Question

As well as having domestic operations, Metram Corp. has operations in Australia, including relatively modest sales, along with a significant level of purchases of Australian

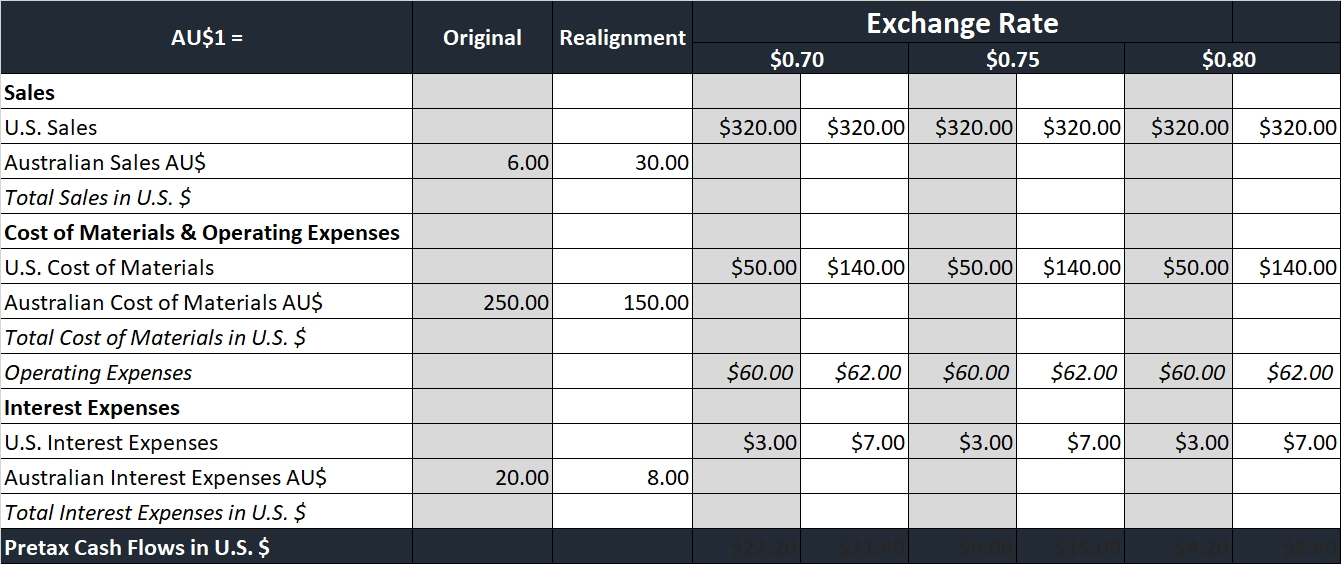

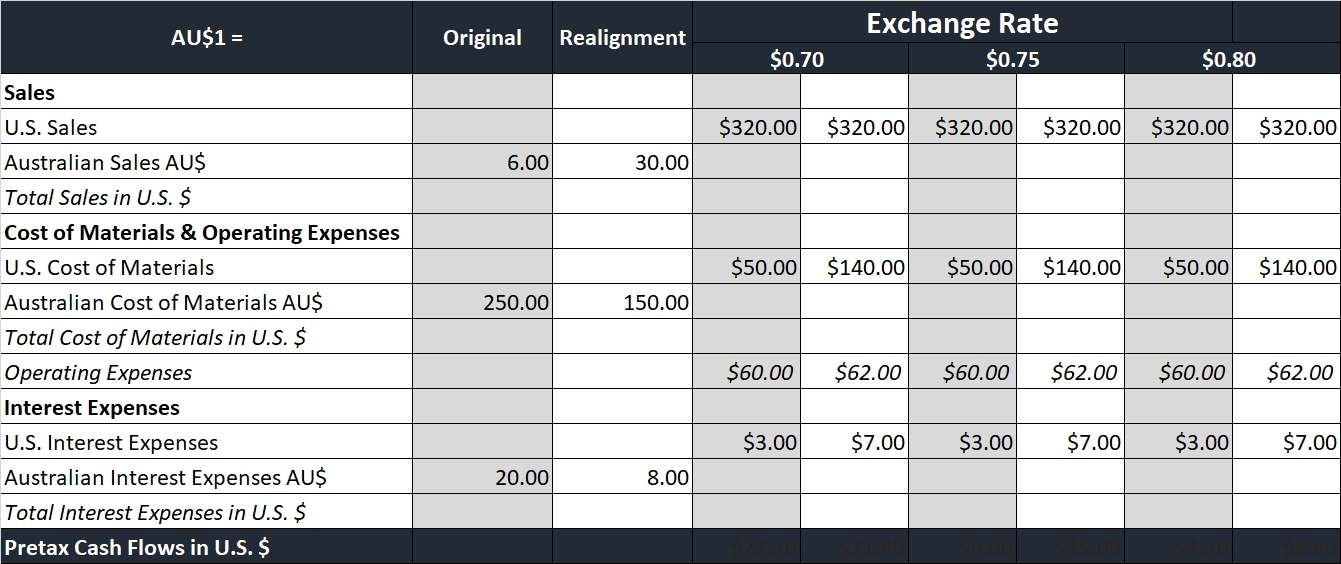

As well as having domestic operations, Metram Corp. has operations in Australia, including relatively modest sales, along with a significant level of purchases of Australian materials, as well as some Australian debt paid in Australian dollars. The company wants to determine the effect of realignment on economic risk exposure under scenarios where the exchange rate ranges from US$0.70 to US$0.75 to US$0.80 per Australian dollar.

- U.S. sales will remain at $320.00 in the original scenario as well as in the realignment, but Australian sales will increase from AU$6.00 to AU$30.00.

- U.S. cost of materials will increase from $50.00 to $140.00, while Australian cost of materials will fall from AU$250.00 to AU$150.00.

- Operating expenses will increase modestly from US$60.00 to US$62.00.

- U.S. interest expenses will rise from US$3.00 to US$7.00 to reduce Australian interest expenses from AU$20.00 to AU$8.00.

The attached table graphic may assist you in organizing the information for your analysis.

Metram Corp. pretax cash flow under realignment at an exchange rate of AU$1=US$0.75 is US$

Metram Corp. pretax cash flow originally at an exchange rate of AU$1=US$0.80 is US$

AU$1 Sales U.S. Sales Australian Sales AU$ Total Sales in U.S. $ Cost of Materials & Operating Expenses U.S. Cost of Materials Australian Cost of Materials AU$ Total Cost of Materials in U.S. $ Operating Expenses Interest Expenses U.S. Interest Expenses Australian Interest Expenses AU$ Total Interest Expenses in U.S. $ Pretax Cash Flows in U.S. $ Original 6.00 250.00 20.00 Realignment 30.00 150.00 8.00 Exchange Rate $0.75 $0.70 $0.80 $320.00 $320.00 $320.00 $320.00 $320.00 $320.00 $50.00 $140.00 $50.00 $140.00 $50.00 $140.00 $60.00 $62.00 $60.00 $62.00 $60.00 $62.00 $3.00 $7.00 $3.00 $7.00 $3.00 $7.00 AU$1 Sales U.S. Sales Australian Sales AU$ Total Sales in U.S. $ Cost of Materials & Operating Expenses U.S. Cost of Materials Australian Cost of Materials AU$ Total Cost of Materials in U.S. $ Operating Expenses Interest Expenses U.S. Interest Expenses Australian Interest Expenses AU$ Total Interest Expenses in U.S. $ Pretax Cash Flows in U.S. $ Original 6.00 250.00 20.00 Realignment 30.00 150.00 8.00 Exchange Rate $0.75 $0.70 $0.80 $320.00 $320.00 $320.00 $320.00 $320.00 $320.00 $50.00 $140.00 $50.00 $140.00 $50.00 $140.00 $60.00 $62.00 $60.00 $62.00 $60.00 $62.00 $3.00 $7.00 $3.00 $7.00 $3.00 $7.00 AU$1 Sales U.S. Sales Australian Sales AU$ Total Sales in U.S. $ Cost of Materials & Operating Expenses U.S. Cost of Materials Australian Cost of Materials AU$ Total Cost of Materials in U.S. $ Operating Expenses Interest Expenses U.S. Interest Expenses Australian Interest Expenses AU$ Total Interest Expenses in U.S. $ Pretax Cash Flows in U.S. $ Original 6.00 250.00 20.00 Realignment 30.00 150.00 8.00 Exchange Rate $0.75 $0.70 $0.80 $320.00 $320.00 $320.00 $320.00 $320.00 $320.00 $50.00 $140.00 $50.00 $140.00 $50.00 $140.00 $60.00 $62.00 $60.00 $62.00 $60.00 $62.00 $3.00 $7.00 $3.00 $7.00 $3.00 $7.00 AU$1 Sales U.S. Sales Australian Sales AU$ Total Sales in U.S. $ Cost of Materials & Operating Expenses U.S. Cost of Materials Australian Cost of Materials AU$ Total Cost of Materials in U.S. $ Operating Expenses Interest Expenses U.S. Interest Expenses Australian Interest Expenses AU$ Total Interest Expenses in U.S. $ Pretax Cash Flows in U.S. $ Original 6.00 250.00 20.00 Realignment 30.00 150.00 8.00 Exchange Rate $0.75 $0.70 $0.80 $320.00 $320.00 $320.00 $320.00 $320.00 $320.00 $50.00 $140.00 $50.00 $140.00 $50.00 $140.00 $60.00 $62.00 $60.00 $62.00 $60.00 $62.00 $3.00 $7.00 $3.00 $7.00 $3.00 $7.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started