Question

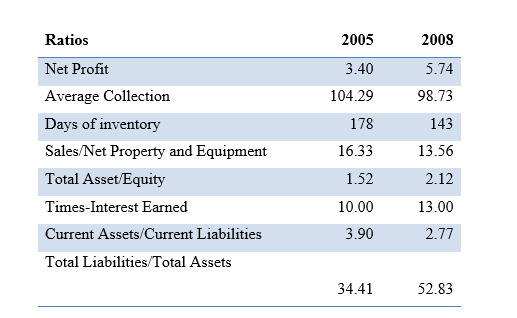

Asset Management 1. What are possible explanations for the improvement in inventor, turnover in 2008 versus 2005? 2. What benchmarks would you use to assess

Asset Management

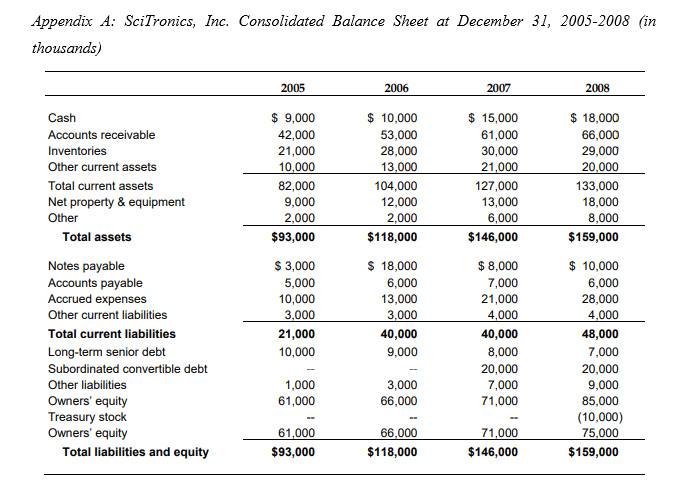

1. What are possible explanations for the improvement in inventor, turnover in 2008 versus 2005?

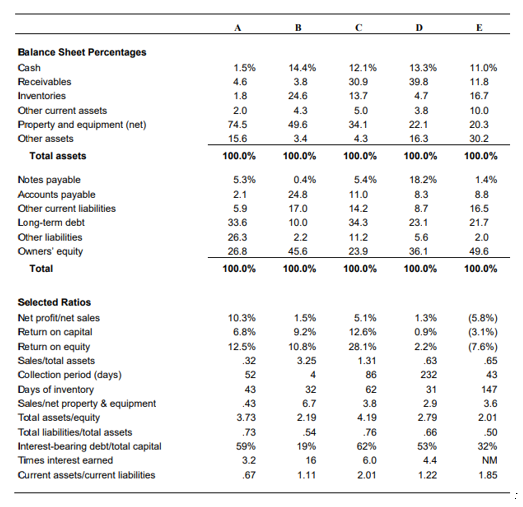

2. What benchmarks would you use to assess asset management? What firms would you select as "comparables"?

Financial Leverage

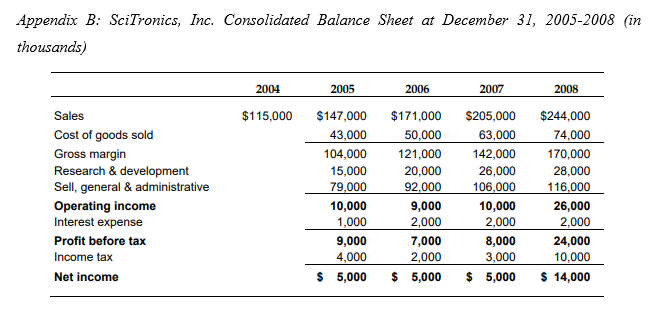

3. What were the sources and uses of funds during the three year period from year-end 2005 and year-end 2008?

4. Did SciTronics' financial leverage increase or decrease between 2005 and 2008? What measures of financial leverage seem most reliable?

Profitability

5. How well has SciTronics performed in terms of profitability?

6.What benchmarks would you use to assess the sufficiency of a company's profitability?

7. Which of the three measures of profitability would you stress: return on sales? Return on equity? Return on capital?

8. What behavior would be encouraged if you stressed return on sales? Return on equity? Return on capital?

9. How did SciTronics increase its return on equity in 2008? Does it matter which of the three levers in the DuPont ratio system is the "driver" in terms of the improvement?

10.Would you spend time analyzing the income statement line item by line item?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started