Answered step by step

Verified Expert Solution

Question

1 Approved Answer

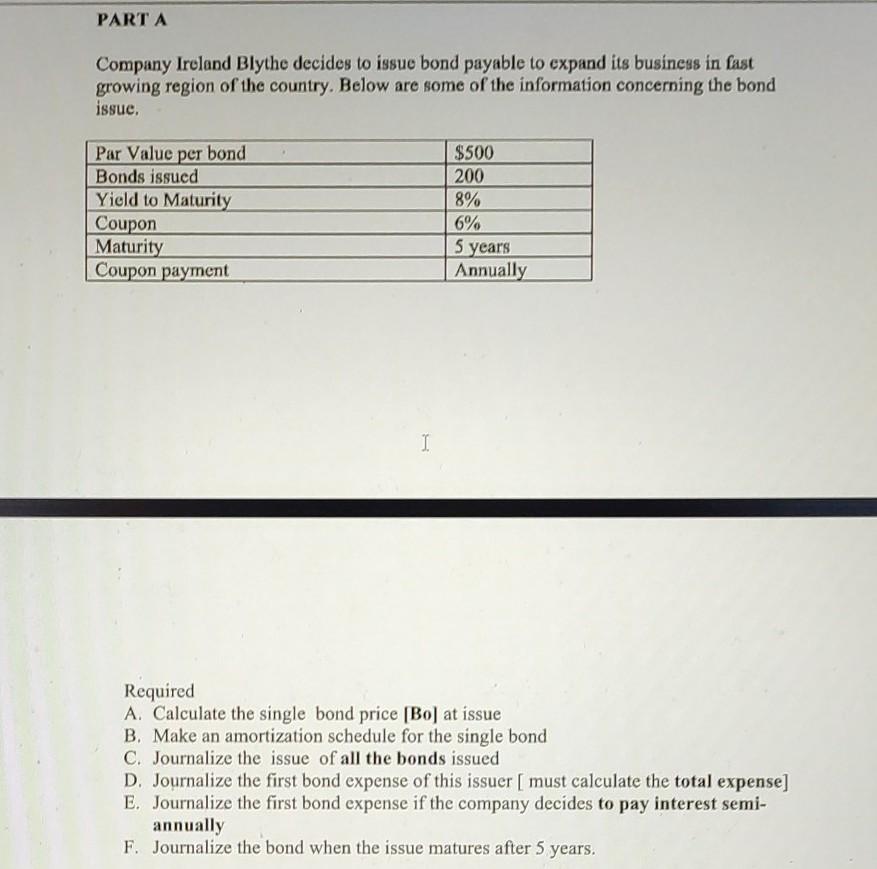

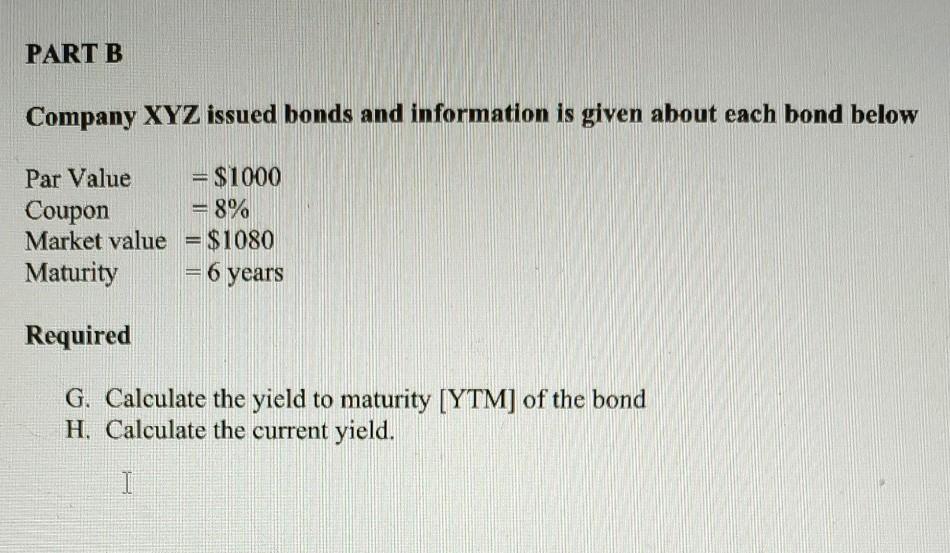

ASAP PARTA Company Ireland Blythe decides to issue bond payable to expand its business in fast growing region of the country. Below are some of

ASAP

PARTA Company Ireland Blythe decides to issue bond payable to expand its business in fast growing region of the country. Below are some of the information concerning the bond issue. Par Value per bond Bonds issued Yield to Maturity Coupon Maturity Coupon payment $500 200 8% 6% 5 years Annually I Required A. Calculate the single bond price (Bo) at issue B. Make an amortization schedule for the single bond C. Journalize the issue of all the bonds issued D. Journalize the first bond expense of this issuer must calculate the total expense] E. Journalize the first bond expense if the company decides to pay interest semi- annually F. Journalize the bond when the issue matures after 5 years. PART B Company XYZ issued bonds and information is given about each bond below Par Value = $1000 Coupon = 8% Market value = $1080 Maturity = 6 years Required G. Calculate the yield to maturity [YTM) of the bond H. Calculate the current yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started