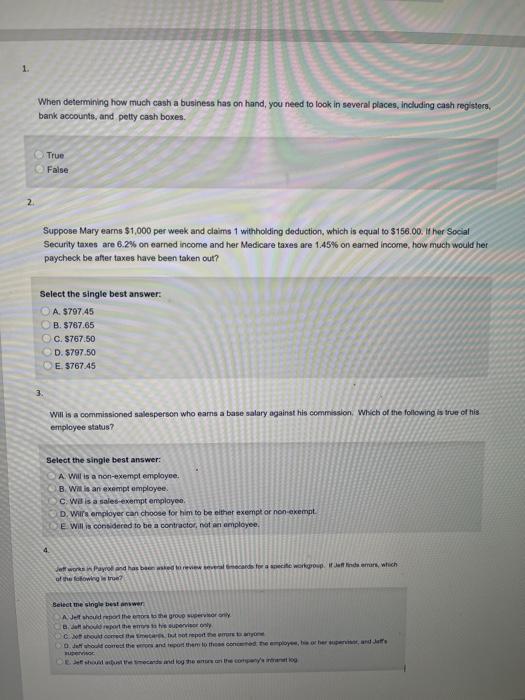

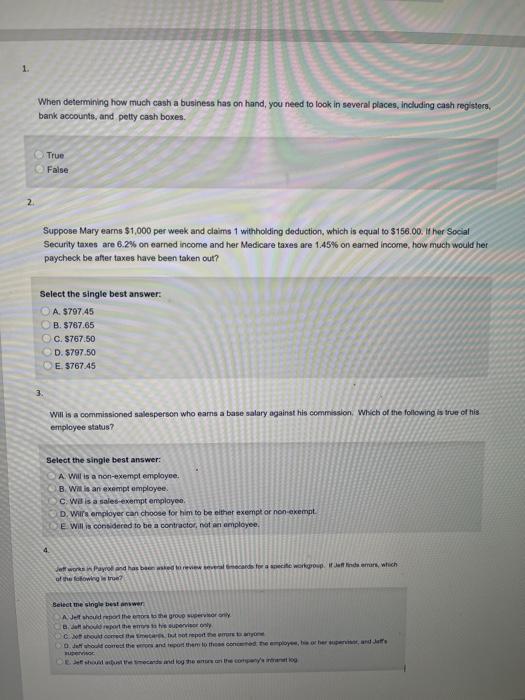

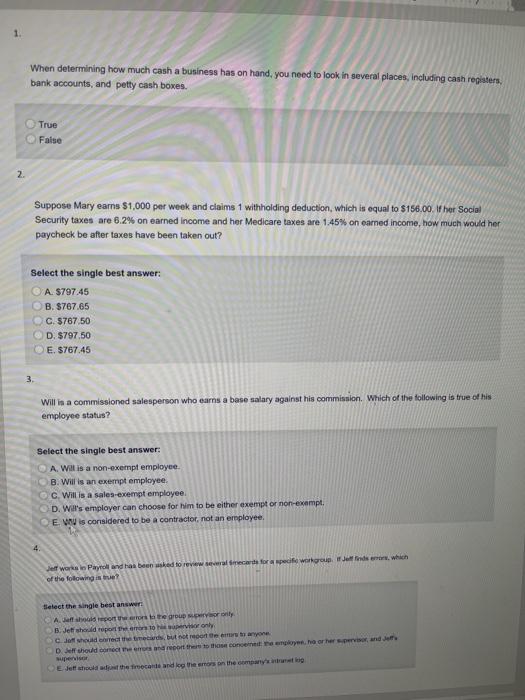

1. When determining how much cash a business has on hand, you need to look in several places, including cash registers, bank accounts, and petty cash boxes. True False 2 al Suppose Mary earns $1,000 per week and claims 1 withholding deduction, which is equal to $156.00. Wher Security taxes are 6.2% on earned income and her Medicare taxes are 1.45% on earned income, how much would her paycheck be after taxes have been taken out? Select the single best answer A. $797.45 B. $767.65 C. $767.50 D. $797.50 E. 576745 Will is a commissioned salesperson who earns a base salary against his commission. Which of the following is true of his employee status? Select the single best answer: A. Wil is a non-exempt employee. B. Wills an exempt employee C. Was is a sales exempt employee D. Wir employer can choose for him to be either exempt or non-exempt E Will is considered to be a contractor, not an employee Jeff Payroll and has been review cards for a secite workgroup. Hindars, which of the flowing listro Select the single best answer A Jeff should reporters to the group super hort the air Cotcorrect reporter who come the and report them to the theory theranda super hocard with us on the court When determining how much cash a business has on hand, you need to look in several places, including cash registers, bank accounts, and petty cash boxes True Faise 2 Suppose Mary ears $1,000 per week and claims 1 withholding deduction, which is equal to $158.00. Wher Social Security taxes are 6.2% on earned income and her Medicare taxes are 1.45% on earned income, how much would her paycheck be after taxes have been taken out? Select the single best answer: A. $797.45 B. $767.65 C. $767.50 D. $797.50 E. 5767.45 Will in a commissioned salesperson who earns a base salary against his commission. Which of the following is true of his employee status? Select the single best answer: A. Will is a non-exempt employee B. Will is an exempt employee C. Will is a sales-exempt employee D. Will's employer can choose for him to be either exemptor non-exempt. OEM is considered to be a contractor, not an employee. Jeff works in Payroll and has been asked to review samecard for a specife workground which of the following Select the single best answer A fi report on the group Monty B Jet should reporterton 10 only Jo should records but only one Dishould come here and report there the content, he or here, and Jeff Jehoud the trade and the errors on the company