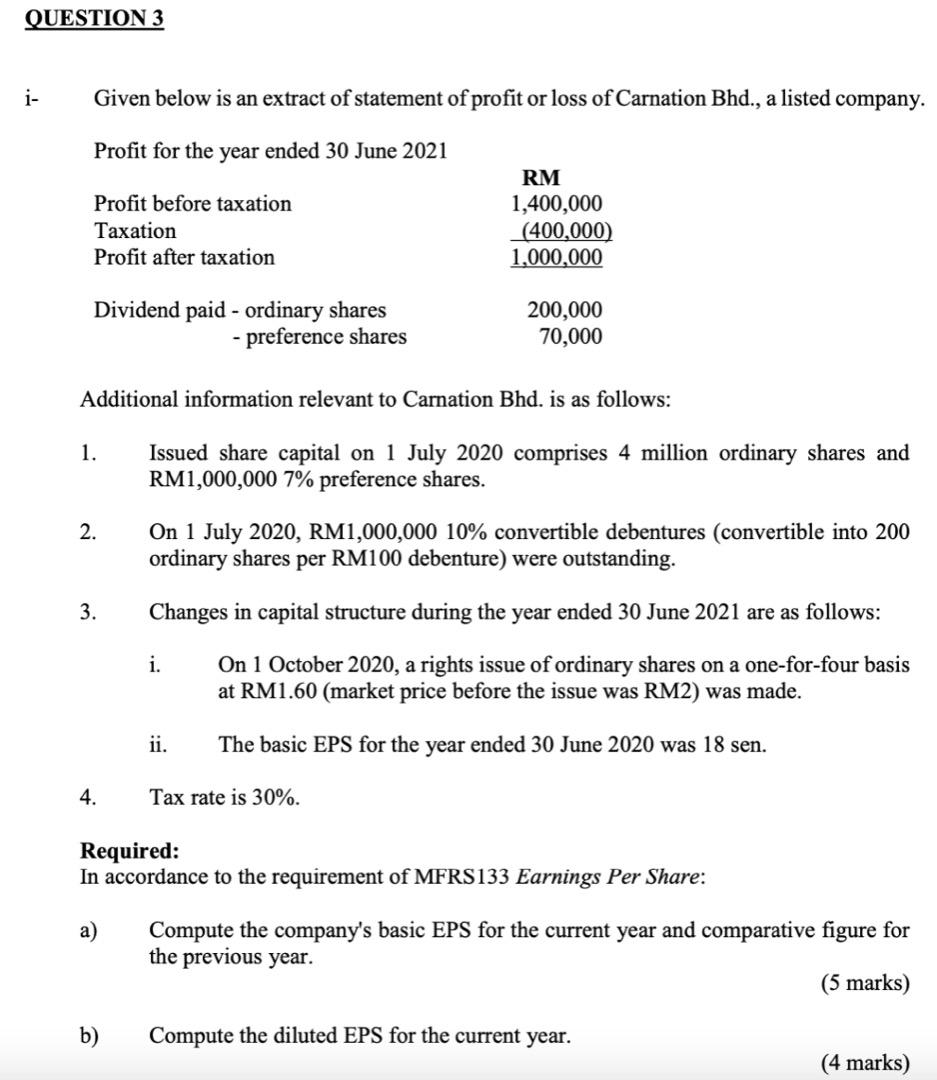

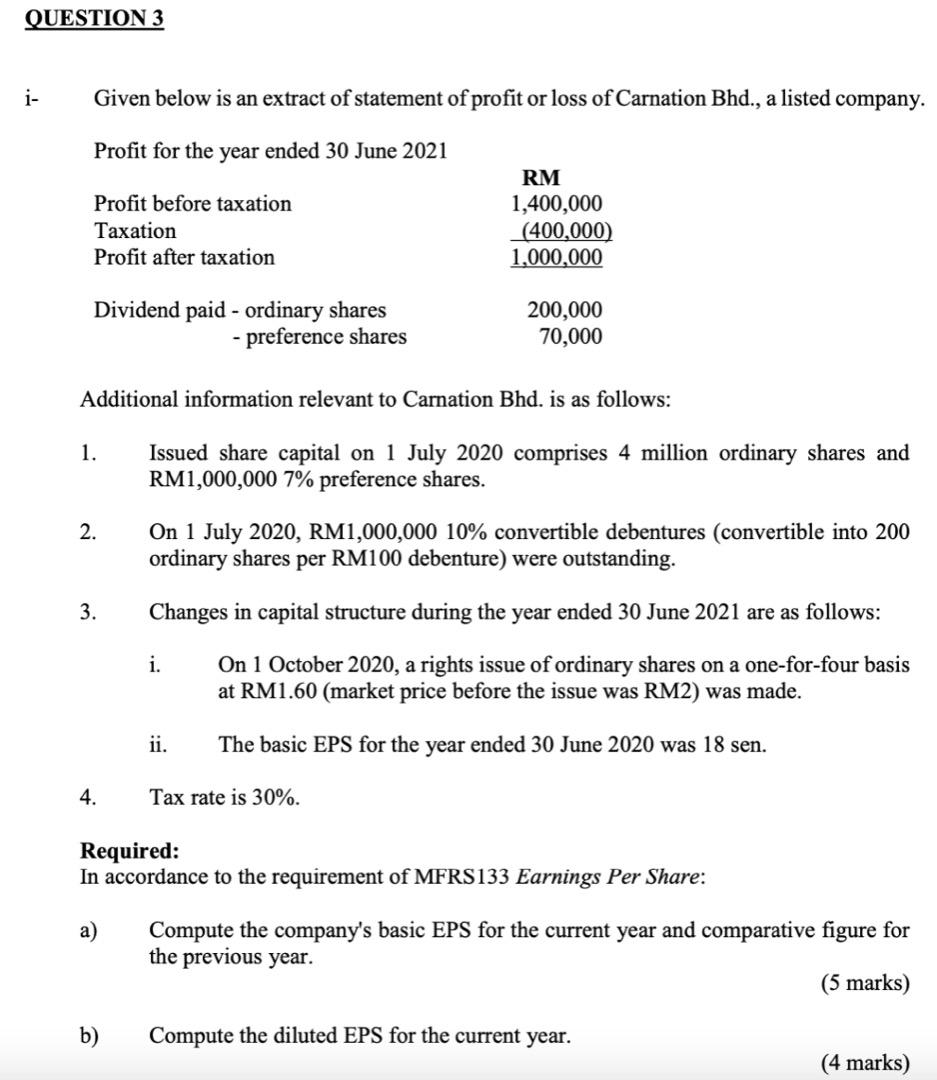

QUESTION 3 i- Given below is an extract of statement of profit or loss of Carnation Bhd., a listed company. Profit for the year ended 30 June 2021 Profit before taxation Taxation Profit after taxation RM 1,400,000 (400,000) 1,000,000 Dividend paid - ordinary shares - preference shares 200,000 70,000 Additional information relevant to Carnation Bhd. is as follows: 1. Issued share capital on 1 July 2020 comprises 4 million ordinary shares and RM1,000,000 7% preference shares. 2. 3. On 1 July 2020, RM1,000,000 10% convertible debentures (convertible into 200 ordinary shares per RM100 debenture) were outstanding. Changes in capital structure during the year ended 30 June 2021 are as follows: i. On 1 October 2020, a rights issue of ordinary shares on a one-for-four basis at RM1.60 (market price before the issue was RM2) was made. ii. The basic EPS for the year ended 30 June 2020 was 18 sen. 4. Tax rate is 30%. Required: In accordance to the requirement of MFRS133 Earnings Per Share: a) Compute the company's basic EPS for the current year and comparative figure for the previous year. (5 marks) b) Compute the diluted EPS for the current year. (4 marks) QUESTION 3 i- Given below is an extract of statement of profit or loss of Carnation Bhd., a listed company. Profit for the year ended 30 June 2021 Profit before taxation Taxation Profit after taxation RM 1,400,000 (400,000) 1,000,000 Dividend paid - ordinary shares - preference shares 200,000 70,000 Additional information relevant to Carnation Bhd. is as follows: 1. Issued share capital on 1 July 2020 comprises 4 million ordinary shares and RM1,000,000 7% preference shares. 2. 3. On 1 July 2020, RM1,000,000 10% convertible debentures (convertible into 200 ordinary shares per RM100 debenture) were outstanding. Changes in capital structure during the year ended 30 June 2021 are as follows: i. On 1 October 2020, a rights issue of ordinary shares on a one-for-four basis at RM1.60 (market price before the issue was RM2) was made. ii. The basic EPS for the year ended 30 June 2020 was 18 sen. 4. Tax rate is 30%. Required: In accordance to the requirement of MFRS133 Earnings Per Share: a) Compute the company's basic EPS for the current year and comparative figure for the previous year. (5 marks) b) Compute the diluted EPS for the current year. (4 marks)