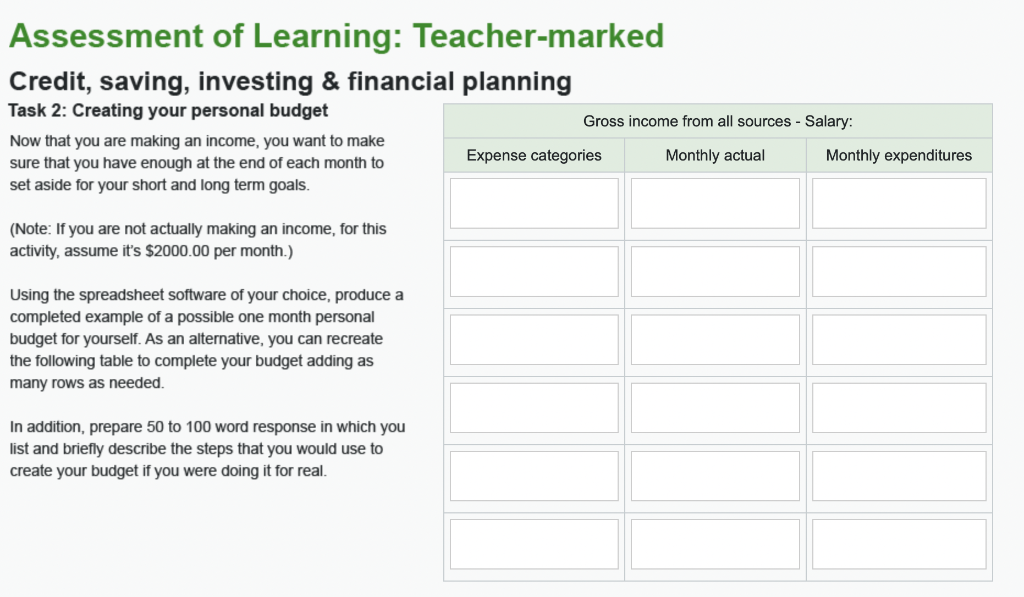

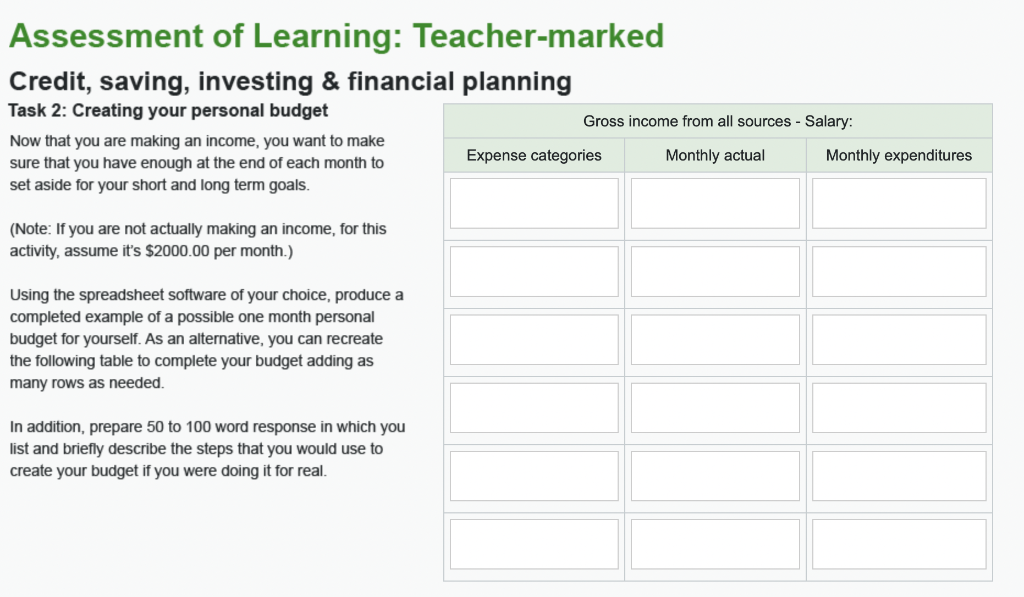

Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning You are near the end of this course. This is your final Assessment of Learning, which is used to evaluate your work based on established criteria and to assign a mark. Your teacher will provide you with feedback and a mark. This Assessment of Learning is worth 24% of your final mark for the course. There are four tasks in this Assessment of Learning. Task 1: Financial planning - Setting goals (3 marks) It's time to consider your finances and start planning ahead! Responding to the following questions, explain what you'd like to accomplish in 50 or more words: 1. What are your short term financial goals? 2. What are your long term financial goals? 3. Do you have an emergency fund? What are some possible emergencies you might need savings for? Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 2: Creating your personal budget Gross income from all sources - Salary: Now that you are making an income, you want to make Expense categories Monthly actual Monthly expenditures sure that you have enough at the end of each month to set aside for your short and long term goals. (Note: If you are not actually making an income, for this activity, assume it's $2000.00 per month.) Using the spreadsheet software of your choice, produce a completed example of a possible one month personal budget for yourself. As an alternative, you can recreate the following table to complete your budget adding as many rows as needed. In addition, prepare 50 to 100 word response in which you list and briefly describe the steps that you would use to create your budget if you were doing it for real. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning You are near the end of this course. This is your final Assessment of Learning, which is used to evaluate your work based on established criteria and to assign a mark. Your teacher will provide you with feedback and a mark. This Assessment of Learning is worth 24% of your final mark for the course. There are four tasks in this Assessment of Learning. Task 1: Financial planning - Setting goals (3 marks) It's time to consider your finances and start planning ahead! Responding to the following questions, explain what you'd like to accomplish in 50 or more words: 1. What are your short term financial goals? 2. What are your long term financial goals? 3. Do you have an emergency fund? What are some possible emergencies you might need savings for? Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 2: Creating your personal budget Gross income from all sources - Salary: Now that you are making an income, you want to make Expense categories Monthly actual Monthly expenditures sure that you have enough at the end of each month to set aside for your short and long term goals. (Note: If you are not actually making an income, for this activity, assume it's $2000.00 per month.) Using the spreadsheet software of your choice, produce a completed example of a possible one month personal budget for yourself. As an alternative, you can recreate the following table to complete your budget adding as many rows as needed. In addition, prepare 50 to 100 word response in which you list and briefly describe the steps that you would use to create your budget if you were doing it for real