Economic Cost of Decisions:

You work for Orizont Consulting, an economic consulting firm. In casual conversation with your cousin Daniel, he mentioned that hes weighing several decisions around his own small business, which is a coffee-roasting factory in his hometown. Given your line of work, hes asked if you would be willing to do him a favor by bringing an economics perspective to his business.

Business has been going very well for Daniel. The shop is always busy, and hes recently hired two new temporary employees. However, he hasnt seen much of an increase in profits. Hes looking for ways to maximize his profits, as he is considering quitting his job to run the business full-time.

Part 1: Letter and Financial Data After your conversation with Daniel, youve promised to look over his financial information and write him a letter with some recommendations.

1. As your work on your recommendations for Daniel, assume that his business is in a perfectly competitive market.

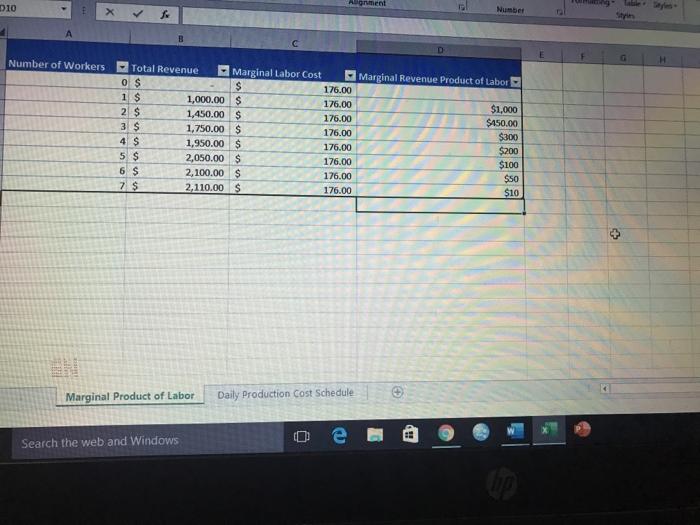

2. Daniel has recently hired two temporary employees, but he isnt sure if he has the right number of workers. To help Daniel calculate how many employees he needs, complete the Marginal Product of Labor tab in the Financial Data spreadsheet (located in the Deliverables section) and address the following:

o Determine the marginal revenue product of labor for workers in the organization, given the wage rate. For each additional labor input Daniel adds, how much additional revenue does he get?

o Determine how many workers Daniel should employ, explaining the impact of the marginal revenue product of labor on organizational decision making.

How many total worker should Daniel employ?

Why does an organization stop hiring workers? Make sure you explain the concept of diminishing return.

3. Daniel is considering the cost of running the business and whether or not he should quit his day job as a customer service specialist earning $45,000 annually. To help Daniel make this decision, answer the following:

o Categorize the economic costs below as fixed or variable in the short run. Explain your rationale for each one and whether or not they will differ in the long run:

Rent

Wages

Raw materials

Energy costs

Phone and internet services

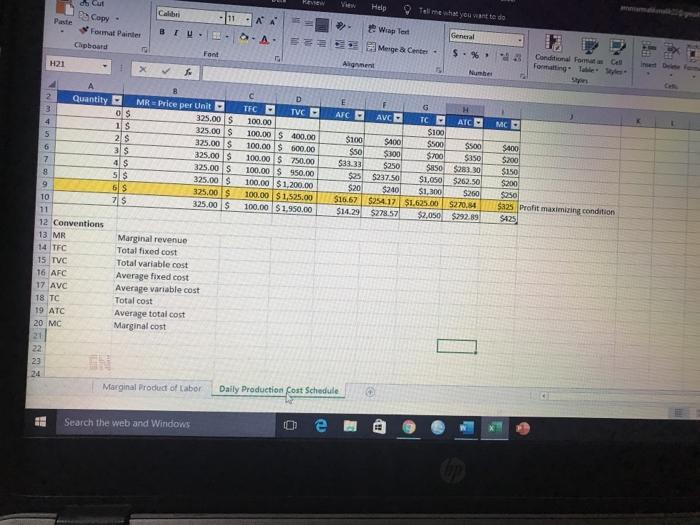

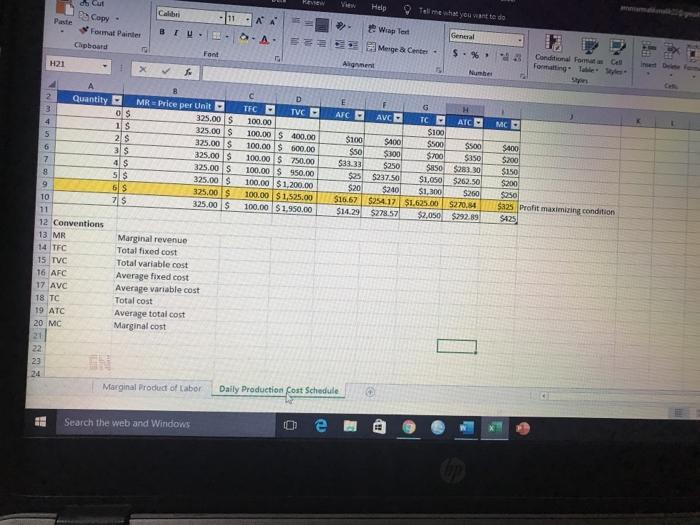

o Complete the Daily Production Cost Schedule tab in the Financial Data spreadsheet to determine the annual profit/loss of Daniels business based on profit-maximizing production. Include the following in your response:

What is the annual profit/loss of Daniels business?

What is the profit-maximizing production level? Explain the process you followed to determine the profit-maximizing production level (quantity).

What would happen if Daniel produces above that amount?

o Using your findings above, determine whether or not Daniel should quit his job as a customer service specialist, referencing the concepts of opportunity cost and economic profit. Assume Daniel operates his factory five days a week and works as a customer service specialist five days a week as well.

What to Submit

1. Letter and Financial Data Youve promised to look over Daniels financial information and give him recommendations about some important decisions he will need to make regarding his business and personal life. Determines the marginal revenue product of labor for workers in an organization, given a wage rate

Feedback Received:

Determines the marginal revenue product of labor for workers in an organization, given a wage rate: Your MRPL spreadsheet is incorrect; therefore your MRPL is incorrect. The marginal Labor cost would not change.

Categorizes economic costs as fixed or variable in the short run, explaining whether or not they will differ in the long run: Please provide a definition/explanation for fixed and variable cost. Please clearly state if each cost is fixed or variable and if they will change in the long run.

Determines the annual profit/loss of an organization based on profit-maximizing production: Please state the Profit-maximizing production and the annual profit. Your Marginal cost (MC) are incorrect.

Applies the concepts of opportunity cost and economic profit to decision making: Please provide an explanation/definition for Opportunity cost and economic profit. Please clearly state if what would be the Opportunity cost if Daniel quits or keeps his job?