Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As an investor you have analysed two stocks and must decide which (if any) to purchase. The following information is provided. a. using the dividend-growth

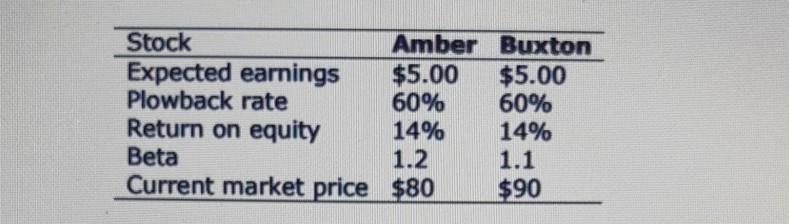

As an investor you have analysed two stocks and must decide which (if any) to purchase. The following information is provided.

a. using the dividend-growth model, what is the maximum price you would be willing to pay for each stock? Which (if any) should you buy? b. What is the amount of the present value of growth opportunities (PVGO) for each stock? c. Why are your valuations different? d. What is your implied rate of return for each stock? What does this imply for stock valuation?

Stock Amber Buxton Expected earnings $5.00 $5.00 Plowback rate 60% 60% Return on equity 14% 14% Beta 1.2 1.1 Current market price $80 $90Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started