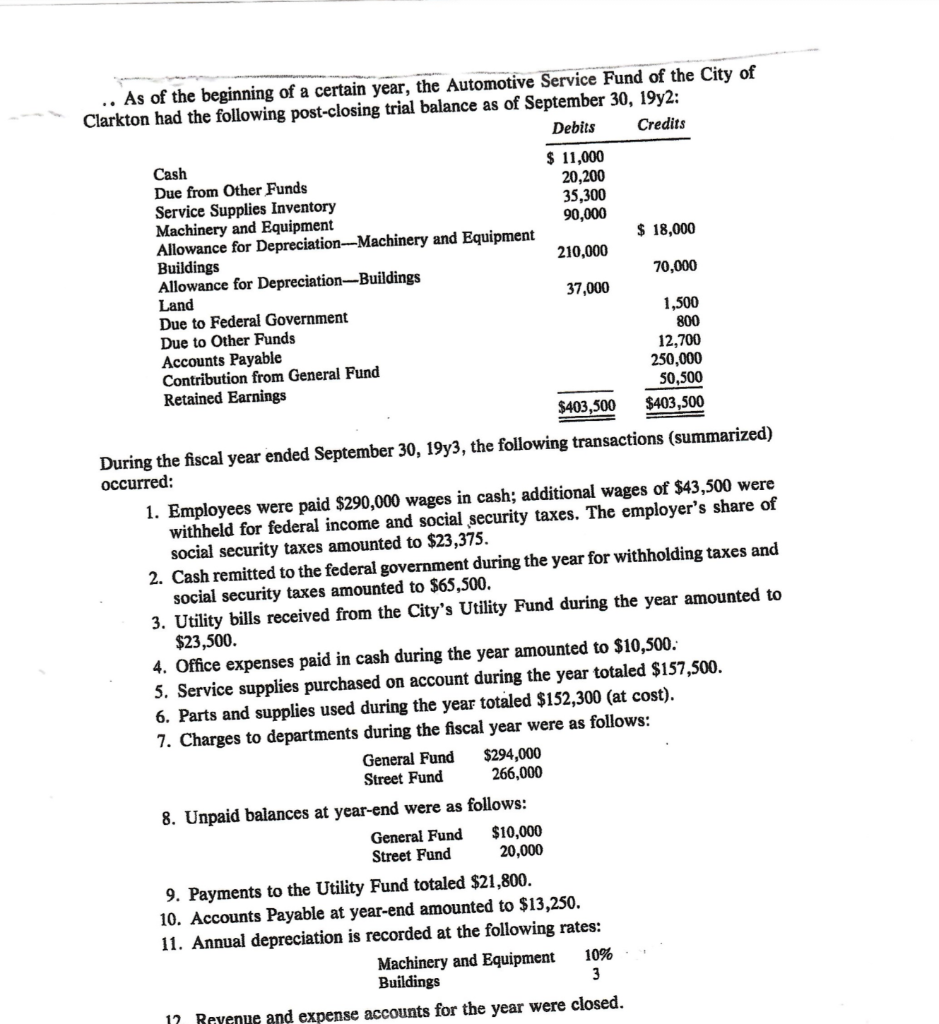

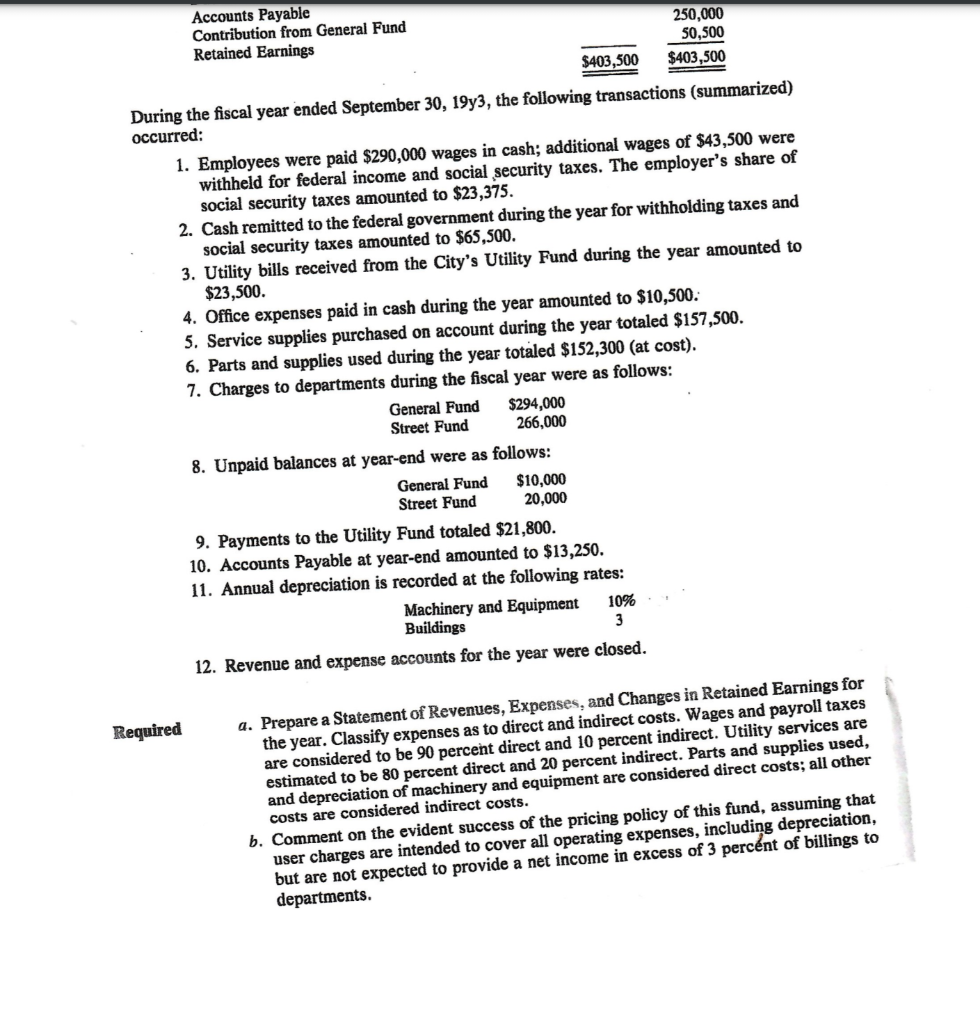

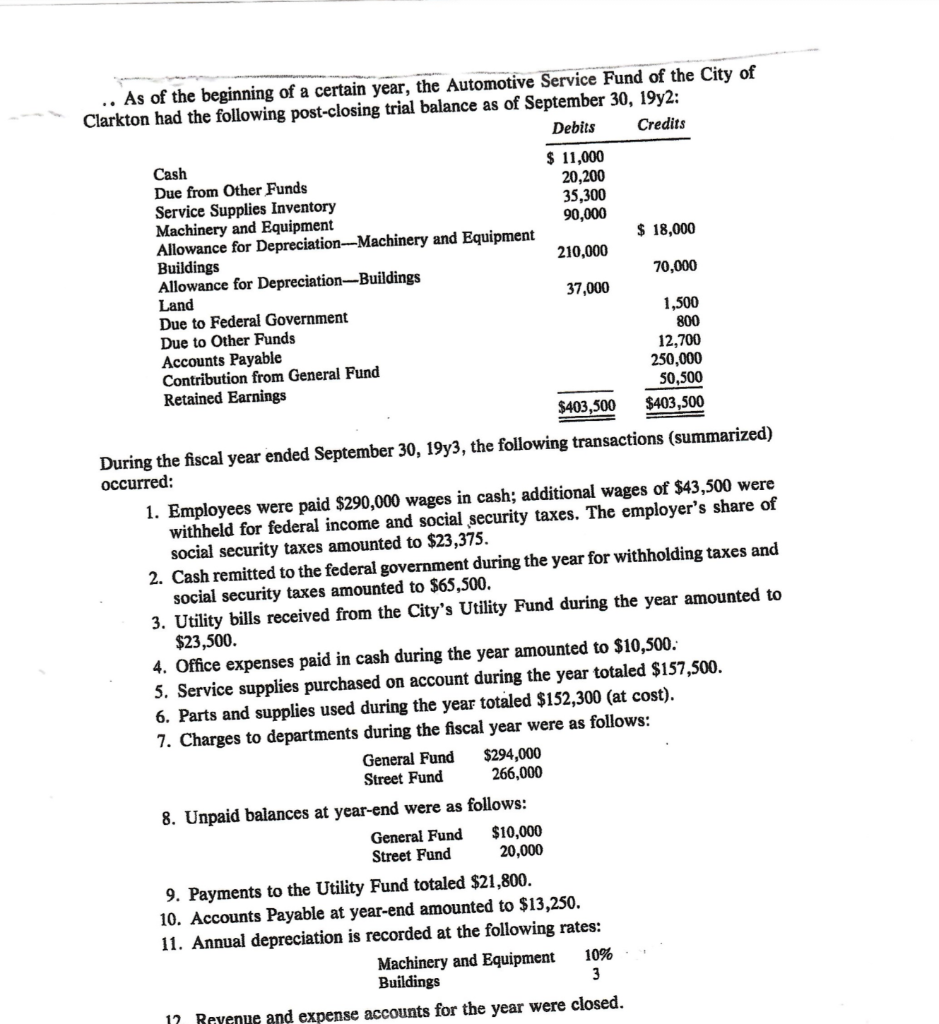

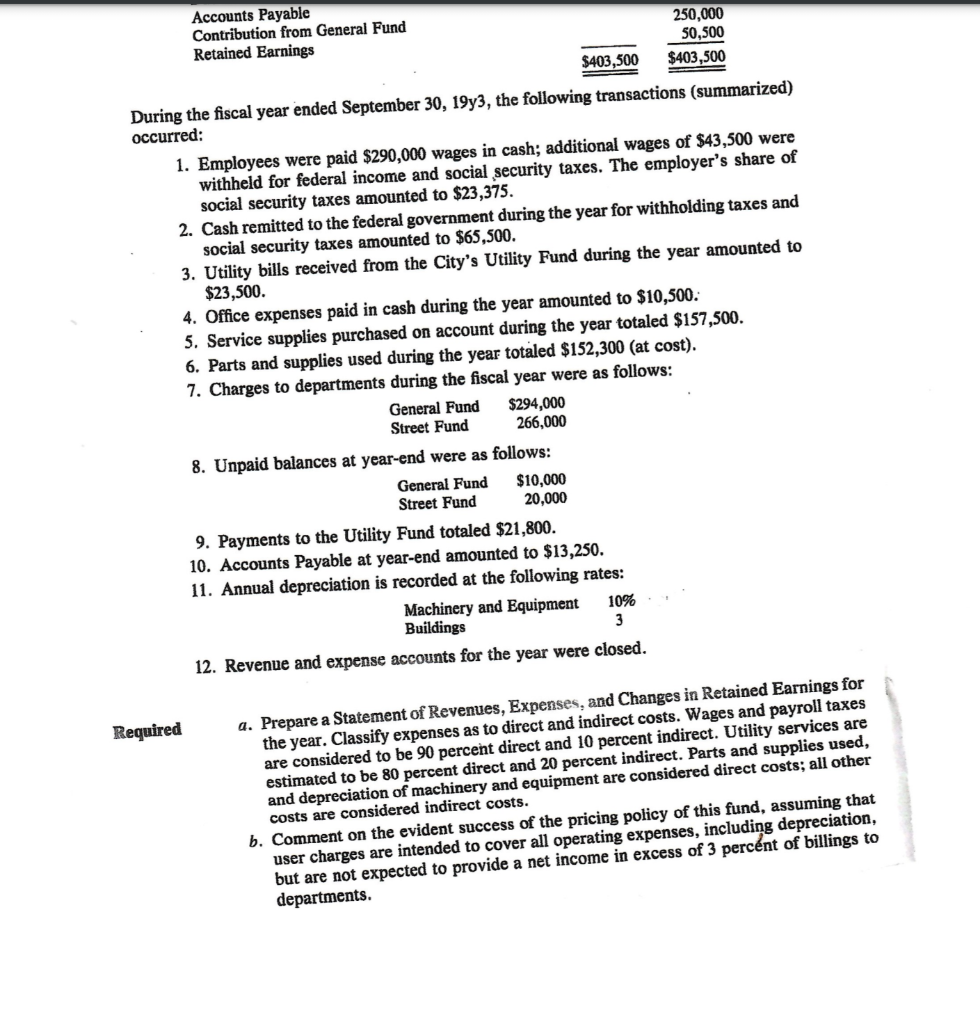

.. As of the beginning of a certain year, the Automotive Service Fund of the City of Clarktc During the fiscal year ended September 30,19y3, the following transactions (summarized) occurred: 1. Employees were paid $290,000 wages in cash; additional wages of $43,500 were withheld for federal income and social security taxes. The employer's share of social security taxes amounted to $23,375. 2. Cash remitted to the federal government during the year for withholding taxes and social security taxes amounted to $65,500. 3. Utility bills received from the City's Utility Fund during the year amounted to $23,500. 4. Office expenses paid in cash during the year amounted to $10,500 : 5. Service supplies purchased on account during the year totaled $157,500. 6. Parts and supplies used during the year totaled $152,300 (at cost). 7. Charges to departments during the fiscal year were as follows: GeneralFundStreetFund$294,000266,000 8. Unpaid balances at year-end were as follows: General Fund $10,000 Street Fund 20,000 9. Payments to the Utility Fund totaled $21,800. 10. Accounts Payable at year-end amounted to $13,250. 11. Annual depreciation is recorded at the following rates: MachineryandEquipmentBuildings10%3 Revenue and expense accounts for the year were closed. During the fiscal year ended September 30,19y3, the following transactions (summarizea) occurred: 1. Employees were paid $290,000 wages in cash; additional wages of $43,500 were withheld for federal income and social security taxes. The employer's share of social security taxes amounted to $23,375. 2. Cash remitted to the federal government during the year for withholding taxes and social security taxes amounted to $65,500. 3. Utility bills received from the City's Utility Fund during the year amounted to $23,500. 4. Office expenses paid in cash during the year amounted to $10,500 : 5. Service supplies purchased on account during the year totaled $157,500. 6. Parts and supplies used during the year totaled $152,300 (at cost). 7. Charges to departments during the fiscal year were as follows: General Fund $294,000 Street Fund 266,000 8. Unpaid balances at year-end were as follows: General Fund $10,000 Street Fund 20,000 9. Payments to the Utility Fund totaled $21,800. 10. Accounts Payable at year-end amounted to $13,250. 11. Annual depreciation is recorded at the following rates: MachineryandEquipment310% Buildings 12. Revenue and expense accounts for the year were closed. a. Prepare a Statement of Revenues, Expenses, and Changes in Retained Earnings for the year. Classify expenses as to direct and indirect costs. Wages and payroll taxes are considered to be 90 percent direct and 10 percent indirect. Utility services are estimated to be 80 percent direct and 20 percent indirect. Parts and supplies used, and depreciation of machinery and equipment are considered direct costs; all other costs are considered indirect costs. b. Comment on the evident success of the pricing policy of this fund, assuming that user charges are intended to cover all operating expenses, including depreciation, but are not expected to provide a net income in excess of 3 percnt of billings to departments