Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aspen Bhd has 100,000 units of convertible bonds issue outstanding which can be converted into shares at any time. Each bond has a face

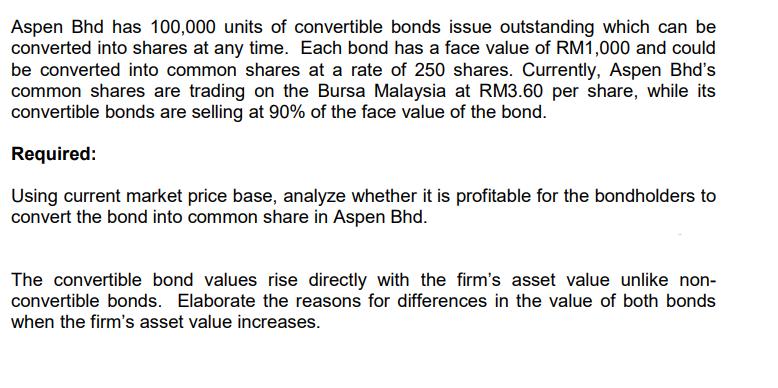

Aspen Bhd has 100,000 units of convertible bonds issue outstanding which can be converted into shares at any time. Each bond has a face value of RM1,000 and could be converted into common shares at a rate of 250 shares. Currently, Aspen Bhd's common shares are trading on the Bursa Malaysia at RM3.60 per share, while its convertible bonds are selling at 90% of the face value of the bond. Required: Using current market price base, analyze whether it is profitable for the bondholders to convert the bond into common share in Aspen Bhd. The convertible bond values rise directly with the firm's asset value unlike non- convertible bonds. Elaborate the reasons for differences in the value of both bonds when the firm's asset value increases.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing Profitability of Convertible Bond Conversion Based on current market prices it is profitable for the bondholders to convert their bonds into ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started