Assess your business:

Fast forward a few months...Your friend asks you how your business is doing and you are unsure how exactly to answer. In fact, you are not necessarily sure how your business is going since you are so new to this! This part will help you organize your thoughts and come up with a more formalized process and financial reporting can help you demonstrate your success (or lack thereof!).

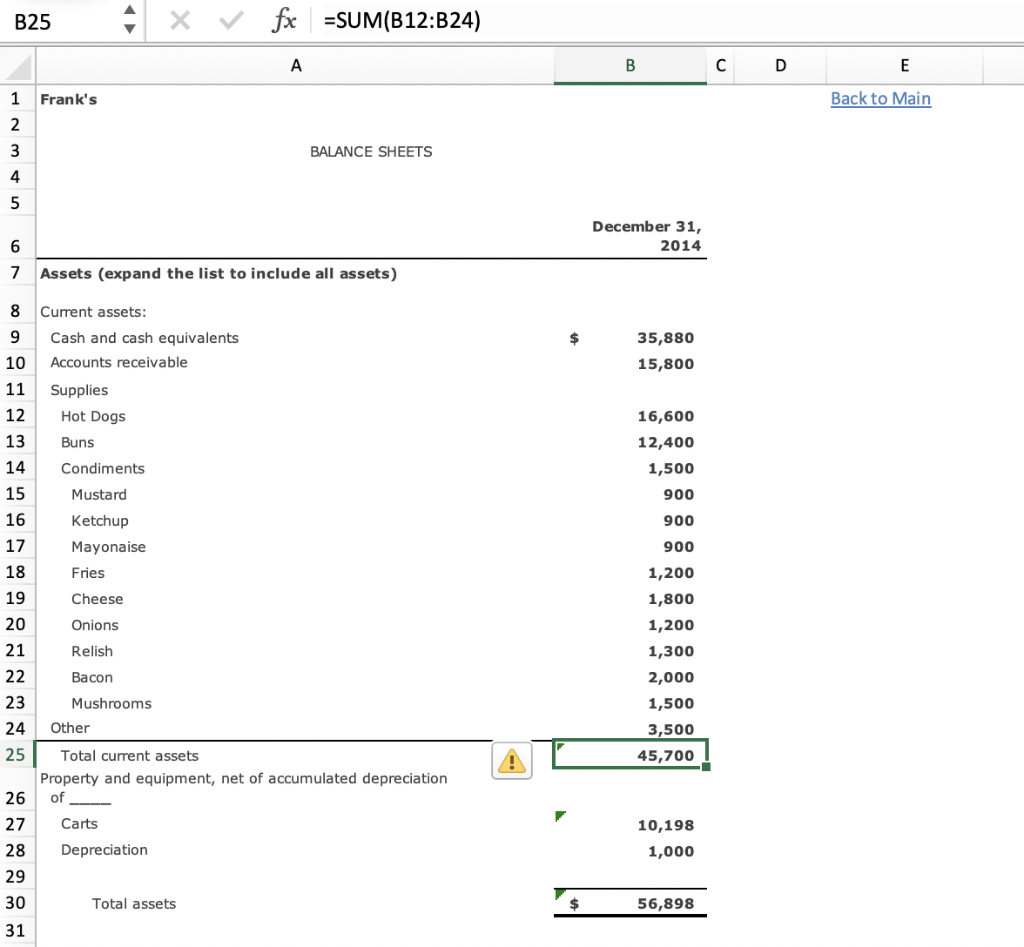

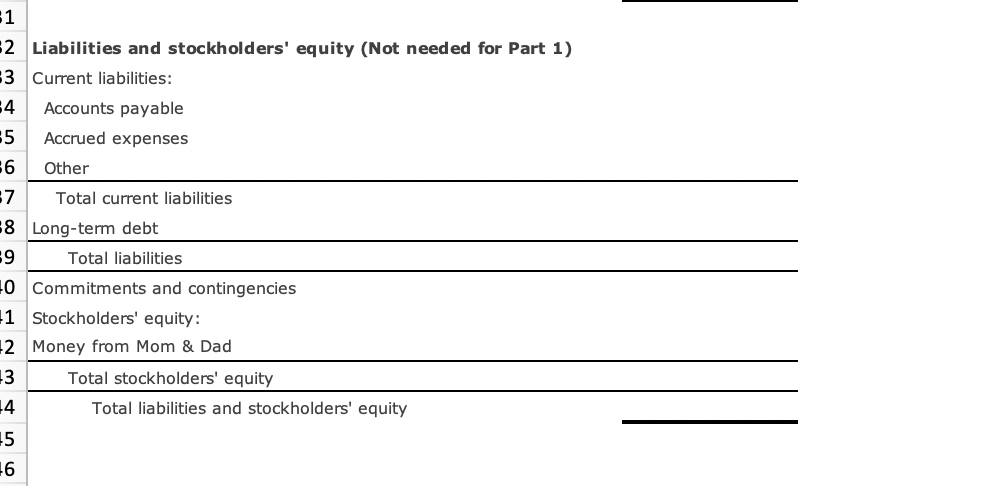

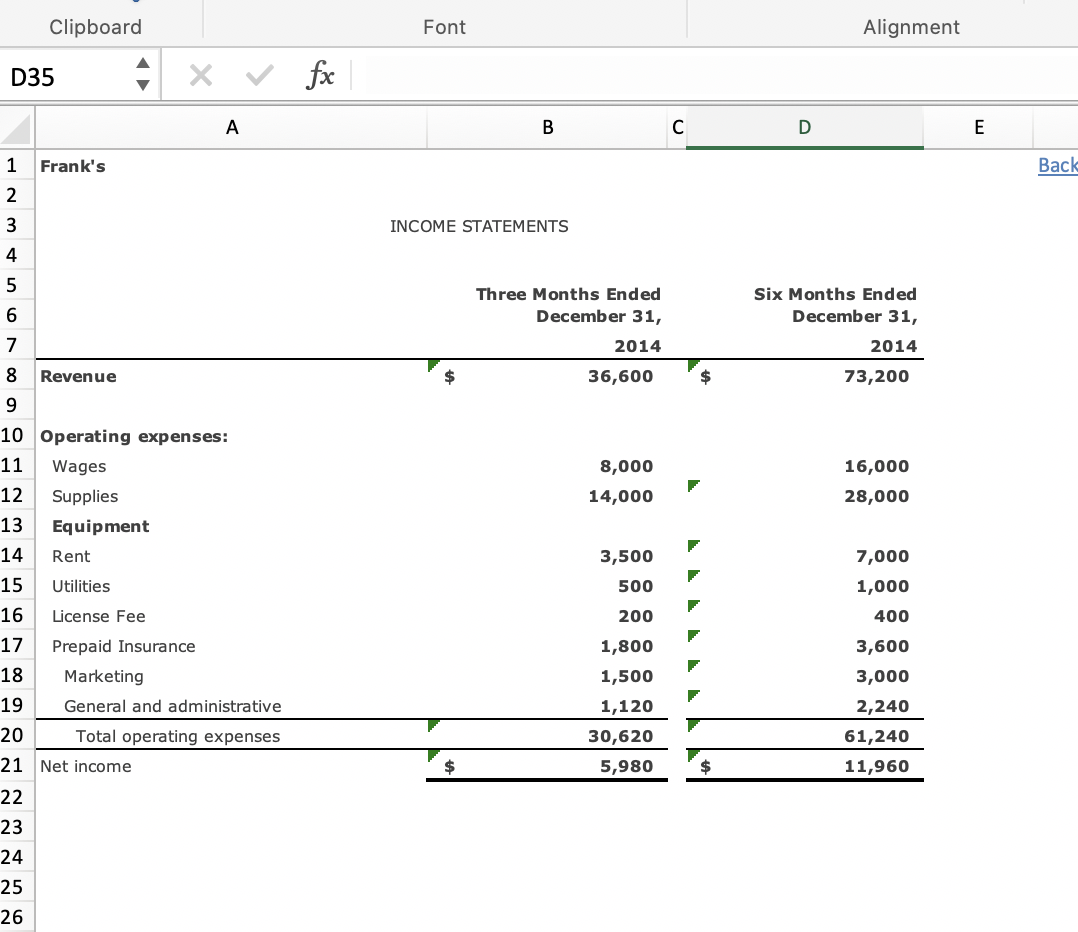

For your cart, come up with a way to determine profit and financial position. Expand your Excel spreadsheet from part 1 by adding an additional tab. There is no specific format for this. Data should be reasonable based on your projections from Part 1 and include all expenses. Your grade is not dependent on whether you are making a profit.

Use the momentum from the discussion forums from week's 6-7 where we collectively brainstormed methods of (a) if the business was profitable and (b) how to measure profitability in a professional format.

Include an analysis that summarizes your findings in a professional manner.

This part of the project should be approximately 2 - 4 pages including the financials.

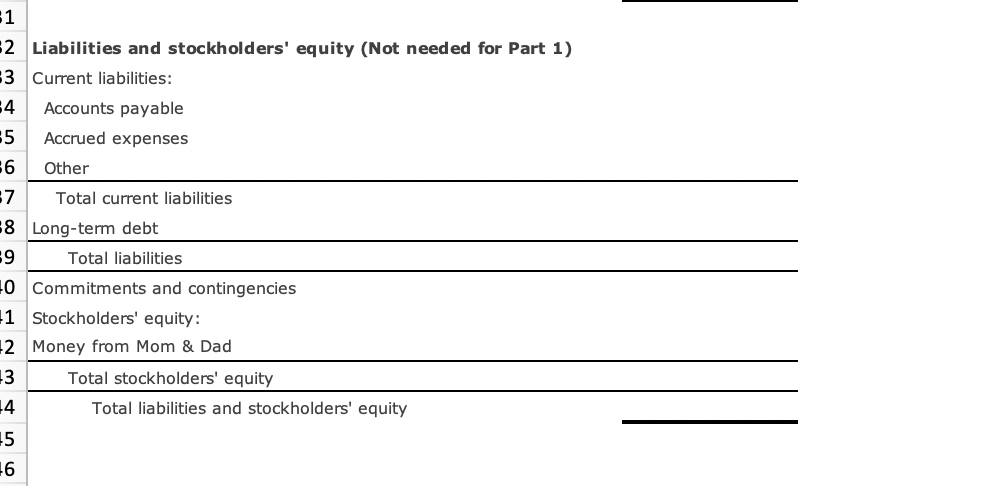

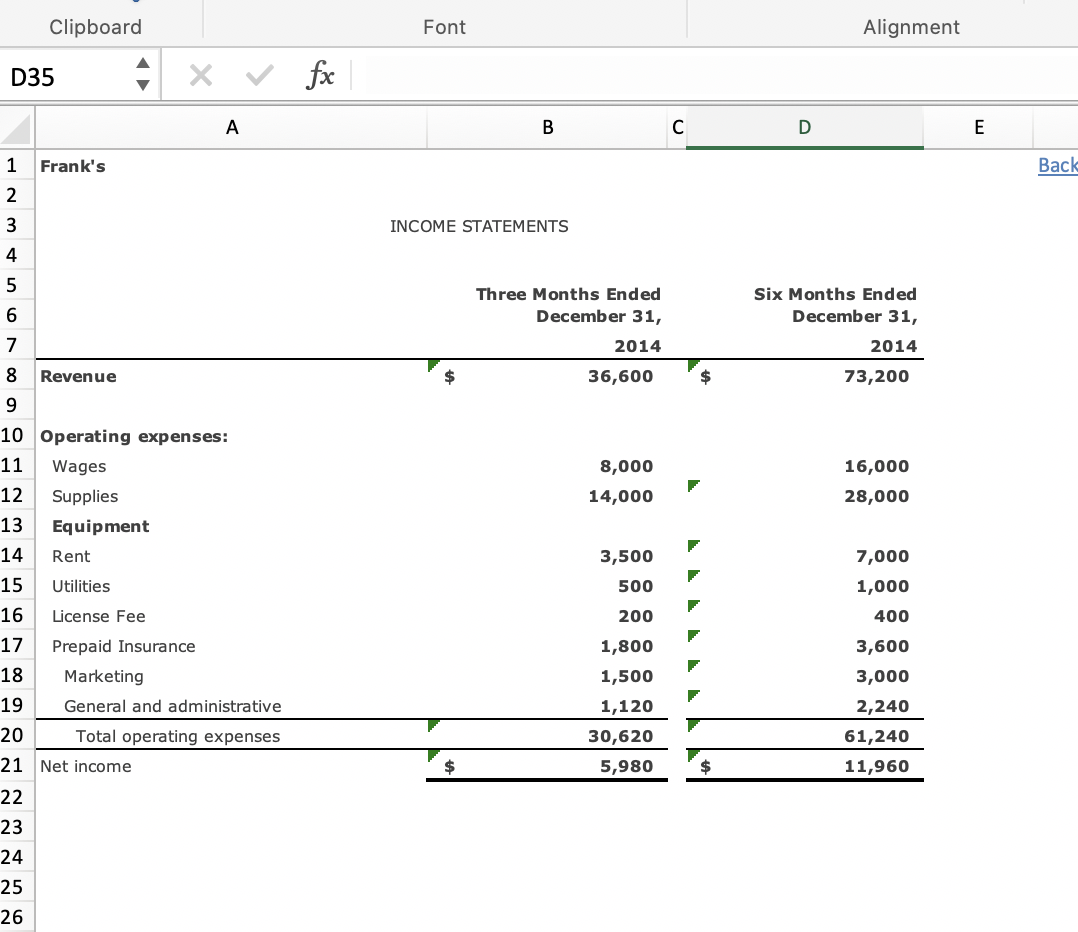

B25 fx =SUM(B12:B24) A B E 1 Frank's Back to Main 2 3 BALANCE SHEETS 4 5 December 31, 2014 6 7 Assets (expand the list to include all assets) 8 Current assets: Cash and cash equivalents Accounts receivable 9 10 $ 35,880 15,800 11 Supplies Hot Dogs Buns 12 13 14 15 16 16,600 12,400 1,500 900 Condiments Mustard 900 17 Ketchup Mayonaise Fries Cheese Onions 18 19 20 21 22 23 24 Relish 900 1,200 1,800 1,200 1,300 2,000 1,500 3,500 45,700 Bacon Mushrooms Other 25 Total current assets Property and equipment, net of accumulated depreciation of 26 27 Carts 10,198 1,000 Depreciation 28 29 30 Total assets 56,898 31 1 2 Liabilities and stockholders' equity (Not needed for Part 1) 3 Current liabilities: 4 Accounts payable 5 Accrued expenses 6 Other :7 Total current liabilities 8 Long-term debt 9 Total liabilities 0 Commitments and contingencies 11 Stockholders' equity: 12 Money from Mom & Dad 13 Total stockholders' equity 14 Total liabilities and stockholders' equity 15 6 Clipboard Font Alignment D35 f A B D E 1 Frank's Back 2 3 INCOME STATEMENTS 4 5 Three Months Ended December 31, Six Months Ended December 31, 6 7 2014 2014 8 Revenue 36,600 $ 73,200 9 10 Operating expenses: 11 Wages 12 Supplies 13 Equipment 14 Rent 8,000 14,000 16,000 28,000 3,500 7,000 1,000 15 Utilities 500 16 License Fee 200 400 17 Prepaid Insurance Marketing General and administrative 1,800 1,500 18 3,600 3,000 2,240 61,240 19 1,120 30,620 20 Total operating expenses 21 Net income $ 5,980 $ 11,960 22 23 24 25 26 B25 fx =SUM(B12:B24) A B E 1 Frank's Back to Main 2 3 BALANCE SHEETS 4 5 December 31, 2014 6 7 Assets (expand the list to include all assets) 8 Current assets: Cash and cash equivalents Accounts receivable 9 10 $ 35,880 15,800 11 Supplies Hot Dogs Buns 12 13 14 15 16 16,600 12,400 1,500 900 Condiments Mustard 900 17 Ketchup Mayonaise Fries Cheese Onions 18 19 20 21 22 23 24 Relish 900 1,200 1,800 1,200 1,300 2,000 1,500 3,500 45,700 Bacon Mushrooms Other 25 Total current assets Property and equipment, net of accumulated depreciation of 26 27 Carts 10,198 1,000 Depreciation 28 29 30 Total assets 56,898 31 1 2 Liabilities and stockholders' equity (Not needed for Part 1) 3 Current liabilities: 4 Accounts payable 5 Accrued expenses 6 Other :7 Total current liabilities 8 Long-term debt 9 Total liabilities 0 Commitments and contingencies 11 Stockholders' equity: 12 Money from Mom & Dad 13 Total stockholders' equity 14 Total liabilities and stockholders' equity 15 6 Clipboard Font Alignment D35 f A B D E 1 Frank's Back 2 3 INCOME STATEMENTS 4 5 Three Months Ended December 31, Six Months Ended December 31, 6 7 2014 2014 8 Revenue 36,600 $ 73,200 9 10 Operating expenses: 11 Wages 12 Supplies 13 Equipment 14 Rent 8,000 14,000 16,000 28,000 3,500 7,000 1,000 15 Utilities 500 16 License Fee 200 400 17 Prepaid Insurance Marketing General and administrative 1,800 1,500 18 3,600 3,000 2,240 61,240 19 1,120 30,620 20 Total operating expenses 21 Net income $ 5,980 $ 11,960 22 23 24 25 26