Answered step by step

Verified Expert Solution

Question

1 Approved Answer

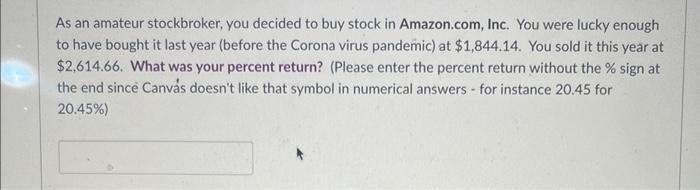

As an amateur stockbroker, you decided to buy stock in Amazon.com, Inc. You were lucky enough to have bought it last year (before the

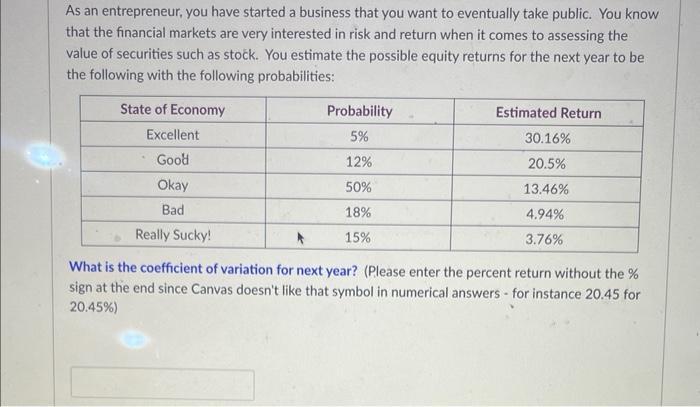

As an amateur stockbroker, you decided to buy stock in Amazon.com, Inc. You were lucky enough to have bought it last year (before the Corona virus pandemic) at $1,844.14. You sold it this year at $2,614.66. What was your percent return? (Please enter the percent return without the % sign at the end since Canvs doesn't like that symbol in numerical answers for instance 20.45 for 20.45%) - As an entrepreneur, you have started a business that you want to eventually take public. You know that the financial markets are very interested in risk and return when it comes to assessing the value of securities such as stock. You estimate the possible equity returns for the next year to be the following with the following probabilities: State of Economy Excellent Good Okay Bad Really Sucky! Probability 5% 12% 50% 18% 15% Estimated Return 30.16% 20.5% 13.46% 4.94% 3.76% A What is the coefficient of variation for next year? (Please enter the percent return without the % sign at the end since Canvas doesn't like that symbol in numerical answers for instance 20.45 for 20.45%) -

Step by Step Solution

★★★★★

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the percent return on your investment you can use the following formula Where Selling Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started