Answered step by step

Verified Expert Solution

Question

1 Approved Answer

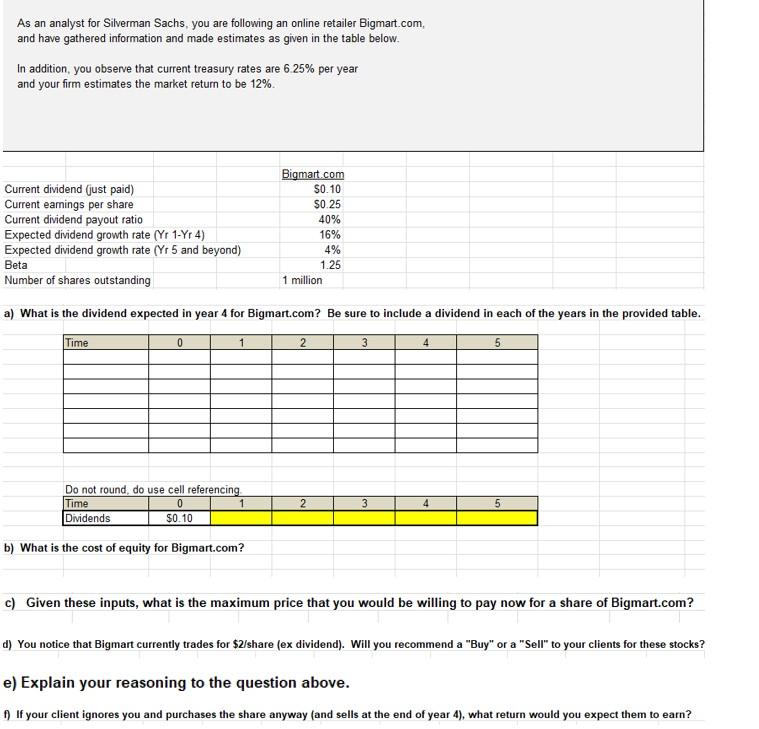

As an analyst for Silverman Sachs, you are following an online retailer Bigmart.com, and have gathered information and made estimates as given in the

As an analyst for Silverman Sachs, you are following an online retailer Bigmart.com, and have gathered information and made estimates as given in the table below. In addition, you observe that current treasury rates are 6.25% per year and your firm estimates the market return to be 12%. Current dividend (just paid) Current earnings per share Current dividend payout ratio Expected dividend growth rate (Yr 1-Yr 4) Expected dividend growth rate (Yr 5 and beyond) Beta Number of shares outstanding 0 a) What is the dividend expected in year 4 for Bigmart.com? Be sure to include a dividend in each of the years in the provided table. Time 4 1 Do not round, do use cell referencing Time Dividends 0 $0.10 b) What is the cost of equity for Bigmart.com? Bigmart.com $0.10 $0.25 40% 16% 4% 1.25 1 1 million 2 2 3 3 4 5 5 c) Given these inputs, what is the maximum price that you would be willing to pay now for a share of Bigmart.com? d) You notice that Bigmart currently trades for $2/share (ex dividend). Will you recommend a "Buy" or a "Sell" to your clients for these stocks? e) Explain your reasoning to the question above. f) If your client ignores you and purchases the share anyway (and sells at the end of year 4), what return would you expect them to earn?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started