Question

As is almost always the case in Macro, there are at least two camps discussing whether the Fed ought to initiate a process of rate

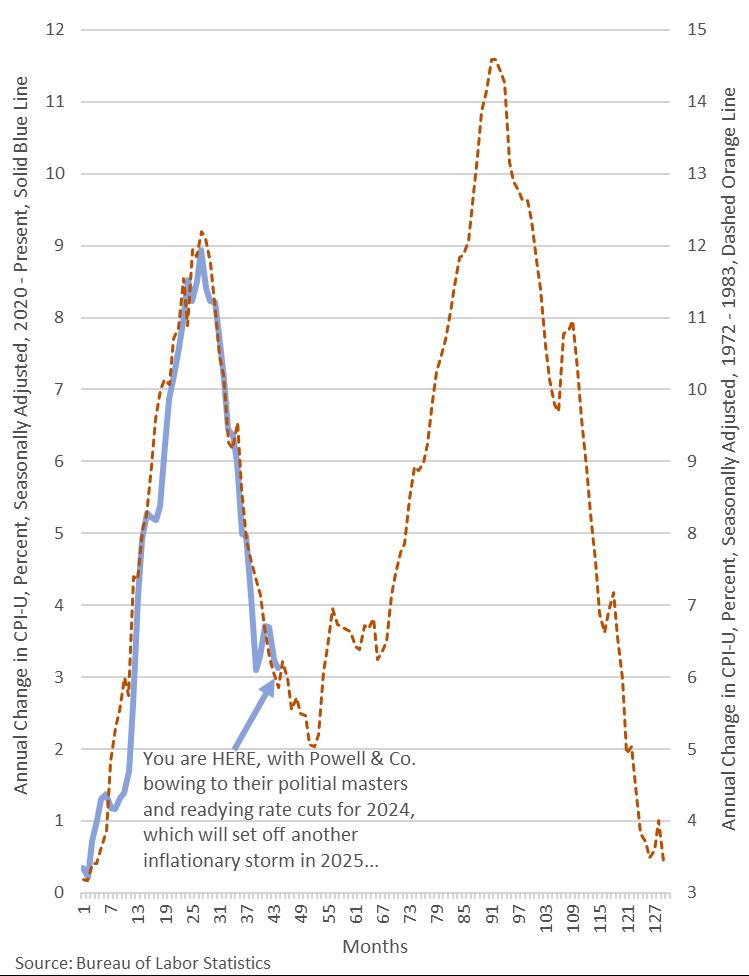

Amongst those that think it would be a mistake they compare the current episode to the 1970's and argue that one of the big errors was that the Fed eased prematurely back then and it might do the same now. One of the economists that argues against an early cut in rates presents the graph below. The argument this camp presents can be summarized in three main points: (i) inflation is still 1.3ppt above target (last 4 months annualized core inflation at 3.3%); (ii) the economy is still hot (economy grew at an annual growth rate of 5.2% in Q3 and current estimates for Q4 put it at 2.7%) growing above potential (1.8%); and (iii) there is significant inflation inertia as observed in wage growth (3-m moving average wage growth of 5.2%).

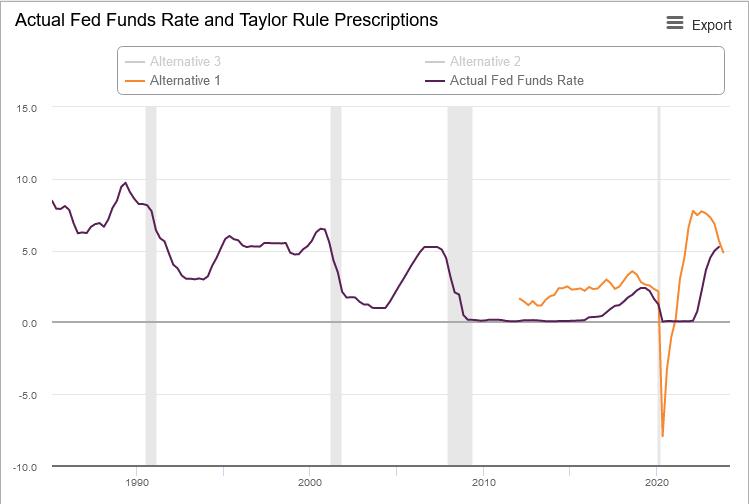

On the other corner are those that argue that the Fed should soon start easing as, otherwise, policy will be too tight. Their arguments can be summarized in: (i) while rates have come down and are already pricing a 76% probability of a rate cut by March, 5y real rates are still high at 1.75%; (ii) wage increases are falling rapidly and rather than inflation inertia, they illustrate rapidly falling inflation expectations (November one-year ahead inflation expectations declined by 0.2ppt to 3.4%, the lowest reading since April 2021); (iii) Estimates of the Taylor Rule show that, right now, the Fed is on target but the trends suggest that it will soon be too tight (see graph).

- Conceptually explain what underlying views might be behind each camp's concerns. Frame your analysis of the discussion in terms of the differences between Keynesians and New Keynesians and what factors you would be looking at to shed additional light and help you take a side.

- Another important part of the discussion is whether by easing monetary policy, the Fed might be giving in to the temptation of pushing the economy during an inflation year, running the risk of destabilizing expectations. Why would such a concern make sense? What are the risks of not easing? Again, is there any data or concept you would look at to help you decide what the Fed ought to do?

- Now introduce in the analysis the possibility that pandemic supply-side bottlenecks have been largely overcome while, at the same time, productivity seems to be growing at a swift pace (5.2% in Q3). If the economy faces faster productivity growth, what is likely to happen to the neutral real rate r* and to the inflation rate?

0 10 Annual Change in CPI-U, Percent, Seasonally Adjusted, 2020 - Present, Solid Blue Line 1 7 12 15 11 14 You are HERE, with Powell & Co. bowing to their politial masters and readying rate cuts for 2024, which will set off another inflationary storm in 2025... Source: Bureau of Labor Statistics Months 103 109 115 121 127 3 11 2 3 Annual Change in CPI-U, Percent, Seasonally Adjusted, 1972 - 1983, Dashed Orange Line

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started