Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As of December 31, 20X8, Sword had declared but not yet paid its fourth-quarter dividend of $5,000. Both companies use straight-line depreciation and amortization. Prince

As of December 31, 20X8, Sword had declared but not yet paid its fourth-quarter dividend of $5,000. Both companies use straight-line depreciation and amortization. Prince uses the fully adjusted equity method to account for its investment in Sword.

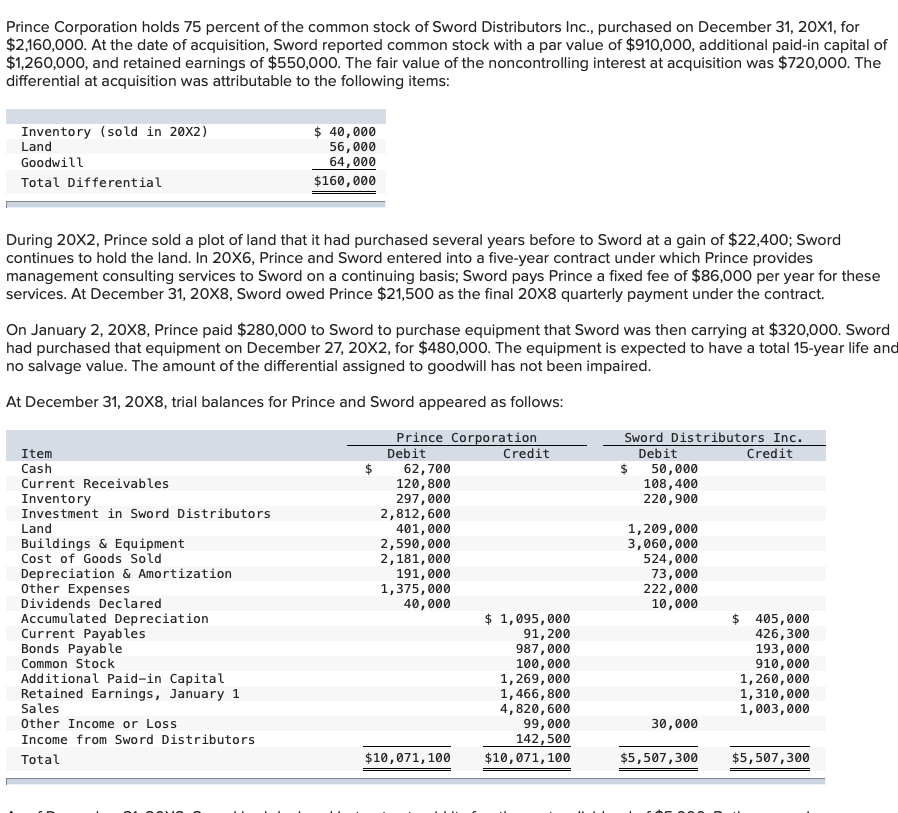

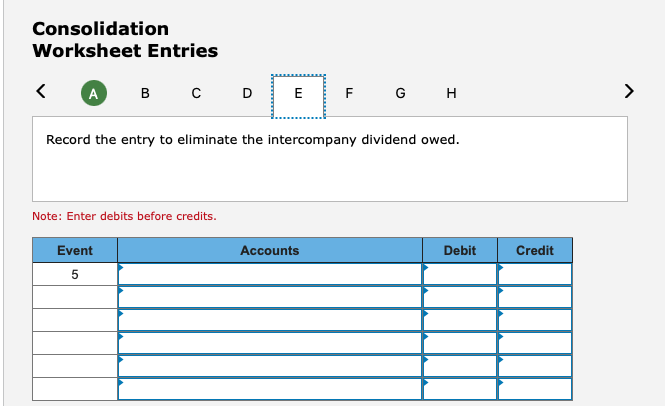

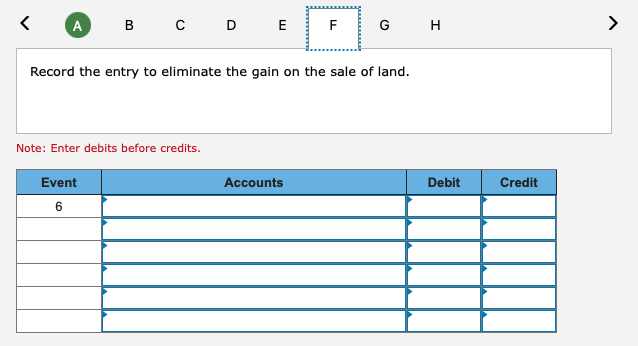

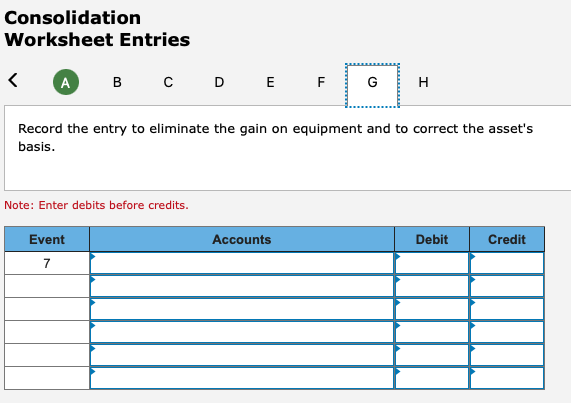

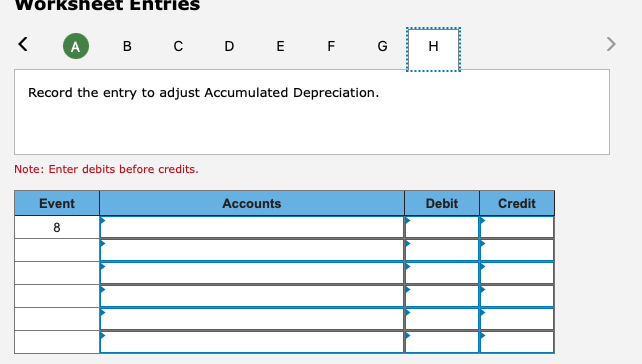

Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1, for $2,160,000. At the date of acquisition, Sword reported common stock with a par value of $910,000, additional paid-in capital of $1,260,000, and retained earnings of $550,000. The fair value of the noncontrolling interest at acquisition was $720,000. The differential at acquisition was attributable to the following items: During 20X2, Prince sold a plot of land that it had purchased several years before to Sword at a gain of \$22,400; Sword continues to hold the land. In 20X6, Prince and Sword entered into a five-year contract under which Prince provides management consulting services to Sword on a continuing basis; Sword pays Prince a fixed fee of $86,000 per year for these services. At December 31, 20X8, Sword owed Prince $21,500 as the final 208 quarterly payment under the contract. On January 2, 20X8, Prince paid $280,000 to Sword to purchase equipment that Sword was then carrying at $320,000. Sword had purchased that equipment on December 27,202, for $480,000. The equipment is expected to have a total 15-year life anc no salvage value. The amount of the differential assigned to goodwill has not been impaired. At December 31,208, trial balances for Prince and Sword appeared as follows: Consolidation Worksheet Entries Record the entry to eliminate the intercompany dividend owed. Note: Enter debits before credits. Record the entry to eliminate the gain on the sale of land. Note: Enter debits before credits. Consolidation Worksheet Entries Record the entry to eliminate the gain on equipment and to correct the asset's basis. Note: Enter debits before credits. Record the entry to adjust Accumulated Depreciation. Note: Enter debits before credits

Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1, for $2,160,000. At the date of acquisition, Sword reported common stock with a par value of $910,000, additional paid-in capital of $1,260,000, and retained earnings of $550,000. The fair value of the noncontrolling interest at acquisition was $720,000. The differential at acquisition was attributable to the following items: During 20X2, Prince sold a plot of land that it had purchased several years before to Sword at a gain of \$22,400; Sword continues to hold the land. In 20X6, Prince and Sword entered into a five-year contract under which Prince provides management consulting services to Sword on a continuing basis; Sword pays Prince a fixed fee of $86,000 per year for these services. At December 31, 20X8, Sword owed Prince $21,500 as the final 208 quarterly payment under the contract. On January 2, 20X8, Prince paid $280,000 to Sword to purchase equipment that Sword was then carrying at $320,000. Sword had purchased that equipment on December 27,202, for $480,000. The equipment is expected to have a total 15-year life anc no salvage value. The amount of the differential assigned to goodwill has not been impaired. At December 31,208, trial balances for Prince and Sword appeared as follows: Consolidation Worksheet Entries Record the entry to eliminate the intercompany dividend owed. Note: Enter debits before credits. Record the entry to eliminate the gain on the sale of land. Note: Enter debits before credits. Consolidation Worksheet Entries Record the entry to eliminate the gain on equipment and to correct the asset's basis. Note: Enter debits before credits. Record the entry to adjust Accumulated Depreciation. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started