Question

Asgone plc is considering an investment to increase its manufacturing capacity from 10,000 units per annum to 15,000 units. The current output is sold at

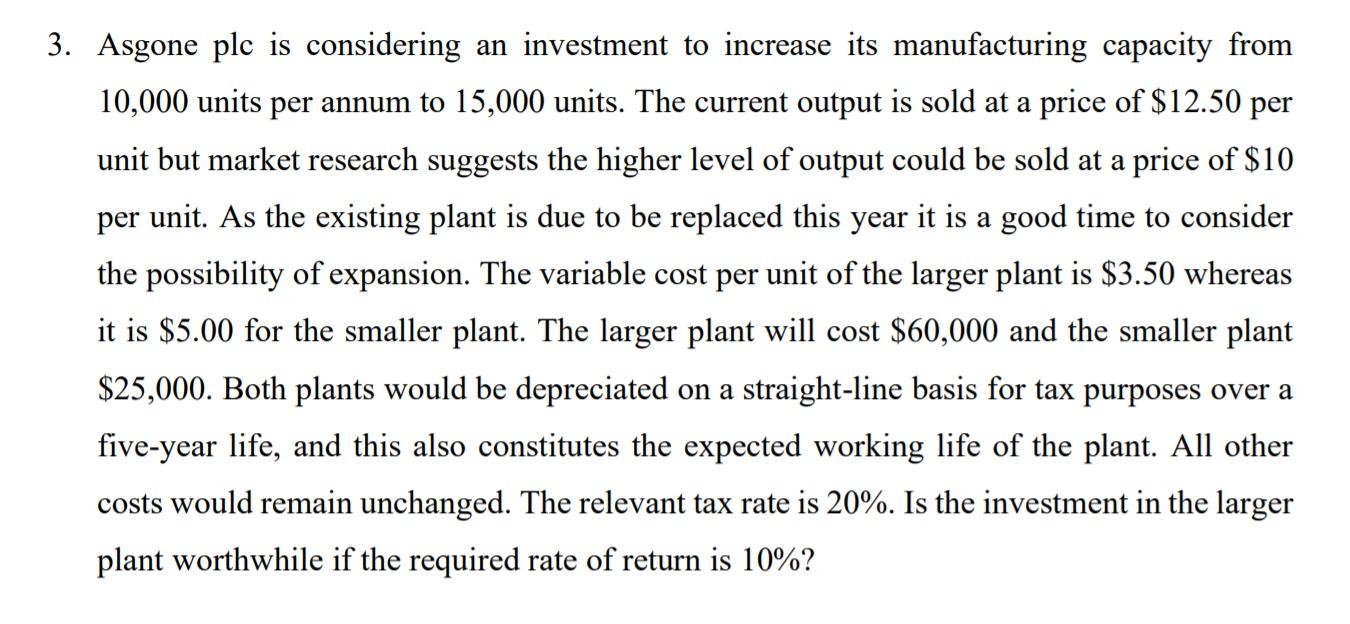

Asgone plc is considering an investment to increase its manufacturing capacity from 10,000 units per annum to 15,000 units. The current output is sold at a price of $12.50 per unit but market research suggests the higher level of output could be sold at a price of $10 per unit. As the existing plant is due to be replaced this year it is a good time to consider the possibility of expansion. The variable cost per unit of the larger plant is $3.50 whereas it is $5.00 for the smaller plant. The larger plant will cost $60,000 and the smaller plant $25,000. Both plants would be depreciated on a straight-line basis for tax purposes over a five-year life, and this also constitutes the expected working life of the plant. All other costs would remain unchanged. The relevant tax rate is 20%. Is the investment in the larger plant worthwhile if the required rate of return is 10%? Use Excel to solve the question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started