Question

The idea is set up a new business and do a budgeting plan for it. Please estimate the revenues based on market research. Set prices

The idea is set up a new business and do a budgeting plan for it.

Please estimate the revenues based on market research.

Set prices according to the market prices.

Cost of goods sold (COGS) could be estimated as 20% of the Prices per unit.

While they were doing their Business Plan, they took the following decisions:

Then plan to run the business at least, for 10 years.

The prices and wages have to be adjusted to the inflation. The European Central Bank has estimated the long-run inflation in the Euro-zone to be an annual 2%. They estimate that revenues can grow twice inflation rate

Things to keep in mind:

Initial Marketing (launching) Campaign and its estimation cost

Loan under French system. Consult the % interest rate

To evaluate the investment project, students have to do the following:

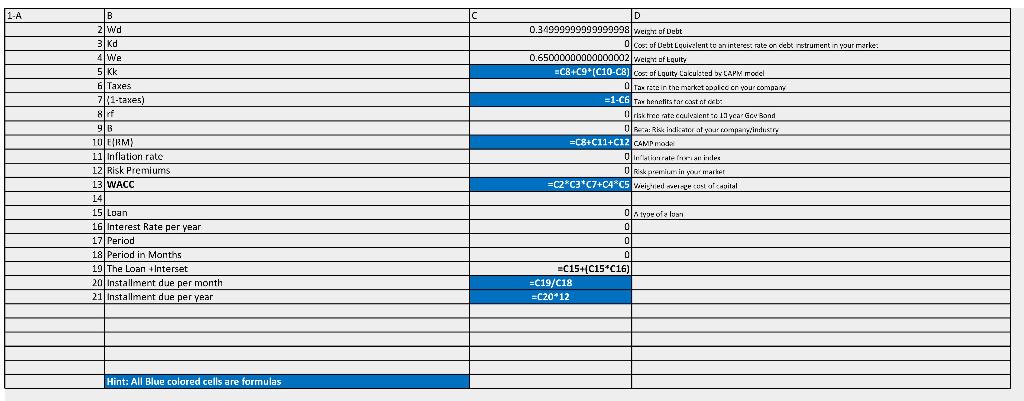

For assessing this investment, the required rate will be estimated using CAPM, considering Risk free rate as German federal Bonds, 10 years maturity (0.95%), market rate, as Ibex-35, last years return 7%, and risk will be considered by using a Beta of 1.60 (slightly above industry average)

For all the other assumptions, please clearly state them on the report.

1-A B 2 Wd Kd We 5Kk 6 Taxes 7(1-taxes) 8 rf 98 10 ERM) 11 Inflation rate 12 Risk Premiums 13 WACC 14 15 Loan 16 Interest Rate per year 17 Period 18 Period in Months 19 The Loan Interset 20 Installment due per month 21 Installment due per year Hint: All Blue colored cells are formulas 0.34999999999999998 weight of Debt 0.65000000000000002 weight of Louite Cost of Debt Equivalent to an interest rate on cebt instrument in your marke: =C8+C9*(C10-C8) Cos: of Lquity Calculated by CAPM mocel Tax rate in the market apalce on your company =1-C6 Tax hennlitstar cast of deb Ortak tree rata cuivalent to 13 year Gey Bond Beca: Rik Indicator of your compa/industry =C8+C11+C12 CAMP mod Inflation rate for an inder Risk premium in your marker =C2 C3*C7+C4 C5 Viederge cust of capital 0 type of a luan 0 0 =C15+|C15*C16) =C19/C18 =C20*12 1-A B 2 Wd Kd We 5Kk 6 Taxes 7(1-taxes) 8 rf 98 10 ERM) 11 Inflation rate 12 Risk Premiums 13 WACC 14 15 Loan 16 Interest Rate per year 17 Period 18 Period in Months 19 The Loan Interset 20 Installment due per month 21 Installment due per year Hint: All Blue colored cells are formulas 0.34999999999999998 weight of Debt 0.65000000000000002 weight of Louite Cost of Debt Equivalent to an interest rate on cebt instrument in your marke: =C8+C9*(C10-C8) Cos: of Lquity Calculated by CAPM mocel Tax rate in the market apalce on your company =1-C6 Tax hennlitstar cast of deb Ortak tree rata cuivalent to 13 year Gey Bond Beca: Rik Indicator of your compa/industry =C8+C11+C12 CAMP mod Inflation rate for an inder Risk premium in your marker =C2 C3*C7+C4 C5 Viederge cust of capital 0 type of a luan 0 0 =C15+|C15*C16) =C19/C18 =C20*12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started