Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As One Due May 4th.pdf Adobe Red 6 75% I. (b) In the tax year 2020 Boniface Lubaya had the following capital transactions 0 On

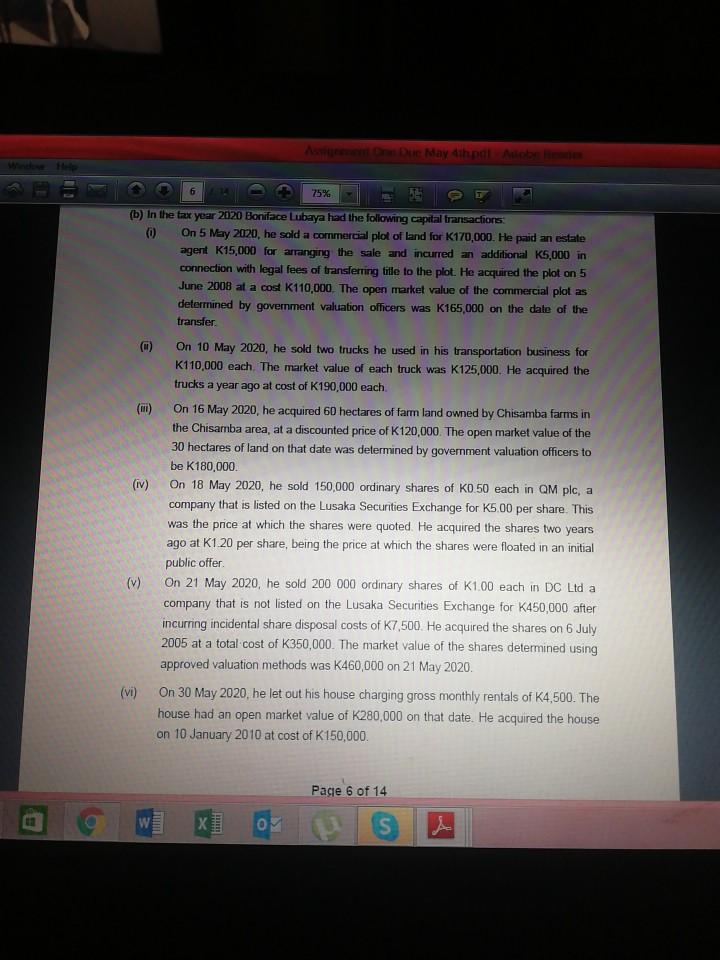

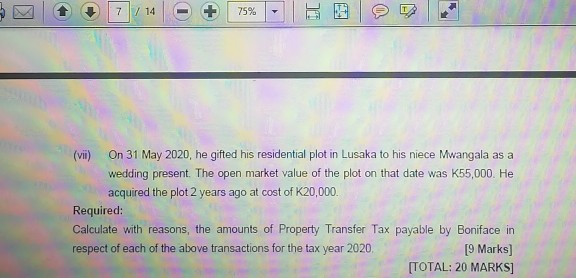

As One Due May 4th.pdf Adobe Red 6 75% I. (b) In the tax year 2020 Boniface Lubaya had the following capital transactions 0 On 5 May 2020, he sold a commercial plot of land for K170,000. He paid an estate agent K15,000 for arranging the sale and incurred an additional K5,000 in connection with legal fees of transferring title to the plot. He acquired the plot on 5 June 2008 at a cost K110,000. The open market value of the commercial plot as determined by government valuation officers was K165,000 on the date of the transfer (iv) On 10 May 2020, he sold two trucks he used in his transportation business for K110,000 each. The market value of each truck was K125,000. He acquired the trucks a year ago at cost of K190,000 each. On 16 May 2020, he acquired 60 hectares of farm land owned by Chisamba farms in the Chisamba area, at a discounted price of K120,000. The open market value of the 30 hectares of land on that date was determined by government valuation officers to be K180,000 On 18 May 2020, he sold 150,000 ordinary shares of K0.50 each in QM plc, a company that is listed on the Lusaka Securities Exchange for K5.00 per share. This was the price at which the shares were quoted. He acquired the shares two years ago at K1.20 per share, being the price at which the shares were floated in an initial public offer. On 21 May 2020, he sold 200 000 ordinary shares of K1.00 each in DC Ltd a company that is not listed on the Lusaka Securities Exchange for K450,000 after incurring incidental share disposal costs of K7,500. He acquired the shares on 6 July 2005 at a total cost of K350,000. The market value of the shares determined using approved valuation methods was K460,000 on 21 May 2020. On 30 May 2020, he let out his house charging gross monthly rentals of K4,500. The house had an open market value of K280,000 on that date. He acquired the house on 10 January 2010 at cost of K150,000 (v) (vi) Page 6 of 14 W 1 OM is 7 / 14 - + 75% On 31 May 2020, he gifted his residential plot in Lusaka to his niece Mwangala as a wedding present. The open market value of the plot on that date was K55,000. He acquired the plot 2 years ago at cost of K20,000 Required: Calculate with reasons, the amounts of Property Transfer Tax payable by Boniface in respect of each of the above transactions for the tax year 2020 [9 Marks) [TOTAL: 20 MARKS] As One Due May 4th.pdf Adobe Red 6 75% I. (b) In the tax year 2020 Boniface Lubaya had the following capital transactions 0 On 5 May 2020, he sold a commercial plot of land for K170,000. He paid an estate agent K15,000 for arranging the sale and incurred an additional K5,000 in connection with legal fees of transferring title to the plot. He acquired the plot on 5 June 2008 at a cost K110,000. The open market value of the commercial plot as determined by government valuation officers was K165,000 on the date of the transfer (iv) On 10 May 2020, he sold two trucks he used in his transportation business for K110,000 each. The market value of each truck was K125,000. He acquired the trucks a year ago at cost of K190,000 each. On 16 May 2020, he acquired 60 hectares of farm land owned by Chisamba farms in the Chisamba area, at a discounted price of K120,000. The open market value of the 30 hectares of land on that date was determined by government valuation officers to be K180,000 On 18 May 2020, he sold 150,000 ordinary shares of K0.50 each in QM plc, a company that is listed on the Lusaka Securities Exchange for K5.00 per share. This was the price at which the shares were quoted. He acquired the shares two years ago at K1.20 per share, being the price at which the shares were floated in an initial public offer. On 21 May 2020, he sold 200 000 ordinary shares of K1.00 each in DC Ltd a company that is not listed on the Lusaka Securities Exchange for K450,000 after incurring incidental share disposal costs of K7,500. He acquired the shares on 6 July 2005 at a total cost of K350,000. The market value of the shares determined using approved valuation methods was K460,000 on 21 May 2020. On 30 May 2020, he let out his house charging gross monthly rentals of K4,500. The house had an open market value of K280,000 on that date. He acquired the house on 10 January 2010 at cost of K150,000 (v) (vi) Page 6 of 14 W 1 OM is 7 / 14 - + 75% On 31 May 2020, he gifted his residential plot in Lusaka to his niece Mwangala as a wedding present. The open market value of the plot on that date was K55,000. He acquired the plot 2 years ago at cost of K20,000 Required: Calculate with reasons, the amounts of Property Transfer Tax payable by Boniface in respect of each of the above transactions for the tax year 2020 [9 Marks) [TOTAL: 20 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started