Question

You ascertain the following additional information: (i) The 'investments' in the statement of financial position comprise solely Harodds's investment in Sanyo ($128,000) and in Yamaha

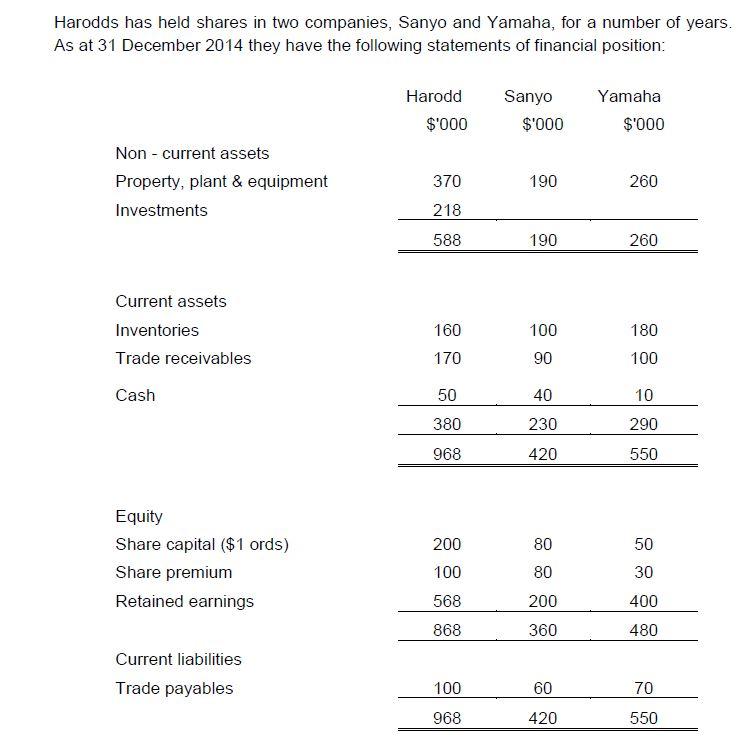

You ascertain the following additional information: (i) The 'investments' in the statement of financial position comprise solely Harodds's investment in Sanyo ($128,000) and in Yamaha ($90,000). (ii) The 48,000 shares in Sanyo were acquired when Sanyo's retained earnings stood at $20,000. The 15,000 shares in Yamaha were acquired when that company had a retained earnings balance of $150,000. (iii) When Harodds acquired its shares in Sanyo the fair value of Sanyo's net assets equalled their book values with the following exceptions: $'000 Property, plant and equipment 50 higher Inventories 20 lower (sold during 2014) Depreciation arising on the fair value adjustment to non-current assets since this date is $5,000. (iv) During the year, Harodds sold inventories to Sanyo for $16,000, which originally cost Harodds $10,000. Three-quarters of these inventories have subsequently been sold by Sanyo. (v) No impairment losses on goodwill had been necessary by 31 December 2014. (vi) It is group policy to value non-controlling interests at full (or fair) value. The fair value of the non-controlling interests at acquisition was $90,000. REQUIRED Prepare the consolidated statement of financial position for the Harodds group (incorporating the associate) as at 31 December 2014

You ascertain the following additional information: (i) The 'investments' in the statement of financial position comprise solely Harodds's investment in Sanyo ($128,000) and in Yamaha ($90,000). (ii) The 48,000 shares in Sanyo were acquired when Sanyo's retained earnings stood at $20,000. The 15,000 shares in Yamaha were acquired when that company had a retained earnings balance of $150,000. (iii) When Harodds acquired its shares in Sanyo the fair value of Sanyo's net assets equalled their book values with the following exceptions: $'000 Property, plant and equipment 50 higher Inventories 20 lower (sold during 2014) Depreciation arising on the fair value adjustment to non-current assets since this date is $5,000. (iv) During the year, Harodds sold inventories to Sanyo for $16,000, which originally cost Harodds $10,000. Three-quarters of these inventories have subsequently been sold by Sanyo. (v) No impairment losses on goodwill had been necessary by 31 December 2014. (vi) It is group policy to value non-controlling interests at full (or fair) value. The fair value of the non-controlling interests at acquisition was $90,000. REQUIRED Prepare the consolidated statement of financial position for the Harodds group (incorporating the associate) as at 31 December 2014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started