Question

suppose (1) the 1-year spot rate is r1 = 1% (2) the 2-year spot rate is r2 = 2% (3) the 1-year forward rate

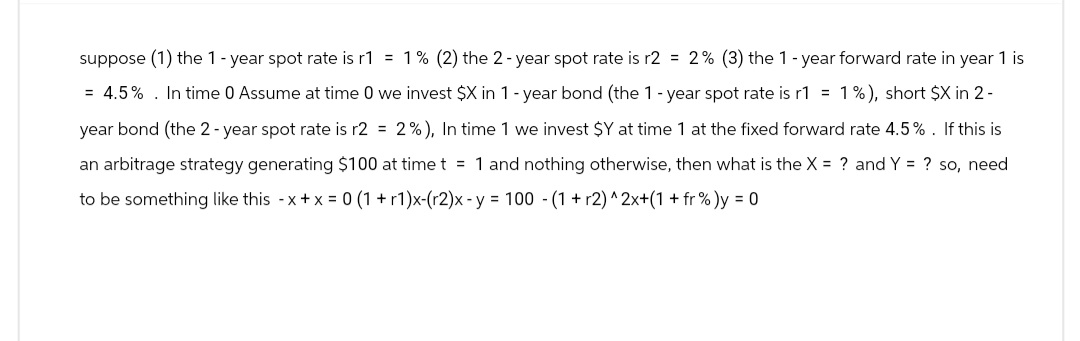

suppose (1) the 1-year spot rate is r1 = 1% (2) the 2-year spot rate is r2 = 2% (3) the 1-year forward rate in year 1 is = 4.5%. In time 0 Assume at time 0 we invest $X in 1-year bond (the 1-year spot rate is r1 = 1%), short $X in 2- year bond (the 2-year spot rate is r2 = 2%), In time 1 we invest $Y at time 1 at the fixed forward rate 4.5%. If this is an arbitrage strategy generating $100 at time t = 1 and nothing otherwise, then what is the X = ? and Y = ? so, need to be something like this -x+x=0 (1+r1)x-(r2)x - y = 100 (1 + r2)^2x+(1 + fr % )y = 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets solve the given equations to find the values of X and Y Given 1 The 1year spot rate r1 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elements Of Chemical Reaction Engineering

Authors: H. Fogler

6th Edition

013548622X, 978-0135486221

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App