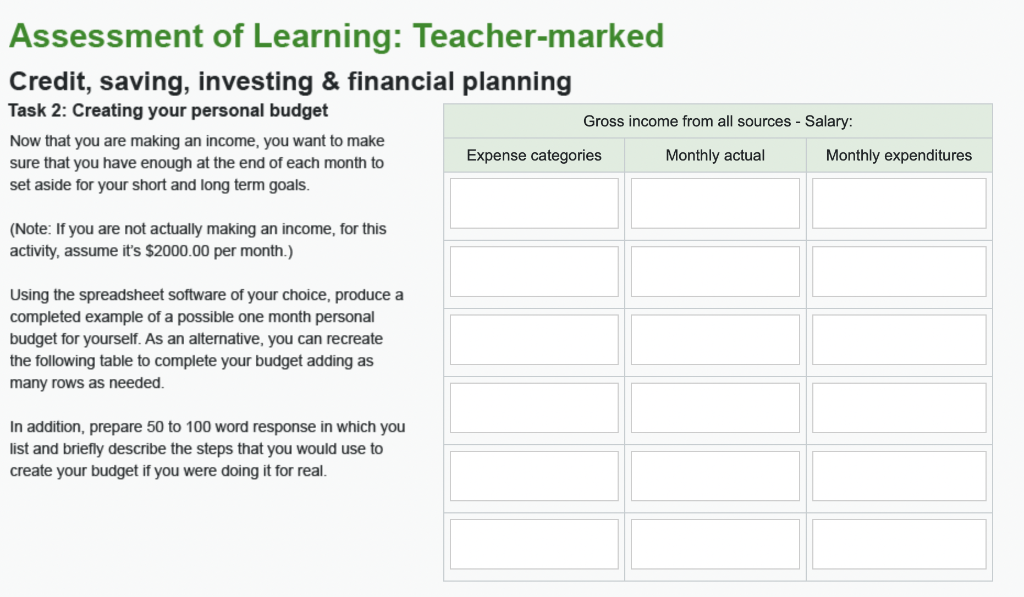

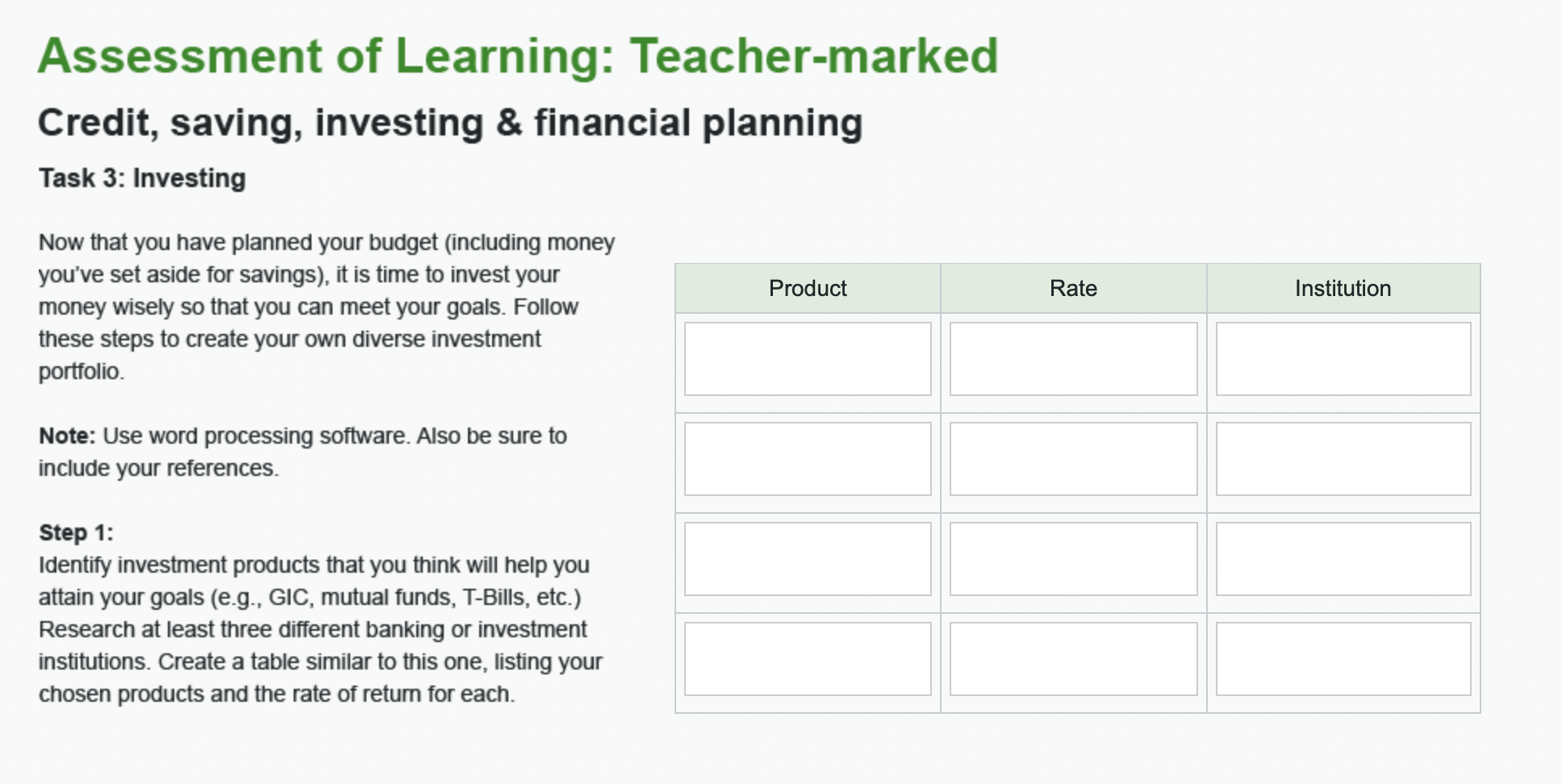

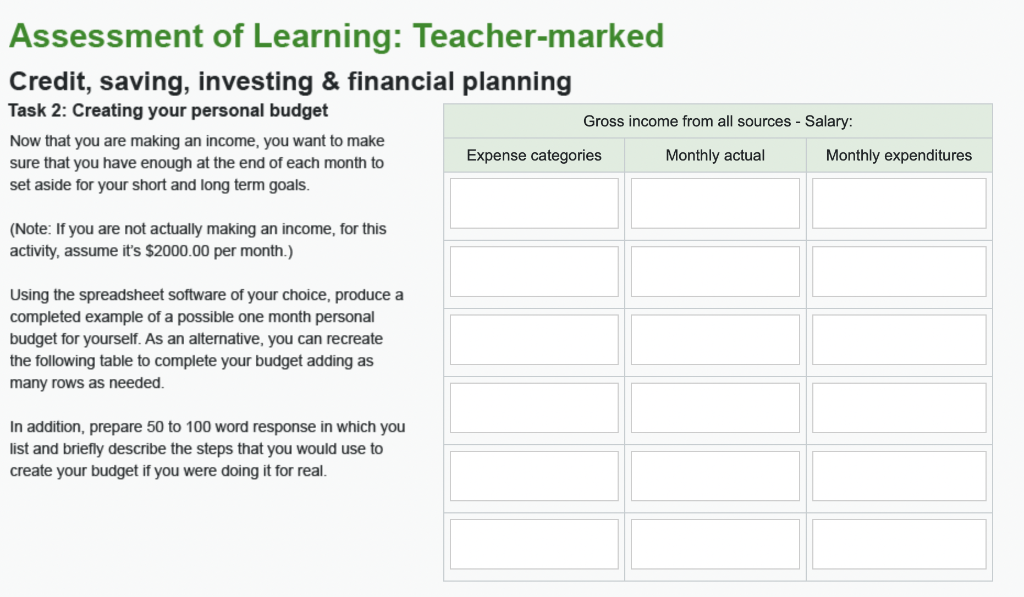

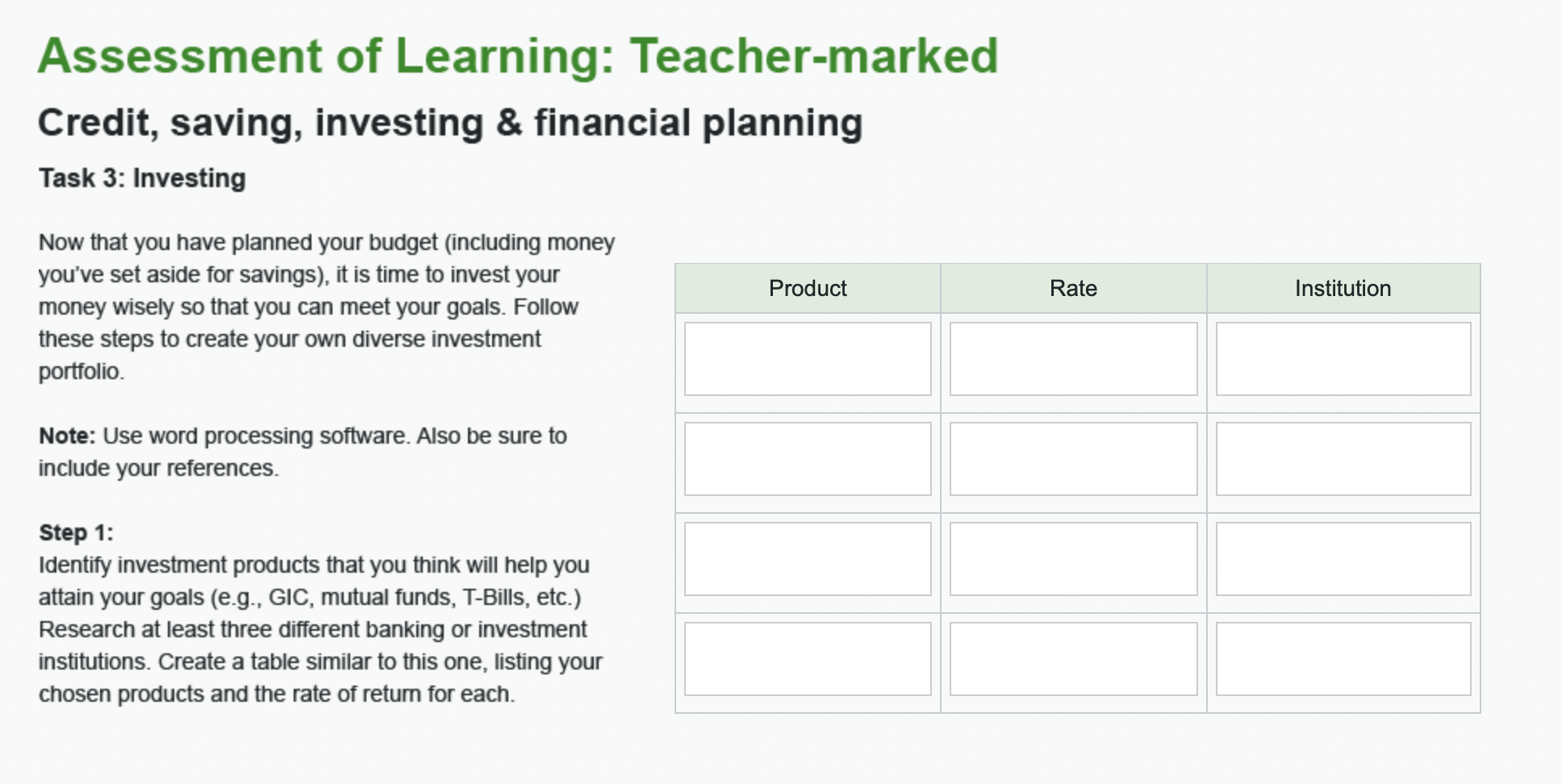

Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning You are near the end of this course. This is your final Assessment of Learning, which is used to evaluate your work based on established criteria and to assign a mark. Your teacher will provide you with feedback and a mark. This Assessment of Learning is worth 24% of your final mark for the course. There are four tasks in this Assessment of Learning. Task 1: Financial planning - Setting goals (3 marks) It's time to consider your finances and start planning ahead! Responding to the following questions, explain what you'd like to accomplish in 50 or more words: 1. What are your short term financial goals? 2. What are your long term financial goals? 3. Do you have an emergency fund? What are some possible emergencies you might need savings for? Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 2: Creating your personal budget Gross income from all sources - Salary: Now that you are making an income, you want to make sure that you have enough at the end of each month to Expense categories Monthly actual Monthly expenditures set aside for your short and long term goals. (Note: If you are not actually making an income, for this activity, assume it's $2000.00 per month.) Using the spreadsheet software of your choice, produce a completed example of a possible one month personal budget for yourself. As an alternative, you can recreate the following table to complete your budget adding as many rows as needed. In addition, prepare 50 to 100 word response in which you list and briefly describe the steps that you would use to create your budget if you were doing it for real. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 3: Investing Product Rate Institution Now that you have planned your budget (including money you've set aside for savings), it is time to invest your money wisely so that you can meet your goals. Follow these steps to create your own diverse investment portfolio. Note: Use word processing software. Also be sure to include your references. Step 1: Identify investment products that you think will help you attain your goals (e.g., GIC, mutual funds, T-Bills, etc.) Research at least three different banking or investment institutions. Create a table similar to this one, listing your chosen products and the rate of return for each. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 3: Investing (continued) Step 2: Make a decision on where you will invest your savings, explaining your rationale. For example: Will you only invest in one product or will you diversify? Will you place all your money within one institution or will you invest in multiple institutions? Why have you decided to invest instead of leaving your money in your savings account? Explain your answer in detail in 50 - 100 words. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 4: Credit worthiness Assume that you had a short term goal of purchasing a used car for $3000, but that your goal has now changed. Instead, you would like to spend your money on a reliable car that will last longer. Now, imagine that you are the loan officer at your local bank tasked with deciding whether or not to lend to an individual like yourself, who would like a car loan for a used car with a cost of $10 000, at an interest rate of 9%, and with a 5-year term. Are you credit worthy? Analyse your credit worthiness and prepare a 50 to 100 word response evaluating each of the 3 C's, as viewed from the bank's perspective. You can assume that you have already accomplished the saving and investing goals that you've identified in previous tasks. Previous 29 of 33 Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning You are near the end of this course. This is your final Assessment of Learning, which is used to evaluate your work based on established criteria and to assign a mark. Your teacher will provide you with feedback and a mark. This Assessment of Learning is worth 24% of your final mark for the course. There are four tasks in this Assessment of Learning. Task 1: Financial planning - Setting goals (3 marks) It's time to consider your finances and start planning ahead! Responding to the following questions, explain what you'd like to accomplish in 50 or more words: 1. What are your short term financial goals? 2. What are your long term financial goals? 3. Do you have an emergency fund? What are some possible emergencies you might need savings for? Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 2: Creating your personal budget Gross income from all sources - Salary: Now that you are making an income, you want to make sure that you have enough at the end of each month to Expense categories Monthly actual Monthly expenditures set aside for your short and long term goals. (Note: If you are not actually making an income, for this activity, assume it's $2000.00 per month.) Using the spreadsheet software of your choice, produce a completed example of a possible one month personal budget for yourself. As an alternative, you can recreate the following table to complete your budget adding as many rows as needed. In addition, prepare 50 to 100 word response in which you list and briefly describe the steps that you would use to create your budget if you were doing it for real. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 3: Investing Product Rate Institution Now that you have planned your budget (including money you've set aside for savings), it is time to invest your money wisely so that you can meet your goals. Follow these steps to create your own diverse investment portfolio. Note: Use word processing software. Also be sure to include your references. Step 1: Identify investment products that you think will help you attain your goals (e.g., GIC, mutual funds, T-Bills, etc.) Research at least three different banking or investment institutions. Create a table similar to this one, listing your chosen products and the rate of return for each. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 3: Investing (continued) Step 2: Make a decision on where you will invest your savings, explaining your rationale. For example: Will you only invest in one product or will you diversify? Will you place all your money within one institution or will you invest in multiple institutions? Why have you decided to invest instead of leaving your money in your savings account? Explain your answer in detail in 50 - 100 words. Assessment of Learning: Teacher-marked Credit, saving, investing & financial planning Task 4: Credit worthiness Assume that you had a short term goal of purchasing a used car for $3000, but that your goal has now changed. Instead, you would like to spend your money on a reliable car that will last longer. Now, imagine that you are the loan officer at your local bank tasked with deciding whether or not to lend to an individual like yourself, who would like a car loan for a used car with a cost of $10 000, at an interest rate of 9%, and with a 5-year term. Are you credit worthy? Analyse your credit worthiness and prepare a 50 to 100 word response evaluating each of the 3 C's, as viewed from the bank's perspective. You can assume that you have already accomplished the saving and investing goals that you've identified in previous tasks. Previous 29 of 33