Answered step by step

Verified Expert Solution

Question

1 Approved Answer

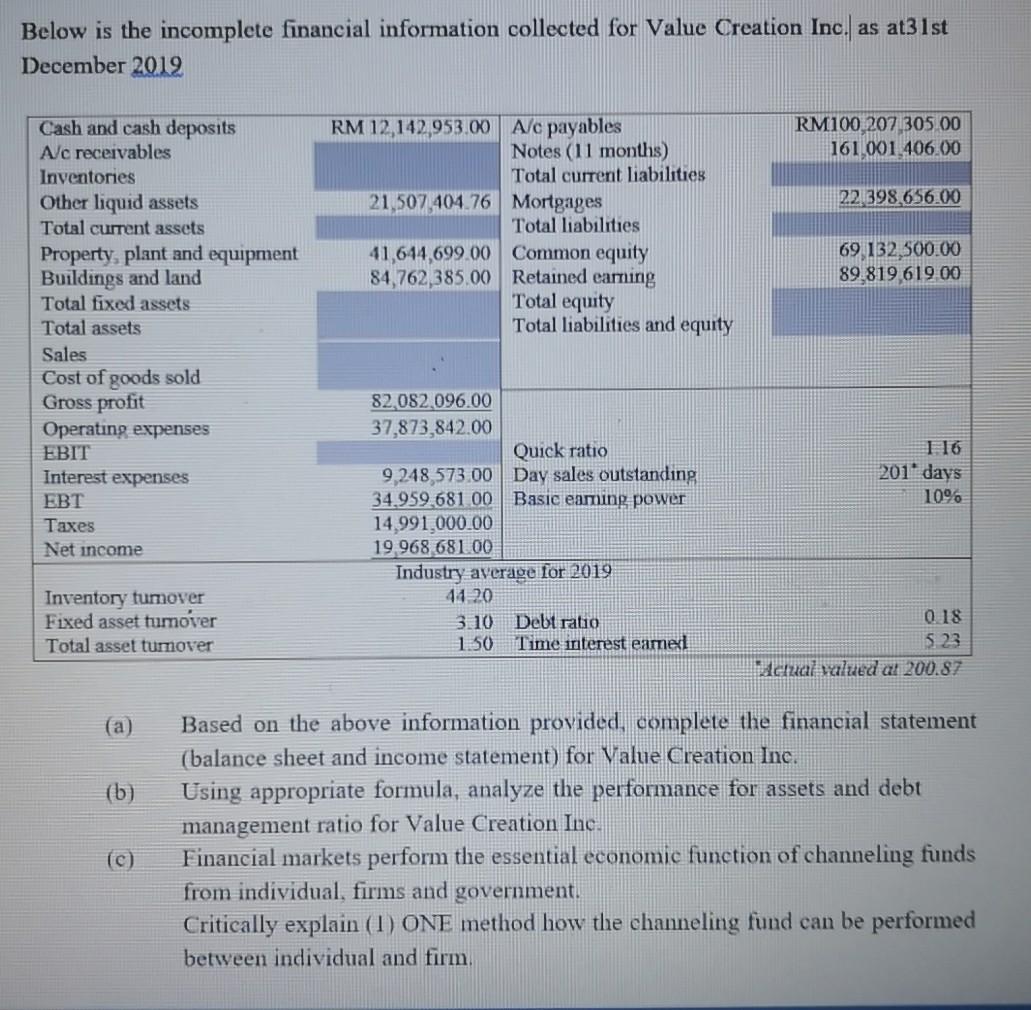

ASAP plz Below is the incomplete financial information collected for Value Creation Inc. as at31st December 2012 RM100 207 305 00 161001,406.00 221398 656.00 RM

ASAP plz

Below is the incomplete financial information collected for Value Creation Inc. as at31st December 2012 RM100 207 305 00 161001,406.00 221398 656.00 RM 12,142,953.00 A/c payables Notes (11 months) Total current liabilities 21,507,404.76 Mortgages Total liabilities 41,644,699 00 Common equity 84,762 385.00 Retained earning Total equity Total liabilities and equity 69 132,500.00 89.819 619 00 Cash and cash deposits A/c receivables Inventories Other liquid assets Total current assets Property, plant and equipment Buildings and land Total fixed assets Total assets Sales Cost of goods sold Gross profit Operating expenses EBIT Interest expenses EBT Taxes Net income 116 2011 days 1096 82,082,096,00 37,873,842.00 Quick ratio 9,248 573.00 Day sales outstanding 34 959.68100 Basic eaming power 14,991,000.00 19 968 68100 Industry average for 2019 44.20 3.10 Debt ratio 1.50 Time interest eated Inventory tumover Fixed asset tumover Total asset tumover 0.18 523 Wadual valued at 200.87 (a) (b) Based on the above information provided, complete the financial statement (balance sheet and income statement) for Value Creation Inc. Using appropriate formula, analyze the performance for assets and debt management ratio for Value Creation Inc. Financial markets perform the essential economic function of channeling funds from individual, firms and government. Critically explain (1) ONE method how the channeling fund can be performed between individual and firm, (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started