Answered step by step

Verified Expert Solution

Question

1 Approved Answer

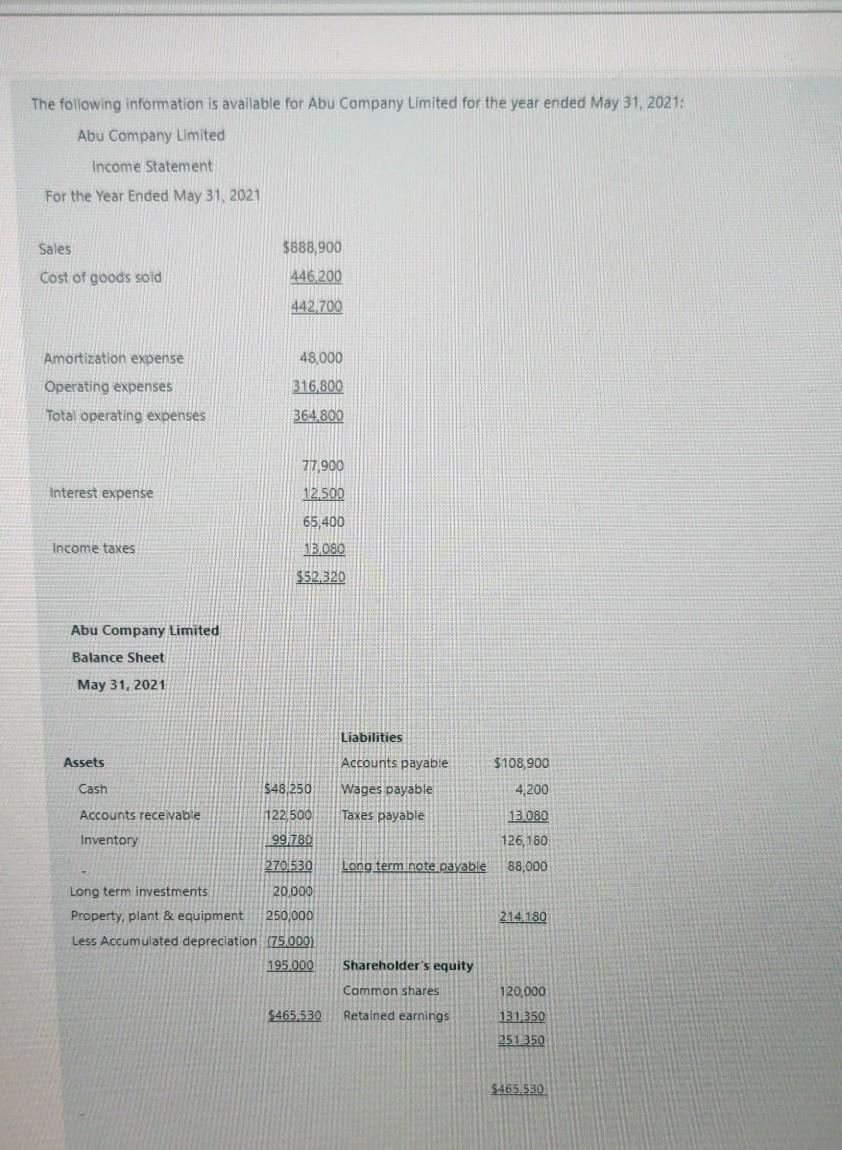

as soon as possible The following information is available for Abu Company Limited for the year ended May 31, 2021: Abu Company Limited Income Statement

as soon as possible

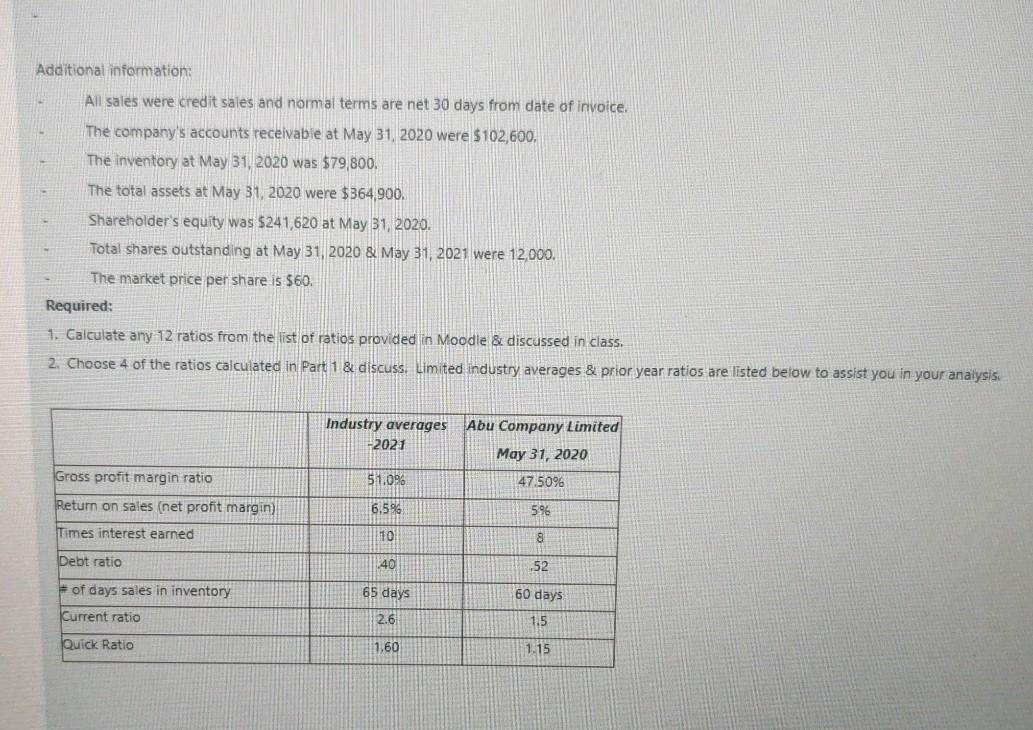

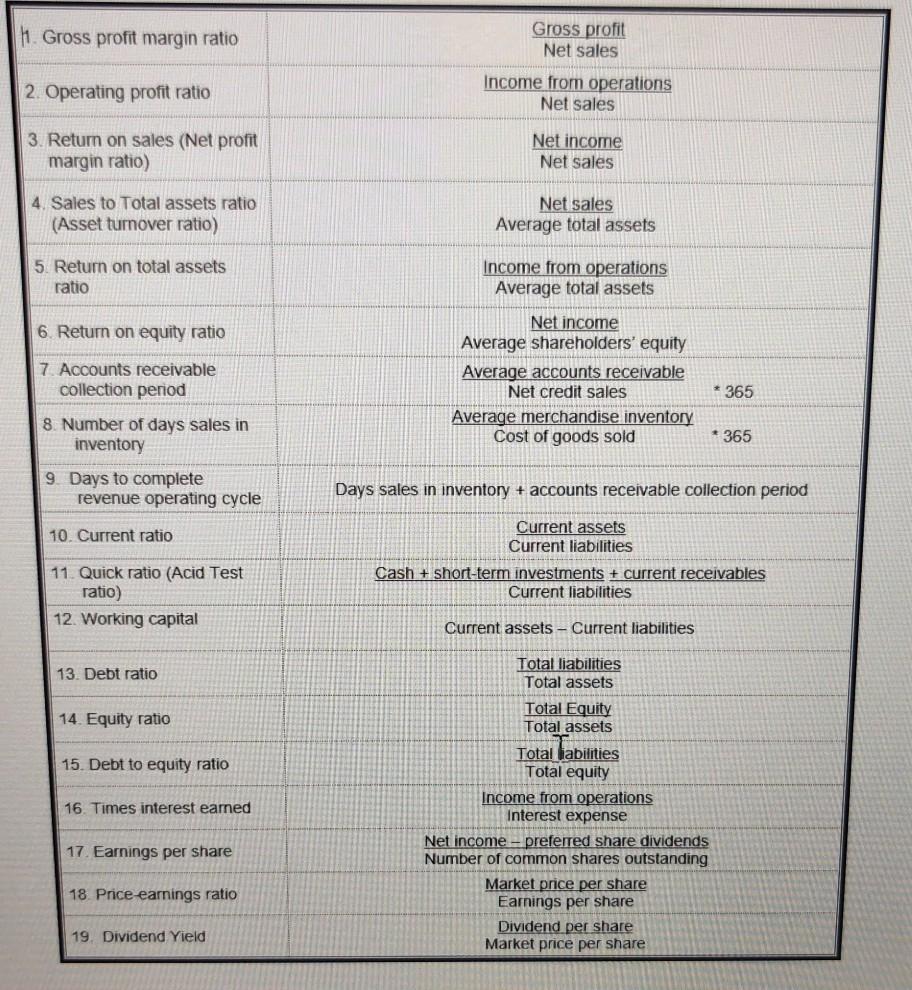

The following information is available for Abu Company Limited for the year ended May 31, 2021: Abu Company Limited Income Statement For the Year Ended May 31, 2021 Sales $888,900 Cost of goods sold 446,200 442 700 Amortization expense 48,000 Operating expenses 316800 Total operating expenses 364.800 77.900 Interest expense 12.500 Income taxes 65,400 13.080 $52.320 Abu Company Limited Balance Sheet May 31, 2021 Liabilities Accounts payable Wages payable $108,900 4,200 Taxes payable 13 080 126,180 Assets Cash 548 250 Accounts receivable 122,500 Inventory 99780 270530 Long term investments 20,000 Property, plant & equipment 250,000 Less Accumulated depreciation (75000) 195000 Long term note payable 88,000 214,180 Shareholder's equity Common shares 5465 530 Retained earnings 120,000 131350 251.350 5465.530 Additional information: All sales were credit sales and normal terms are net 30 days from date of invoice. The company's accounts receivable at May 31, 2020 were $102,600, The inventory at May 31, 2020 was $79,800. The total assets at May 31, 2020 were $364,900. Shareholder's equity was $241,620 at May 31, 2020. Total shares outstanding at May 31, 2020 & May 31, 2021 were 12,000. The market price per share is $60. Required: 1. Calculate any 12 ratios from the list of ratios provided in Moodle & discussed in class. 2. Choose 4 of the ratios calculated in Part 1 & discuss. Limited industry averages & prior year ratios are listed below to assist you in your analysis Industry averages -2021 Abu Company Limited May 31, 2020 51.096 47.5096 Gross profit margin ratio Return on sales (net profit margin Times interest earned 6.5% 596 10 8 Debt ratio 40 .52 # of days sales in inventory 65 days 60 days Current ratio 2.6 1.5 Quick Ratio 1.60 1.15 11. Gross profit margin ratio Gross profit Net sales 2. Operating profit ratio Income from operations Net sales 3. Return on sales (Net profit margin ratio) Net income Net sales 4. Sales to Total assets ratio (Asset turnover ratio) Net sales Average total assets 5. Return on total assets ratio Income from operations Average total assets 6. Return on equity ratio 7. Accounts receivable collection period Net income Average shareholders' equity Average accounts receivable Net credit sales Average merchandise inventory Cost of goods sold * 365 8. Number of days sales in inventory * 365 9. Days to complete revenue operating cycle Days sales in inventory + accounts receivable collection period 10. Current ratio Current assets Current liabilities Cash + short-term investments + current receivables Current liabilities 11. Quick ratio (Acid Test ratio) 12. Working capital Current assets - Current liabilities 13. Debt ratio 14. Equity ratio 15. Debt to equity ratio 16. Times interest earned Total liabilities Total assets Total Equity Total assets Total iabilities Total equity Income from operations Interest expense Net income - preferred share dividends Number of common shares outstanding Market price per share Earnings per share Dividend per share Market price per share 17. Earnings per share 18 Price earnings ratio 19. Dividend YieldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started