Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable

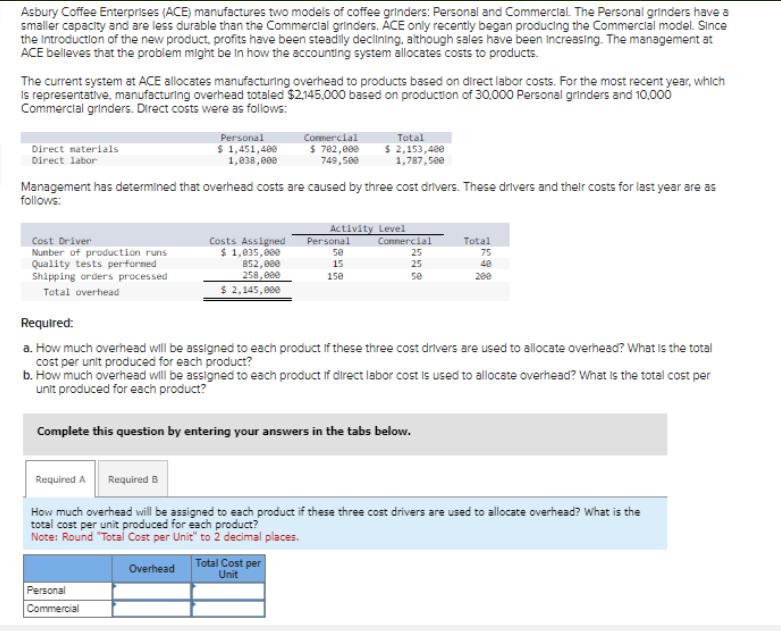

Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the Introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE believes that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which Is representative, manufacturing overhead totaled $2,145,000 based on production of 30.000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Personal $ 1,451,400 1,038,000 Commercial $ 782,000 749,500 Total $ 2,153,400 1,787,500 Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows: Cost Driver Number of production runs Quality tests performed Shipping orders processed Total overhead Activity Level Costs Assigned Personal $ 1,035,000 852,000 258,000 50 15 Connercial 25 25 Total 75 40 150 se 200 $ 2,145,000 Required: a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product? Complete this question by entering your answers in the tabs below. Required A Required B How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? Note: Round "Total Cost per Unit" to 2 decimal places. Personal Commercial Overhead Total Cost per Unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started