Answered step by step

Verified Expert Solution

Question

1 Approved Answer

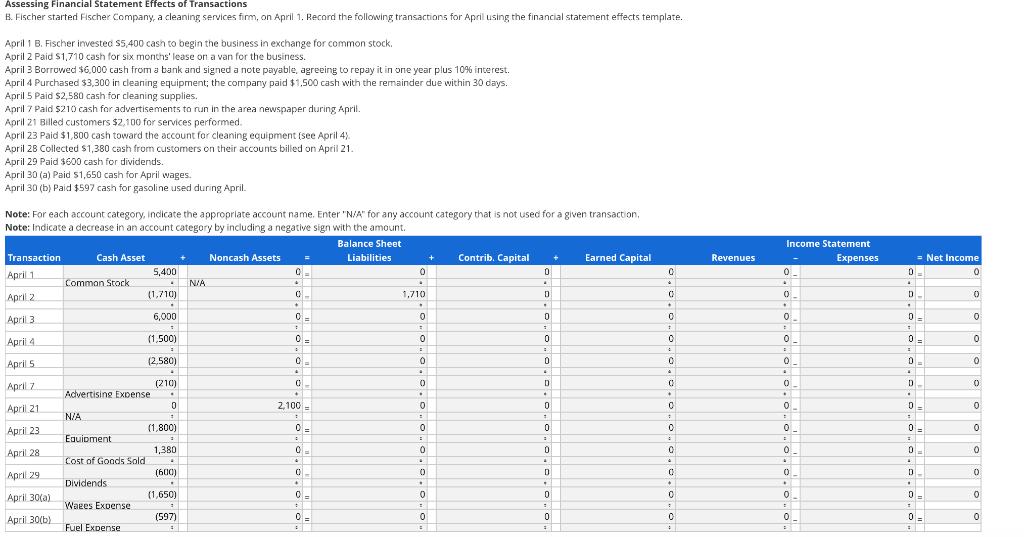

Assessing Financial Statement Effects of Transactions B. Fischer started Fischer Company, a cleaning services firm, on April 1. Record the following transactions for April

Assessing Financial Statement Effects of Transactions B. Fischer started Fischer Company, a cleaning services firm, on April 1. Record the following transactions for April using the financial statement effects template.. April 1 B. Fischer invested $5,400 cash to begin the business in exchange for common stock. April 2 Paid $1,710 cash for six months' lease on a van for the business. April 3 Borrowed $6,000 cash from a bank and signed a note payable, agreeing to repay it in one year plus 10% interest. April 4 Purchased $3,300 in cleaning equipment; the company paid $1,500 cash with the remainder due within 30 days. April 5 Paid $2,580 cash for cleaning supplies. April 7 Paid $210 cash for advertisements to run in the area newspaper during April. April 21 Billed customers $2,100 for services performed. April 23 Paid $1,800 cash toward the account for cleaning equipment (see April 4). April 28 Collected $1,380 cash from customers on their accounts billed on April 21. April 29 Paid $600 cash for dividends. April 30 (a) Paid $1,650 cash for April wages. April 30 (b) Paid $597 cash for gasoline used during April. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction, Note: Indicate a decrease in an account category by including a negative sign with the amount. Balance Sheet Liabilities Contrib. Capital + Earned Capital Transaction April 1 Cash Asset Comman Stock + Noncash Assets = 5,400 (1,710) 0 + 0 . 0 N/A April 2 April 3 6,000 April 4 (1,500) April 5 (2,580) . April 7 (210) Advertising Expense . April 21 N/A April 23 Equipment April 28 Cost of Goods Sold April 29 Dividends April 30(a) Wages Expense April 30(b) Fuel Expense 0 REN (1,800) 1 1,380 (600) (1,650) (597) C3 4 0 + 0 0. B 0 4 0 + 2,100 * 0 A = 0 4 0 . = 0. # 0= # 1,710 . 0 S 0 0 . 0 . 0 = 0 = 0 . 0 . 0 : 0 = . D . 0 1 + 0 = 0 4 D . 0 1 0 = 0 . D . 0 = 0 # 0 4 0 + 0 + 0 4 0 A 0 + 0 + 0 0 4 0 + 0 * 0 4 Revenues Income Statement Expenses 0 . 0_ . 0 = 2 0. = 0 . 0 DI . 0 = 0 = 0 A 0. . 0 = 0 = 0 . D . 0 + 0 = 0 . D . 0- # 0- = 0. D . 0 : = Net Income 0 0 0 0 0 0 0 0 0 0 0 0 0 =

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Cash Asset Non Cash Asset Liabilities Contri Capital Earned Capital Reve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started