Question

As a recently accredited CPA you have joined a growing firm of CPAs, Cromdex LLP. As the calendar has turned to 2024, you have been

As a recently accredited CPA you have joined a growing firm of CPAs, Cromdex LLP. As the calendar has turned to 2024, you have been asked to attend a meeting with one of the founding partners, Mr. James Cromartie. At the meeting, Mr. Cromartie welcomes you to the firm and hands you a file that contains the following for a long standing client, Standbro Corp.: i. Notes of a Meeting with Standbros Management (Appendix I). ii. Draft Statement of Comprehensive Income for the year ended December 31, 2023 (Appendix II). iii. Draft Balance Sheet as at December 31, 2023 (Appendix III). Standbro Corp. manufactures specialized grinding equipment. The equipment can be ordered by customers from a catalogue or specialized to a customers requirement. Mr. Cromartie has asked you to review the Notes of the Meeting and prepare a report noting any adjusting journal entries that should be presented to the client. He specifically instructed that When preparing your report, focus on the current year only. We will consider any impact on the comparative numbers later. Also in your report, consider any matters of importance for Mr. Cromartie to review with the client. This report should also include two visualiations to assist in the understanding of the report. Please round any monetary amount to the nearest whole number.

The President, Warren Cromartie was ecstatic that the Company closed a transaction December 15, 2023 after months of negotiations. That sale was a big boost to our year end financial statements claimed Mr. Cromartie. The machine, an NX 69843 was sold for $825,000 with an inventory cost of $380,000. There were no special concessions or discounts associated with the sale. As this was the first transaction with this customer, the customer asked for and was granted a 30-day testing period with a right of return. The Company has recognized the sale in its full amount in 2023. From a financing perspective, the Company has an excellent relationship with First National Commercial Bank. All bank debt is through this financial institution and is covered by a covenant to maintain a debt-to-equity ratio below 1.5. The management of Standbro has a bonus program that requires maintaining minimum basic earnings per share of $7.50 (based on 1,000,000 Common Shares outstanding). Management is seeking assistance from Mr. Cromartie to evaluate the compliance with the covenants in 2023 and understand the implication accounting adjustments will have on the management bonus.

Please provide adjusted journal entries and case answer with references to Gaap.

Thank you

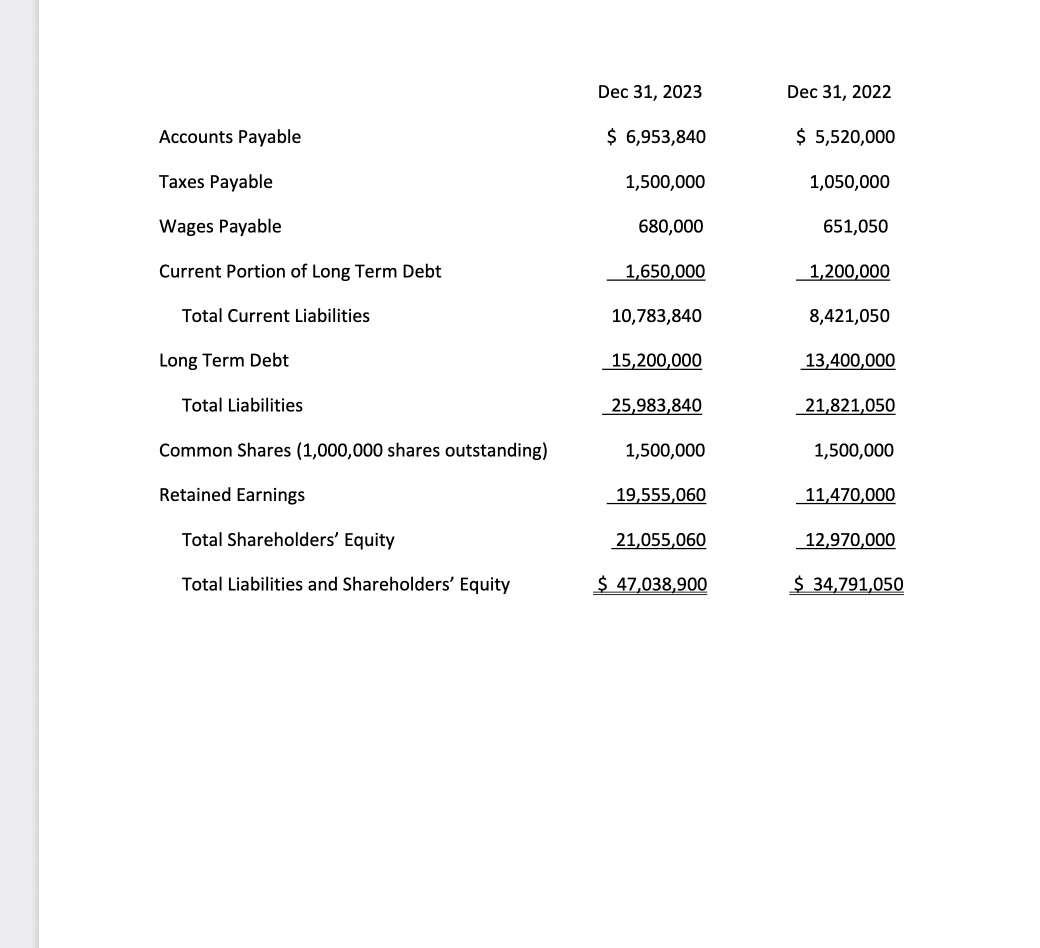

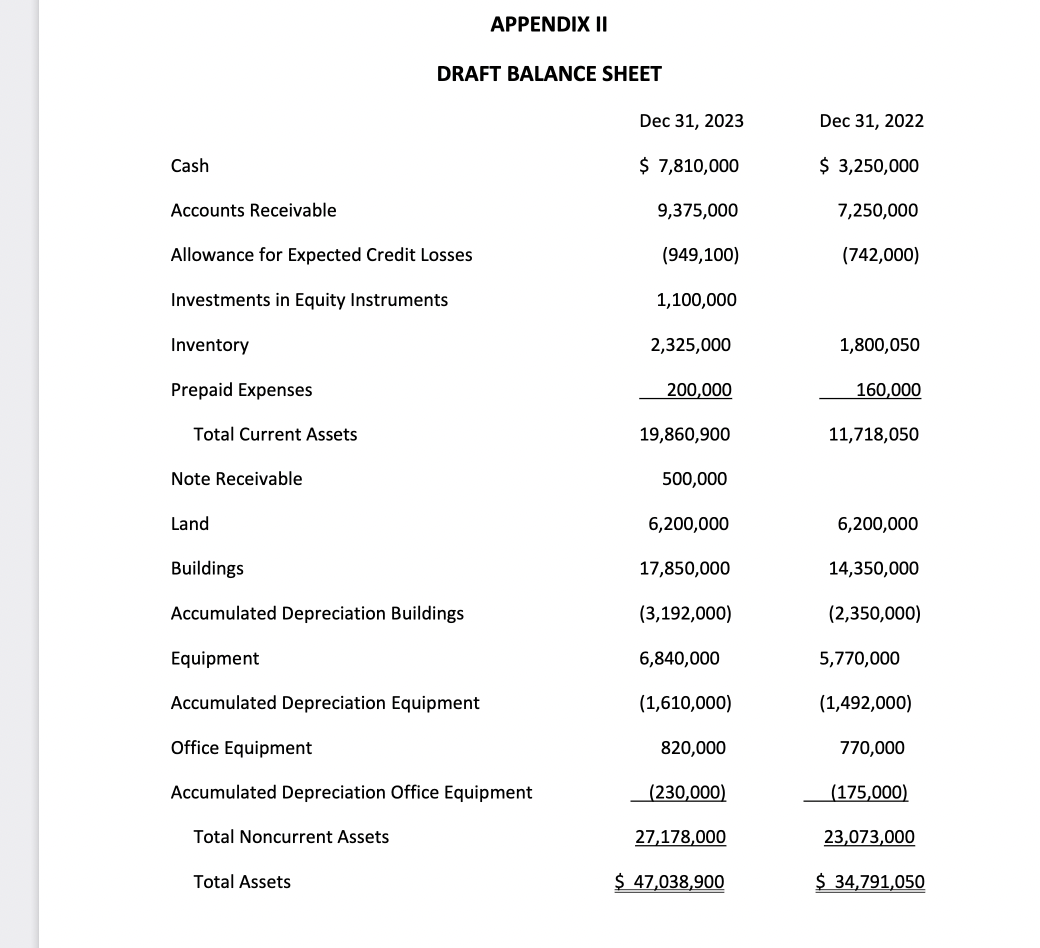

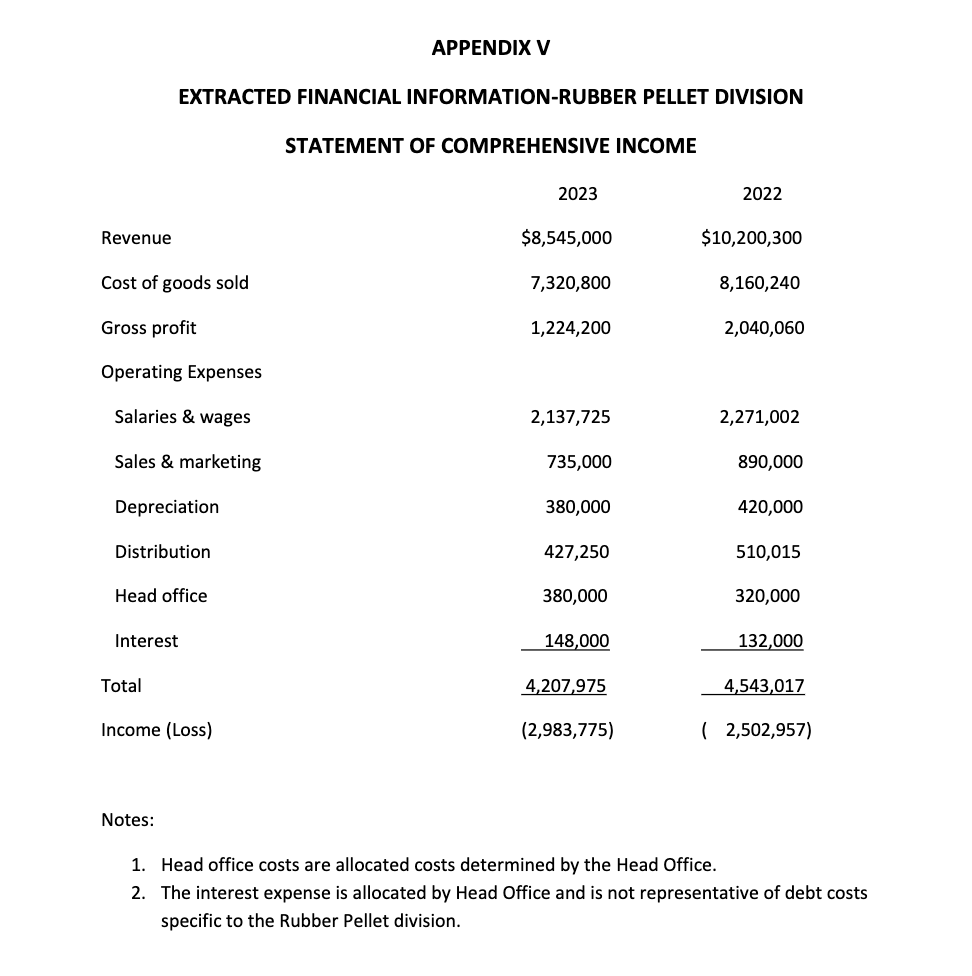

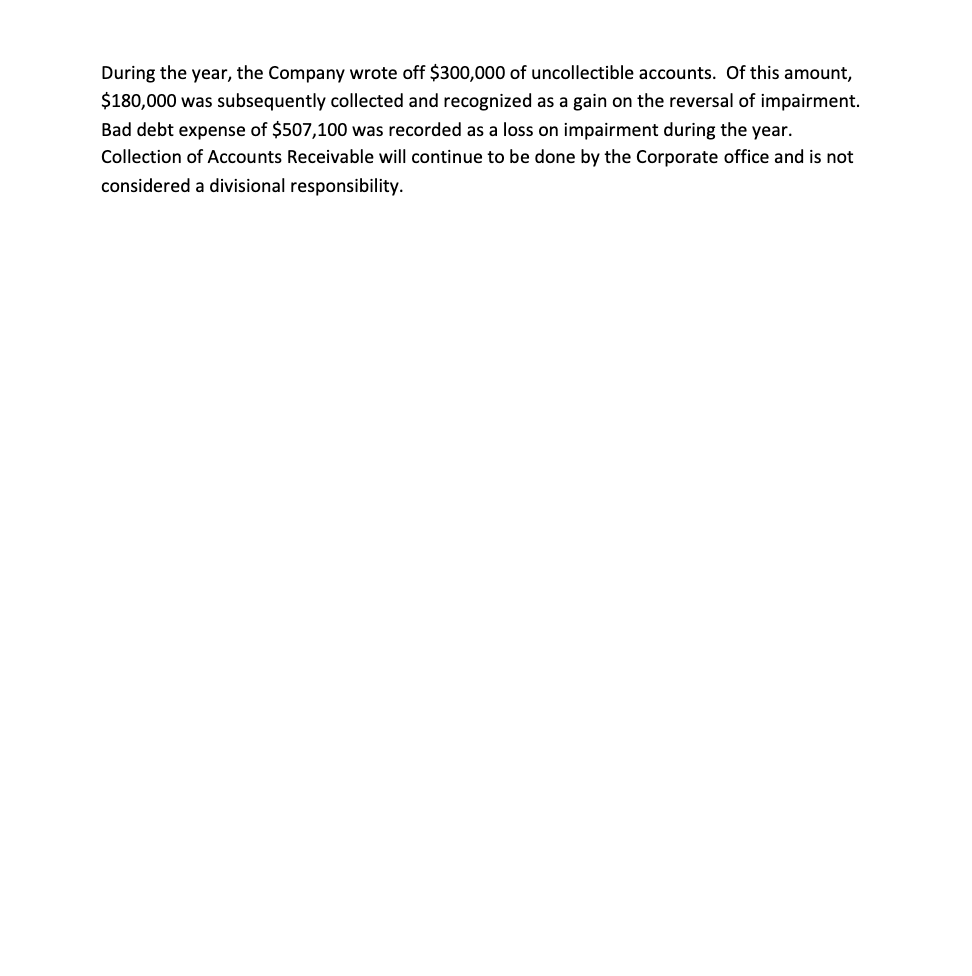

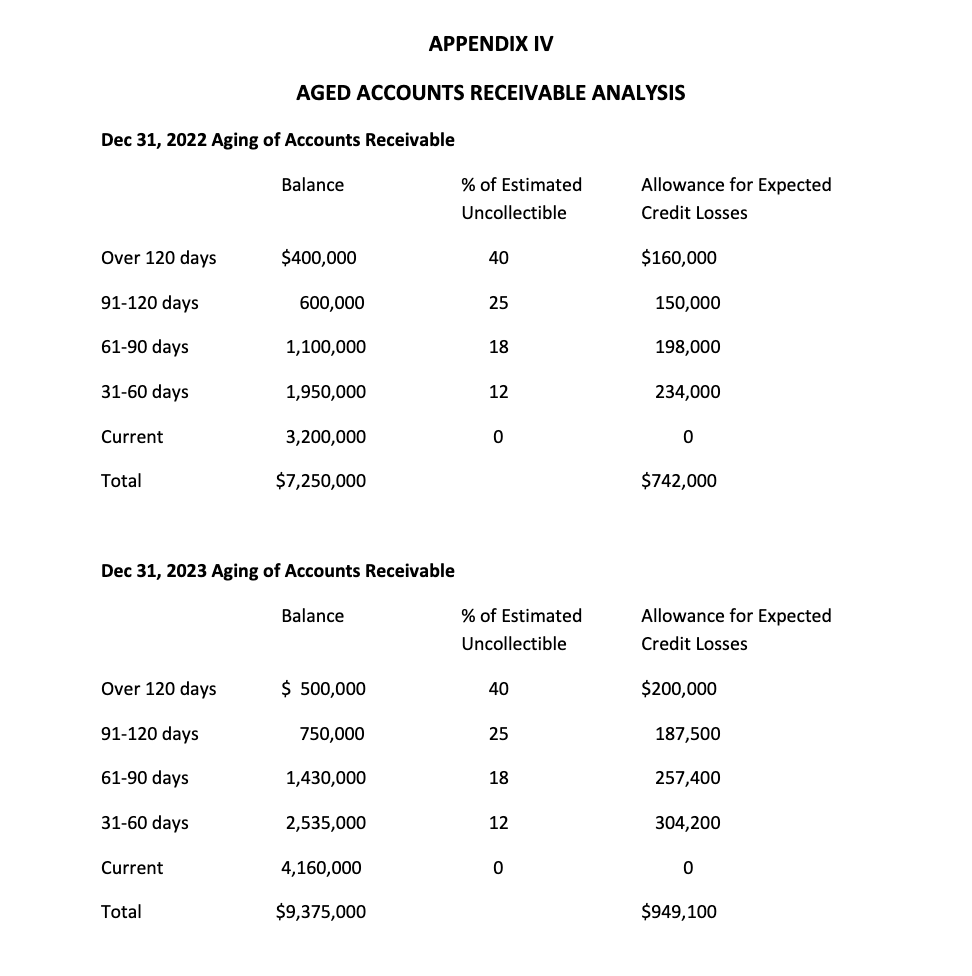

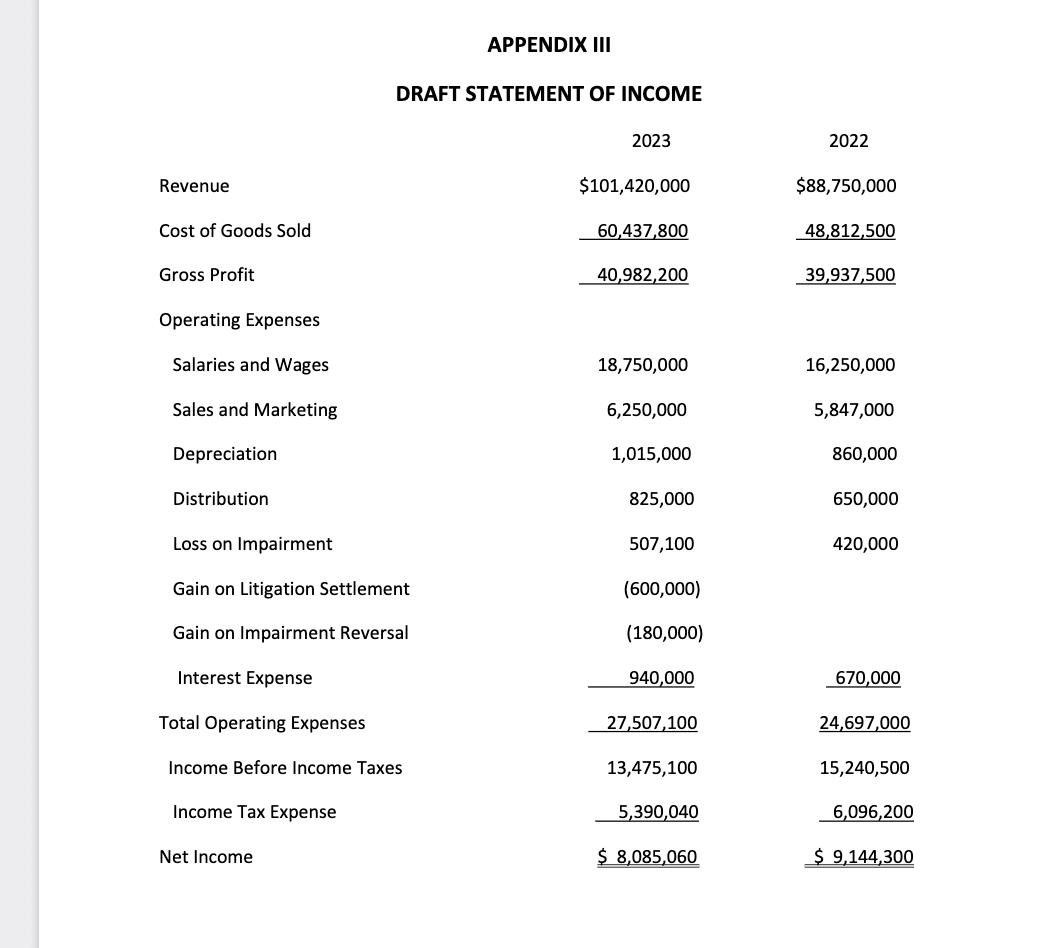

\begin{tabular}{lrr} & Dec 31, 2023 & Dec 31, 2022 \\ Accounts Payable & $6,953,840 & $5,520,000 \\ Taxes Payable & 1,500,000 & 1,050,000 \\ Wages Payable & 680,000 & 651,050 \\ Current Portion of Long Term Debt & 1,650,000 & 1,200,000 \\ Total Current Liabilities & 10,783,840 & 8,421,050 \\ Long Term Debt & 15,200,000 & 13,400,000 \\ 25,983,840 & 21,821,050 \\ Total Liabilities & 1,500,000 & 1,500,000 \\ Common Shares (1,000,000 shares outstanding) & 19,555,060 & 11,470,000 \\ Retained Earnings & 21,055,060 & 12,970,000 \\ Total Shareholders' Equity & 44,038,900 & 34,791,050 \end{tabular} APPENDIX II DRAFT BALANCE SHEET \begin{tabular}{|c|c|c|} \hline & Dec 31, 2023 & Dec 31, 2022 \\ \hline Cash & $7,810,000 & $3,250,000 \\ \hline Accounts Receivable & 9,375,000 & 7,250,000 \\ \hline Allowance for Expected Credit Losses & (949,100) & (742,000) \\ \hline Investments in Equity Instruments & 1,100,000 & \\ \hline Inventory & 2,325,000 & 1,800,050 \\ \hline Prepaid Expenses & 200,000 & 160,000 \\ \hline Total Current Assets & 19,860,900 & 11,718,050 \\ \hline Note Receivable & 500,000 & \\ \hline Land & 6,200,000 & 6,200,000 \\ \hline Buildings & 17,850,000 & 14,350,000 \\ \hline Accumulated Depreciation Buildings & (3,192,000) & (2,350,000) \\ \hline Equipment & 6,840,000 & 5,770,000 \\ \hline Accumulated Depreciation Equipment & (1,610,000) & (1,492,000) \\ \hline Office Equipment & 820,000 & 770,000 \\ \hline Accumulated Depreciation Office Equipment & (230,000) & (175,000) \\ \hline Total Noncurrent Assets & 27,178,000 & 23,073,000 \\ \hline Total Assets & $47,038,900 & $34,791,050 \\ \hline \end{tabular} EXTRACTED FINANCIAL INFORMATION-RUBBER PELLET DIVISION Notes: 1. The fair value of the Inventory and Equipment is based on a written offer received from a local auction business. The Company is waiting for two other offers but has indicated the auction business offer is likely to be the best of the three possible offers. Other costs to close the sale are ignorable. 2. The fair value of the Land and Building is based on an independent appraisal provided by an experienced commercial property broker that has successfully sold comparable properties in the area. It is estimated the cost to dispose of the Land and Building would be approximately 10%. 3. Ignore any adjustment to depreciation. Notes: 1. Head office costs are allocated costs determined by the Head Office. 2. The interest expense is allocated by Head Office and is not representative of debt costs specific to the Rubber Pellet division. During the year, the Company wrote off $300,000 of uncollectible accounts. Of this amount, $180,000 was subsequently collected and recognized as a gain on the reversal of impairment. Bad debt expense of $507,100 was recorded as a loss on impairment during the year. Collection of Accounts Receivable will continue to be done by the Corporate office and is not considered a divisional responsibility. APPENDIX IV AGED ACCOUNTS RECEIVABLE ANALYSIS Dec 31, 2022 Aging of Accounts Receivable Dec 31, 2023 Aging of Accounts Receivable APPENDIX III DRAFT STATEMENT OF INCOME 2023 Revenue Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Sales and Marketing Depreciation Distribution Loss on Impairment Gain on Litigation Settlement Gain on Impairment Reversal Interest Expense Total Operating Expenses Income Before Income Taxes Income Tax Expense Net Income \begin{tabular}{cc} 2023 & 2022 \\ $101,420,000 & $88,750,000 \\ 60,437,800 & 48,812,500 \\ \hline 40,982,200 & 39,937,500 \\ \hline \end{tabular} \begin{tabular}{rr} 18,750,000 & 16,250,000 \\ 6,250,000 & 5,847,000 \\ 1,015,000 & 860,000 \\ 825,000 & 650,000 \\ 507,100 & 420,000 \end{tabular} (600,000) (180,000) \begin{tabular}{rr} \hline 940,000 & 670,000 \\ \hline 27,507,100 & 24,697,000 \\ \hline 13,475,100 & 15,240,500 \\ 5,390,040 & 6,096,200 \\ \hline$8,085,060 & $9,144,300 \\ \hline \end{tabular}

\begin{tabular}{lrr} & Dec 31, 2023 & Dec 31, 2022 \\ Accounts Payable & $6,953,840 & $5,520,000 \\ Taxes Payable & 1,500,000 & 1,050,000 \\ Wages Payable & 680,000 & 651,050 \\ Current Portion of Long Term Debt & 1,650,000 & 1,200,000 \\ Total Current Liabilities & 10,783,840 & 8,421,050 \\ Long Term Debt & 15,200,000 & 13,400,000 \\ 25,983,840 & 21,821,050 \\ Total Liabilities & 1,500,000 & 1,500,000 \\ Common Shares (1,000,000 shares outstanding) & 19,555,060 & 11,470,000 \\ Retained Earnings & 21,055,060 & 12,970,000 \\ Total Shareholders' Equity & 44,038,900 & 34,791,050 \end{tabular} APPENDIX II DRAFT BALANCE SHEET \begin{tabular}{|c|c|c|} \hline & Dec 31, 2023 & Dec 31, 2022 \\ \hline Cash & $7,810,000 & $3,250,000 \\ \hline Accounts Receivable & 9,375,000 & 7,250,000 \\ \hline Allowance for Expected Credit Losses & (949,100) & (742,000) \\ \hline Investments in Equity Instruments & 1,100,000 & \\ \hline Inventory & 2,325,000 & 1,800,050 \\ \hline Prepaid Expenses & 200,000 & 160,000 \\ \hline Total Current Assets & 19,860,900 & 11,718,050 \\ \hline Note Receivable & 500,000 & \\ \hline Land & 6,200,000 & 6,200,000 \\ \hline Buildings & 17,850,000 & 14,350,000 \\ \hline Accumulated Depreciation Buildings & (3,192,000) & (2,350,000) \\ \hline Equipment & 6,840,000 & 5,770,000 \\ \hline Accumulated Depreciation Equipment & (1,610,000) & (1,492,000) \\ \hline Office Equipment & 820,000 & 770,000 \\ \hline Accumulated Depreciation Office Equipment & (230,000) & (175,000) \\ \hline Total Noncurrent Assets & 27,178,000 & 23,073,000 \\ \hline Total Assets & $47,038,900 & $34,791,050 \\ \hline \end{tabular} EXTRACTED FINANCIAL INFORMATION-RUBBER PELLET DIVISION Notes: 1. The fair value of the Inventory and Equipment is based on a written offer received from a local auction business. The Company is waiting for two other offers but has indicated the auction business offer is likely to be the best of the three possible offers. Other costs to close the sale are ignorable. 2. The fair value of the Land and Building is based on an independent appraisal provided by an experienced commercial property broker that has successfully sold comparable properties in the area. It is estimated the cost to dispose of the Land and Building would be approximately 10%. 3. Ignore any adjustment to depreciation. Notes: 1. Head office costs are allocated costs determined by the Head Office. 2. The interest expense is allocated by Head Office and is not representative of debt costs specific to the Rubber Pellet division. During the year, the Company wrote off $300,000 of uncollectible accounts. Of this amount, $180,000 was subsequently collected and recognized as a gain on the reversal of impairment. Bad debt expense of $507,100 was recorded as a loss on impairment during the year. Collection of Accounts Receivable will continue to be done by the Corporate office and is not considered a divisional responsibility. APPENDIX IV AGED ACCOUNTS RECEIVABLE ANALYSIS Dec 31, 2022 Aging of Accounts Receivable Dec 31, 2023 Aging of Accounts Receivable APPENDIX III DRAFT STATEMENT OF INCOME 2023 Revenue Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Sales and Marketing Depreciation Distribution Loss on Impairment Gain on Litigation Settlement Gain on Impairment Reversal Interest Expense Total Operating Expenses Income Before Income Taxes Income Tax Expense Net Income \begin{tabular}{cc} 2023 & 2022 \\ $101,420,000 & $88,750,000 \\ 60,437,800 & 48,812,500 \\ \hline 40,982,200 & 39,937,500 \\ \hline \end{tabular} \begin{tabular}{rr} 18,750,000 & 16,250,000 \\ 6,250,000 & 5,847,000 \\ 1,015,000 & 860,000 \\ 825,000 & 650,000 \\ 507,100 & 420,000 \end{tabular} (600,000) (180,000) \begin{tabular}{rr} \hline 940,000 & 670,000 \\ \hline 27,507,100 & 24,697,000 \\ \hline 13,475,100 & 15,240,500 \\ 5,390,040 & 6,096,200 \\ \hline$8,085,060 & $9,144,300 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started