PLEASE MATCH THE RATIOS FOR A,B,D,F,H,I,K,L,M WITH THE COMPANIES PROVIDED. PLEASE INCLUDE AN EXPLANATION AS TO WHY YOU CHOSE THIS.

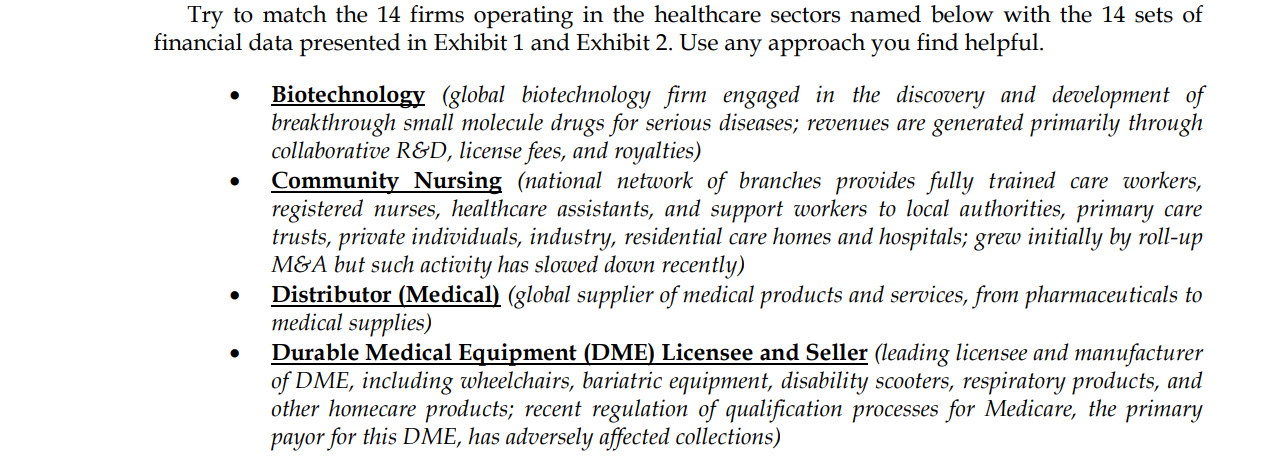

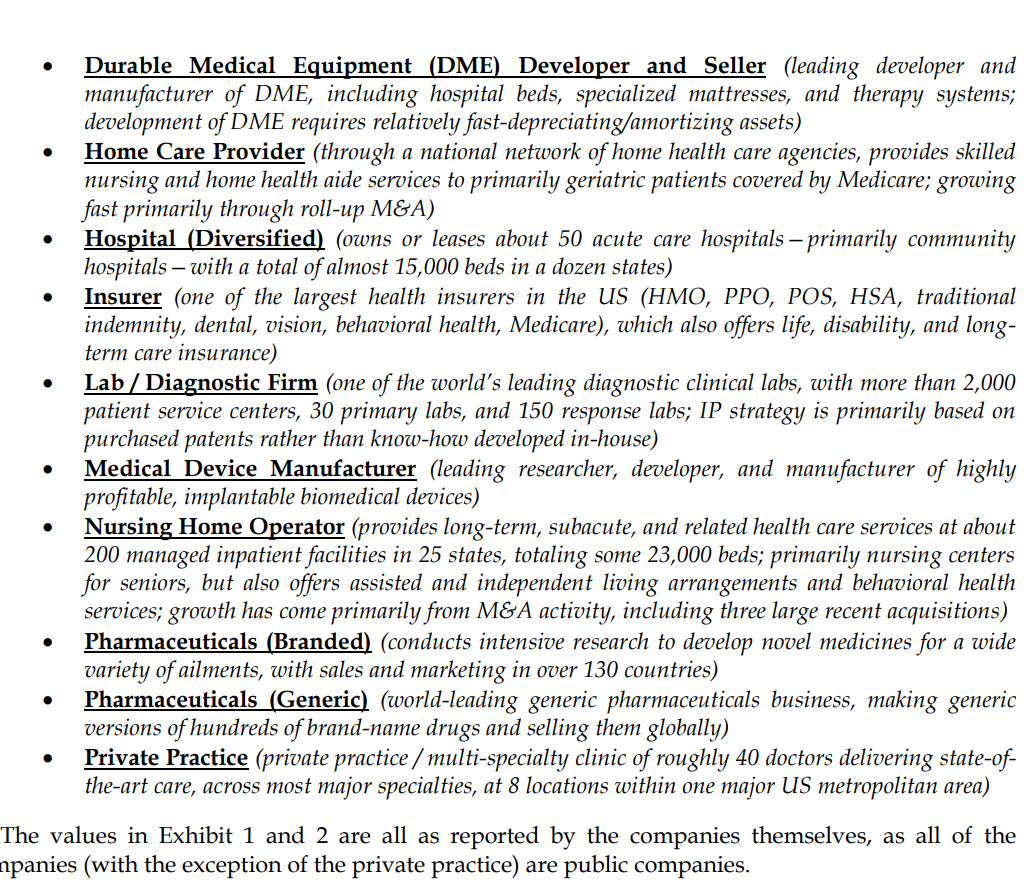

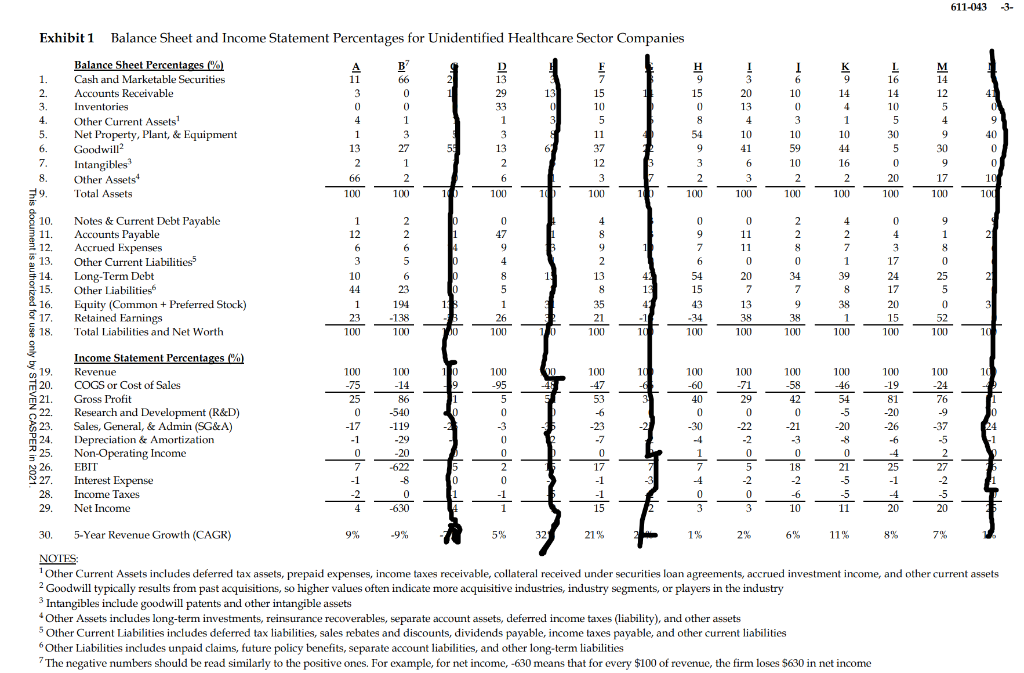

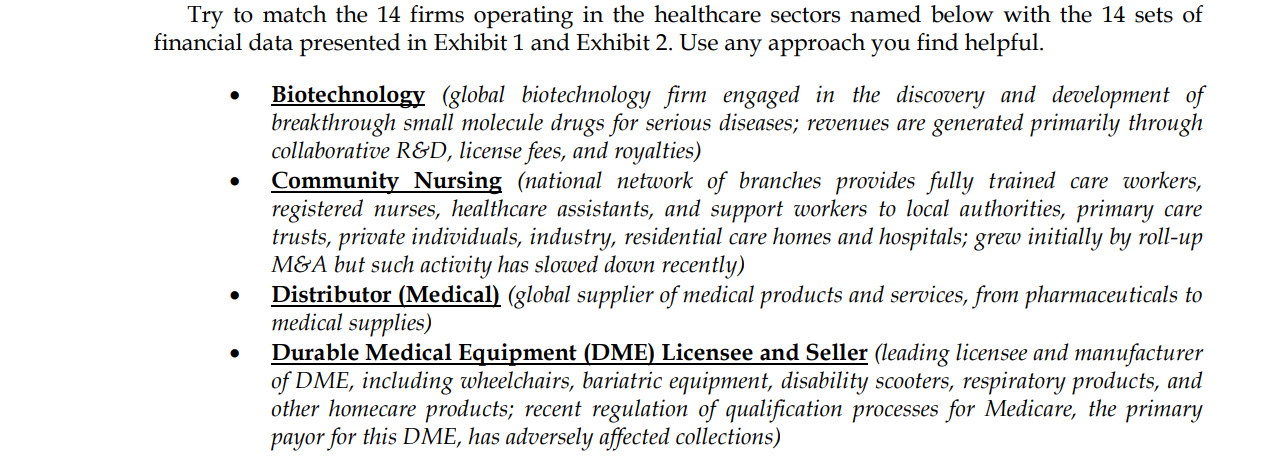

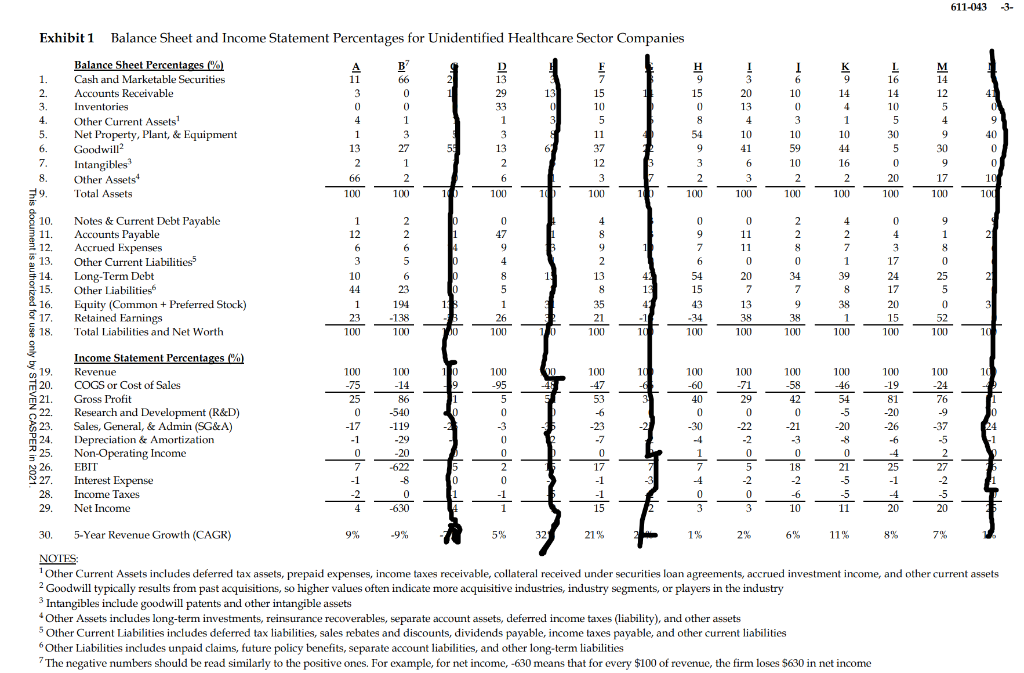

. . Try to match the 14 firms operating in the healthcare sectors named below with the 14 sets of financial data presented in Exhibit 1 and Exhibit 2. Use any approach you find helpful. Biotechnology (global biotechnology firm engaged in the discovery and development of breakthrough small molecule drugs for serious diseases; revenues are generated primarily through collaborative R&D, license fees, and royalties) Community Nursing (national network of branches provides fully trained care workers, registered nurses, healthcare assistants, and support workers to local authorities, primary care trusts, private individuals, industry, residential care homes and hospitals; grew initially by roll-up M&A but such activity has slowed down recently) Distributor (Medical) (global supplier of medical products and services, from pharmaceuticals to medical supplies) Durable Medical Equipment (DME) Licensee and Seller (leading licensee and manufacturer of DME, including wheelchairs, bariatric equipment, disability scooters, respiratory products, and other homecare products; recent regulation of qualification processes for Medicare, the primary payor for this DME, has adversely affected collections) . . Durable Medical Equipment (DME) Developer and Seller (leading developer and manufacturer of DME, including hospital beds, specialized mattresses, and therapy systems; development of DME requires relatively fast-depreciating/amortizing assets) Home Care Provider (through a national network of home health care agencies, provides skilled nursing and home health aide services to primarily geriatric patients covered by Medicare; growing fast primarily through roll-up M&A) Hospital (Diversified) (owns or leases about 50 acute care hospitals primarily community hospitals with a total of almost 15,000 beds in a dozen states) Insurer (one of the largest health insurers in the US (HMO, PPO, POS, HSA, traditional indemnity, dental, vision, behavioral health, Medicare), which also offers life, disability, and long- term care insurance) Lab / Diagnostic Firm (one of the world's leading diagnostic clinical labs, with more than 2,000 patient service centers, 30 primary labs, and 150 response labs; IP strategy is primarily based on purchased patents rather than know-how developed in-house) Medical Device Manufacturer (leading researcher, developer, and manufacturer of highly profitable, implantable biomedical devices) Nursing Home Operator (provides long-term, subacute, and related health care services at about 200 managed inpatient facilities in 25 states, totaling some 23,000 beds; primarily nursing centers for seniors, but also offers assisted and independent living arrangements and behavioral health services; growth has come primarily from M&A activity, including three large recent acquisitions) Pharmaceuticals (Branded) (conducts intensive research to develop novel medicines for a wide variety of ailments, with sales and marketing in over 130 countries) Pharmaceuticals (Generic) (world-leading generic pharmaceuticals business, making generic versions of hundreds of brand-name drugs and selling them globally) Private Practice (private practice / multi-specialty clinic of roughly 40 doctors delivering state-of- the-art care, across most major specialties, at 8 locations within one major US metropolitan area) The values in Exhibit 1 and 2 are all as reported by the companies themselves, as all of the npanies (with the exception of the private practice) are public companies. 611-043 -3- Exhibiti Balance Sheet and Income Statement Percentages for Unidentified Healthcare Sector Companies Balance Sheet Percentages (%) A B? D F H 1. Cash and Marketable Securities 11 66 13 7 9 2. Accounts Receivable 3 0 1 29 13 15 15 3. Inventories 0 0 33 0 10 0 4. Other Current Assets 4 1 1 3 5 8 5. Net Property, Plant, & Equipment 1 3 3 11 54 6. Goodwill 13 27 56 13 6 37 9 7. Intangibles 2 1 2 12 3 8. Other Assets 66 2 6 3 17 2 9. 9 Total Assets 100 100 10) 100 100 100 10 100 41 0 9 Tewbor ! 3 20 13 4 10 41 6 3 100 **** 811 1 6 10 0 3 10 59 10 2 100 K 9 14 4 1 10 44 16 2 100 L 16 14 10 5 30 5 0 20 100 M 14 12 5 4 9 30 9 17 100 40 0 0 0 10 100 1 0 0 D 1 11 2 1 D 8 10. 11. 12. 13. 14. 15. & 16. 17 18. Notes & Current Debt Payable Accounts Payable Accrued Expenses Other Current Liabilities Long-Term Debt Other Liabilities Equity (Common + Preferred Stock) Retained Earnings Total Liabilities and Net Worth 1 1 12 6 3 10 44 1 23 100 2 2 6 5 6 23 194 -138 100 0 47 9 4 8 5 1 26 1 4 8 9 2 13 8 35 21 100 D 10 18 A 00 0 9 7 6 54 15 43 -34 100 42 13 4 -1 : 10 2 2 8 0 34 7 9 38 100 11 0 20 7 13 38 100 2 4 2 7 7 1 39 8 38 1 100 9 1 8 0 25 5 0 52 100 3 17 24 17 20 15 100 3 100 0 10 20 10 10 10 9 1 0 9 19. 20. 21. 22. # 23. 24 25. 26. 27 28. 29. 100 -60 40 0 -30 Income Statement Percentages (%) Revenue COGS or Cost of Sales Gross Profit Research and Development (R&D) Sales, General, & Admin (SG&A) Depreciation & Amortization Non-Operating Income EBIT Interest Expense Income Taxes Net Income 100 -75 25 0 -17 -1 0 7 -1 -2 4 100 -95 5 0 -3 0 0 100 -14 86 -540 -119 -29 -20 -622 8 0 -630 100 -47 53 -6 -23 -7 0 1 0 24 100 -71 29 0 -22 -2 0 5 -2 0 3 100 -58 42 0 0 -21 -3 0 18 -2 -6 10 100 -46 54 -5 -20 8 0 21 -5 -5 11 100 -19 81 -20 -26 -6 100 -24 76 -9 -37 -5 27 25 -1 -1 0 -1 1 -4 0 3 -5 20 15 20 30 5-Year Revenue Growth (CAGR) 9% -9% 59% 32 21% 199 2% 6% 11% 8% 7" NOTES: Other Current Assets includes deferred tax assets, prepaid expenses, income taxes receivable, collateral received under securities loan agreements, accrued investment income, and other current assets 2 Goodwill typically results from past acquisitions, so higher values often indicate more acquisitive industries, industry segments, or players in the industry Intangibles include goodwill patents and other intangible assets Other Assets includes long-term investments, reinsurance recoverables, separate account assets, deferred income taxes (liability), and other assets 5 Other Current Liabilities includes deferred tax liabilities, sales rebates and discounts, dividends payable, income taxes payable, and other current liabilities Other Liabilities includes unpaid claims, future policy benefits, separate account liabilities, and other long-term liabilities 7 The negative numbers should be read similarly to the positive ones. For example, for net income, -630 means that for every $100 of revenue, the firm loses $630 in net income . . Try to match the 14 firms operating in the healthcare sectors named below with the 14 sets of financial data presented in Exhibit 1 and Exhibit 2. Use any approach you find helpful. Biotechnology (global biotechnology firm engaged in the discovery and development of breakthrough small molecule drugs for serious diseases; revenues are generated primarily through collaborative R&D, license fees, and royalties) Community Nursing (national network of branches provides fully trained care workers, registered nurses, healthcare assistants, and support workers to local authorities, primary care trusts, private individuals, industry, residential care homes and hospitals; grew initially by roll-up M&A but such activity has slowed down recently) Distributor (Medical) (global supplier of medical products and services, from pharmaceuticals to medical supplies) Durable Medical Equipment (DME) Licensee and Seller (leading licensee and manufacturer of DME, including wheelchairs, bariatric equipment, disability scooters, respiratory products, and other homecare products; recent regulation of qualification processes for Medicare, the primary payor for this DME, has adversely affected collections) . . Durable Medical Equipment (DME) Developer and Seller (leading developer and manufacturer of DME, including hospital beds, specialized mattresses, and therapy systems; development of DME requires relatively fast-depreciating/amortizing assets) Home Care Provider (through a national network of home health care agencies, provides skilled nursing and home health aide services to primarily geriatric patients covered by Medicare; growing fast primarily through roll-up M&A) Hospital (Diversified) (owns or leases about 50 acute care hospitals primarily community hospitals with a total of almost 15,000 beds in a dozen states) Insurer (one of the largest health insurers in the US (HMO, PPO, POS, HSA, traditional indemnity, dental, vision, behavioral health, Medicare), which also offers life, disability, and long- term care insurance) Lab / Diagnostic Firm (one of the world's leading diagnostic clinical labs, with more than 2,000 patient service centers, 30 primary labs, and 150 response labs; IP strategy is primarily based on purchased patents rather than know-how developed in-house) Medical Device Manufacturer (leading researcher, developer, and manufacturer of highly profitable, implantable biomedical devices) Nursing Home Operator (provides long-term, subacute, and related health care services at about 200 managed inpatient facilities in 25 states, totaling some 23,000 beds; primarily nursing centers for seniors, but also offers assisted and independent living arrangements and behavioral health services; growth has come primarily from M&A activity, including three large recent acquisitions) Pharmaceuticals (Branded) (conducts intensive research to develop novel medicines for a wide variety of ailments, with sales and marketing in over 130 countries) Pharmaceuticals (Generic) (world-leading generic pharmaceuticals business, making generic versions of hundreds of brand-name drugs and selling them globally) Private Practice (private practice / multi-specialty clinic of roughly 40 doctors delivering state-of- the-art care, across most major specialties, at 8 locations within one major US metropolitan area) The values in Exhibit 1 and 2 are all as reported by the companies themselves, as all of the npanies (with the exception of the private practice) are public companies. 611-043 -3- Exhibiti Balance Sheet and Income Statement Percentages for Unidentified Healthcare Sector Companies Balance Sheet Percentages (%) A B? D F H 1. Cash and Marketable Securities 11 66 13 7 9 2. Accounts Receivable 3 0 1 29 13 15 15 3. Inventories 0 0 33 0 10 0 4. Other Current Assets 4 1 1 3 5 8 5. Net Property, Plant, & Equipment 1 3 3 11 54 6. Goodwill 13 27 56 13 6 37 9 7. Intangibles 2 1 2 12 3 8. Other Assets 66 2 6 3 17 2 9. 9 Total Assets 100 100 10) 100 100 100 10 100 41 0 9 Tewbor ! 3 20 13 4 10 41 6 3 100 **** 811 1 6 10 0 3 10 59 10 2 100 K 9 14 4 1 10 44 16 2 100 L 16 14 10 5 30 5 0 20 100 M 14 12 5 4 9 30 9 17 100 40 0 0 0 10 100 1 0 0 D 1 11 2 1 D 8 10. 11. 12. 13. 14. 15. & 16. 17 18. Notes & Current Debt Payable Accounts Payable Accrued Expenses Other Current Liabilities Long-Term Debt Other Liabilities Equity (Common + Preferred Stock) Retained Earnings Total Liabilities and Net Worth 1 1 12 6 3 10 44 1 23 100 2 2 6 5 6 23 194 -138 100 0 47 9 4 8 5 1 26 1 4 8 9 2 13 8 35 21 100 D 10 18 A 00 0 9 7 6 54 15 43 -34 100 42 13 4 -1 : 10 2 2 8 0 34 7 9 38 100 11 0 20 7 13 38 100 2 4 2 7 7 1 39 8 38 1 100 9 1 8 0 25 5 0 52 100 3 17 24 17 20 15 100 3 100 0 10 20 10 10 10 9 1 0 9 19. 20. 21. 22. # 23. 24 25. 26. 27 28. 29. 100 -60 40 0 -30 Income Statement Percentages (%) Revenue COGS or Cost of Sales Gross Profit Research and Development (R&D) Sales, General, & Admin (SG&A) Depreciation & Amortization Non-Operating Income EBIT Interest Expense Income Taxes Net Income 100 -75 25 0 -17 -1 0 7 -1 -2 4 100 -95 5 0 -3 0 0 100 -14 86 -540 -119 -29 -20 -622 8 0 -630 100 -47 53 -6 -23 -7 0 1 0 24 100 -71 29 0 -22 -2 0 5 -2 0 3 100 -58 42 0 0 -21 -3 0 18 -2 -6 10 100 -46 54 -5 -20 8 0 21 -5 -5 11 100 -19 81 -20 -26 -6 100 -24 76 -9 -37 -5 27 25 -1 -1 0 -1 1 -4 0 3 -5 20 15 20 30 5-Year Revenue Growth (CAGR) 9% -9% 59% 32 21% 199 2% 6% 11% 8% 7" NOTES: Other Current Assets includes deferred tax assets, prepaid expenses, income taxes receivable, collateral received under securities loan agreements, accrued investment income, and other current assets 2 Goodwill typically results from past acquisitions, so higher values often indicate more acquisitive industries, industry segments, or players in the industry Intangibles include goodwill patents and other intangible assets Other Assets includes long-term investments, reinsurance recoverables, separate account assets, deferred income taxes (liability), and other assets 5 Other Current Liabilities includes deferred tax liabilities, sales rebates and discounts, dividends payable, income taxes payable, and other current liabilities Other Liabilities includes unpaid claims, future policy benefits, separate account liabilities, and other long-term liabilities 7 The negative numbers should be read similarly to the positive ones. For example, for net income, -630 means that for every $100 of revenue, the firm loses $630 in net income