Question

Asset acquisition (fair value is different from book value) The following financial statement information is for an investor company and an investee company on January

Asset acquisition (fair value is different from book value)

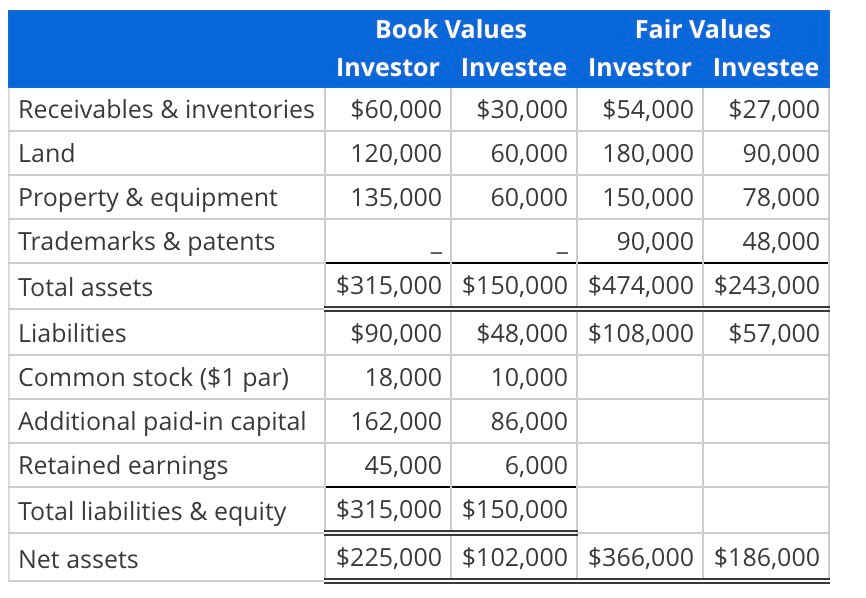

The following financial statement information is for an investor company and an investee company on January 1, 2013. On January 1, 2013, the investor company's common stock had a traded market value of $10.5 per share, and the investee company's common stock had a traded market value of $19 per share.

Assume that the investor company issued 18,000 new shares of the investor company's common stock in exchange for all of the individually identifiable assets and liabilities of the investee company, in a transaction that qualifies as a business combination. The financial information presented, above, was prepared immediately before this transaction. Provide the Investor Company's balance (i.e., on the investor's books, before consolidation) for "Goodwill" immediately following the acquisition of the investee's net assets:

$0

$39,000

$3,000

$87,000

Receivables & inventories Land Property & equipment Trademarks & patents Total assets Book Values Fair Values Investor Investee Investor Investee $60,000 $30,000 $54,000 $27,000 120,000 60,000 180,000 90,000 135,000 60,000 150,000 78,000 90,000 48,000 $315,000 $150,000 $474,000 $243,000 $90,000 $48,000 $108,000 $57,000 18,000 10,000 162,000 86,000 45,000 6,000 $315,000 $150,000 $225,000 $102,000 $366,000 $186,000 Liabilities Common stock ($1 par) Additional paid-in capital Retained earnings Total liabilities & equity Net assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started