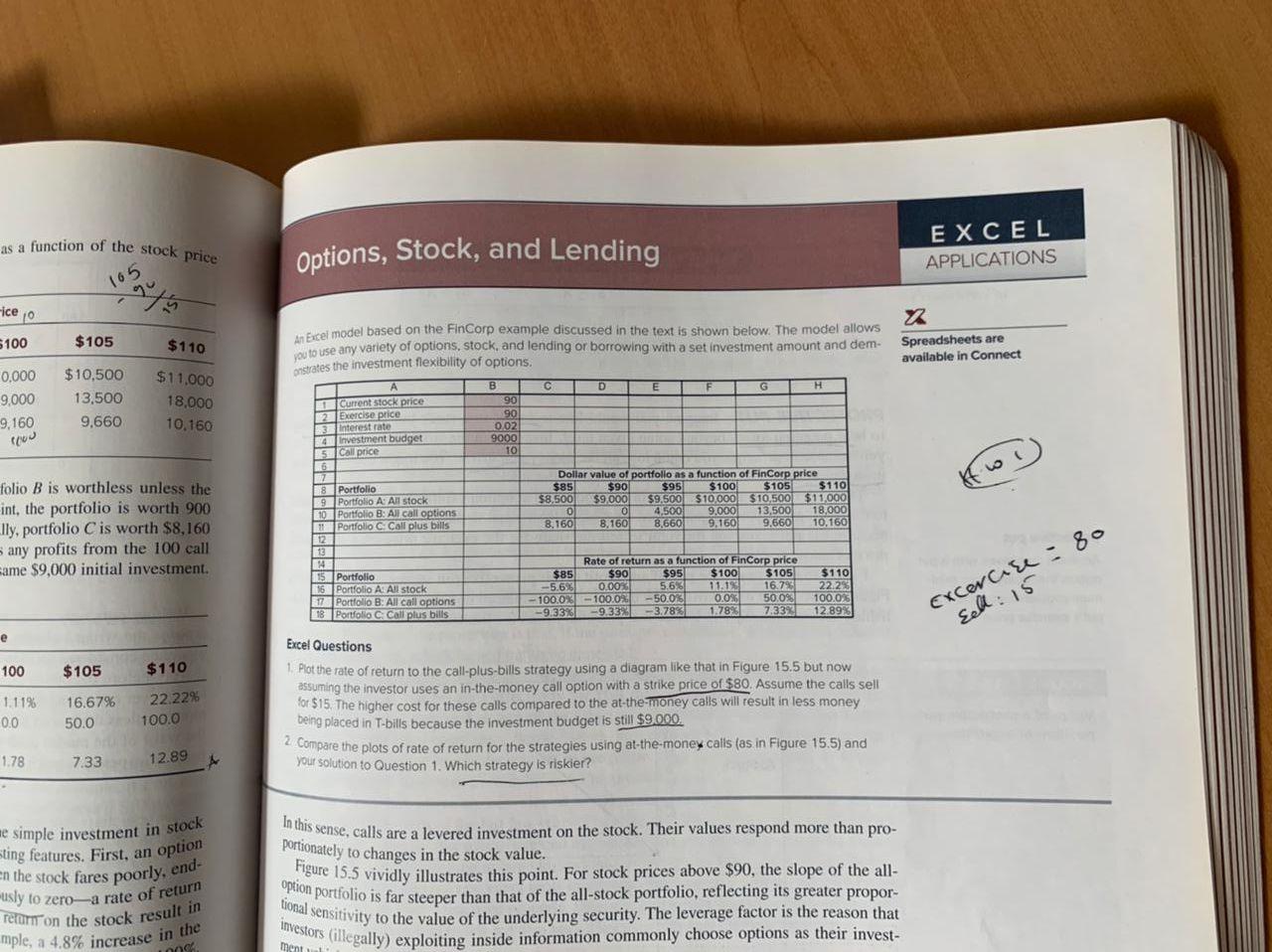

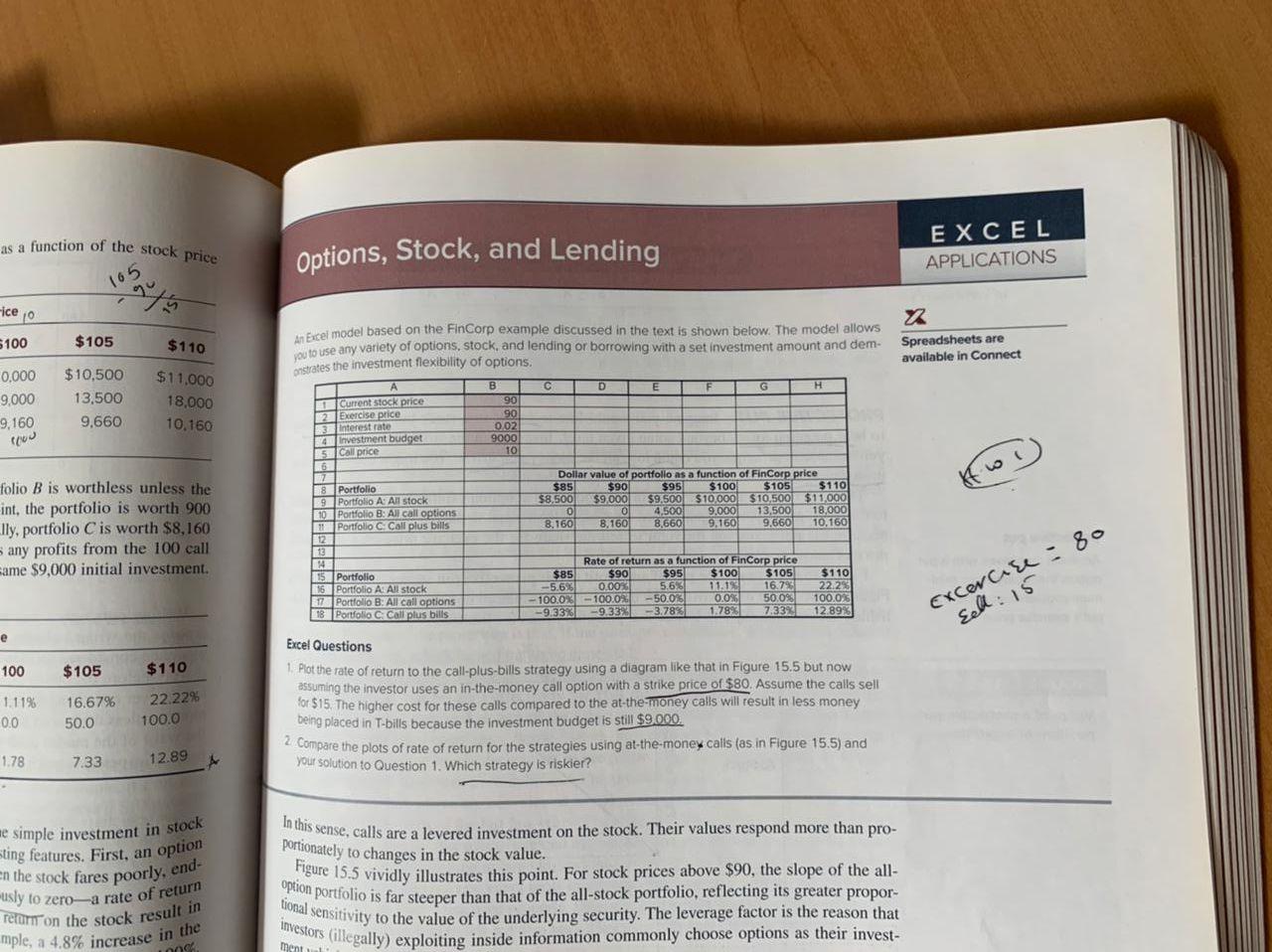

as a function of the stock price Options, Stock, and Lending An Excel model based on the FinCorp example discussed in the text is shown below. The model allows you to use any variety of options, stock, and lending or borrowing with a set investment amount and demgratas the investment flexibility of options. folio B is worthless unless the int, the portfolio is worth 900 lly, portfolio C is worth $8,160 any profits from the 100 call tame $9,000 initial investment. Excel Questions 1. Plot the rate of return to the call-plus-bills strategy using a diagram like that in Figure 15.5 but now assuming the investor uses an in-the-money call option with a strike price of $80. Assume the calls sell for \$15. The higher cost for these calls compared to the at-the-money calls will result in less money being placed in T-bills because the investment budget is still $9.000. 2. Compare the plots of rate of return for the strategies using at-the-money calls (as in Figure 15.5) and your solution to Question 1. Which strategy is riskier? e simple investment in stock In this sense, calls are a levered investment on the stock. Their values respond more than proting features. First, an option portionately to changes in the stock value. en the stock fares poorly, end- Figure 15.5 vividly illustrates this point. For stock prices above $90, the slope of the allusly to zero-a rate of return tional portfolio is far steeper than that of the all-stock portfolio, reflecting its greater proporretirnon the stock result in investorsitivity to the value of the underlying security. The leverage factor is the reason that mple, a 4.8% increase in the as a function of the stock price Options, Stock, and Lending An Excel model based on the FinCorp example discussed in the text is shown below. The model allows you to use any variety of options, stock, and lending or borrowing with a set investment amount and demgratas the investment flexibility of options. folio B is worthless unless the int, the portfolio is worth 900 lly, portfolio C is worth $8,160 any profits from the 100 call tame $9,000 initial investment. Excel Questions 1. Plot the rate of return to the call-plus-bills strategy using a diagram like that in Figure 15.5 but now assuming the investor uses an in-the-money call option with a strike price of $80. Assume the calls sell for \$15. The higher cost for these calls compared to the at-the-money calls will result in less money being placed in T-bills because the investment budget is still $9.000. 2. Compare the plots of rate of return for the strategies using at-the-money calls (as in Figure 15.5) and your solution to Question 1. Which strategy is riskier? e simple investment in stock In this sense, calls are a levered investment on the stock. Their values respond more than proting features. First, an option portionately to changes in the stock value. en the stock fares poorly, end- Figure 15.5 vividly illustrates this point. For stock prices above $90, the slope of the allusly to zero-a rate of return tional portfolio is far steeper than that of the all-stock portfolio, reflecting its greater proporretirnon the stock result in investorsitivity to the value of the underlying security. The leverage factor is the reason that mple, a 4.8% increase in the