Question

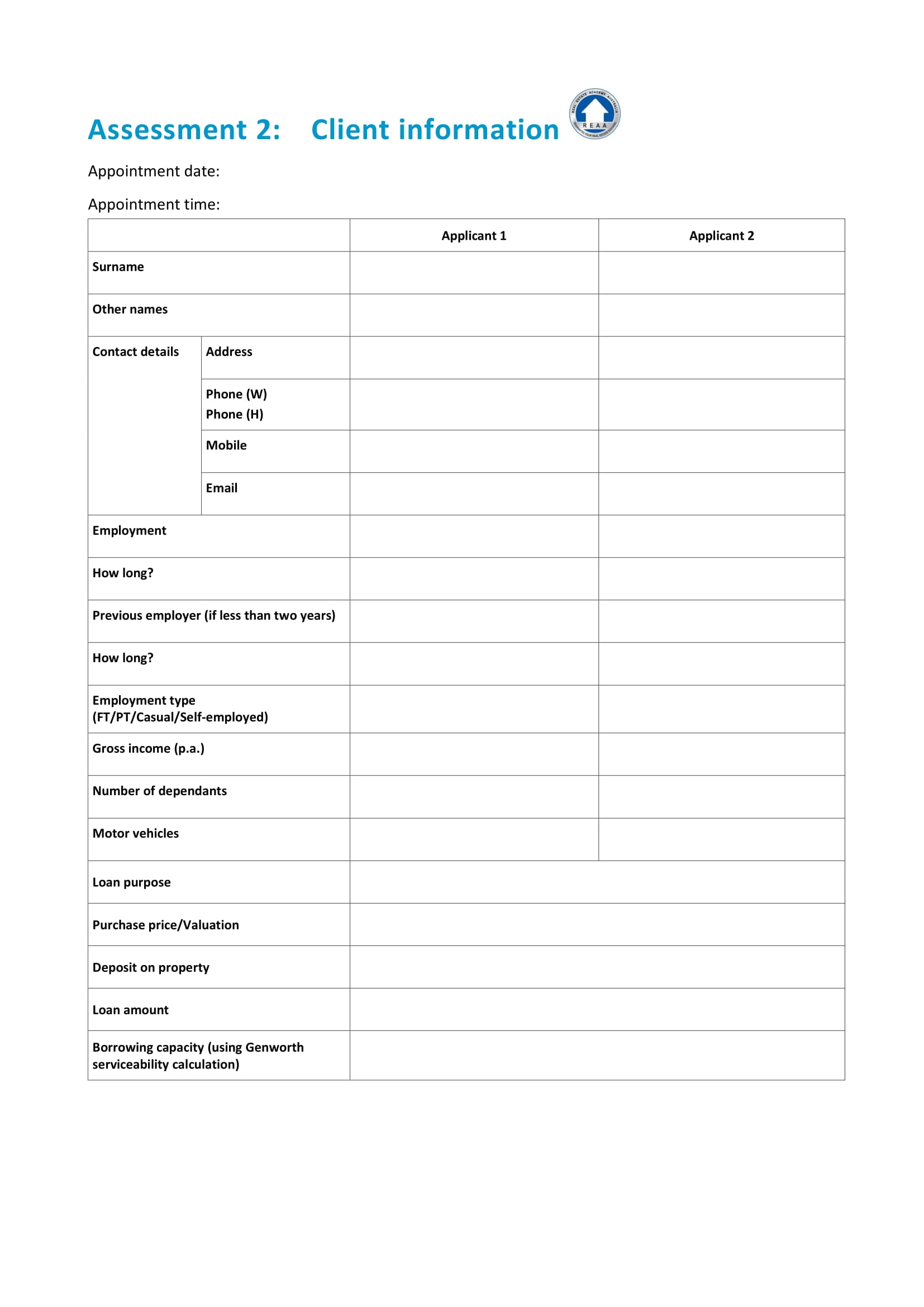

Assessment 2:Client information Appointment date: Appointment time: Applicant 1 Applicant 2 Surname Other names Contact details Address Phone (W) Phone (H) Mobile Email Employment How

Assessment 2:Client information

Appointment date:

Appointment time:

Applicant 1

Applicant 2

Surname

Other names

Contact details

Address

Phone (W)

Phone (H)

Mobile

Employment

How long?

Previous employer (if less than two years)

How long?

Employment type

(FT/PT/Casual/Self-employed)

Gross income (p.a.)

Number of dependants

Motor vehicles

Loan purpose

Purchase price/Valuation

Deposit on property

Loan amount

Borrowing capacity (using Genworth serviceability calculation)

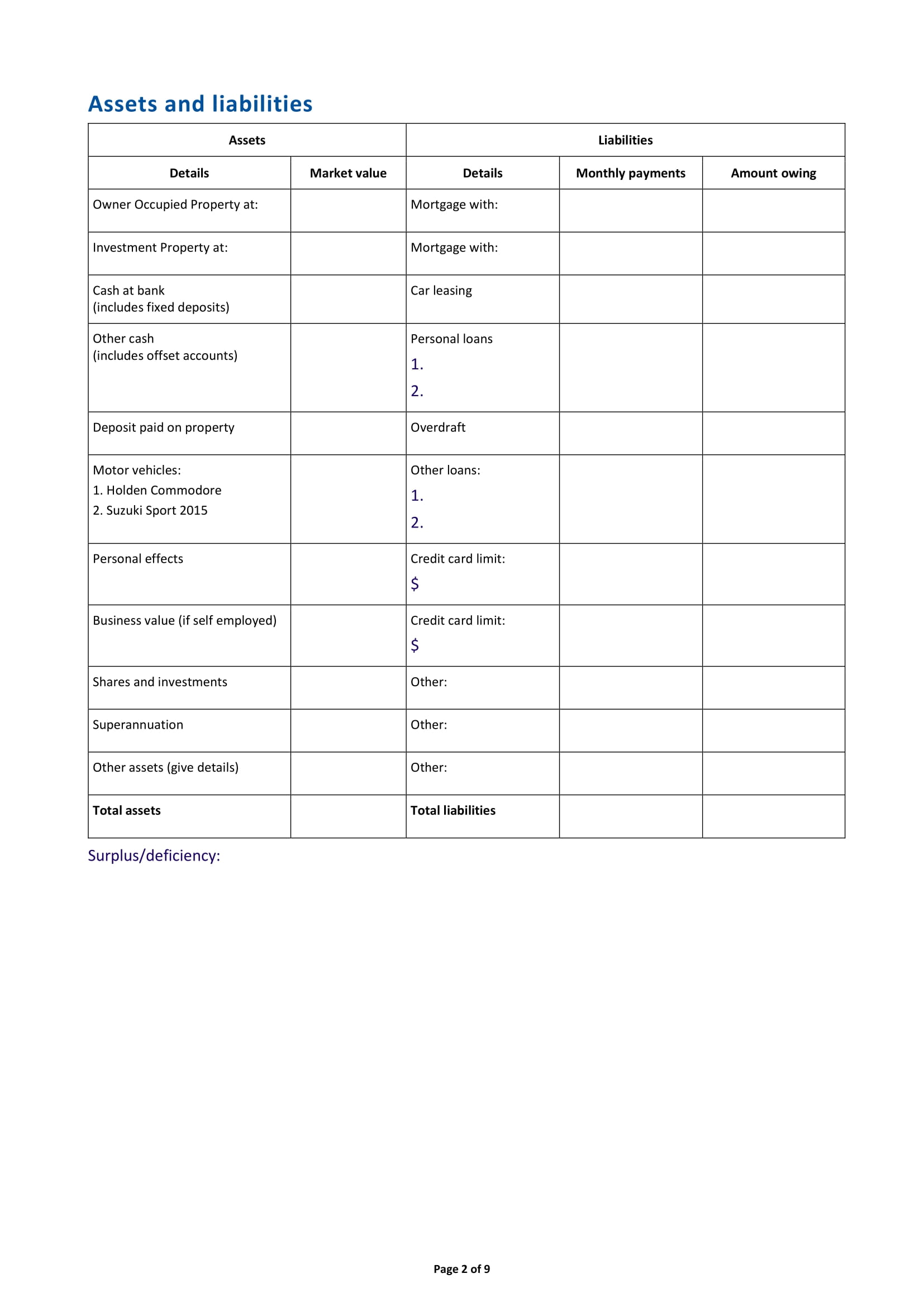

Assets and liabilities

Assets

Liabilities

Details

Market value

Details

Monthly payments

Amount owing

Owner Occupied Property at:

Mortgage with:

Investment Property at:

Mortgage with:

Cash at bank

(includes fixed deposits)

Car leasing

Other cash

(includes offset accounts)

Personal loans

1.

2.

Deposit paid on property

Overdraft

Motor vehicles:

1. Holden Commodore

2. Suzuki Sport 2015

Other loans:

1.

2.

Personal effects

Credit card limit:

$

Business value (if self employed)

Credit card limit:

$

Shares and investments

Other:

Superannuation

Other:

Other assets (give details)

Other:

Total assets

Total liabilities

Surplus/deficiency:

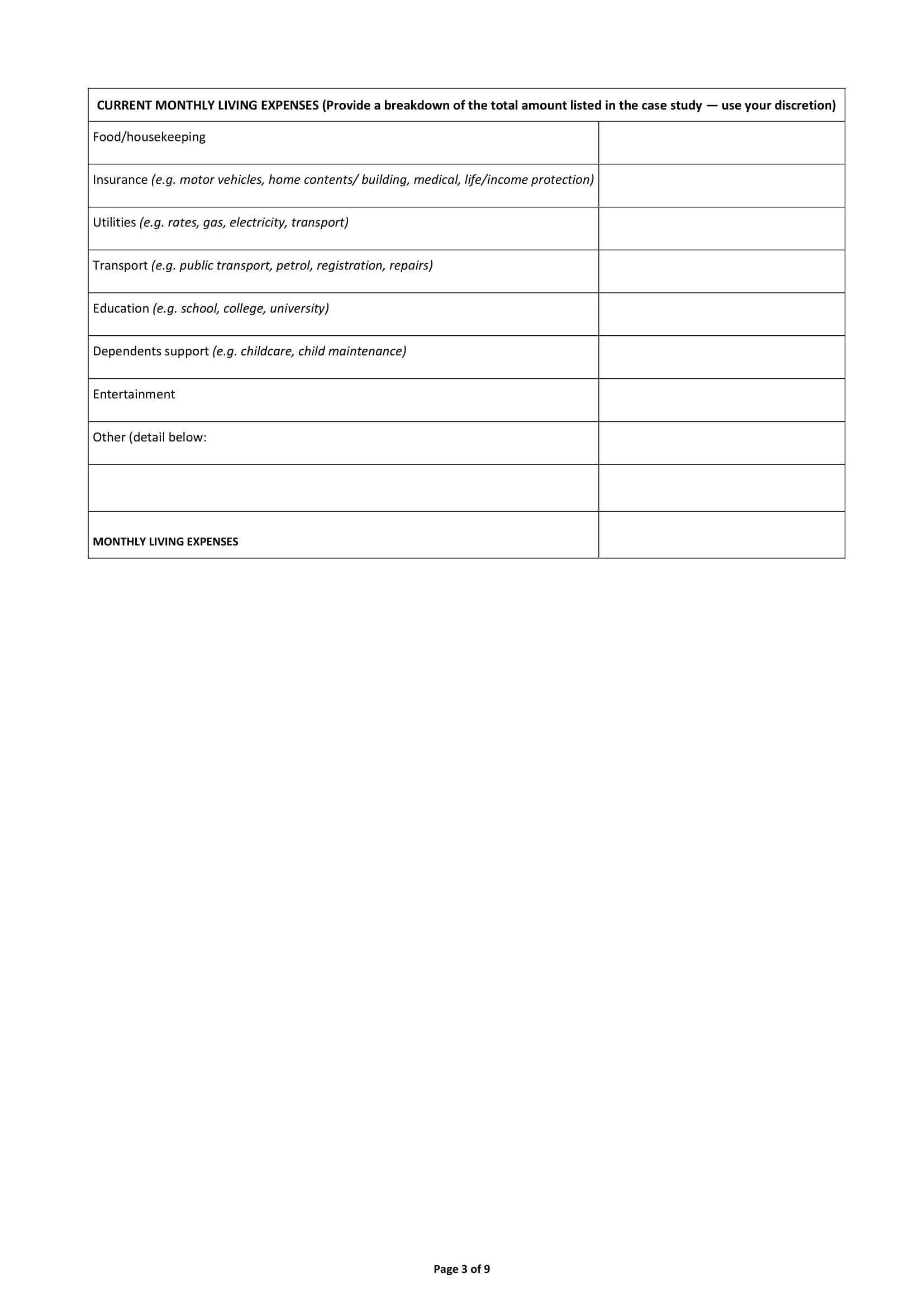

CURRENT MONTHLY LIVING EXPENSES (Provide a breakdown of the total amount listed in the case study ? use your discretion)

Food/housekeeping

Insurance (e.g. motor vehicles, home contents/ building, medical, life/income protection)

Utilities (e.g. rates, gas, electricity, transport)

Transport (e.g. public transport, petrol, registration, repairs)

Education (e.g. school, college, university)

Dependents support (e.g. childcare, child maintenance)

Entertainment

Other (detail below:

MONTHLY LIVING EXPENSES

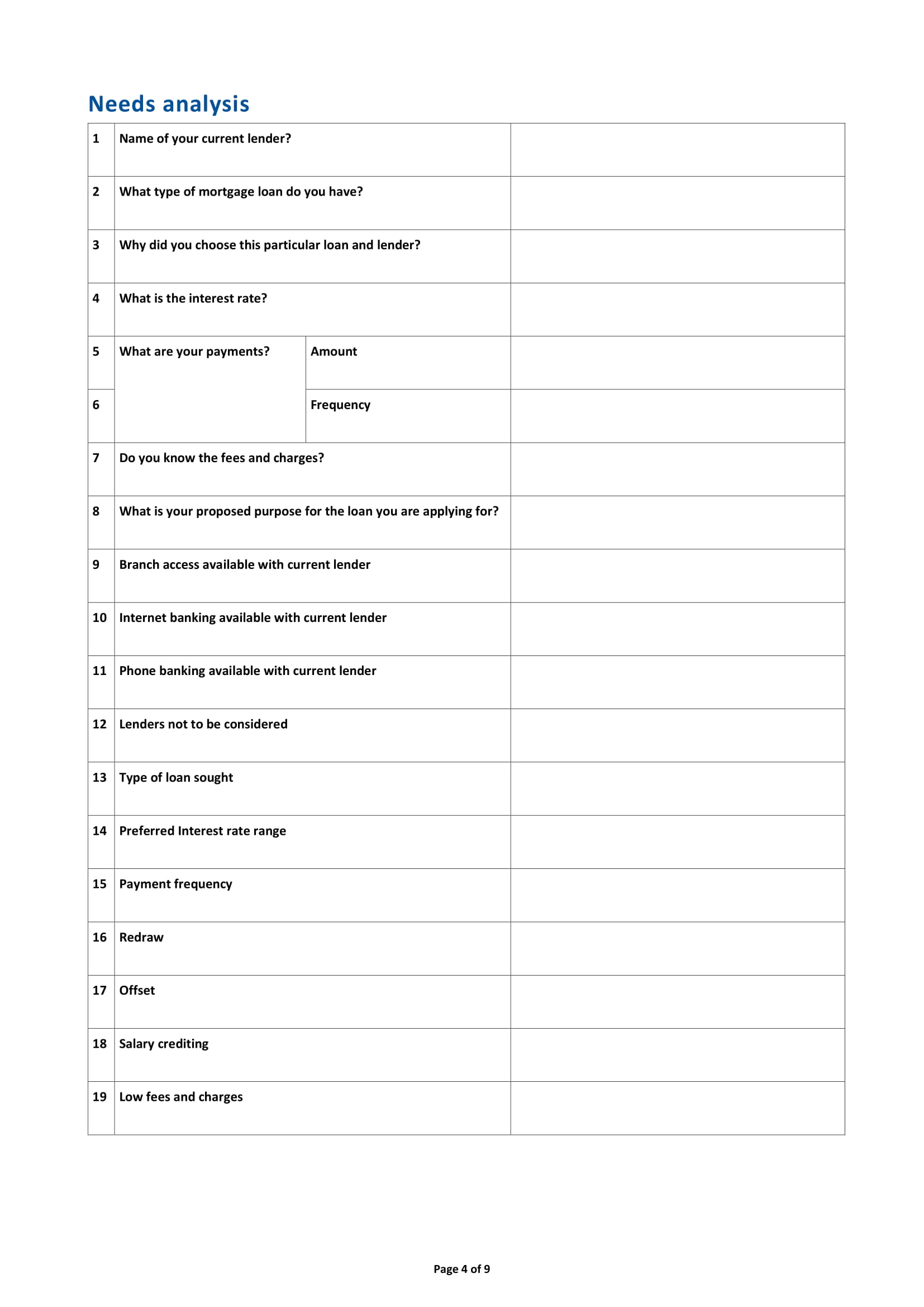

Needs analysis

1

Name of your current lender?

2

What type of mortgage loan do you have?

3

Why did you choose this particular loan and lender?

4

What is the interest rate?

5

What are your payments?

Amount

6

Frequency

7

Do you know the fees and charges?

8

What is your proposed purpose for the loan you are applying for?

9

Branch access available with current lender

10

Internet banking available with current lender

11

Phone banking available with current lender

12

Lenders not to be considered

13

Type of loan sought

14

Preferred Interest rate range

15

Payment frequency

16

Redraw

17

Offset

18

Salary crediting

19

Low fees and charges

Notes

NB: Providing substantive notes here is a compulsory part of your assessment.

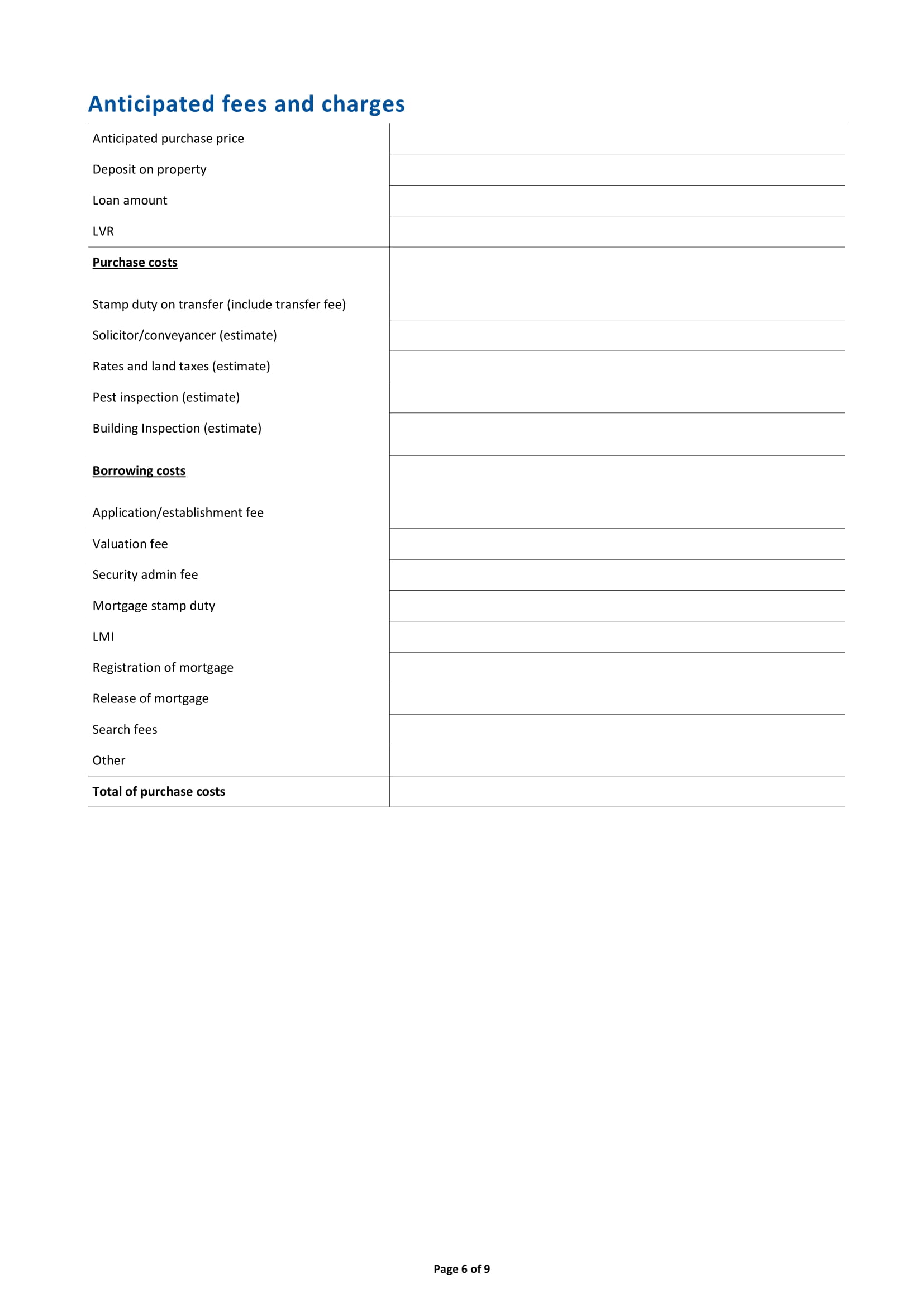

Anticipated fees and charges

Anticipated purchase price

Deposit on property

Loan amount

LVR

Purchase costs

Stamp duty on transfer (include transfer fee)

Solicitor/conveyancer (estimate)

Rates and land taxes (estimate)

Pest inspection (estimate)

Building Inspection (estimate)

Borrowing costs

Application/establishment fee

Valuation fee

Security admin fee

Mortgage stamp duty

LMI

Registration of mortgage

Release of mortgage

Search fees

Other

Total of purchase costs

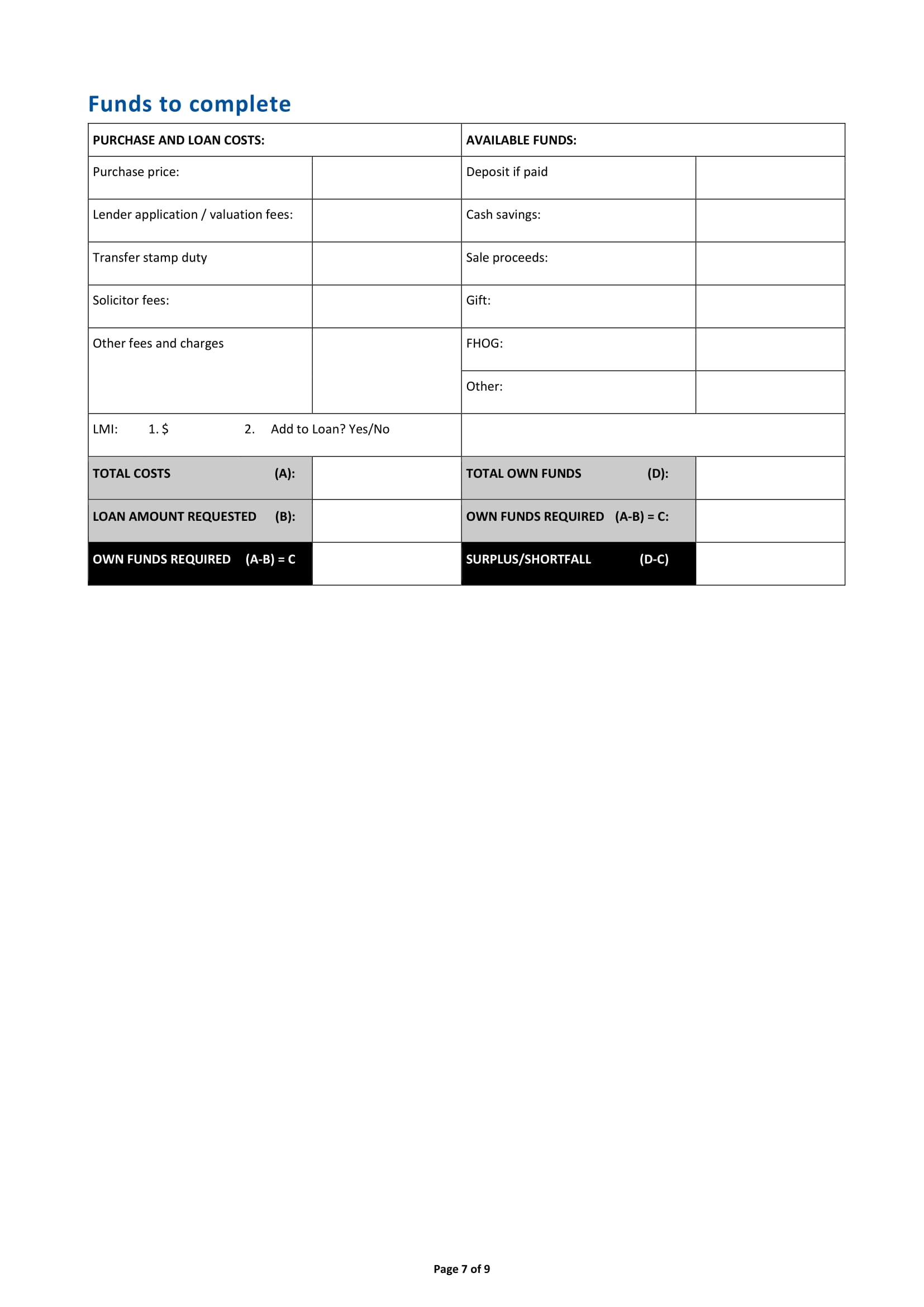

Funds to complete

PURCHASE AND LOAN COSTS:

AVAILABLE FUNDS:

Purchase price:

Deposit if paid

Lender application / valuation fees:

Cash savings:

Transfer stamp duty

Sale proceeds:

Solicitor fees:

Gift:

Other fees and charges

FHOG:

Other:

LMI:

1. $

2.Add to Loan? Yes/No

TOTAL COSTS (A):

TOTAL OWN FUNDS (D):

LOAN AMOUNT REQUESTED(B):

OWN FUNDS REQUIRED(A-B) = C:

OWN FUNDS REQUIRED (A-B) = C

SURPLUS/SHORTFALL (D-C)

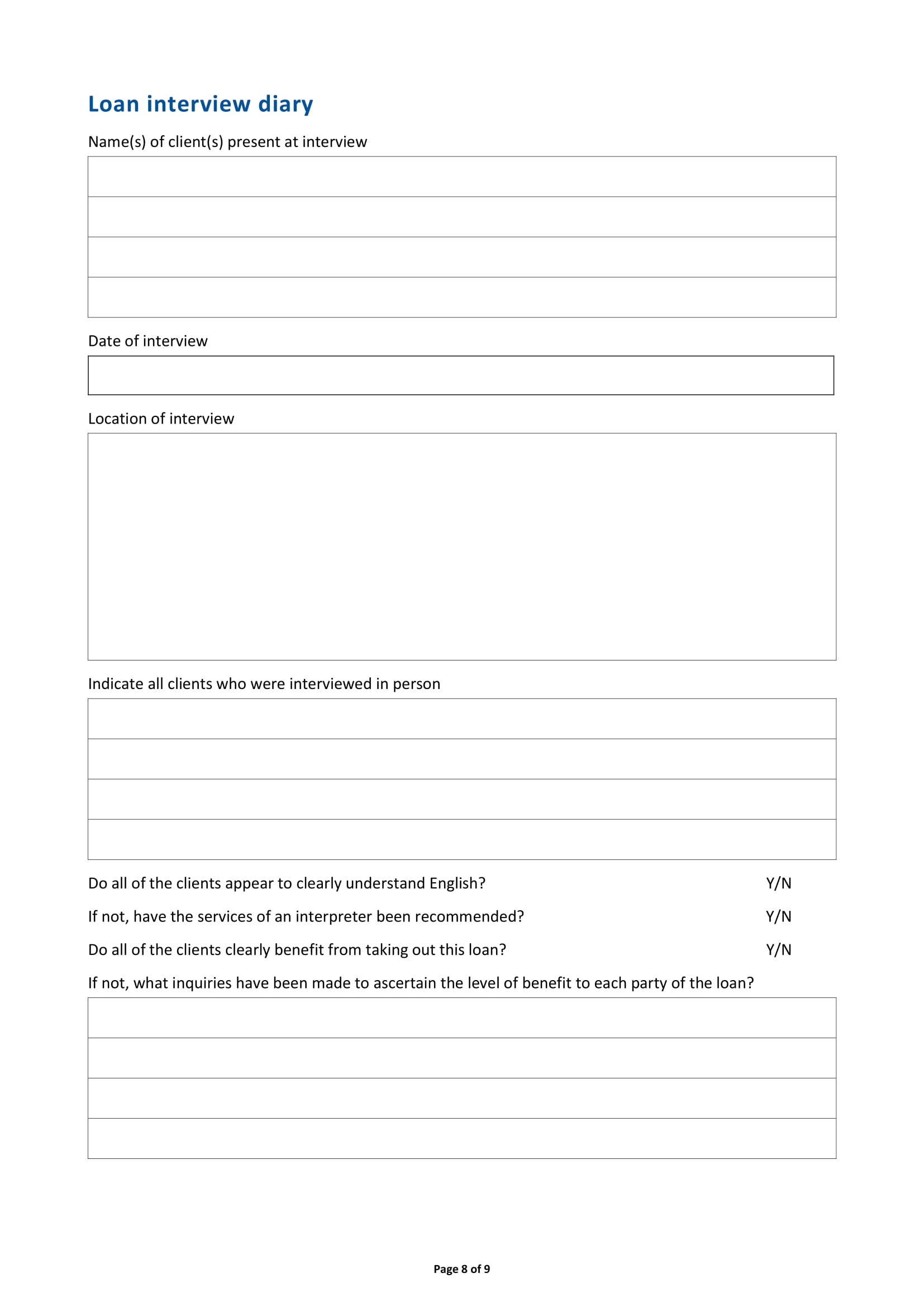

Loan interview diary

Name(s) of client(s) present at interview

Date of interview

Location of interview

Indicate all clients who were interviewed in person

Do all of the clients appear to clearly understand English?Y/N

If not, have the services of an interpreter been recommended?Y/N

Do all of the clients clearly benefit from taking out this loan?Y/N

If not, what inquiries have been made to ascertain the level of benefit to each party of the loan?

Are any clients acting as though they are under duress or other disability?Y/N

Are any clients acting as though they are unsure of anything about the loan?Y/N

Are any of the clients acting as though they are unable to comprehend their obligations?Y/N

Are there any guarantors?Y/N

If yes is answered to any of the above questions, have the clients been advised to seek

the services of a lawyer or financial adviser?Y/N

Provide details of other pertinent information obtained during the loan interview which may be of interest or of any unusual circumstances you may wish to record.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started