Answered step by step

Verified Expert Solution

Question

1 Approved Answer

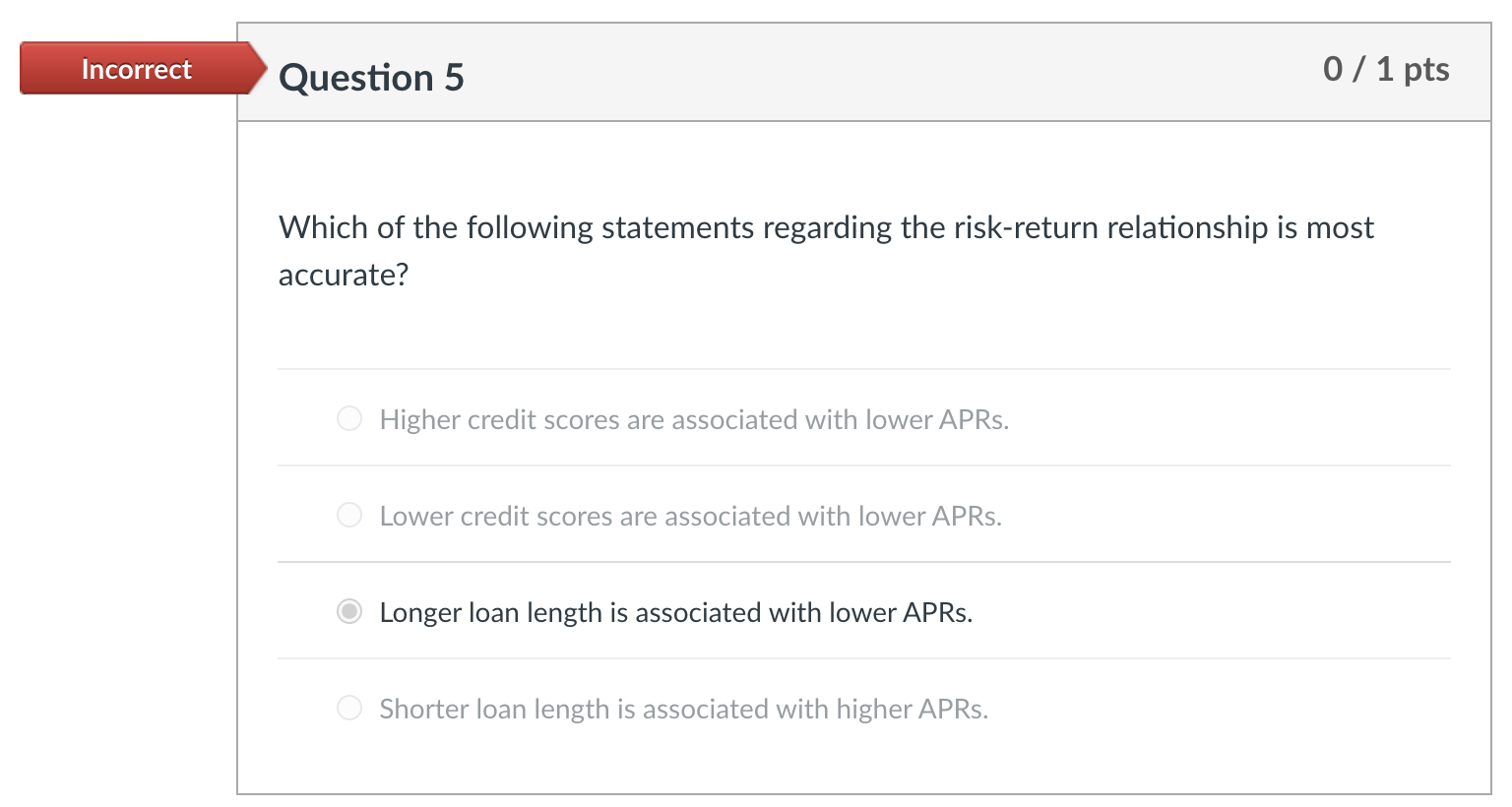

What are the correct answers? Incorrect Question 5 0/1 pts Which of the following statements regarding the risk-return relationship is most accurate? Higher credit scores

What are the correct answers?

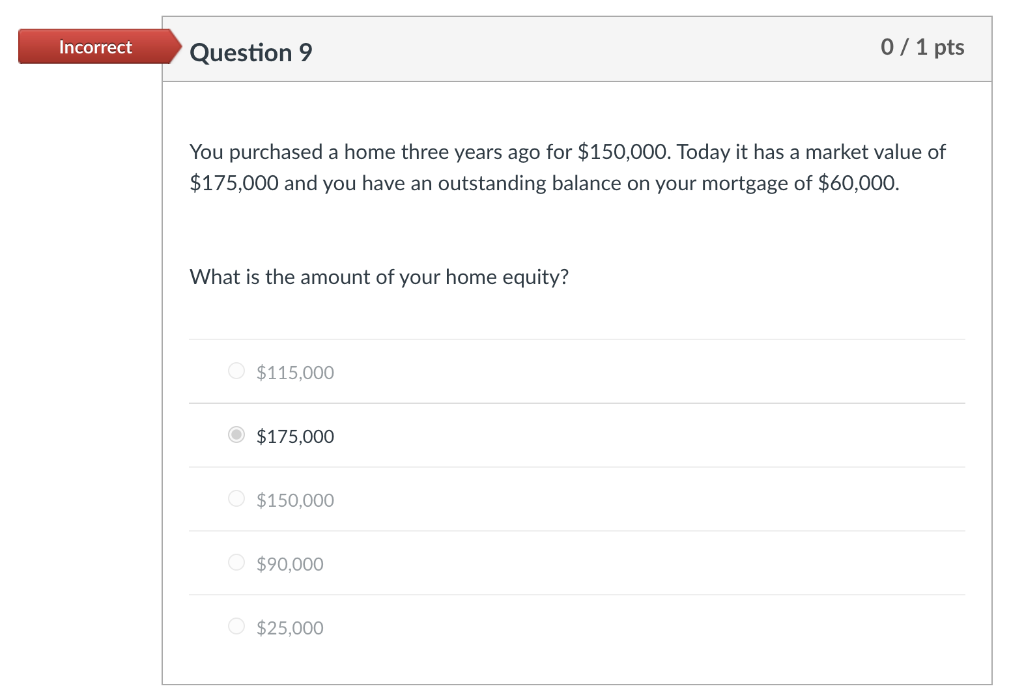

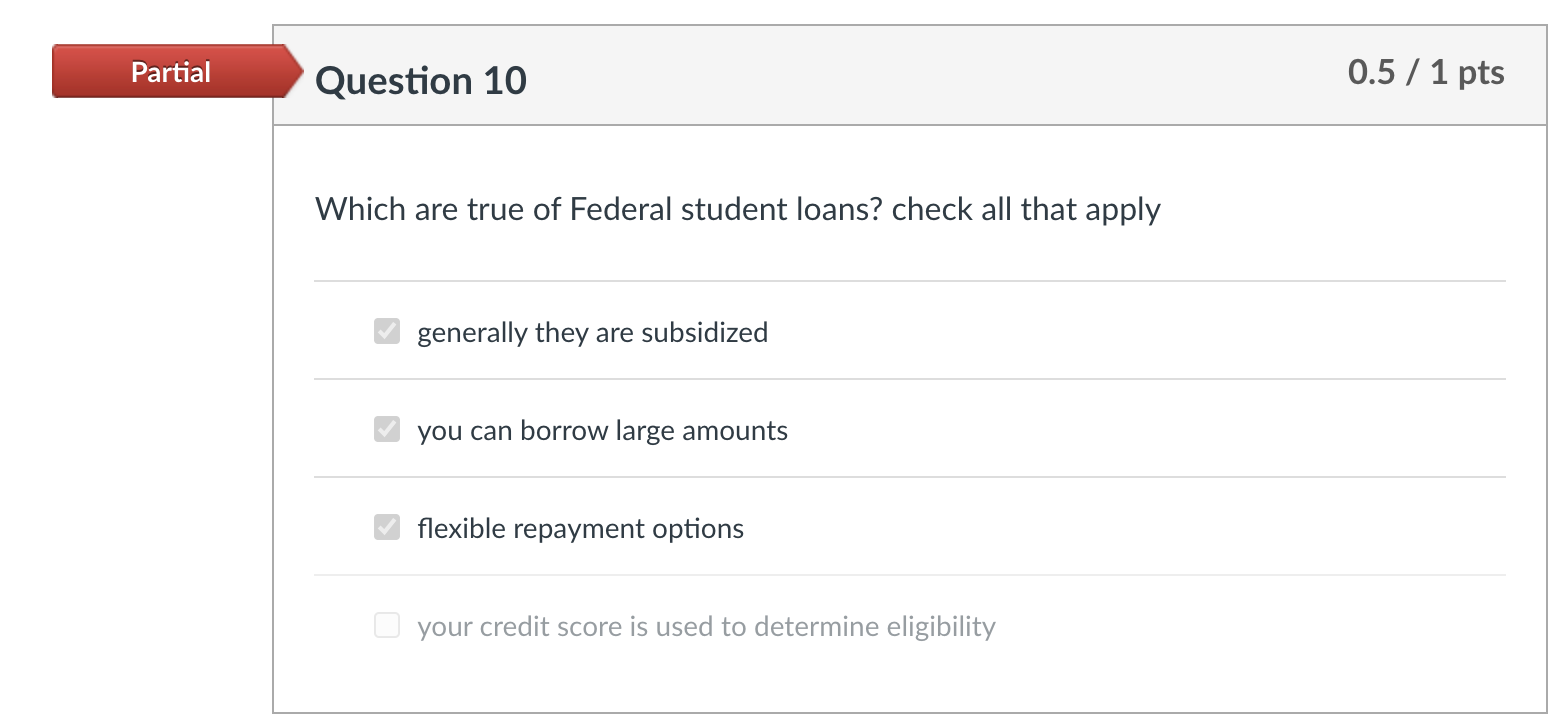

Incorrect Question 5 0/1 pts Which of the following statements regarding the risk-return relationship is most accurate? Higher credit scores are associated with lower APRs. Lower credit scores are associated with lower APRs. Longer loan length is associated with lower APRs. Shorter loan length is associated with higher APRs. Incorrect Question 9 0 / 1 pts You purchased a home three years ago for $150,000. Today it has a market value of $175,000 and you have an outstanding balance on your mortgage of $60,000. What is the amount of your home equity? $115,000 O $175,000 $150,000 $90,000 $25,000 Partial Question 10 0.5 / 1 pts Which are true of Federal student loans? check all that apply generally they are subsidized you can borrow large amounts flexible repayment options your credit score is used to determine eligibility Incorrect Question 5 0/1 pts Which of the following statements regarding the risk-return relationship is most accurate? Higher credit scores are associated with lower APRs. Lower credit scores are associated with lower APRs. Longer loan length is associated with lower APRs. Shorter loan length is associated with higher APRs. Incorrect Question 9 0 / 1 pts You purchased a home three years ago for $150,000. Today it has a market value of $175,000 and you have an outstanding balance on your mortgage of $60,000. What is the amount of your home equity? $115,000 O $175,000 $150,000 $90,000 $25,000 Partial Question 10 0.5 / 1 pts Which are true of Federal student loans? check all that apply generally they are subsidized you can borrow large amounts flexible repayment options your credit score is used to determine eligibilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started