Question

As a recently accredited CPA you have joined a growing firm of CPAs, Cromdex LLP. As the calendar has turned to 2024, you have been

As a recently accredited CPA you have joined a growing firm of CPAs, Cromdex LLP. As the calendar has turned to 2024, you have been asked to attend a meeting with one of the founding partners, Mr. James Cromartie. At the meeting, Mr. Cromartie welcomes you to the firm and hands you a file that contains the following for a long standing client, Standbro Corp.:

i. Notes of a Meeting with Standbros Management (Appendix I). ii. Draft Statement of Comprehensive Income for the year ended December 31, 2023 (Appendix II). iii. Draft Balance Sheet as at December 31, 2023 (Appendix III).

Standbro Corp. manufactures specialized grinding equipment. The equipment can be ordered by customers from a catalogue or specialized to a customers requirement.

Mr. Cromartie has asked you to review the Notes of the Meeting and prepare a report noting any adjusting journal entries that should be presented to the client. He specifically instructed that When preparing your report, focus on the current year only. We will consider any impact on the comparative numbers later. Also in your report, consider any matters of importance for Mr. Cromartie to review with the client. This report should also include two visualiations to assist in the understanding of the report. Please round any monetary amount to the nearest whole number.

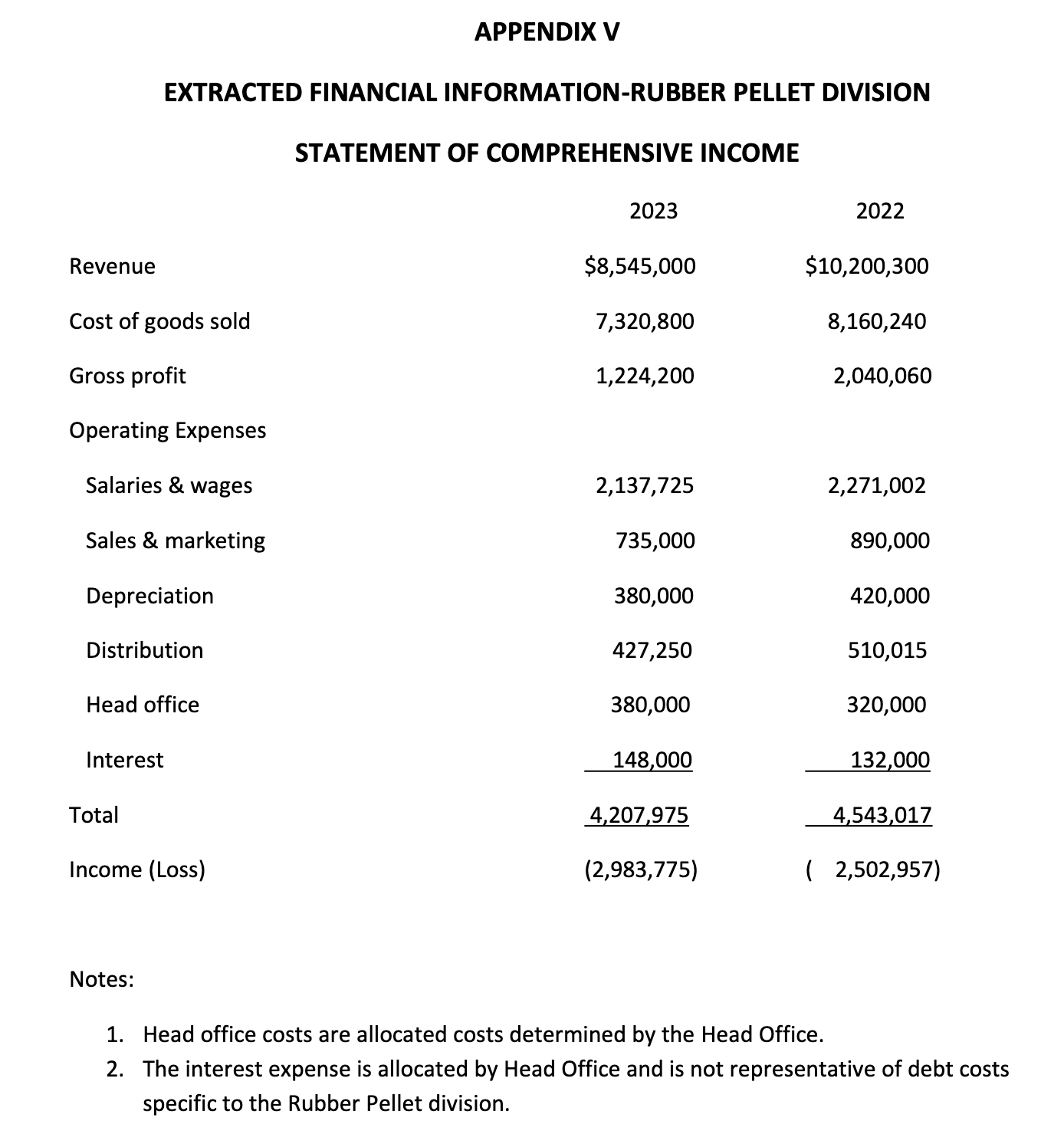

During the meeting with management, Mr. Cromartie reviewed the minutes of the quarterly meetings of Standbros Board of Directors. During this review, it was noted that there were no Common Shares issued or purchased during 2023. Mr. Cromartie did note minutes of a special meeting of the Board where it was decided to cease the operations of the rubber pellet division. From that meeting, a formal plan was formulated and negotiations with potential buyers were ongoing during 2023. In his notes, Mr. Cromartie expressed uncertainty regarding the current standard on the appropriate presentation of this matter in the financial statements. The Company has provided draft internal financial statements of the rubber pellet division for the years 2023 and 2022 (Appendix V).

What is the issue in this accounting case and what GAAP should I connect it to? Please help analyze the information with adjusting entries and come up with a recommendation.

What is the issue in this accounting case and what GAAP should I connect it to? Please help analyze the information with adjusting entries and come up with a recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started