Answered step by step

Verified Expert Solution

Question

1 Approved Answer

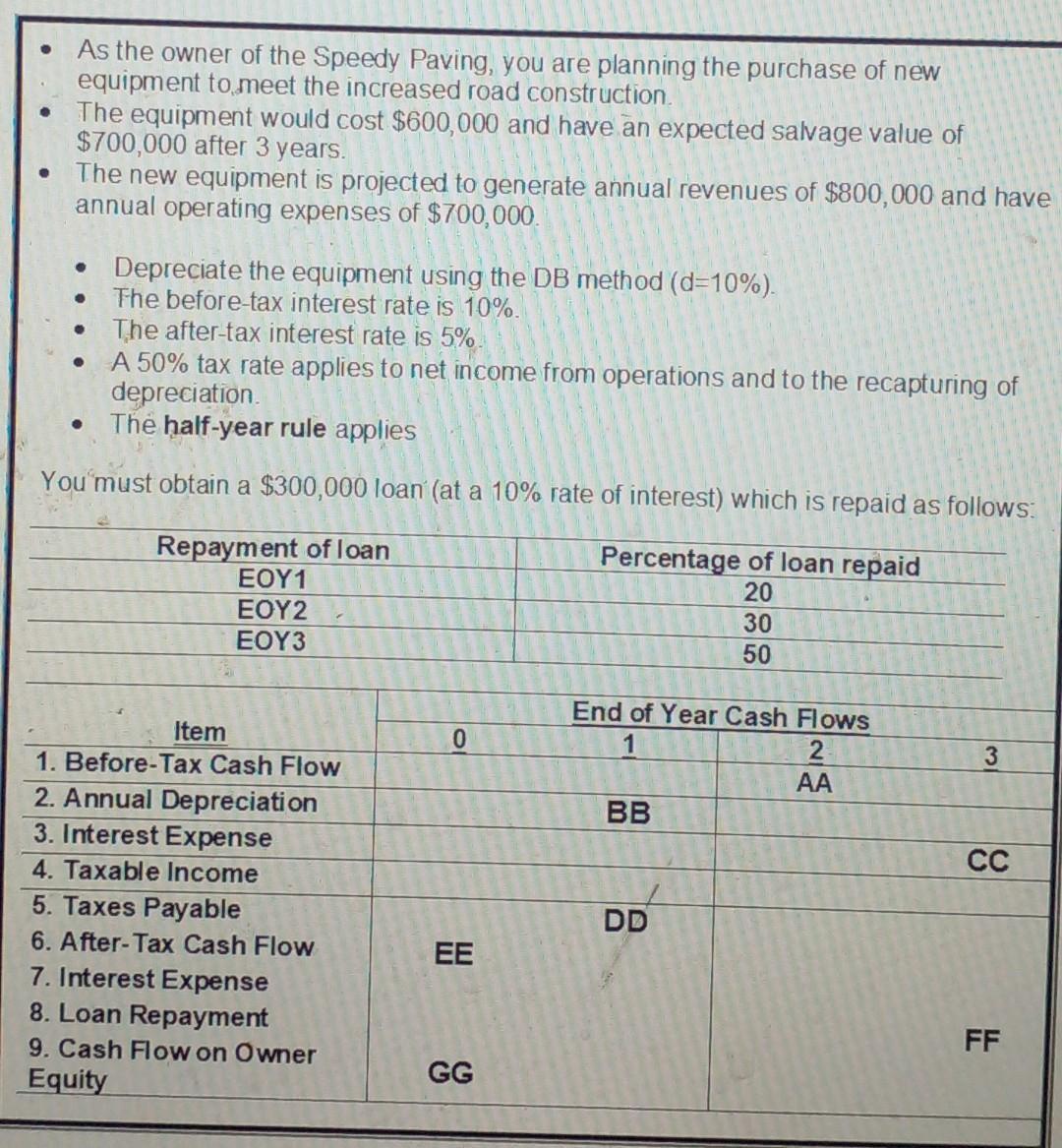

As the owner of the Speedy Paving, you are planning the purchase of new equipment to meet the increased road construction. The equipment would

As the owner of the Speedy Paving, you are planning the purchase of new equipment to meet the increased road construction. The equipment would cost $600,000 and have an expected salvage value of $700,000 after 3 years. The new equipment is projected to generate annual revenues of $800,000 and have annual operating expenses of $700,000. Depreciate the equipment using the DB method (d=10%). The before-tax interest rate is 10%. The after-tax interest rate is 5% A 50% tax rate applies to net income from operations and to the recapturing of depreciation. Th half-year rule applies You'must obtain a $300,000 loan (at a 10% rate of interest) which is repaid as follows: Repayment of loan 1 2 Percentage of loan repaid 20 30 3 50 End of Year Cash Flows Item 1 2 AA 1. Before-Tax Cash Flow 2. Annual Depreciation 3. Interest Expense 4. Taxable Income 5. Taxes Payable BB CC DD 6. After-Tax Cash Flow EE 7. Interest Expense 8. Loan Repayment 9. Cash Flow on Owner Equity FF GG 3/ The dollar value of cell FF is O 150,000 O 90,000 60,000

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The option 1 is correct The dollar value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started